US equities ended Friday mildly higher but closed the week down as US president Donald Trump’s inauguration provided little inspiration to the markets. DJIA closed at 19827.25 comparing to prior week’s close at 19885.73. S&P 500 closed at 2271.31 comparing to prior week’s close at 2274.64. Treasury yields, however, were notably higher. 10 year yield closed at 2.467 comparing to prior week’s close at 2.309. Dollar ended the week mixed, closing higher against Yen and Canadian but down against all others. Dollar index gyrated around 101 last week, where the 55 day EMA sits. In other markets, Gold hit as high as 1218.9 but lost momentum above 1200 handle. WTI crude oil stayed in recent range and closed at 53.24.

Focus will remain on Trump’s new administration this week as we’d likely see actions in terms of executive orders. The would set the tone of his priorities. Fed officials delivered generally hawkish but cautious tones over the week. For example, Fed chair Janet Yellen reiterated that it’s "prudent to adjust the stance of monetary policy gradually over time". But she also talked down the risks of a surge in inflation and emphasized that Fed has not "fallen behind the curve". Fed fund futures are pricing in 70.6% chance of another Fed hike by June.

Overall, Canadian Dollar was the weakest major currency over the week. BoC left its overnight rate unchanged at 0.50%. Governor Stephen Poloz revealed that ‘Governing Council was particularly concerned about the ramifications of U.S. trade policy, because it is so fundamental to the Canadian economy’. He suggested that further rate cut cannot be ruled out of US’ protectionist policy puts BOC’s inflation target at risk. On the other hand, Sterling was the strongest one as it rebounded after UK prime minister Theresa May’s speech on Brexit.

The development, or the lack of development, in the financial markets was a bit disappointing. The dull price actions so far did reveal that markets were generally in a consolidative mode, rather than trend reversal. For example, 10 year yield rebounded strongly ahead of 55 day EMA. The structure of the price actions from 2.621 so far suggest that it’s forming a consolidative pattern. Such consolidation should extend for a while below 2.621 and there is prospect of another fall. But downside should be contained by 38.2% retracement of 1.336 to 2.621 at 2.130 to bring up trend resumption. We’re still looking at a take on 2013 high at 3.036 later in medium term.

Dollar index’s price actions from 103.82 also gives us more confidence that it’s merely a correction. Deeper fall could still be seen in near term and break of 100 handle cannot be ruled out. But downside should be contained by 99.11/43 support zone to bring rebound. Recent up trend is not completed yet and we’re expecting another rise to 61.8% projection of 78.90 to 100.39 from 91.91 at 105.19. Hence, while more downside in dollar is possible in near term, we’re expecting the greenback to pick up strength again later. But that would come only after more clarity on Trump’s policies and FOMC rate decision on February 1. And as for trading strategies, we’ll keep our hands off for the moment.

USD/CAD Weekly Outlook

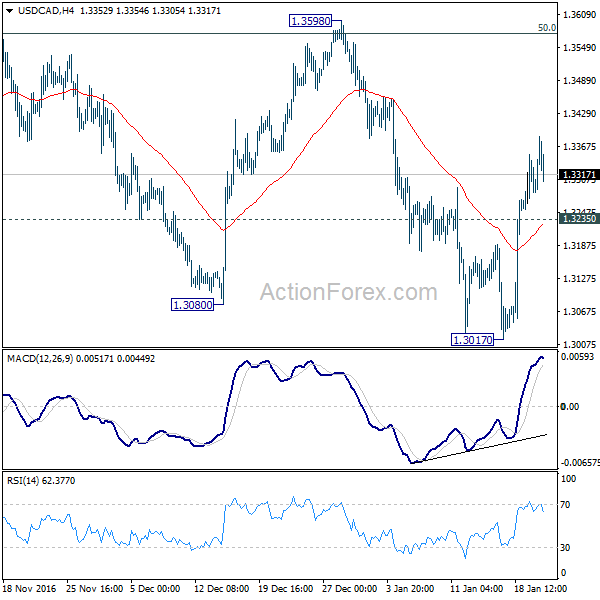

USD/CAD’s strong rebound from 1.3017 argues that price actions from 1.3588 are merely a three wave consolidation pattern. It could also be completed at 1.3017 already. Initial bias stays mildly on the upside this week for 1.3598 resistance. Break will extend the whole choppy rise from 1.2460 to next fibonacci level at 1.3838. On the downside, below 1.3235 minor support will turn focus back to 1.3017 instead.

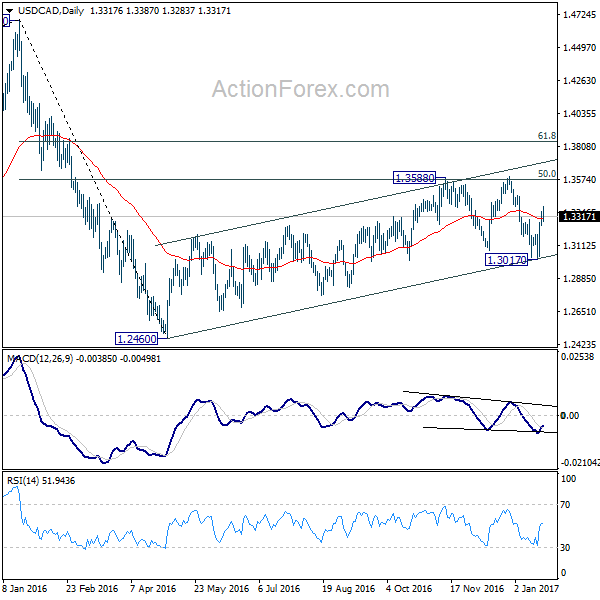

In the bigger picture, price actions from 1.4689 medium term top are seen as a correction pattern. The first leg has completed at 1.2460. The second leg is still in progress and could target 61.8% retracement of 1.4689 to 1.2460 at 1.3838. As rise from 1.2460 is seen as a corrective move, we’d look for reversal signal above 1.3838. Meanwhile, break of 1.3017 will likely start the third leg to 1.2460 and below.

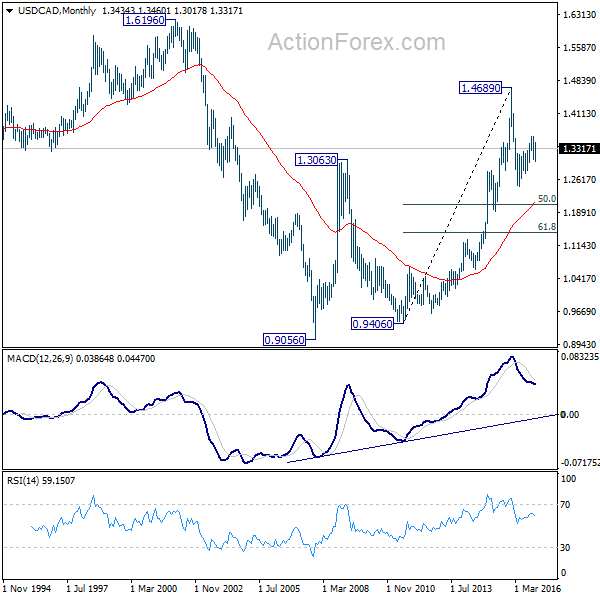

In the longer term picture, rise from 0.9056 (2007 low) is viewed as a long term up trend. It’s taking a breath after hitting 1.4689. But such rise expected to resume later to test 1.6196 down the road.

Subscribe to our daily and mid-day newsletter to get this report delivered to your mail box