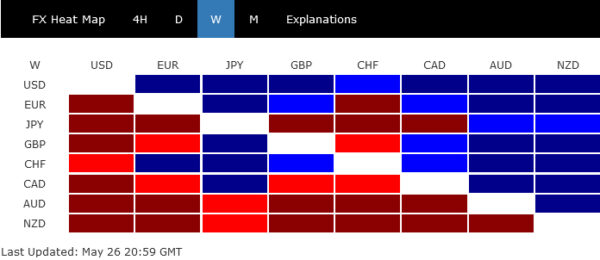

Last week saw the US Dollar dominating the currency markets, with a surprising rally buoyed by market sentiments flipping in favor of an imminent Fed rate hike in June. An atmosphere of growing optimism pervaded the scene, buoyed by increasing confidence in a forthcoming agreement on raising the US debt ceiling, thus staving off a looming government default.

The greenback’s impressive stride was synchronized with an appreciable leap in treasury yields. An intriguing development was the apparent decoupling of Dollar’s inverse performance from risk markets, as exemplified by NASDAQ’s robust gains. It is now speculated that Dollar might maintain this trajectory of reduced sensitivity to risk sentiment in the near future.

Within the foreign exchange market, the New Zealand dollar trailed at the back of the pack. ‘Kiwi’ took a hit following what was perceived as a dovish rate hike by RBNZ. Australian Dollar, hampered perhaps by market pessimism over a waning Chinese recovery, was the second-worst performer. Yen also languished, buckling under the pressure of escalating global benchmark yields.

European majors, despite losing ground to the dollar, held their own against other currencies. Notably, the Swiss Franc and Euro managed to outpace the Sterling, if only just. These developments serve as a reminder of the capricious nature of the currency markets, where fortunes can shift rapidly based on global economic dynamics.

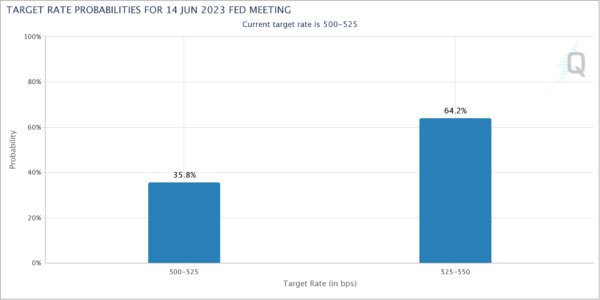

Markets now sees 64% chance of another Fed hike in Jun

There was an unexpected and drastic U-turn in market expectations for Fed’s June meeting. Fed funds futures are now pricing in 64.2% chance of another 25bps hike to 5.25-5.50% on June 14, with 35.8% chance of a odd. A week ago, there was just 17.4% chance of a hike with an overwhelming 82.6% chance of a hold.

The set of strong set release on Friday was a key driver of the change in sentiment. Both headline and core PCE inflation accelerated again in April, to 4.4% yoy and 4.7% yoy respectively. At the same, time, personal spending had robust growth of 0.8% mom, arguing that consumers might have well adapted themselves to the high inflation environment.

In the mean time, IMF also said in a statement: “To bring inflation firmly back to target will require an extended period of tight monetary policy, with the federal funds rate remaining at 5¼–5½ percent until late in 2024.”

There are still more than two weeks to go before the next FOMC meeting. Theoretically, there is still lots of room for the picture to change. But markets reactions to upcoming US data, like non-farm payroll report on June 2 and CPI on June 13, could be asymmetric, and be more sensitive to the hawkish side.

Dollar index extending near term rise towards 106

Dollar index extended the rebound from 100.78 short term bottom as expected, to close at 104.20. The rally was driven by both Fed expectations and surging treasury yields. Meanwhile, the greenback has continued to engage in on-off inverse relationship with risk sentiment.

For now, further rally is expected as long as 55 D EMA (now at 102.73) holds, towards 105.88 resistance, and 38.2% retracement of 114.77 to 100.82 at 106.14. Based on current development this target zone could be reached within June.

However, it should be noted that DXY is still seen as in a three-wave corrective pattern from 100.82. Hence, strong resistance could emerge at 105.88/106.14) to complete the rebound. Or, sustained break of 106.14 will argue that it’s already in a bullish trend reversal, which would set the tone for an up trend in H2.

