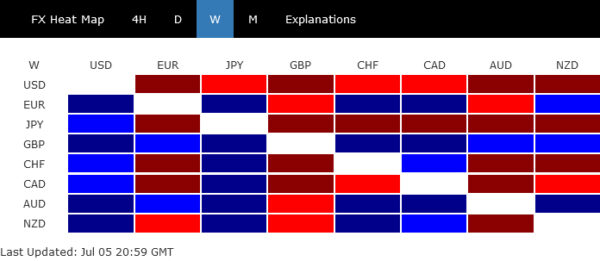

The past week marked a significant downturn for Dollar, which found itself at the bottom of the currency performance chart. A slew of unfavorable economic reports has highlighted the tangible effects of sustained high interest rates on the American economy, fostering a growing consensus that Fed may begin to ease these rates as soon as September. This expectation, in turn, fueled a surge in investor confidence, propelling stocks to new record highs. The positive ripple effects through equity markets contributed to a risk-on sentiment that exerted additional downward pressure on the Dollar.

In contrast to Dollar’s plight, Japanese Yen, although still underperforming as the second worst, showed signs of slowing its decline against the greenback, hinting at some stabilization or reduced selling momentum in the near future. Canadian Dollar also faced challenges, ranking as the third weakest performer following disappointing job data that cast shadows on the strength of Canada’s economic recovery.

On the more positive side of the spectrum, British Pound emerged as the standout performer last week. This strength was partly fueled by a broader market shift towards riskier assets and was significantly bolstered by the political stability anticipated following the UK’s general elections. Australian Dollar and Euro also saw appreciable gains, driven by similar dynamics of returning investor confidence and a favorable shift in market sentiment. Meanwhile, Swiss Franc and New Zealand Dollar occupied the middle ground.

Fed Rate Cut Prospects Rise as US Economy Encounters Growing Headwinds

Dollar was sold off broadly last week, as an array of disappointing economic data for June suggested that the prolonged period of high interest rates is starting to profoundly affect the US economy. July could be the point for the economy to start to turn south.

This emerging evidence of a slowdown has sharply realigned market expectations, with a growing expectations that Fed would be ready commence interest rate reductions in September. This shift in market sentiment was emphatically reflected across major financial indices, with S&P 500 and NASDAQ both soaring to record highs. Meanwhile, 10-year Treasury yield, which initially spiked up, reversed dramatically to close the week noticeably lower.

The industrial sector’s struggles were highlighted in the latest ISM indexes, which confirmed the recessionary state of US manufacturing. The manufacturing PMI has remained in contraction territory almost continuously since the end of 2022, with a fleeting moment of expansion this past May.

Equally concerning is the downturn in the services sector, which has been a pillar of strength during manufacturing sector’s weakness. ISM services PMI showed contraction for the second time in three months, signaling a possible turn in the sector’s trend.

Additionally, Non-Farm Payrolls reported job growth of 206k, which, while respectable, was slightly below the average monthly gain of 220,000 observed over the previous year. More alarmingly, significant downward revisions for April and May, totaling -111k, suggest that the labor market was way less robust in the second quarter than previously reported.

