Risk aversion dominated the markets last week as tension between US and North Korea suddenly intensified on verbal exchanges of the leaders. DOW initial made new record high at 22179.11 but ended the week down -234.49 pts or -1.06% at 21858.32. S&P 500 closed down -35.51 pts or -1.43% at 2441.32. European indices were harder hit with DAX closed down -283.66 pts or -2.31%. FTSE closed down -201.75 pts or -2.69%. Japan was on holiday on Friday but Hong Kong HSI closed the week down -2.46%. US yields was further hit by tame CPI and PPI data with 10 year yield closed at 2.189, taking out 2.225 near term support decisively. In the currency markets, Yen and Swiss Franc ended as the strongest ones on risk aversion. Commodity currencies ended as the weakest ones, followed by Sterling. Gold surged on risk aversion and Dollar weakness and closed up 2.4% at 1295. WTI crude oil traded like a passerby and struggled to regain 50 on another attempt.

Fed fund futures pricing in 4.1% of September cut

A key takeaway from last week’s development is the drastic change in Fed interest rate expectations. Risk aversion and tame inflation readers are factors contributing to the change. Also, markets keeps wondering when US President Donald Trump is going to put his focus back on the economy. Fed fund futures priced in 0% chance of a rate hike in September, that’s expected. But the surprise is that they’re now pricing in 4.1% chance of a rate cut in September, something that we haven’t seen for some time. Meanwhile, the odds for December hike dropped to 35.9% only, comparing to 46% a week ago.

10 year yield heading back to 2.103/30 support zone

The change in market expectations is also clearly reflected in weakness in yield and Dollar. 10 year yield (TNX) dropped through 2.225 key near term support last week should be heading back to 2.103 cluster support level (38.2% retracement of 1.336 to 2.621 at 2.130. The mild downside acceleration now makes 2.103/30 quite vulnerable. We could see TNX drop further to 50% retracement at 1.9785 before completing the correction from 2.621.

Dollar index risk breaking 91.91/3 key support

Dollar’s recovery was limited well below 94.28 resistance and weakened again. More decline would be seen in near term with focus back on 91.91/3 cluster support (38.2% retracement of 72.69 to 103.82 at 91.93). At this point, we’d expect strong support from there to contain downside and bring rebound. But a firm break will extend the whole correction from 103.82 to 50% retracement at 88.25 and below.

Still early to call reversal in DOW

Risk sentiment will be the main theme in the markets this week and that will be the main factor to determine which currencies will perform best. 22179.11 is clearly a short term top in DOW. Friday’s mild recovery only indicates stabilization, not bottoming. Deeper fall is expected in near term. But still, it’s too early to call for a trend reversal yet. Focus will be on 55 day EMA (now at 21535.63) and 38.2% retracement of 20379.55 to 22179.11 at 21491.67. The up trend is still intact as long as this levels hold and another record high is in favor. However, firm break there will indicate that fall from 22179.11 is developing into a medium term correction for support zone at 20379.55/21169.11.

DAX likely in medium term correction

On the other hand, DAX is now more likely in a medium term correction already. That, is a medium term top is formed at 12951.54 on bearish divergence condition in daily MACD. And, this is supported by the break of channel support. Near term outlook will remain bearish as long as 12336.00 resistance holds. Break of 11941.57 support should confirm this bearish view and bring DAX lower to 38.2% retracement of 8699.29 to 12951.54 at 11327.18 before finding a bottom.

FTSE headling back to 7096 key support

FTSE’s sharp fall last week and breach of 7302.71 key near term support suggests that the correction from 7598.99 medium term top is resuming. Further decline would now be seen back to 7096.83 support first. Decisive break there will confirm that fall from 7598.99 is a medium term decline and will drag it to 38.2% retracement of 5499.50 to 7598.99 at 6796.98 next.

