Risk-on, risk-off, and then risk-on. It’s a roller-coaster ride for investors last week,with a slew of heavy-weight events. In the end, commodity currencies ended as the best performers, with support from rebound in sentiment. Canadian Dollar held a slight advantage over Australian and New Zealand Dollar. But all have them have reasons to extend last week rally, subject to overall risk sentiment, of course.

Dollar and Euro tied as the worst performers, even though both Fed and ECB extended tightening cycle. But even so, technically, Euro remains in pole position against the greenback for now, as also evidenced in the outlook in Dollar Index. Swiss Franc was somewhat dragged down by Euro too, while Yen and Sterling ended mixed.

Risk sentiment resilient, Dollar pressured in an eventful week

The US markets saw a week full of actions and events, with complex intermarket reactions influenced by economic data, the FOMC rate decision, and ongoing concerns over regional banks. The robust April non-farm payroll data, featuring strong job and wage growth, and a dip in unemployment rate, was overshadowed by significant downward revisions for March numbers. Fed softened its hawkish tone after delivering the expected 25bps rate hike, but Chair Jerome Powell refrained from providing clear guidance on a pause.

Investor sentiment was largely driven by persistent worries over regional banks, causing DOW to plummet mid-week. However, sentiment rebounded on Friday following JPMorgan’s upgrade of Western Alliance, Zions Bancorp, and Comerica, citing that they were “substantially mispriced” due to short-selling activity. Apple’s strong fiscal Q2 report, which beat top and bottom line expectations, further boosted sentiment.

Although DOW briefly broke near-term support at 33362.64, S&P 500 and NASDAQ defended their corresponding levels effectively. As for the SPX, rise from 3491.58 is expected to continue as long as 4049.35 support holds, with key hurdle at 4325.28 cluster resistance (61.8% retracement of 4818.62 to 3491.58 at 4311.69).

Dollar Index struggled to extend its near-term rebound, suggesting that consolidation from 100.78 might have already completed without even reaching 55 D EMA (now at 102.54). Downside breakout through 100.78 appears imminent. The question is whether it could bottom at around 61.8% retracement of 89.20 to 114.77 at 98.96. Or, there won’t be enough buying for a bounce until 61.8% projection of 114.77 to 100.82 from 105.88 at 97.25.

Euro also struggled on uncertain ECB path ahead

Euro didn’t fare better than Dollar last week, even as ECB also delivered a 25bps rate hike. President Christine Lagarde made it clear that “we are not pausing.” However, the step-down in tightening created some uncertainty for the path ahead. While some analysts still expect two more 25bps hikes in June and July, risks are tilted towards an earlier end due to tightening bank lending conditions and collapsing loan demand in the Eurozone.

EUR/AUD ended notably lower at 1.6313 last week, and although 1.6219 support still holds, the risks of a top formation ahead of 100% projection of 1.4281 to 1.5976 from 1.5254 at 1.6949 are increasing. Given bearish divergence condition in D MACD, firm break of 1.6219 would suggest that EUR/AUD has entered a correction to the whole uptrend from 1.4281, risking deeper pullback into the 1.5254/5976 support zone.

Commodity currencies triumph as risk sentiment and bullish factors align

Commodity currencies were the biggest winners last week. Resilient risk sentiment played a role, but each of New Zealand, Australian, and Canadian had their own bullish factors. Strong Q1 job data from New Zealand supported another rate hike by RBNZ on May 24. RBA surprised with a 25bps last week, rather than another pause. RBA Statement on Monetary Policy also argue it’s not done with tightening.

Canadian Dollar once experienced some jitters with WTI crude oil spiked to lowest level since 2021. But oil price than rebounded quickly, with WTI settling above 71 handle. Strong job data from Canada prompted doubts on whether BoC should rethink about its rate pause. At least, the possible of a rate cut by BoC was pushed further into 2024.

The Loonie was the relatively stronger one among commodity currencies last week. AUD/CAD’s late decline raises the chance that corrective pattern from 0.8941 has completed already, after rejection by 0.9104 resistance. Failure to sustain above 55 D EMA (now at 0.9058) is also a bearish signal.

Deeper decline is mildly in favor this week through 0.8941. The main question is whether the sell off could power through 61.8% projection of 0.9545 to 0.9043 from 0.9229 at 0.8919. If that happens, deeper fall could be seen towards 100% projection at 0.8727, with downside acceleration.