10-year yield in progress for 4.091 resistance next

10-year yield’s rally from 3.253 extended higher to close at 3.810 last week. For the near term, further rise is expected as long as 55 D EMA (now at 3.576) holds. The primary question now is whether correction from 4.333 has completed in a three-wave pattern to 3.253. Firm break of 4.091 resistance would boost the bullish case, targeting 4.333.

It’s too early to be confident about an upcoming bullish development. But TNX had drawn strong support from rising 55 W EMA (now at 3.312). Thus, the up trend from 0.398 is intact. Firm break of 4.333 would resume the up trend to 61.8% projection of 1.343 to 4.333 from 3.253 at 5.100.

Should this scenario unfold, it’s likely that DXY could also break through the aforementioned 106 resistance level, confirming a bullish trend reversal.

NASDAQ surged again as AI rally continued

US stocks concluded the week on a high note as traders harbored hopes an agreement would be reached to raise US debt ceiling, thereby averting a potentially disastrous default. The strong rally towards the week’s end suggests that investors were not unduly concerned by potential further interest rate hikes from Fed in June.

NASDAQ, the standout performer, registered its fifth consecutive weekly gain, rising by 2.5%, as the rally in AI continued unabated. The spotlight was undoubtedly on chipmaker Nvidia, which reported an extraordinary earnings performance and its leading position in AI technology. However, other tech giants such as Microsoft, Meta, and Alphabet also made their share of gains, each showcasing their individual contributions to the burgeoning AI narrative.

NASDAQ is now quickly approaching a key clusters resistance zone at 13150/81, 13181.08, 50% retracement of 16212.22 to 10088.82 at 13150.52, and 100% projection of 10088.82 to 12269.55 from 10982.80 at 13163.53.

Rejection by this resistance zone will keep the down trend from 16212.22 intact. However, sustained break there will suggest that the trend has already reversed. Next target is 161.8% projection at 14511.22.

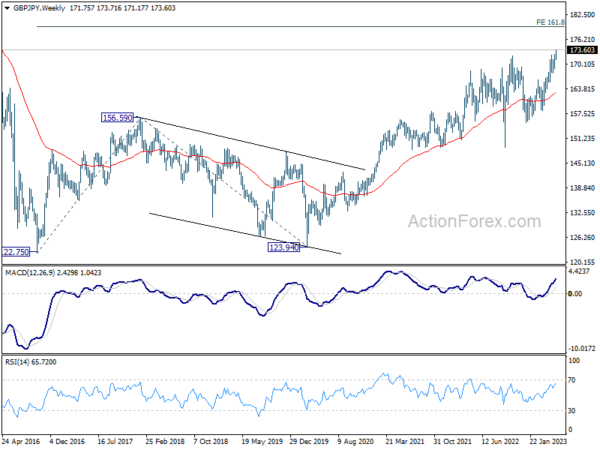

GBP/JPY extending up trend towards 178/180 zone

Yen’s development is also a highlight for the near term in addition to Dollar. BoJ Governor Kazuo Ueda threw out the idea of tweaking YCC to target 5-year JGB yields. But that was largely ignored by the markets. After all, the central bank is still not expected to really exit its massive stimulus any time soon. Nikkei is also staying strong, which reinforces its trend with Yen’s selloff.

GBP/JPY’s up trend finally took off late last week, as UK CPI data suggested that BoE would likely have no change but to tighten again in June. From a near term point of view, further rally is expected as long as 171.26 support holds. Next target is 100% projection of 148.93 to 172.11 from 155.33 at 178.51.

From a medium term point of view, it’s now extending the up trend from 123.94. Next target will be 161.8% projection of 122.75 (2016 low) to 156.59 (2018 high) from 123.94 at 178.69.

That is, there might be strong resistance around 178/180 to limit upside. But let’s see if the cross could pick up momentum from now on.

