Dollar and Yen ended as the strongest ones last week as global stock markets tumble. There were concerns over resurgence in coronavirus infections in Europe, with worries over a return to lockdown. Though, the US markets ended not too badly after Friday’s rebound. It’s still not clear if the overall trend in risks has reversed. We’re viewing Dollar’s rise, while strong, as nothing more than a correction so far.

On the other hand, Australian and New Zealand Dollar ended as the weakest ones on expectation of further easing by respective central banks. However, Aussie sellers are not totally committed yet. Opinions on whether RBA would cut interest rate in less than two weeks are divided. The coming days will be interest for the Aussie.

Dollar index now correcting the fall from 102.99 to 91.74

Dollar index finally took out 93.66 resistance last week to confirm bottoming at 91.74. Further rally will now remain in favor for the near term to cluster resistance zone of 95.71 and 38.25 retracement of 102.99 to 91.74 at 96.03. At this point, we’re viewing the current rise as a corrective move. Hence, strong resistance could be seen from 95.71/96.03 to limit upside and bring another medium term fall through 91.74.

Looking at the weekly chart, it’s not impossible that fall from 102.99 has completed as the third leg of the consolidation pattern from 103.82. The five wave structure of the fall form 102.99 to 91.74 is consistent with a 3-3-5 structure. Yet, the time spent is a bit too short. A key barrier in 55 week EMA (now at 96.55), which is reasonably close to the 95.71/96.03 resistance zone, needs to be taken out firmly to give us more confidence on the bullish case.

NASDAQ’s corrective fall slowing down

Development in US stocks were actually not too bad despite all the headlines. NASDAQ has indeed closed the week slightly higher. The fall from 12074.05 started to decelerate and struggled to take away 55 day EMA cleanly. The structure is also rather corrective looking so far.

We’d maintain the view that it’s a correction to rise from 6631.42 to 12074.06 only. While deeper fall cannot be ruled out, strong support should be seen around 38.2% retracement at 9994.97, which is close to 10000 psychological level, to contain downside and bring rebound. Hence, for now, it’s not likely for Dollar to be given persistent boost from risk aversion.

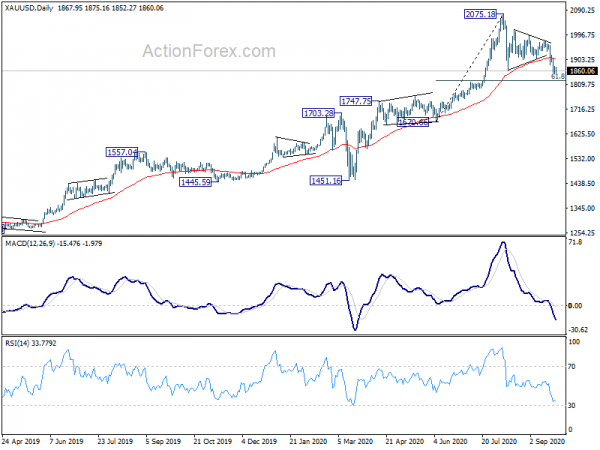

Gold broke out of triangle, strong support at 1825 fibonacci level

Gold finally broke out of triangle pattern to resume the fall correction form 2071.58 last week. First target of 1862.55 was already met. Deeper fall would be seen for the near term to 61.8% retracement of 1670.66 to 2075.18 at 1825.16. We’re currently seeing it as correcting the rise from 1670.66 only. Hence, we’d expect strong support from 1825.16 to contain downside. In this case, the corresponding support to Dollar won’t last too long, which is in line with the above view.

However, sustained break of 1825.16 would argue that Gold is indeed corrective the up trend from 1160.17. In that case, we might seen deeper fall in medium term to 38.2% retracement of 1160.17 to 2075.18 at 1725.64 in the medium term, which would then be close to 55 week EMA (now at 1695.40). If this is the case, favor will shift to the unpreferred bullish case in Dollar.

Aussie bears not too committed yet and opinions on RBA cut diverge

Australian Dollar tumbled broadly as speculations on RBA easing surfaced after Deputy Governor Guy Debelle’s speech, which outlined more easing options. Westpac predicted that the moves will be announced on October 6, the same day the government delivers budget, on the spirit of “Team Australia”. The measures would include lowering cash rate by -15bps to 0.10%, lowering 3-year yield target to 0.10%, and expanding asset purchases to longer maturities. NAB was less sure and expected the easing to come in either October or November meeting.

CBA, on the other hand, expected RBA to hold on rates as the costs would outweigh the benefits. In particular, with cash rate at 0.10%, it would be too easy for rates to flip into negative, which is a deterrent for the central bank. CBA expects that bond purchase would be the option to go, but doesn’t expect that to happen in October.

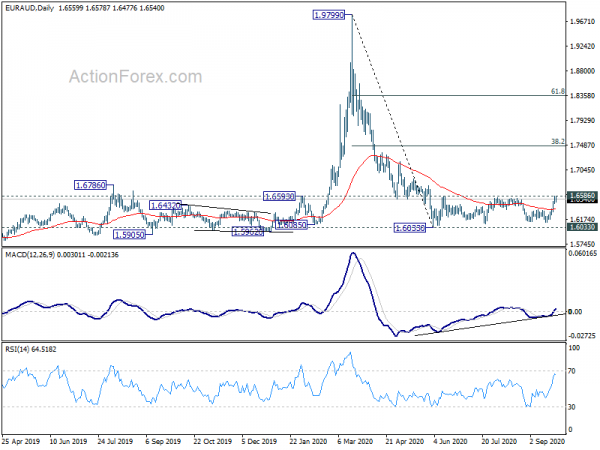

With less than two weeks to go, the upcoming development in Australian Dollar would be an interesting one to watch. So far, Aussie bears are not too committed yet. For example, EUR/AUD failed to break out of range of 1.6033/6586 firmly despite last week’s strong rise. Decisive break of 1.6586, if happens, would at least bring further rally to 38.2% retracement of 1.9799 to 1.6033 at 1.7472. to correct the decline from 1.9799.

