Euro has surprisingly ended as the strongest one last week. While a rebound against Dollar was expected, the turnaround against commodity currency, in a risk-on week, was impressive. Though, as discussed below, the common currency still has a lot to prove. Sterling also overwhelmed New Zealand Dollar slightly and ended as second strongest.

On the other hand, Dollar and Yen were the worst performing one, in risk seeking environment. Investor were riding on the theme of more US fiscal stimulus, as well as resolution of the pandemic with vaccinations despite near term lockdowns. Canadian Dollar was surprisingly among the weakest too, as the balanced BoC didn’t give enough support, while oil price also failed to extend recent rally.

Euro turned around after perceived hawkish twist in ECB statement

ECB statement and press conference was a turning for the Euro as it reversed from there to close high against all major currencies. On the economy, President Christine Lagarde acknowledged that roll-out of vaccines allows for “greater confidence in the resolution of the health crisis”. Also, while risks are still tilted to the downside, they are now “less pronounced”.

Another hawkish “twist” was that “if favorable financing conditions can be maintained with asset purchase flows that do not exhaust the envelope over the net purchase horizon of the PEPP, the envelope need not be used in full”. Some saw that change in the statement as a compromise to the hawks inside the board and the governing council.

However, firstly, an “envelop” is called an “envelop” because it’s an “envelop” in the first place. The idea was already communicated in the after the first round of PEPP was launched last year. Secondly, ECB also holds the card that the envelop “can be recalibrated if required” in response to negative shocks. So, that’s not too hawkish indeed.

More needed for Euro to prove it’s bullishness

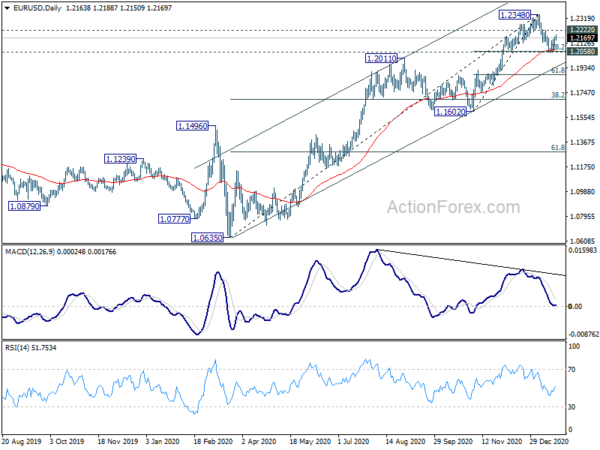

While Euro rebounded towards the end of the week, overall development was not too convincingly bullish yet. EUR/USD received strong support from 1.2058 cluster support (38.2% retracement of 1.1602 to 1.2348 at 1.2063) as expected and rebounded. Though, break of 1.2222 minor resistance would need to confirm underlying upside momentum for a test on 1.2348. Or, risk of another fall through 1.2052 remains.

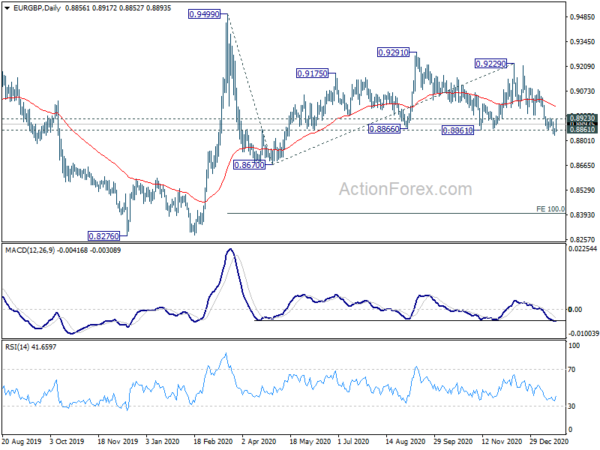

EUR/GBP breached 0.8861 support briefly and recovered. But break of 0.8923 minor resistance is needed to indicate short term bottoming. Or, another fall and sustained trading below 0.8861 will open up the case for 0.8670 support.

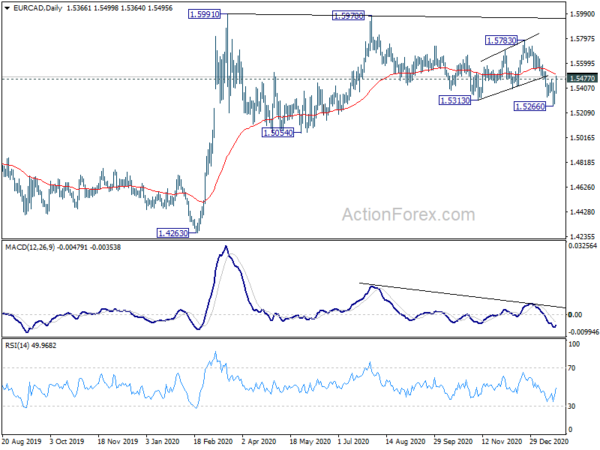

EUR/CAD was actually the better looking one as break of 1.5477 minor resistance argue that fall from 1.5970 might have completed much earlier than expected, with three waves down to 1.5266. Though, we’ll also need sustained break of 55 day EMA (now at 1.5518) to give us more confidence on this bullish case.