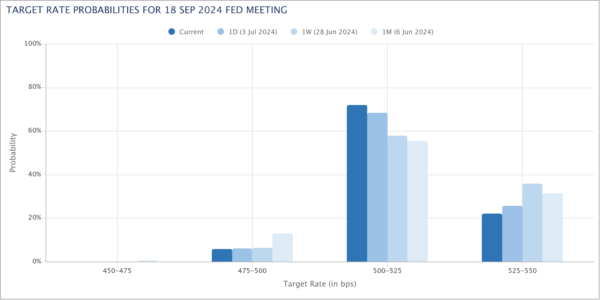

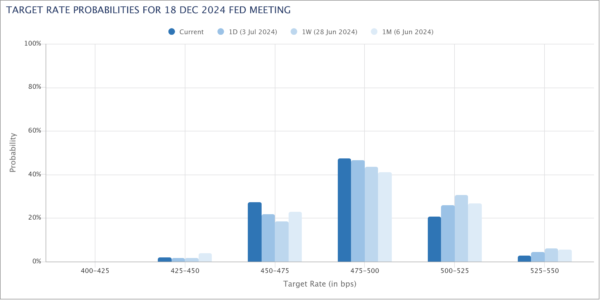

In response to these developments, the likelihood of a 25 bps rate cut by Fed to 5.00-5.25% in September surged to approximately 78%, up from 64% just a week earlier. Moreover, by the end of the year, market expectations for a total of two rate cuts, bringing rates down to between 4.75% and 5.00%, have risen to 77% from 63%.

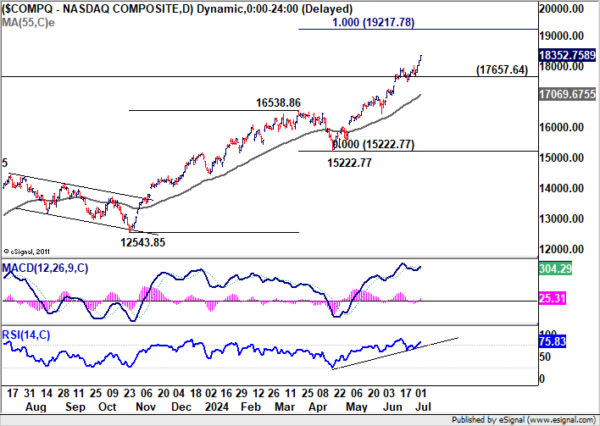

NASDAQ Hits New Record, Heading towards 20k

Both S&P 500 and NASDAQ achieved new record highs last week. S&P 500’s impressive rally has now accumulated a year-to-date gain of 16.7%, while NASDAQ has outpaced this with a substantial 22.3% increase since the beginning of the year.

Technically, near term outlook in NASDAQ will stay bullish as long as 17657.64 support holds. Next target is 100% projection of 12543.85 to 16538.86 from 15222.77 at 19217.78. That would also be close to long term target of 100% projection of 6631.42 to 16212.22 from 10088.82 at 19669.62.

These two levels lie just ahead of the psychologically significant 20k mark. Together with overbought conditions in both daily and week chart, significant resistance might be seen there to bring a corrective phase first, as traders might start to take profits.

US 10-Year Yield Reverses After Initial Spike, Dollar Index Under Pressure

US 10-year Yield initially gapped higher to 4.493 but reversed to close sharply lower at 4.272. While the spike was brief, the driving force is important to note.

The initial surge in TNX was influenced notably by the political scene, particularly after Donald Trump’s perceived strong performance in a televised debate against Joe Biden. The resurgence of the “Trump trade” has stirred market speculations. According to Morgan Stanley strategists, a Trump victory in November could reshape economic expectations, forecasting steeper yield curve due to anticipated policies on immigration and tariffs, alongside fiscal expansion leading to increased bond issuances.

Despite this, markets are currently much more occupied by optimism about cooling inflation and impending Fed policy easing. Nevertheless, the potential impact of Trump trade effect should not be overlooked, at least in the lead-up to the November election.

Technically, 10-year yield remain confined within the near term falling channel after the brief bounce faltered. Outlook is mixed for now with focus on 4.188 support, and 55 W EMA (now at 4.186). Sustained break of these levels will argue that fall from 4.737 is already the third leg of the corrective pattern from 4.997 (2023 high). That would open up deeper medium term decline through 3.785, likely aligning with Fed’s rate cut and falling inflation. However, strong bounce from the 55 W EMA would keep the rise from 3.785 alive for another push through 4.737 at a later stage.

Dollar index’s firm break of 105.12 support and 55 D EMA (now at 105.11) suggests that rebound from 103.99 has completed at 106.13 already. Fall from there is seen as the third leg of the pattern from 106.51 and would extend to 103.99 support. 55 W EMA (now at 104.31) would be the key level to defend. Sustained break there will argue that whole rise from 100.61 has completed, and open up deeper medium term decline back to this support. Nevertheless, strong bounce from 103.99 and the 55 W EMA will keep the rise from 100.61 alive for another attempt on 107.34 resistance later.