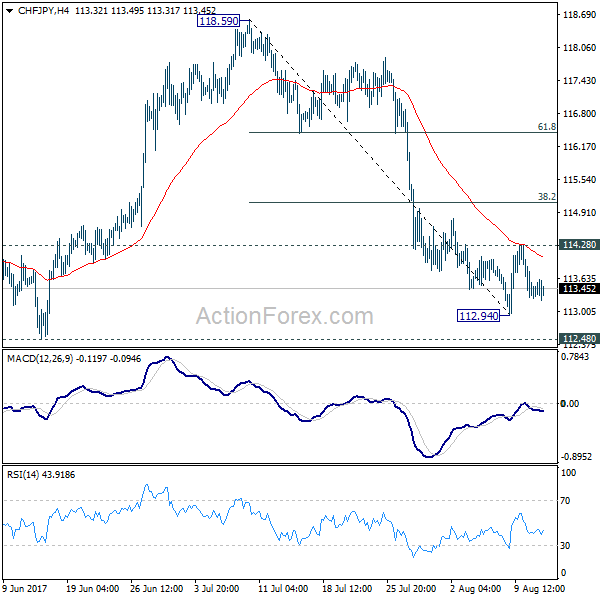

Rebound in CHF/JPY disapppointing

Based on the above analysis, risk aversion will likely continue in near term. Yen and Swiss Franc would be the ones that benefit most. We’ve pointed out the possibility of near term reversal in CHF/JPY during the week but the rebound from 112.94 was quite disappointing. The cross was rejected from 4 hour 55 EMA and weakened again. Initial bias will now stays neutral this week first. But considering that CHF/JPY is close to key support level at 112.48, with diminishing downside momentum, we’d still expect bottoming zone. Break of 114.28 resistance will affirm the case of reversal and target 38.2% retracement of 118.59 to 112.94 at 115.09.

Trading strategy: Close GBP/USD short, sell NZD/JPY on recovery

Regarding trading strategy, we sold GBP/USD at 1.3030 at open last week. The idea against Sterling was not too bad but Dollar clearly didn’t have the momentum to sustain it’s rebound. As Dollar index is now expected to resume it’s recent decline, we will just close the position at market open this week first. Hopefully, we’d still be able to pocket a little bit of profit.

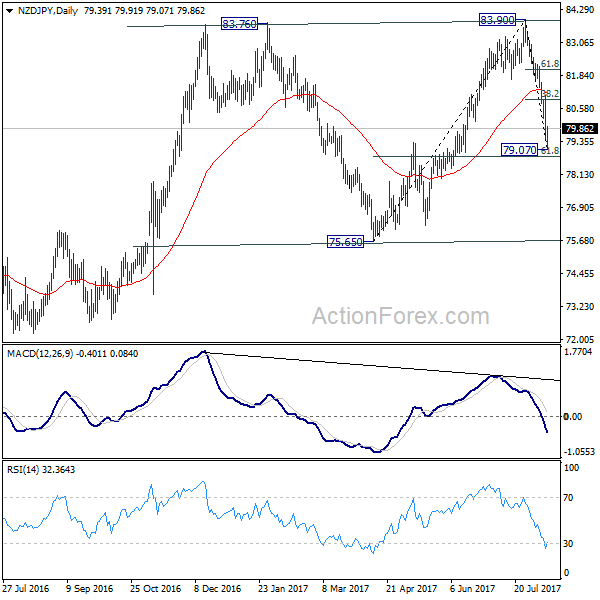

Instead, we’ll look into selling NZD/JPY this week. Kiwi suffered some selloff last week as RBNZ heightened warning of the exchange rate. And as noted above, we’re expecting further Yen strength in near term. There is much room for the decline from 83.90 to extend back to 75.65 support. Nonetheless, since NZD/JPY should have past its immediate selling climax after hitting 79.07, we’ll try to sell it on recovery 80.85. 80.85 is slightly below 38.2% retracement of 83.90 to 79.07 at 80.91. Stop will be placed at 82.10, slightly above 61.8% retracement at 82.05. 75.65 will be the target.

EUR/USD Weekly Outlook

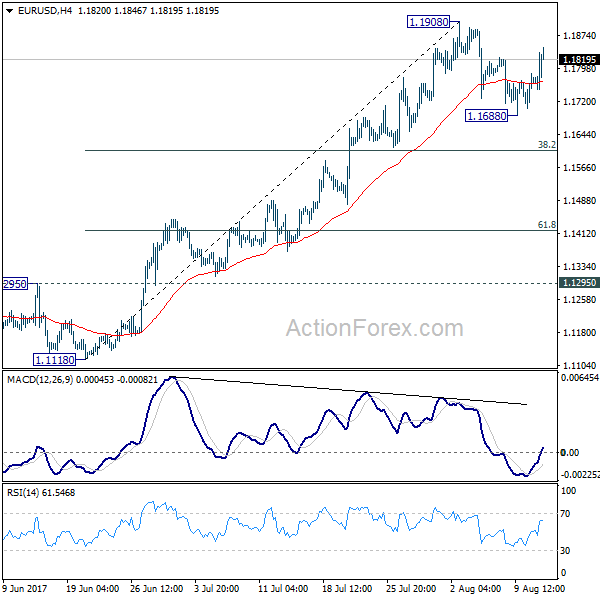

EUR/USD’s pull back from 1.1908 extended to 1.1688 last week but recovered since then. With 1.1908 resistance intact, initial bias remains neutral this week for some more consolidations first. In case of another fall, downside should be contained by 38.2% retracement of 1.1119 to 1.1908 at 1.1606 to bring rebound. On the upside, break of 1.1908 will extend recent up trend to 1.2042 long term support turned resistance next.

