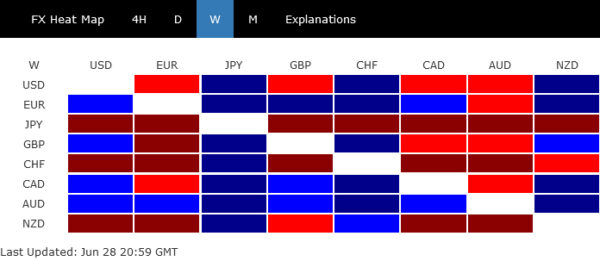

Yen remained in the spotlight last week, dominating headlines even as some significant global inflation data also moved markets. The Japanese currency continued its downtrend, reaching multi-decade lows. Despite the prolonged decline, Japanese authorities refrained from intervening directly in the markets. However, the looming threat of intervention kept traders cautious, resulting in a more controlled descent. Nevertheless, Yen ended the week as the worst-performing currency.

In contrast, Australian dollar emerged as the strongest performer, buoyed by increased speculations of another RBA rate hike following robust inflation data. Canadian dollar also showed strength, securing the third spot due to strong inflation figures that diminished the likelihood of an imminent rate cut by BoC. Euro, which had been impacted by political uncertainties in France, recovered and became the second strongest currency of the week. Despite this recovery, Euro remains the second weakest currency for the month, just ahead of Yen.

Swiss franc was the second weakest performer of the week. Global inflation data suggested that the monetary easing cycle would continue at a slow pace, keeping rate gap with SNB wide. New Zealand Dollar also struggled, ending as the third worst performer, partly due to additional pressure from its decline against Aussie.

Dollar and the British Pound finished in middle positions. While the greenback fell against Euro, Sterling, Loonie and Aussie, it remained within the previous week’s range. Market participants have become cautious ahead of the upcoming election risks in France and the plethora of US economic data, including non-farm payrolls report, scheduled for the coming week. Similarly, the Pound has not found a clear direction, with UK’s upcoming elections adding to the uncertainty.

Yen Hits 38-Year Low Against Dollar, Japan Appoints New Currency Head

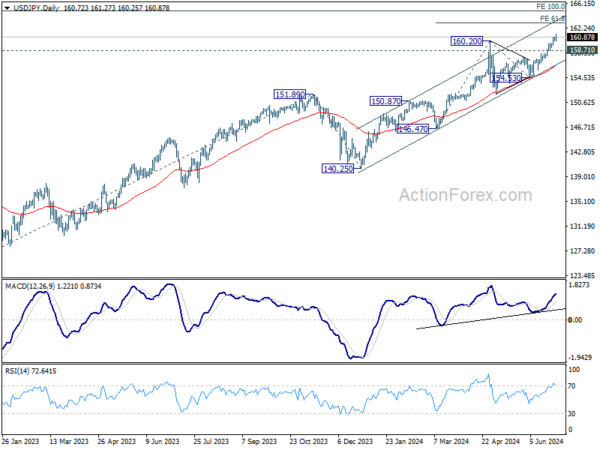

Japanese Yen continued to dominate headlines last week, plummeting to a 38-year low against Dollar and closing below the critical 160 threshold. This significant drop has heightened concerns and led Japanese authorities to ramp up verbal interventions. Finance Minister Shunichi Suzuki expressed his “high sense of urgency” in monitoring Yen’s movements, using language similar to that employed before the April intervention. Despite these strong words, no concrete action has been taken by Japan to halt Yen’s decline.

In a related development, Japan has appointed Atsushi Mimura as the new top currency diplomat, replacing Masato Kanda at the end of July. Currently serving as the director-general of the Ministry of Finance’s international bureau, Mimura’s approach to achieving a stable currency that reflects economic fundamentals is largely unknown. His forthcoming statements and actions will be crucial and closely watched by market participants.

US/JPY’s break of 160.20 resistance last week confirmed long term up trend resumption. While some consolidations might be seen, outlook will stay bullish as long as 158.71 support holds. Next target is 61.8% projection of 146.47 to 160.20 from 154.53 at 163.01. However, the pressing question remains: will Japan step in now, or allow USD/JPY to climb further to 165 before intervening?

Yen Also Slides Significantly Against Aussie and Loonie

Talking about Yen, its declines against both Aussie and Loonie were also significantly. In particular, ‘s 1.12% gain was partly driven by stronger-than-expected May monthly CPI data from Australia, indicating surprised reacceleration in inflation.

