Global investors were all in risk seeking mode in the first full week of 2021. That came despite all the headlines of surges in coronavirus infection and death, return to strict lockdowns, chaos in Washington and Joe Biden’s certification as US President-Elect. Dollar didn’t perform too well but there was surprisingly no deep selloff neither. Strong rally is US treasury yield was probably finally giving Dollar some support, which was in turn reflected in the selloff in Gold too. Is Dollar’s finally building a base for sustainable rebound? We’d likely see very soon.

Staying in the currency markets, selling focus turned to the Japanese Yen. Sterling followed Yen and Dollar and ended as the third weakest. Australian Dollar ended as the strongest one, followed by New Zealand Dollar. Other major currencies are generally mixed, including the Canadian, which reacted little to rise in oil prices.

DOW extended up trend with upside acceleration

DOW’s up trend continued last week and closed at new record high at 31097.97. Daily MACD’s cross above signal line suggests upside acceleration again. Near term outlook will stays bullish as long as 29881.82 support holds. Next target is 61.8% projection of 18213.65 to 29199.35 from 26143.77 at 32932.93.

Meanwhile, it should be noted that the above mentioned level is slightly above 61.8% projection of 6469.96 (2009 low) to 29568.57 (2020 high) from 18213.65 (2020 low) at 32488.59. DOW might start to feel heavy and top around in between these two levels. However, sustained break of the resistance zone will carry rather bullish long term implication, and prompt further medium term up side acceleration. We’d probably know which way it goes within Q1.

Strength also seen in DAX and Nikkei

Strength was also seen in other global markets. DAX surged to new record high at 14049.53. Near term outlook remain bullish as long as 13566.47 support holds. Next near term target if 61.8% projection of 8255.65 to 13460.50 from 11450.08 at 14666.65.

Nikkei also accelerated up to close at 28139.02. Near term outlook remain bullish as long as 27002.18 support holds. Decisive break of 100% projection of 16358.19 to 23178.10 from 21710.00 at 28529.91 will bring further acceleration to 61.8% projection at 32744.61.

US 10-year yield surged on growth and reflation optimism

US 10-year yield also surged sharply last week, on the theme of post-vaccine economic growth and reflation. 1% psychological level would now likely provide a floor for any pull back. Immediate focus is on channel resistance at 1.14. Decisive break there could indicate upside acceleration towards 1.266 key resistance.

Dollar index might bottom earlier than expected

Dollar index didn’t suffer any deep selloff last week despite strong risk appetite. Surging treasury yield might finally be supporting the greenback. Also, as we noted before, while the down trend could still continue as long as 91.01 resistance holds, we’re expecting strong support from key support zone, between 88.25 and 61.8% projection of 102.99 to 91.74 from 94.74 at 87.88, to bring rebound.

Break of 91.01 resistance would now suggest that DXY has bottomed slightly earlier than expected, on bullish convergence condition in daily MACD. Stronger rebound should then be seen back towards 94.74 resistance, as a correction. Still, even in this case, we won’t consider the case of bullish trend reversal yet as long as 94.74 resistance holds.

Gold extending correction from 2075 after rejection by 1965.50

Development in Gold last also some what reflected Dollar’s resilience. Gold suffered a steep reversal after being rejected by 1965.50 resistance. The corrective pattern from 2075.18 might be starting another down leg for 1764.31 and below. Though, even in that case, we’d expect strong support from 38.2% retracement of 1160.17 to 2075.18 at 1725.64 to contain downside to bring rebound. Sustained break of 1725.64 is needed to be a tentative signal for bullish reversal in Dollar.

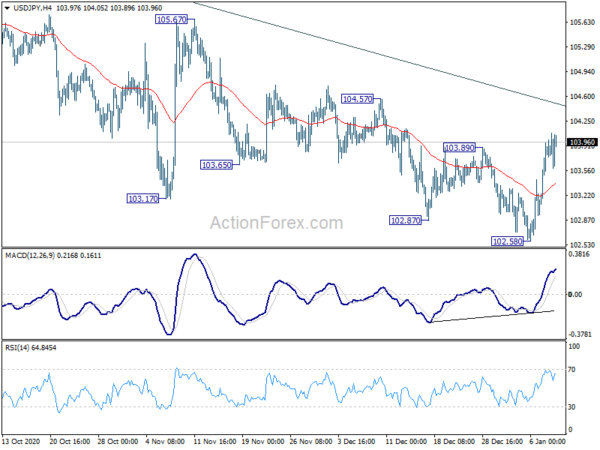

USD/JPY Weekly Outlook

USD/JPY staged a strong rebound after dipping to 102.58 last week. Break of 103.89 resistance suggests short term bottoming on bullish convergence condition in 4 hour MACD. Initial bias is mildly on the upside this week for channel resistance (now at 104.47). Sustained break there will argue that the down trend from 111.71 has finally completed. Stronger rise would be seen to 105.67 resistance for confirmation. Nevertheless, rejection by the channel resistance will maintain bearishness, for extending the down trend through 102.58 at a later stage.

In the bigger picture, USD/JPY is still staying in long term falling channel that started back in 118.65 (Dec. 2016). Hence, there is no clear indication of trend reversal yet. The down trend could still extend through 101.18 low. On the upside, break of 105.67 resistance is needed to be the first signal of medium term reversal. Otherwise, outlook will remain bearish.

In the long term picture, the rise from 75.56 (2011 low) long term bottom to 125.85 (2015 high) is viewed as an impulsive move, no change in this view. Price actions from 125.85 are seen as a corrective pattern which could still extend. In case of deeper fall, downside should be contained by 61.8% retracement of 75.56 to 125.85 at 94.77. Up trend from 75.56 is expected to resume at a later stage for above 135.20/147.68 resistance zone.