Swiss Franc and Euro ended as the strongest ones last week, as investors reversed their short positions accumulated in Q1. In particular, such reversals pushed Sterling to be the worst performing one, suffering heavy pressure against both Euro and Franc. The outlook for European looked a bit less pessimistic on a couple of factors. But technically, Euro still has a lot to prove that it’s coming back.

On the other hand, as risk-appetite came back, there wasn’t much apparent selloff in Yen, nor was there apparent buying in highly risk-correlated commodity currencies. Australian Dollar was indeed the third weakest for the week, just next to Dollar. Canadian Dollar ended mixed despite a very strong job report. The forex markets might need to take some more time to realign themselves with the risk markets.

Euro reversing Q1′ losses, but strength not convincing enough

Euro made a strong come back last week, as markets started to reverse the overly pessimistic trades back in Q1. On the economic front, latest PMIs suggested that the recent lockdowns were weathered well. Businesses had been increasingly adapted to life with the coronavirus. Financing conditions also improved with stabilization in treasury yields, with ECB started to conduct the PEPP purchases at significantly faster pace.

One of the negative factors for Euro since the start of the year was that EU had significantly lagged behind the US and UK on vaccine rollouts. Though, production was give a boost with the approval of new BioNTech-Pfizer, Moderna and AstraZeneca manufacturing sites. EU appears to be back on track to vaccinate 70% of adult population by the end of Q2. Infections in some countries like Franc had also started to trend down.

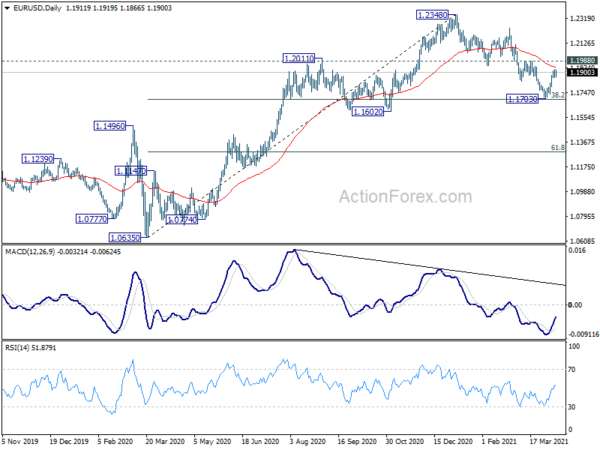

Still, technically, the rally in Euro was not convincing enough. We’re favoring the case the EUR/USD’s correction from 1.2348 has completed with three waves down to 1.1703, just ahead of 38.2% retracement of 1.0635 to 1.2348 at 1.1694. Yet, the pair has to break through 55 day EMA (now at 1.1943) and 1.1988 resistance decisively to give us more confidence on the case. Rejection by this resistance zone will retain near term bearishness for another fall through 1.1703.

EUR/GBP should have formed a short term bottom at 0.8470. We’re expecting strong rise back to 38.2% retracement of 0.9229 to 0.8470 at 0.8784. Sustained break there will add to the case that whole pattern from 0.9499 has completed with three waves down to 0.8470. That should signal the start of at least a near term up trend. But then, it has to overcome mentioned 0.8784 fibonacci level to give us more confidence on this case.

Finally, to full convince us of underlying strength in Euro, EUR/CHF will have to complete the corrective pattern from 1.1149, with a strong upside breakout, to resume the up trend from 1.1503. But judging from last week’s decline, the corrective pattern might still take a week or two to finish, with a brief test on 55 day EMA (now at 1.0977).

S&P 500 hit new record, but currency markets not following

Another development to note was the decoupling of stock markets and risk on/off currencies. S&P 500 closed the week on a strong note, a new record high at 4128.80. More importantly, in appears that 61.8% projection of 2191.86 to 3588.11 from 3233.94 is being firmly taken out. That would set the stage to extend the up trend to 100% projection at 4630.19 in the medium term.

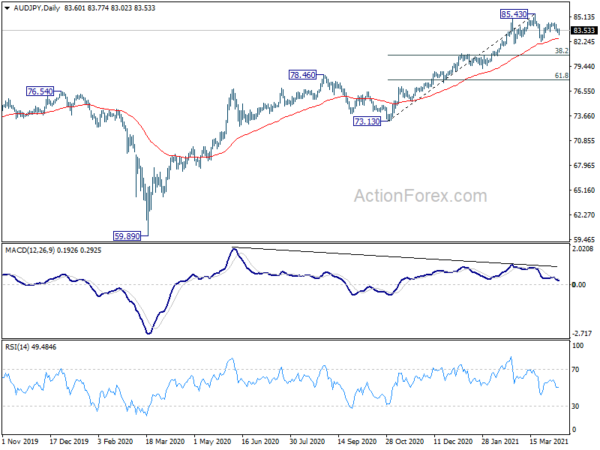

But there was no apparent selloff in Dollar or Yen, or buying in Aussie or Kiwi, on the risk on developments. AUD/JPY continued to struggle in corrective pattern from 85.43. At this point, there is indeed still risk for deeper fall through 82.27 support as the third leg of the corrective pattern extends, towards 38.2% retracement of 73.13 to 85.43 at 80.73.