RBA Deputy Governor Andrew Hauser attempted to downplay the impact of a single data point, and emphasized the importance of upcoming data before RBA’s next meeting in August. The robust inflation figures have fueled speculations about a potential rate hike at the meeting. For now, most economists still anticipate the next move will be a rate cut, albeit at a later date, but the risks have certainly increased. While opinions may differ, all would agree that Q2 inflation report, due on July 31, will be crucial in shaping RBA’s decision.

AUD/JPY’s outlook will stay bullish as long as 105.57 support holds, even in case of retreat. Next target is 61.8% projection of 95.48 to 104.91 from 102.59 at 108.41. Decisive break there could prompt upside acceleration to 100% projection at 112.02.

Similarly, Yen fell to its lowest level against the Canadian dollar in more than 15 years. The unexpected acceleration in Canadian inflation for May led traders to reduce bets on another rate cut by BoC in July. However, with another CPI report due on July 16 before the BoC meeting on July 24, nothing is set in stone.

For now, CAD/JPY’s near term outlook will stay bullish as long as 116.04 support holds. Next target is 61.8% projection of 108.66 to 117.30 from 112.94 at 118.27. Decisive break there could prompt upside acceleration to 100% projection at 121.58.

Euro Withstands Pressure Despite Uncertainties in French Elections

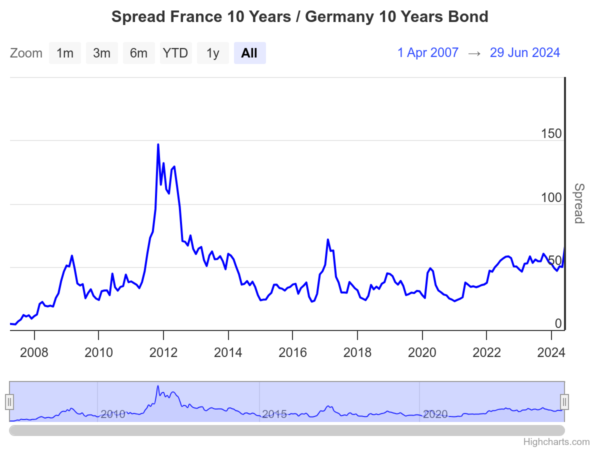

Euro demonstrated unexpected resilience last week despite significant political uncertainties in France ahead of the upcoming snap elections. Investors’ concerns were evident as French debt risk premium surged, with the spread between French and German borrowing costs reaching its highest level since 2012. Both French and German bonds were heavily sold off, leading to the German 10-year yield surpassing 2.5% and the French 10-year yield climbing above 3.25%. CAC 40 also experienced renewed selling pressure on Friday, although DAX remained relatively stable.

The far-right National Rally has extended its lead in the polls, followed by the left-wing alliance in second place. President Emmanuel Macron’s centrist party appears headed for a significant defeat, potentially leading to either a National Rally-led government or a hung parliament, which could result in political paralysis. Investors are particularly concerned about the potential radicalization of economic policy from both the right and left, fearing unrealistic economic programs.

From a technical perspective, CAC 40 is now back at a crucial support zone after a brief recovery over the past two weeks. The zone include 55 W EMA (now at 7859.20), trend line support at around 7490, 38.2 retracement of 5638.42 to 8259.19 at 7254.23. Decisive break of this support zone will argue that CAC is probably already in a medium term down trend that could extend beyond 6773.81 support. Nevertheless, strong bounce from current level, followed by break of 7725.27 resistance will confirm short term bottoming, and bring stronger rebound to 55 EMA (now at 7868.18) before deciding what’s next.

DAX has been resilient so far but the price actions from 17951.17 look like a near term consolidation pattern at best. Break of 17951.17 support will resume the fall from 18892.92. Even just as a correction to the rise from 14630.21, DAX would decline to 38.2% retracement of 14630.21 to 18892.91 at 17264.55, or even further to 55 W EMA (now at 17013.41).

As for EUR/USD, it extended the sideway consolidations from 1.0667 last week. Outlook will stay bearish as long as 1.0760 resistance holds. Break of 1.0667 will resume the fall from 1.0915, as the third leg of the decline from 1.1138, through 1.0601 support.

Dollar Index’s Rebound Continues With Indecisive Momentum

While Dollar showed strength against the yen and some resilience against the Swiss franc, is was largely indecisive against other currencies. May’s PCE inflation data, a key gauge for Fed, indicated continued progress in disinflation, which should be welcomed by Fed policymakers. Yet, the path to the first rate cut remains fraught with uncertainties. Traders are also beginning to look beyond September, the likely timing for the first cut, considering the path of rate adjustments into the next year.