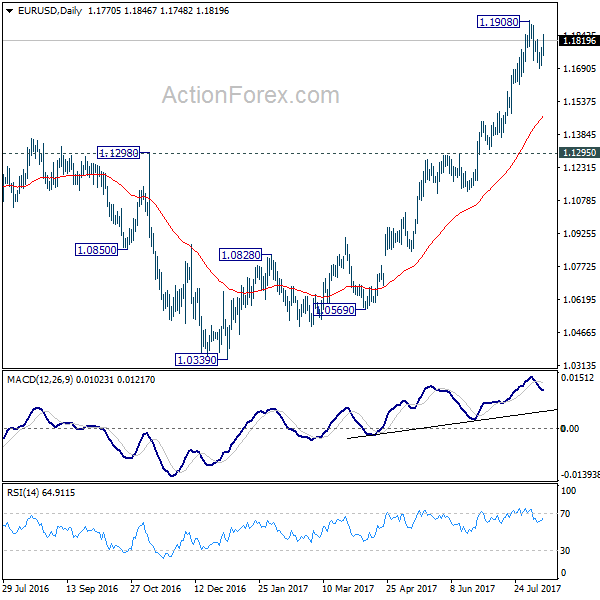

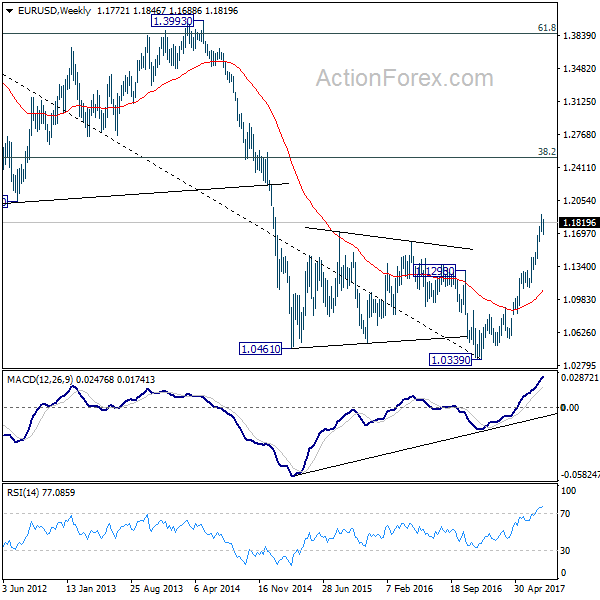

In the bigger picture, an important bottom was formed at 1.0339 on bullish convergence condition in weekly MACD. Sustained trading above 55 month EMA (now at 1.1768) will pave the way to key fibonacci level at 38.2% retracement of 1.6039 (2008 high) to 1.0339 (2017 low) at 1.2516. While rise from 1.0339 is strong, there is no confirmation that it’s developing into a long term up trend yet. Hence, we’ll be cautious on strong resistance from 1.2516 to limit upside. But for now, medium term outlook will remain bullish as long as 1.1295 support holds, in case of pull back.

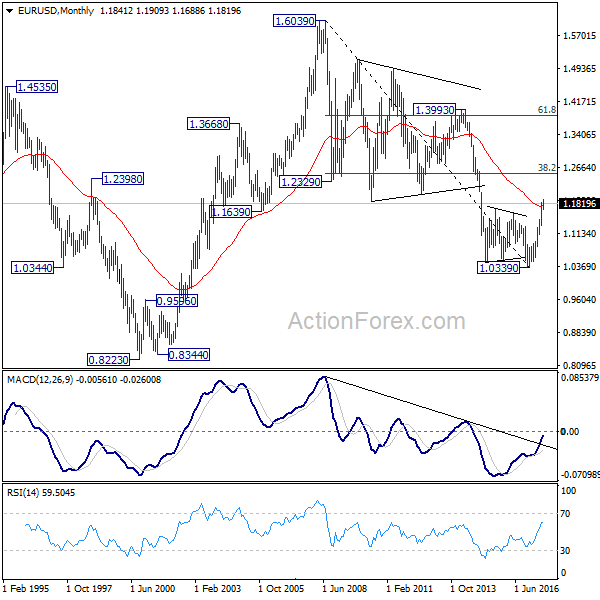

In the long term picture, 1.0339 is now seen as an important bottom as the down trend from 1.6039 (2008 high) could have completed. It’s still early to decide whether price action form 1.0339 is developing into a corrective or impulsive move. But in either case, further rally would be seen to 38.2% retracement of 1.6039 to 1.0339 at 1.2516