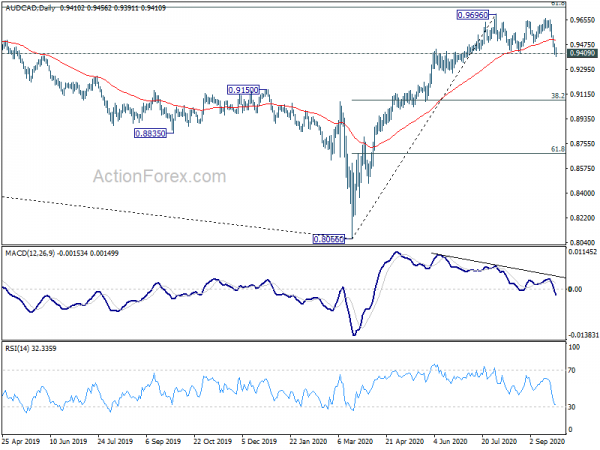

Similarly, there is no follow through selling in AUD/CAD yet to push it cleanly through 0.9409 support. Firm break there would at least bring decline to 38.2% retracement of 0.8066 to 0.9696 at 0.9073. We’ll find out which way to go very soon.

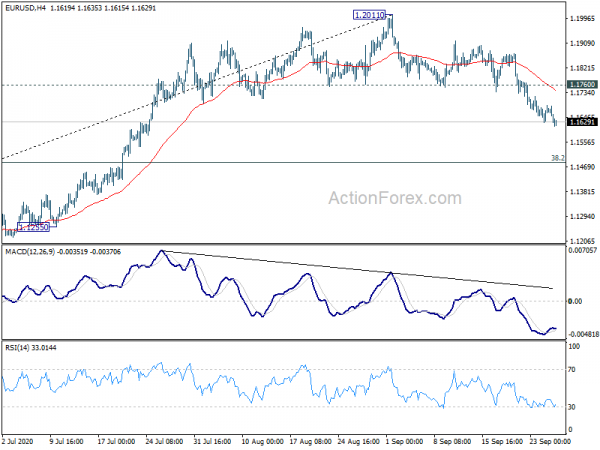

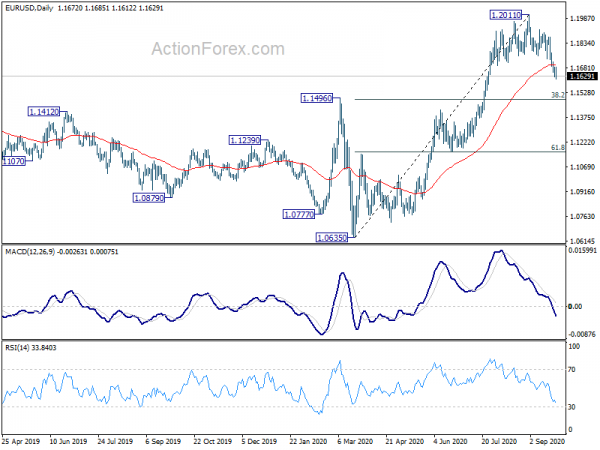

EUR/USD Weekly Outlook

EUR/USD’s decline from 1.2011 accelerates to as low as 1.1612 last week. The development suggests that it’s now in correction to whole rise from 1.0635. Deeper fall is expected this week as long as 1.1760 resistance holds, to 38.2% retracement of 1.0635 to 1.2011 at 1.1485. As it’s seen as a corrective move, strong support should be seen at 1.1485 to contain downside to bring rebound. On the upside, above 1.1760 will turn intraday bias back to the upside for retesting 1.2011 instead. However, sustained break of 1.1485 will pave the way to 61.8% retracement at 1.1161.

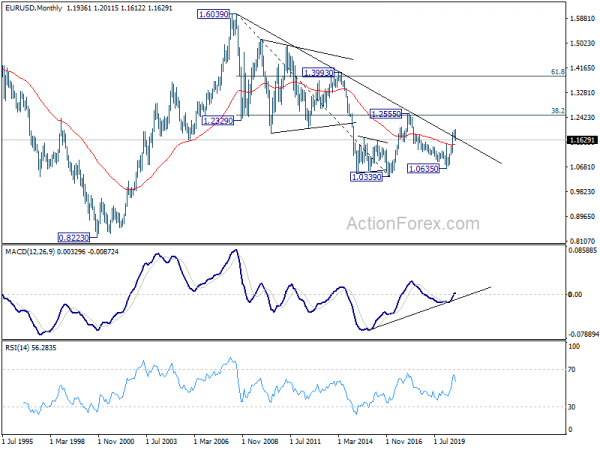

In the bigger picture, rise from 1.0635 is seen as the third leg of the pattern from 1.0339 (2017 low). Further rally rise should be seen to cluster resistance at 1.2555 next, (38.2% retracement of 1.6039 to 1.0339 at 1.2516 ). This will remain the favored case as long as 1.1422 resistance turned support holds.

In the long term picture, the strong break of 55 month EMA is taken as a sign of long term trend reversal. Immediate focus will be on decade long trend line resistance (now at 1.1700). Sustained trading above there will add more credence to the case that down trend from 1.6039 (2008 high) has finished at 1.0339. Further break of 1.2555 cluster resistance (38.2% retracement of 1.6039 to 1.0339 at 1.2516 ) will confirm and target 61.8% retracement at 1.3862 and above.