Sterling Climbs Following Labour’s Electoral Success, Stocks Show Limited Enthusiasm

The UK’s general election has culminated in a substantial victory for the Labour Party, but elicited varied reactions across different market segments. The British Pound and government bonds received a noticeable boost. While FTSE index also enjoyed a brief uptick, it failed to keep those gains.

On the positive side, this election outcome promises a phase of stability, given Labour’s commanding majority in Parliament—a development that could bring much-needed predictability following years of political turmoil since Brexit, which had its crescendo during Liz Truss’s historically short stint as Prime Minister.

There are also anticipations surrounding new Prime Minister Keir Starmer’s to reinforce ties with the EU, specifically through amendments to the EU/UK Trade and Cooperation Agreement and introduction of a UK-EU defense pact. Such initiatives are expected to favorably impact the Pound.

However, despite Labour’s significant parliamentary majority, a closer examination of the election results reveals a more complex picture. Labour’s victory added over 200 seats, yet their share of the popular vote increased by less than two percentage points to 34%. This modest increase contrasts sharply with the Conservative Party’s loss of vote share, which plummeted 20 points to 24%, culminating in a loss of 251 seats.

Meanwhile, the Liberal Democrats made modest gains in vote shares to 12% but claimed 71 seats. The far-right Reform Party increased its vote share notably by 12% to 14%, although this did not translate significantly into seats.

These dynamics suggest that the election outcome may be more indicative of Conservative losses rather than a strong mandate for Labour, which could present challenges for Starmer’s policy agenda.

Technically, FTSE is still extending the corrective pattern from 8474.41. But in case of another dip, downside would likely be supported by 38.2% retracement of 7404.08 to 8474.41 at 8065.54. Break of 8307.92 resistance will be the first sign that larger up trend is ready to resume, and should bring retest of 8474.41 high next.

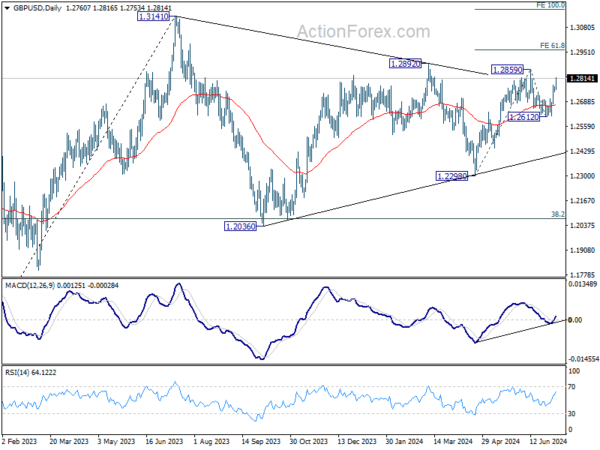

GBP/USD’s focus is now back on 1.2859 resistance after last week’s strong rally. Firm break there will firstly resume the rise from 1.2298. More importantly, that would revive that case that corrective pattern from 1.3141 has completed at 1.2298. Next target would be 61.8% projection of 1.2298 to 1.2859 from 1.2612 at 1.2959. Decisive break there would prompt upside acceleration through 1.3141 to 100% projection at 1.3173.

Japanese Stocks Hit New Peaks Amid Yen’s Continued Decline

Mood in the Japanese financial markets was buoyantly optimistic, with Nikkei surging past 40k mark again to set a new record high. Additionally, the broader Topix also reached new heights, surpassing its historical peak from the bubble era of 1989. This jubilation in the stock market occurred concurrently with Yen’s drop to multi-decade lows against Dollar, although it did recover slightly later.

Recent depreciation of Yen, surprisingly met with minimal verbal intervention from Japanese authorities, has been a significant catalyst for the stock market rally. The weaker Yen is generally viewed as bullish for Japanese stocks, particularly for exporters, as it raises the value of profits repatriated to Japan. The government’s apparent acquiescence to Yen’s decline through 160 level has injected additional optimism into the market.