Despite the encouraging disinflation data, the broader economic state suggests that substantial progress in reducing inflation and cooling the job market will be necessary for Fed to embark on a sustained path of rate cuts. The possibility of a first rate cut in September is becoming more realistic, but Fed will likely proceed with caution. Unless there is a significant broadening of disinflationary trends and a noticeable cooling in the labor market, the pace of monetary easing is expected to be gradual at best.

Dollar Index’s rebound from 103.99 continued throughout the week, though the momentum appeared rather unconvincing. This lack of conviction was primarily due to EUR/USD’s failure to break downward from its near term range. For now, outlook will stay bullish as long as 105.12 support holds. Rise from 100.61 should still be in progress through 106.51, and possibly 107.34 resistance too. But break of 105.12 will raise the chance that Dollar index’s rebound is over and it’s heading back to 103.99 support and below.

GBP/USD Weekly Outlook

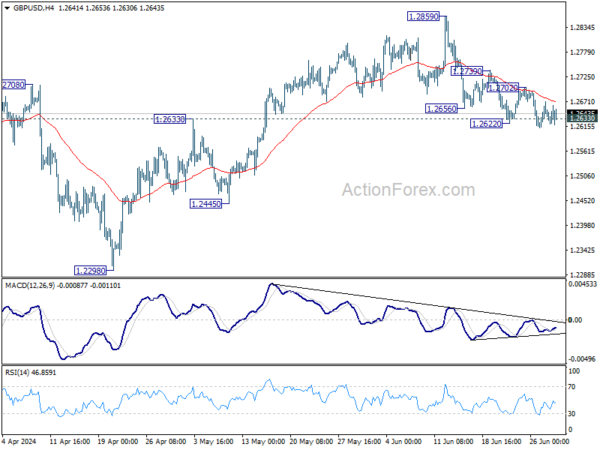

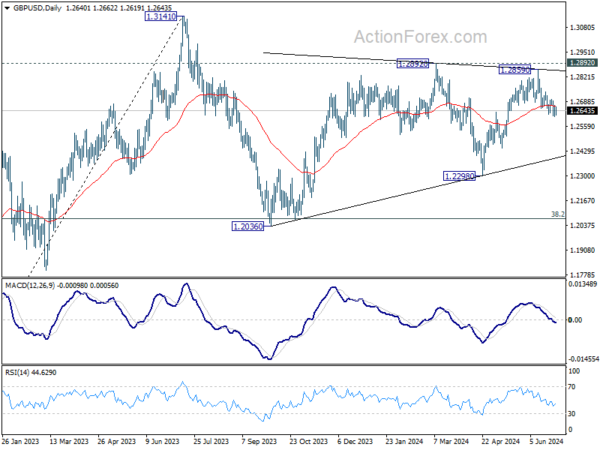

GBP/USD’s fall from 1.2859 tied to continued last week but failed to sustain below 1.2633 resistance turned support. Still, further decline is expected as long as 1.2702 resistance holds. Sustained trading below 1.2633 resistance turned support will argue that whole rise from 1.2298 has completed, and target 1.2445 and below. On the upside, however, firm break of 1.2702 resistance will argue that pull back from 1.2859 has completed, and bring retest of this high instead.

In the bigger picture, price actions from 1.3141 medium term top are seen as a corrective pattern that is still in progress. Break of 1.2445 support will confirm that another falling leg has started and target 1.2036 cluster support again (38.2% retracement of 1.0351 (2022 low) to 1.3141 at 1.2075. Nevertheless, break of 1.2892 resistance will argue that larger up trend from 1.0351is ready to resume through 1.3141.

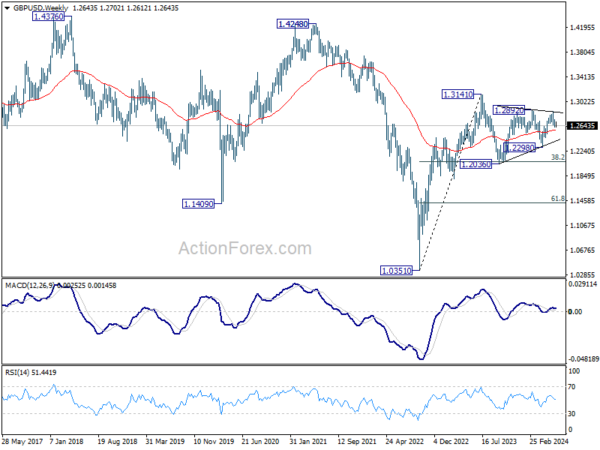

In the long term picture, a long term bottom should be in place at 1.0351 on bullish convergence condition in M MACD. But momentum of the rebound from 1.3051 argues GBP/USD is merely in consolidation, rather than trend reversal. Range trading is likely between 1.0351/4248 for some more time.