Vaccine optimism pushed global stocks higher last week, with Nikkei completing the most impressive rally. Commodity currencies ended generally higher as led by New Zealand Dollar. Yen and Dollar ended as the worst performing ones. Though, no key levels were taken out, except in NZD/USD and NZD/JPY. Dollar index is also holding on to an important near term support.

While the British Pound ended as just the third weakest, the late selloff is worth a mention. The clock is ticking as the Brexit transition period is going to end in a month’s time. The upcoming days could see some violent move in Sterling, in particular against other European majors.

Japan returning to the glory days of 80s and 90s

Talking about stocks, Japanese Nikkei deserves the first mention as it hit new 30-year high last week, following the strong upside breakout this month. Japan has likely emerged from the three “lost decades” already, and it’s returning to the glory days of the 80s and 90s.

Sustained break of 61.8% retracement of 39260 to 6994.89 at 26934.72 will solidify this optimistic case. We might finally hear Nikkei making record highs again (well, “again” for those who lived through the golden age), in the coming year or two.

How that would reshape BoJ’s position as the everlasting dovish central remains to be seen. That could also directly and indirectly change the dynamics between Yen’s exchange rate and global risk sentiments, which, we felt, has already started somewhat.

DOW hit 30k level for the first time ever

DOW’s up trend continued last week and hit 30k level for the first time ever. 38.2% projection of 18213.65 to 29199.35 from 26143.77 at 30340.30 presents an important test to the sustainability of the up trend. Decisive break there will pave the way to 61.8% projection at 32932.93 and above, with prospect of upside acceleration.

However, break of 29231.20 support will be the first sign of rejection by the mentioned projection level. Focus will then be turned back to 55 day EMA (now at 28334.21). Sustained break there will be an alarm of near term trend reversal.

Dollar index still holding on to 91.74 support for now

While Dollar was solid off broadly last week, no important near term support level was taken out. The levels include 1.2011 resistance in EUR/USD, 1.3482 resistance in GBP/USD, 0.7413 resistance in AUD/USD, 0.8982 support in USD/CHF, 103.17 support in USD/JPY and 1.2928 support in USD/CAD.

Such development is reflected in Dollar index too, as it’s gyrated further lower, but barely held on to 91.74 support. Current downside momentum doesn’t warrant a strong break of 91.74 yet. Instead, break of 55 day EMA (now at 93.08) will extend the consolidation pattern from 9.174 with another rise through 94.30 resistance. However, firm break of 91.74 will resume whole down trend from 102.99.

EUR/GBP and GBP/CHF to react to last-ditch Brexit negotiation

Sterling could be subject to much volatility in the coming days as EU negotiation Michel is now in London for a four day make-or break Brexit negotiations. With just a month before the end of transition period, significant gaps remain between the UK and EU. Either way, an announcement of a deal or a no-deal would prompt further movements in the Pound.

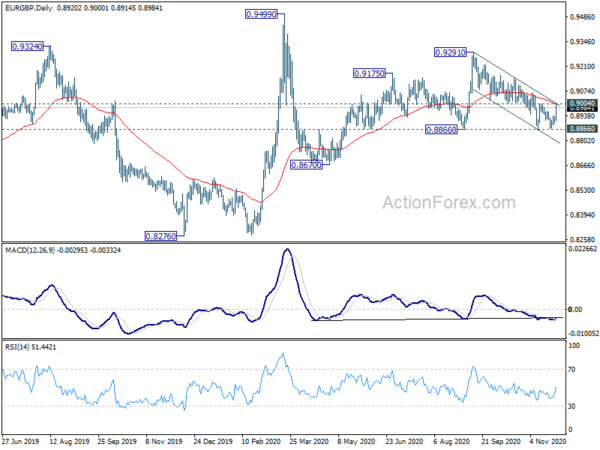

We’ll keep an eye on both EUR/GBP and GBP/CHF to gauge the direction in Sterling. EUR/GBP rebounded strongly last week after another failed attempt to break through 0.8866 structural support. Firm break of 0.9004 will suggest that pull back from 0.9291 has completed. That would also keep the rise from 0.8670 intact. Further rally should be seen back to 0.9291 and above. Though, sustained break of 0.8866 will likely extend the pattern from 0.9499 with another falling leg through 0.8670 support.