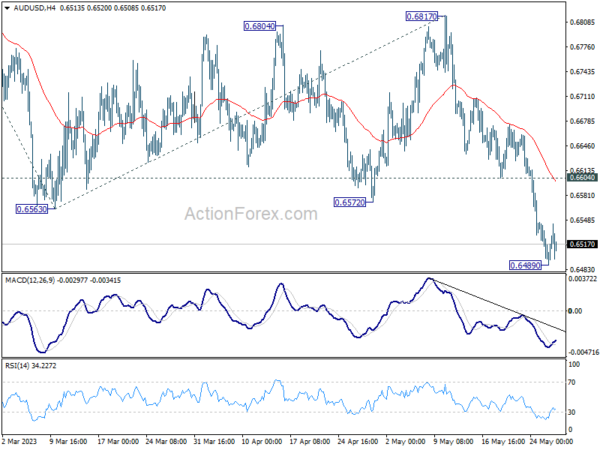

AUD/USD Weekly Report

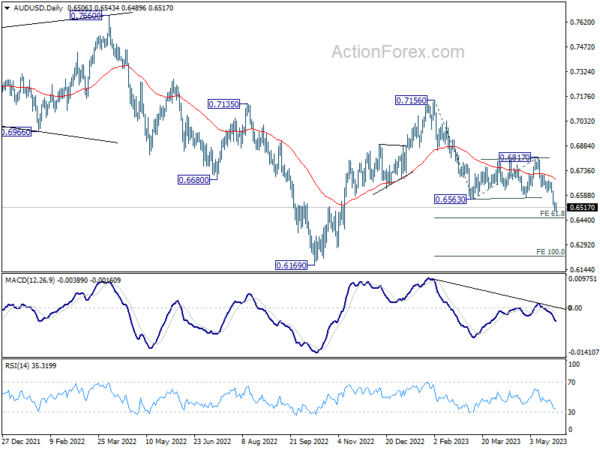

AUD/USD’s decline from 0.7156 resumed by breaking through 0.6563 support last week. A temporary low was formed after falling to 0.6489. Initial bias is neutral this week for some consolidations first. Upside of recovery should be limited by 0.6604 support turned resistance to bring another decline. Break of 0.6489 will target 61.8% projection of 0.7156 to 0.6563 from 0.6817 at 0.6451. Firm break there will target 100% projection at 0.6224.

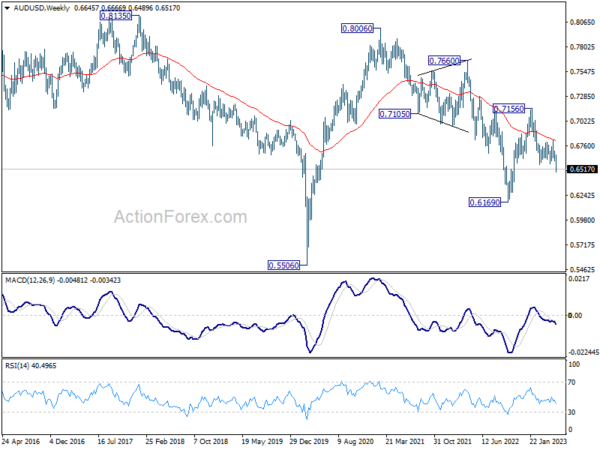

In the bigger picture, rejection by 55 W EMA (now at 0.6822) keeps medium term outlook bearish. Current development suggests that down trend from 0.8006 (2021 high) is possibly still in progress. Retest of 0.6169 (2022 low) should be seen next. Firm break there will confirm down trend resumption. For now, this will remain the favored case as long as 0.6817 resistance holds.

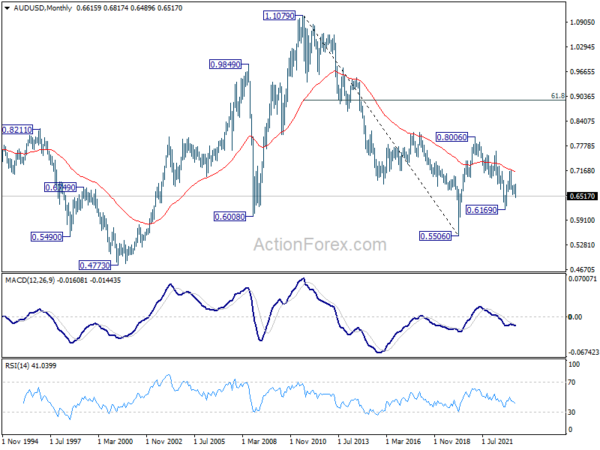

In the long term picture, initial rejection by 55 M EMA (now at 0.7119) retains long term bearishness. That is, down trend from 1.1079 (2011 high) could still resume through 0.5506 (2020 low) on resumption.