However, several factors suggest caution is warranted. First, Yen’s rapid selloff against Dollar seems to be losing momentum, indicating a potential upcoming rebound. Second, it remains to be seen how this year’s strong wage growth from the annual Shunto will translate into increased domestic consumption, which is crucial for sustaining Japan’s economic and stock market growth.

Looking forward, Nikkei faces a critical juncture at its long-term channel resistance, currently near the 42,000 level. Decisive break there would solidify medium term buying momentum and pave the way to 61.8% projection of 30538.28 to 41087.75 from 37950.19 at 44469.76. However, reversal from the channel resistance could turn in to a medium term down trend back to 55 W EMA or even to channel support. It’s make or break time for Nikkei soon.

USD/JPY edged higher to 161.94 last week but turned into consolidations since then. Further rally is expected as long as 160.25 minor support holds. But loss of momentum could cap upside at 61.8% projection of 146.47 to 160.20 from 154.53 at 163.01 on first attempt. Meanwhile, firm break of 160.25 will suggest that a short term top is at least formed and bring deeper pull back.

GBP/JPY Weekly Outlook

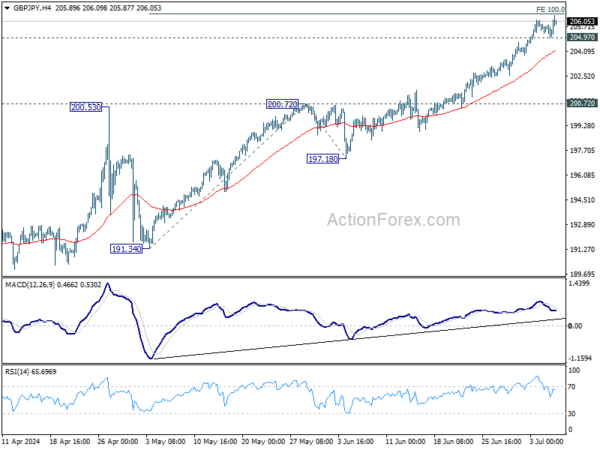

GBP/JPY’s up trend continued last week and hit as high as 206.42. Initial bias is on the upside this week for further rally. Firm break of 100% projection of 191.34 to 200.72 from 197.18 at 206.56 will target 138.2% projection at 210.17. On the downside, below 204.97 minor support will turn bias to the downside for deeper pull back.

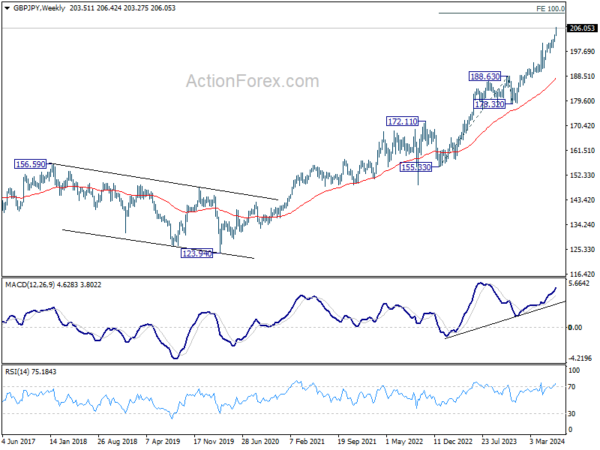

In the bigger picture, long term up trend is still in progress. Next target is 100% projection of 155.33 to 188.63 from 178.32 at 211.62. Outlook will stay bullish as long as 197.18 support holds, even in case of deep pullback.

In the longer term picture, rise from 122.75 (2016 low) is seen as the third leg of the pattern from 116.83 (2011 low). Next target is 138.2% projection of 116.83 to 195.86 from 122.75 at 231.96. Outlook will stay bullish as long as 178.32 support holds, or until a clear reversal pattern forms.