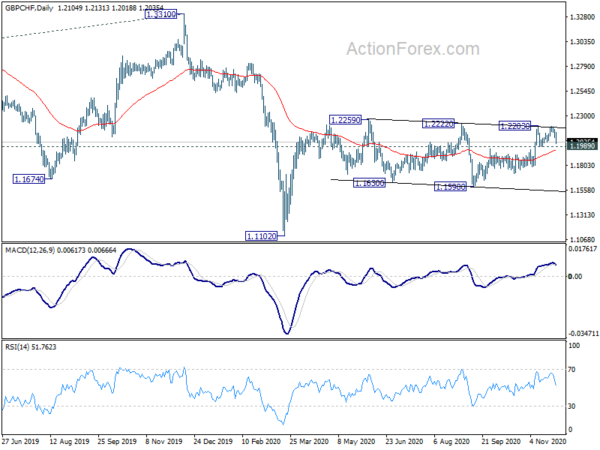

GBP/CHF also failed to break through 1.2222/2259 resistance with another attempt last week and dropped sharply. Break of 1.1989 support will argue that the rebound form 1.1598 has completed. Sideway pattern fro m1.2259 should have then started another falling leg back towards 1.1598. Though, sustained break of 1.2259 will confirm resumption of the whole rise form 1.1102 towards 1.3310 resistance.

EUR/USD Weekly Outlook

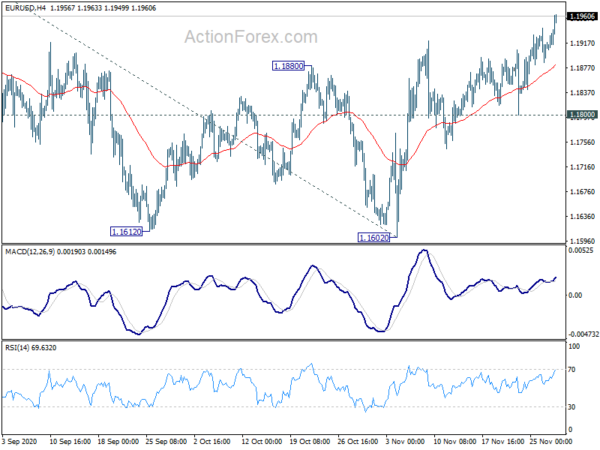

EUR/USD’s rebound from 1.1602 resumed last week and hit as high as 1.1963. Initial bias stays on the upside this week for 1.2011 high. Decisive break of 1.2011 high will resume whole rally from 1.0635 low. Next target is 61.8% projection of 1.0635 to 1.2011 from 1.1602 at 1.2452. On the downside, however, break of 1.1800 support will turn bias to the downside, to extend the consolidation pattern from 1.2011 with another falling leg.

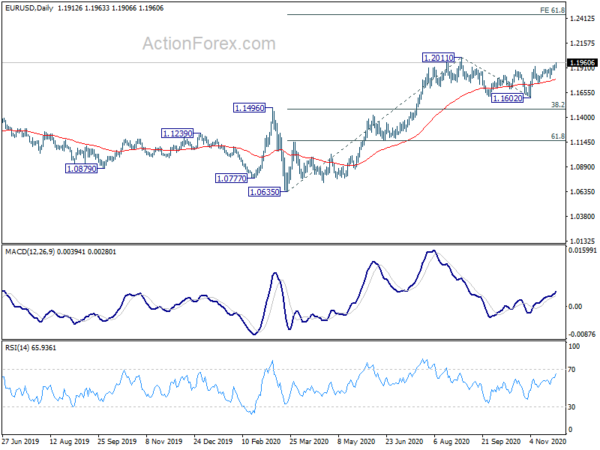

In the bigger picture, rise from 1.0635 is seen as the third leg of the pattern from 1.0339 (2017 low). Further rally could be seen to cluster resistance at 1.2555 next, (38.2% retracement of 1.6039 to 1.0339 at 1.2516). This will remain the favored case as long as 1.1422 resistance turned support holds.

In the long term picture, the strong break of 55 month EMA is taken as a sign of long term trend reversal. Immediate focus will be on decade long trend line resistance (now at 1.1576). Sustained trading above there will add more credence to the case that down trend from 1.6039 (2008 high) has finished at 1.0339. Further break of 1.2555 cluster resistance (38.2% retracement of 1.6039 to 1.0339 at 1.2516 ) will confirm and target 61.8% retracement at 1.3862 and above.