Yen and Dollar ended the week as overwhelmingly the worst performing ones. Despite all the jitters regarding US President Donald Trump’s coronavirus infections, stimulus talks stalemate, major stock indices ended the week strongly higher. Yen is additionally pressured by strong rally in treasury yields too.

On the other hand, Canadian Dollar was doubled boosted by the rally in oil prices, as well as solid employment data, ending as the strongest. Australian Dollar performed very well too even though RBA signaled more easing ahead, probably in November. New Zealand Dollar, lagged behind as RBNZ is actively preparing for negative rates.

S&P 500 to retest 3588 record high next

Despite initial set back and some volatility, US stocks staged a strong rally last week. S&P 500 defended 55 day EMA well and rose to close at 3477.13. Further rise would be expected in near term for retesting 3588.11 key resistance.

Technically, we’d still believe price action from 3588.11 hasn’t fullfil both the time and depth of the corrective pattern. Fundamentally, we’d doubt the commitment of bulls before clearing US election risks. Hence, we’d be cautious on strong resistance from 3588.11 to bring another fall. Break of 55 day EMA (now at 3336.61) will target 38.2% retracement of 2191.86 to 3588.11 at 3054.74 to complete the three wave consolidation. However, sustained break of 3588.11 will invalidate our cautious view again and confirm up trend resumption.

10-year yield targeting 0.957 resistance after strong rally

US treasury yield also staged an impressive rally last week. 10-year yield jumped to close at 0.775, getting rid of 55 day EMA cleanly. Further rise is now expected for the near term to 0.957 resistance At this point, we’d re not expecting a firm break there. Rather, strong resistance should be see to keep TNX in range. Nevertheless, near term outlook won’t be too bad as long as 55 day EMA (now at 0.6849) holds.

Dollar index completed corrective rebound, heading back to 91.74 low

The combined development was accompanied by sharp, broad based decline in Dollar, in particular on Friday. Rising yields provided no support to the greenback. Instead, reverse safe-haven flows were in full force. The development now suggests that Dollar index’s rebound from 91.74 has completed at 94.74 already. Retest of 91.74 should be seen next.

The prospect of breaking through 91.74 to resume the down trend from 102.99 would depend very much on overall risk sentiments. We’re not expecting a clear decision from trader before US elections. Hence, 91.74 should on for the near term. Still, October could be full of surprises.

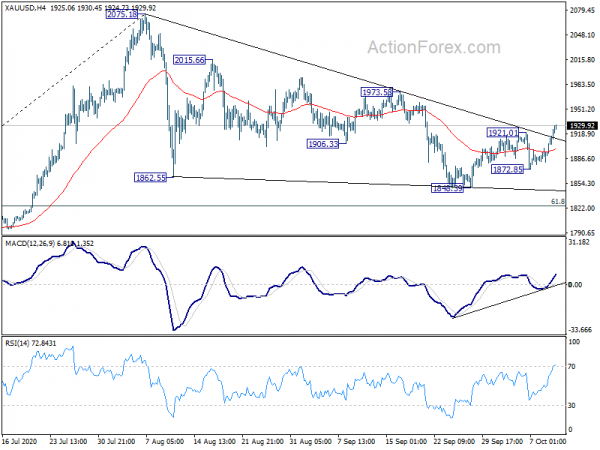

Gold’s near term outlook turning bullish

Gold’s intra-week sharp decline now proved to be a bear trap that caught many sellers. Subsequent strong rally, on the back of Dollar weakness, pushed it through 1921.01 resistance, as well as the trend line resistance. Near term development is now rather bullish as the consolidation pattern fro m2075.18 could have completed at 1848.39 already. Further rise would be seen back to 1973.58 resistance next.

Decisive break of 1973.58 would add to the case of larger up trend resumption and target a retest on 2075.18 high. If it happens this way, it could be an early signal, or reconfirmation of Dollar index’s break of 91.74 low.

