Sterling was in free fall last week after both UK and EU admitted that a no-deal Brexit is more likely than not. Negotiation deadline was ended to end of Sunday. Euro and Dollar, followed as the next weakest and focus turned to rally in commodity currencies. In particular, Australian Dollar was pulled up by surging iron ore prices on supply disruption. Canadian Dollar was also strong as oil prices resumed rally. But New Zealand Dollar and Swiss Franc were even stronger.

For the near term, reactions to Brexit talks will be the biggest focuses in the early part of the coming week. In particular, movements in European-Sterling crosses would be watched closely. As for the rest of the month, the next move in stock markets, another up leg or a correction, would decide how Dollar flares before year-end.

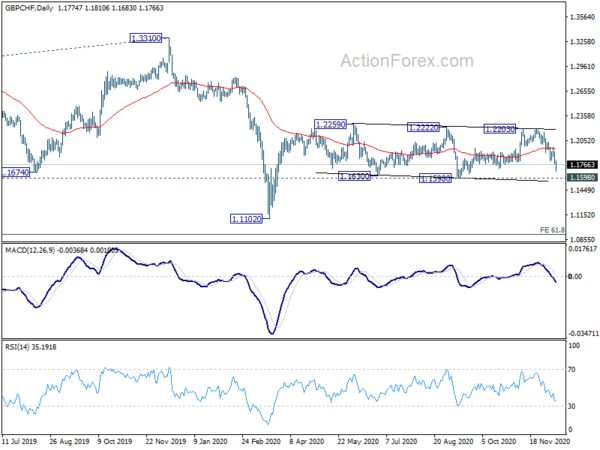

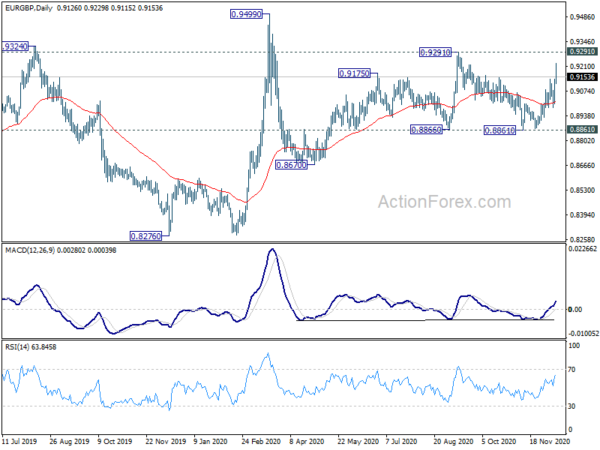

GBP/CHF and EUR/GBP to gauge market reactions to Brexit talk outcome

At the time of writing, Brexit trade negotiations are still carrying on. Both UK and EU admitted that a no-deal Brexit is the more likely scenario. But who knows if there would be anything dramatic out of Sunday’s deadline. We’d pay special attention to European-Pound crosses on Monday to gauge market reactions.

As for GBP/CHF, in case of a positive surprise, decisive break of 1.2203 resistance is needed to confirm that Sterling bulls are back. Otherwise, the upside moves are viewed as knee-jerk reactions only, and the Pound would be just back to “normal”.

However, in case of a negative outcome, decisive break of 1.1598 support would carry some larger bearish implications. That would seal the case of rejection by 55 week EMA and the long term down trend in GBP/CHF could then be resuming through 1.1102 low, possibly to 61.8% projection of 1.5570 to 1.1701 from 1.3310 at 1.0919.

For EUR/GBP, firm break of 0.8861 support is needed to confirm Sterling’s rebound. Otherwise, the choppy rise from 0.8670 would still resume at a later stage. On the other hand, firm break of 0.9291 resistance will firstly bring a test on 0.9499 high. More importantly, that would also suggest resumption of the up trend from 0.6395 (2015 low) to 0.9799 (2009 high).

Iron ore prices shot Aussie higher, AUD/JPY to face long term channel resistance.

The strong upside acceleration in iron ore prices was seen as the major driving force behind Aussie’s powerful rally last weeks. The strong suggests that the up trend is not over yet. Further rise would likely be seen to 161.8% projection of 62.99 to 119.45 from 88.14 at 171.49. Some resistance would likely be seen there to cap upside, on initial attempt at least. That is, there is some more upside potential in the Aussie.

AUD/JPY surged to as high as 78.78 last week. Break of 78.46 resistance indicates resumption of whole rise from 59.89. Further rise is expected as long as 76.90 support holds. But the cross would immediately be facing long term channel resistance (now at 79.32) that started back in 2013. Sustained break there should confirm long term bullish reversal. Next medium term target would be 61.8% projection of 59.89 to 78.46 from 73.13 at 84.60. However, rejection by the channel resistance will retain long term bearishness and turn focus back to 73.13 support.

NASDAQ losing momentum, more rally or a correction by year end?

As for the rest of the month, a big question is whether there would a Santa Claus rally, or a correction. US stocks had clearly lost upside momentum, yet there is no clear sign of a deep correction yet. As long as 12027.16 support holds, further rise is still in favor in NASDAQ to 38.2% projection of 6631.42 to 12074.06 from 10822.57 at 12901.65 next. However, firm break of 12027.16 would bring deeper pull back to 55 day EMA (now at 11771.73) at least. The correction could last till 2021 arrives.