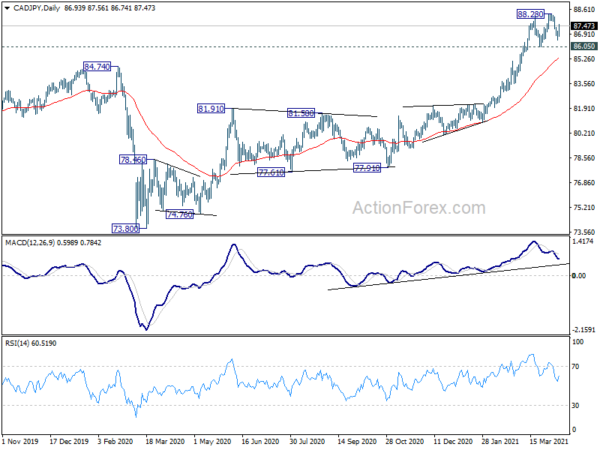

CAD/JPY was a better performing one last week, comparing to AUD/JPY. Yet, the stellar job report, as well as risk-on environment, were not enough to push it through 88.28 short term top. Consolidation from 88.28 could still extend further, and one more fall through 86.05 support to 55 day EMA (now at 85.22) cannot be ruled out. Overall, it appears that the forex markets might need to take some time to realign themselves with the risk markets.

AUD/USD Weekly Outlook

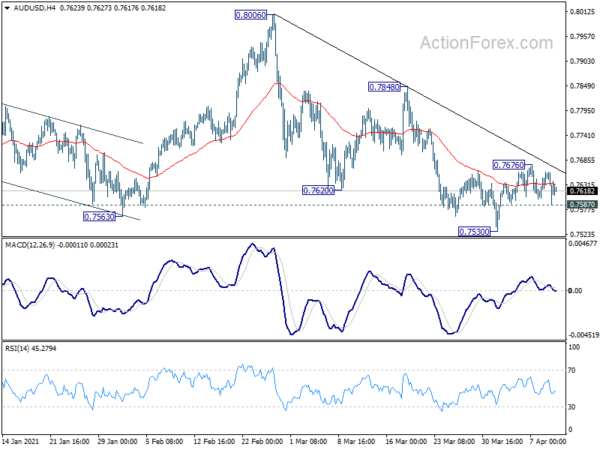

AUD/USD edged higher to 0.7676 last week but struggled to break through 55 day EMA and turned sideway. Initial bias remains neutral this week first. Rebound form 0.7530 is in favor to continue as long as 0.7587 minor support holds. Break of 0.767 will target 0.7848 resistance. Firm break there should confirm completion of the corrective fall from 0.8006. However, break of 0.7587 will likely resume the correction from 0.8006 through 0.7530.

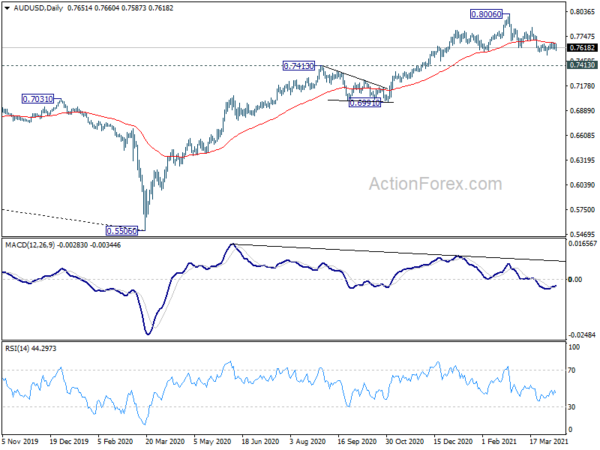

In the bigger picture, whole down trend from 1.1079 (2001 high) should have completed at 0.5506 (2020 low) already. Rise from 0.5506 could either be the start of a long term up trend, or a corrective rise. Reactions to 0.8135 key resistance will reveal which case it is. But in any case, medium term rally is expected to continue as long as 0.7413 resistance turned support holds.

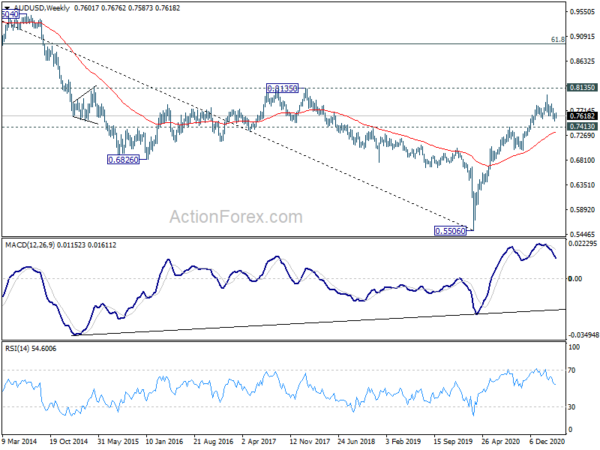

In the longer term picture, 0.5506 is a long term bottom, on bullish convergence condition in monthly MACD. Focus is now back on 0.8135 structural resistance. Decisive break there will raise the chance that rise from 0.5506 is an impulsive up trend. Next target should be 61.8% retracement at 0.8950 of 1.1079 to 0.5506 and above. Though, rejection by 0.8135 will keep the case of medium to long term sideway consolidation open.