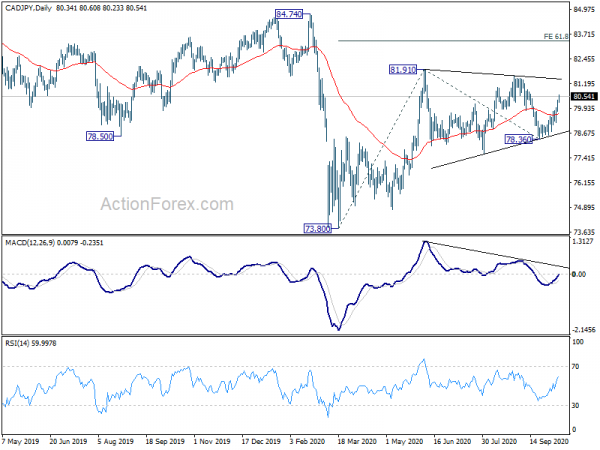

CAD/JPY ended as top mover, ready for upside breakout

CAD/JPY ended as the strongest mover last week and the development raises the chance that consolidation pattern from 81.91 has already completed at 78.36. Near term outlook will now remain bullish as long as 55 day EMA (now at 79.66) holds. Decisive break of 81.91 will confirm resumption of whole rise from 73.80, for 61.8% projection of 73.80 to 81.91 from 78.36 at 83.37 next.

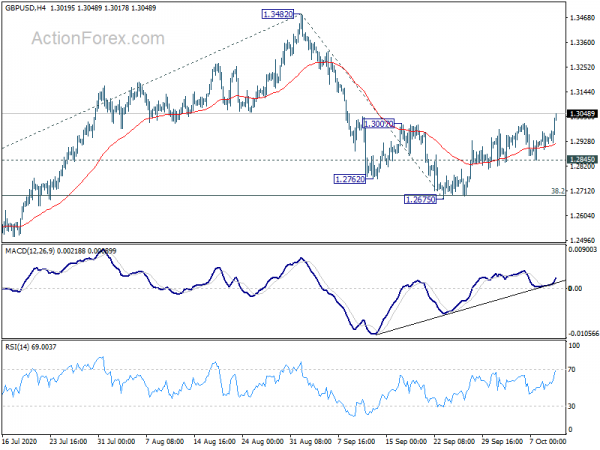

GBP/USD Weekly Outlook

GBP/USD’s break of 1.3007 resistance last week suggests that correction from 1.3482 has completed at 1.2675. That came after drawing support from 38.2% retracement of 1.1409 to 1.3482 at 1.2690. Initial bias is now back on the upside this week for retesting 1.3482/3514 resistance zone next. Decisive break there will carry larger bullish implications and target 61.8% projection of 1.1409 to 1.3482 from 1.2675 at 1.3956 next. On the downside, break of 1.2845 support will dampen this view and turn focus back to 1.2675 support instead.

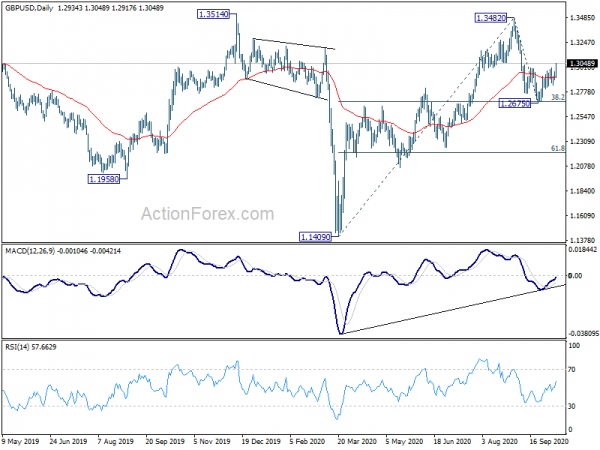

In the bigger picture, focus is back on 1.3415 key resistance now. Decisive break there should also come with sustained trading above 55 month EMA (now at 1.3312). That should confirm medium term bottoming at 1.1409. Outlook will be turned bullish for 1.4376 resistance and above. Nevertheless, rejection by 1.3514 will maintain medium term bearishness for another lower below 1.1409 at a later stage.

In the longer term picture, GBP/USD is staying below decade long trend line from 2.1161 (2007 high). It also struggles to sustain above 55 month EMA (now at 1.3317). Long term outlook stays bearish for now, despite bullish convergence condition in monthly MACD.