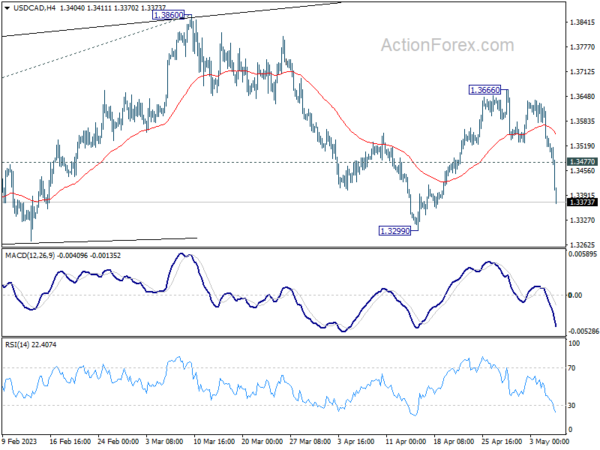

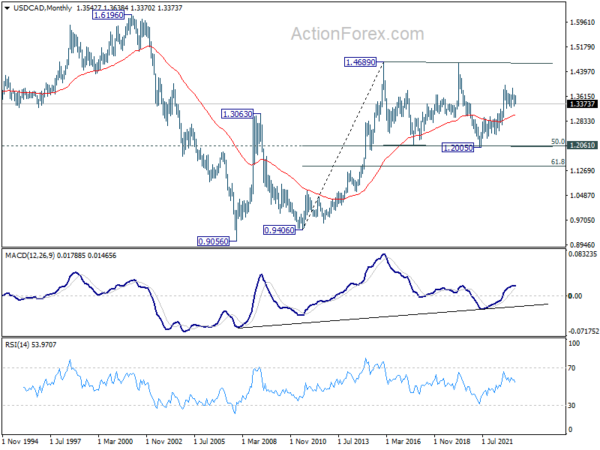

USD/CAD Weekly Outlook

USD/CAD’s steep decline last week indicates short term topping at 1.3666. More importantly, the downside acceleration now argues that fall from 1.3860 is the third leg of the pattern from 1.3976. Initial bias is no won the downside this week first 1.3299 support first. Firm break there will target 100% projection of 1.3976 to 1.3224 from 1.3860 at 1.3395 next. On the upside, though, above 1.3477 minor resistance will turn intraday bias neutral first.

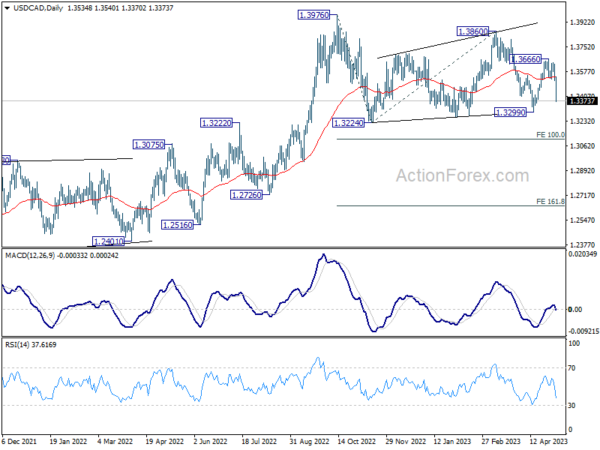

In the bigger picture, as long as 55 W EMA (now at 1.3312) holds, up trend from 1.2005 (2021 low) is still in favor to resume through 1.3976 at a later stage. However, sustained trading below the EMA and 38.2% retracement of 1.2005 to 1.3976 at 1.3233 will raise the chance of bearish reversal. Deeper should then be seen to 61.8% retracement at 1.2758 next.

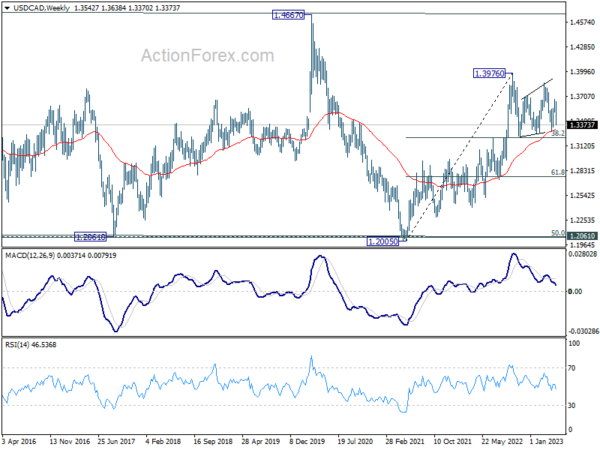

In the longer term picture, price actions from 1.4689 (2016 high) are seen as a consolidation pattern only, which might have completed at 1.2005. That is, up trend from 0.9506 (2007 low) is expected to resume at a later stage. This will remain the favored case as 55 M EMA (now at 1.3025) holds.