Dollar index still holding on to 90 cluster support

Development in stocks, or actually overall risk sentiment, could decide the reaction of AUD/JPY to the channel resistance as mentioned above. That would also decide whether Dollar index could hold on to 90 handle and turn into a rebound. Such psychological level coincides with 61.8% projection of 102.99 to 91.74 from 94.30 at 90.00. We’re expecting some recovery but not a firm break of 91.74 support turned resistance. However, sustained break of 90 could prompt more downside acceleration in Dollar in general.

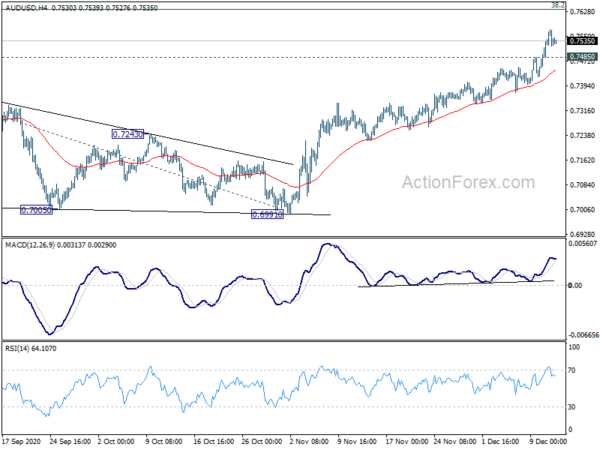

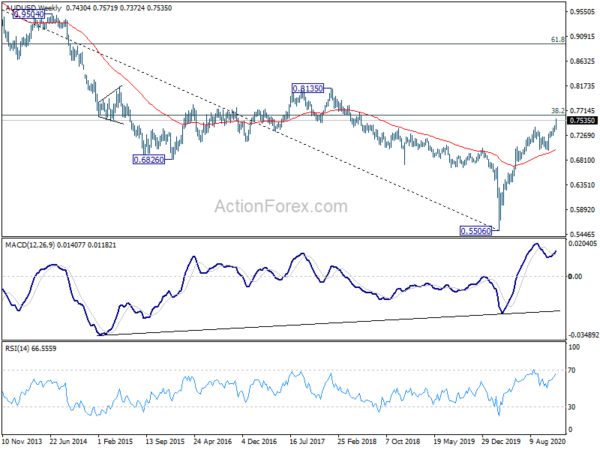

AUD/USD Weekly Outlook

AUD/USD’s rally accelerated to as high as 0.7571 last week and there is no clear sign of topping yet. Initial bias remains on the upside this week for 0.7635 key long term fibonacci level. Decisive break there will carry larger bullish implication. Next target is 61.8% projection of 0.5506 to 0.7413 from 0.6991 at 0.8170. On the downside, break of 0.7485 minor support will turn intraday bias neutral and bring consolidations first.

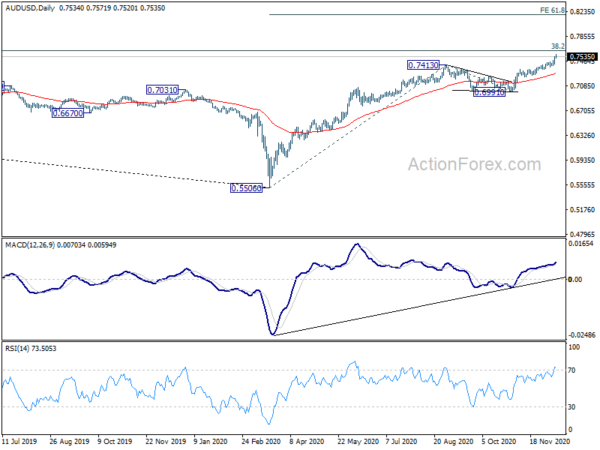

In the bigger picture, the sustained trading above 55 week EMA (now at 0.6994) is a sign of medium term bullishness. Nevertheless, AUD/USD will still need to overcome 38.2% retracement of 1.1079 (2011 high) to 0.5506 (2020 low) at 0.7635 decisively to indicate completion of long term down trend from 1.1079. In that case, next medium term target would be 61.8% retracement at 0.8950. Rejection by 0.7635 will retain long term bearishness instead.

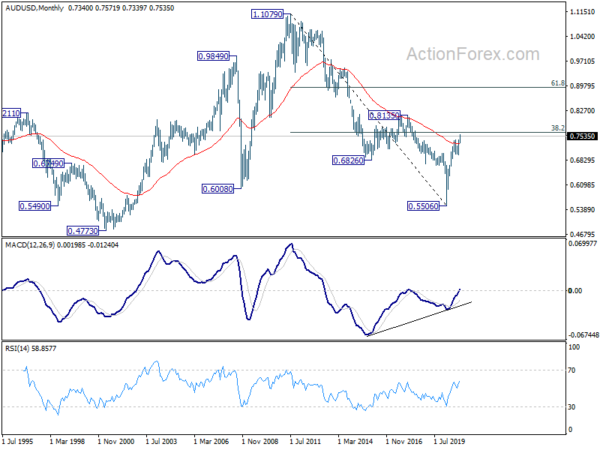

In the longer term picture, bullish convergence condition in monthly MACD is a condition for long term bullish reversal. Focus will be on 38.2% retracement of 1.1079 (2011 high) to 0.5506 (2020 low) at 0.7635. Decisive break there should confirm reversal and target 61.8% retracement at 0.8950. Though, rejection by 0.7635 will retain long term bearishness for another low through 0.5506 at a later stage.