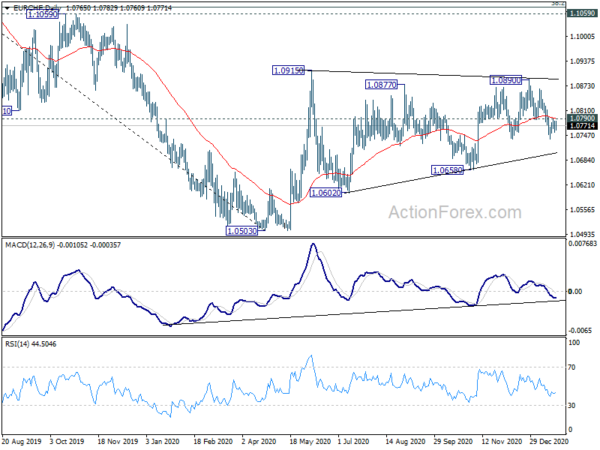

EUR/CHF’s decline was also capped at 1.0790, by 55 day EMA. Firm break of of this level is needed to indicate short term bottoming for stronger rebound. Or EUR/CHF could head to retest 1.0658 support.

NASDAQ extended record run, dollar index rebound capped

As for the Dollar, persistent risk-on market could continue to cap it’s upside in any rally attempt. NASDAQ surged to new record high last week and closed strongly at 13543.06. Near term channel resistance is somewhat capping it’s upside momentum. But outlook will stay bullish as long as 13208.08 support holds. Next target is 61.8% projection of 6631.42 to 12074.06 from 10822.57 at 14186.12.

Dollar index failed to break through 91.01 resistance to confirm short term bottoming at 89.20. Upside was also limited below 55 day EMA (now at 90.99). At this point, we might still see the medium term down trend extends to 61.8% projection of 102.99 to 91.74 from 94.74 at 87.78. Sustainable rebound might only be seen after that. Though, the markets are highly interactive. Pull back in stocks, or completion of EUR/USD’s rebound, would have push DXY through 91.01 resistance to target 91.74/94.74 resistance zone.

GBP/USD Weekly Outlook

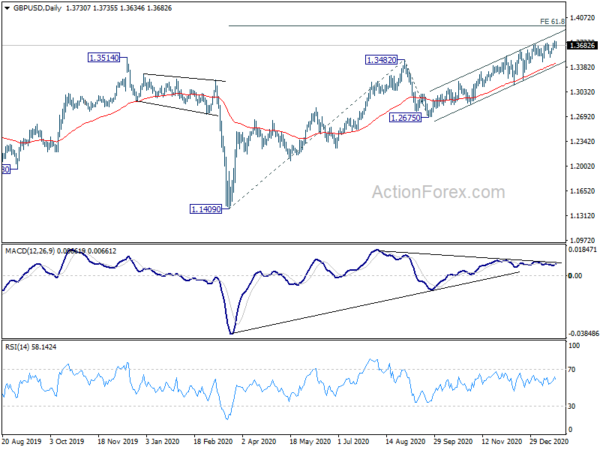

GBP/USD edged higher to 1.3745 last week but quickly lost momentum and retreated. Initial bias remains neutral this week first. As long as 1.3518 support holds, further rally is expected. Break of 1.3745 will turn bias to the upside, and extend the rise from 1.1409 to 61.8% projection of 1.1409 to 1.3482 from 1.2675 at 1.3956. On the downside, break of 1.3518 will indicate short term topping, on bearish divergence condition in 4 hour MACD. Intraday bias will be turned back to the downside for deeper pull back.

In the bigger picture, rise from 1.1409 medium term bottom is in progress. Further rally would be seen to 1.4376 resistance and above. On the downside, break of 1.2675 support is needed to indicate completion of the rise. Otherwise, outlook will stay cautiously bullish even in case of deep pullback.

In the longer term picture, a long term bottom should be in place at 1.1409, on bullish convergence condition in monthly MACD. Rise from there would target 38.2% retracement of 2.1161 to 1.1409 at 1.5134. Reaction from there would reveal whether rise from 1.1409 is just a correction, or developing into a long term up trend.