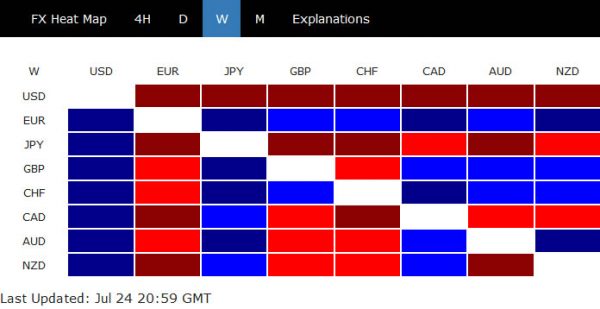

Euro ended as the strongest one last week as boosted by the agreement on the Next Generation EU recovery fund. It’s seen as a landmark deal which would increase cohesion of the EU. The burden on ECB would also be dramatically eased with the fiscal support. Meanwhile, Eurozone PMI composite jumped to a 25-month high in July, hinting at an initial V-shaped recovery. The strength in Euro took Swiss Franc and Sterling higher today, with the latter supported by PMI composite at 61-month high.

On the other hand, Dollar ended as the weakest as rebound in initial jobless claims raised concerns of a double dip recession. That came in with the background that US and global daily coronavirus cases hit new records. Yen might look weak in the weekly heat map but it has actually regained much ground towards the end of the week on risk aversion. US Secretary of State Mike Pompeo’s speech, titled “Communist China and the Free World’s Future“, was seen as sealing the turning point of multi-decade long US-China relations. Stock indices in Hong Kong and China were in steep decline since then, dragging down commodity currencies too.

Technically developments suggest that Euro’s upside momentum will continue for the near term at least. There are prospects of more downside in commodity currencies, in particular against Euro and Yen. There is no clear sign of bottoming Dollar for now. But a long-overdue correction could help the greenback for rebound, at least against commodity currencies.

Dollar heading back to 88.25 if 93.88 couldn’t be defended

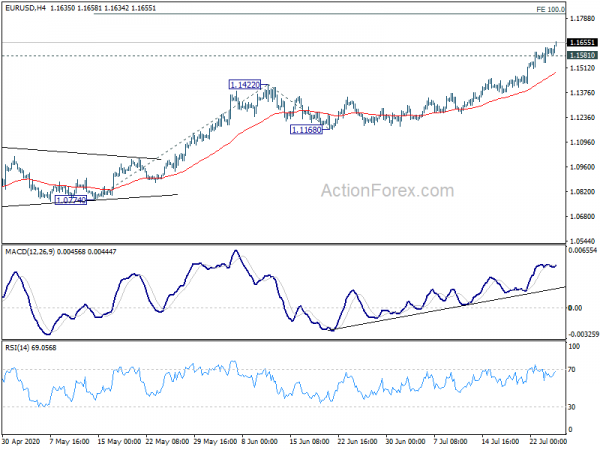

The biggest technical development last week was EUR/USD’s strong break of 1.1496 structural resistance, which confirms medium term bullish reversal. Correspondingly, Dollar index took out 94.65 support as anticipated support didn’t happen. Fall from 102.99 is seen as the third leg of the pattern from 103.82. Outlook will remain bearish as long as 97.78 resistance holds in any case. Next line of defense is 61.8% retracement of 88.25 to 102.99 at 93.88. Sustained break there will pave the way to 88.25 low.

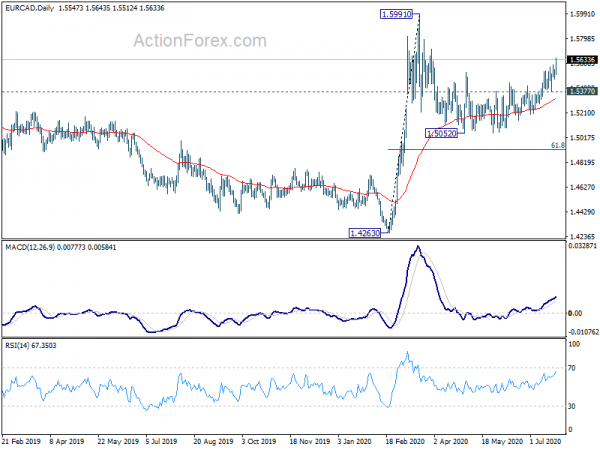

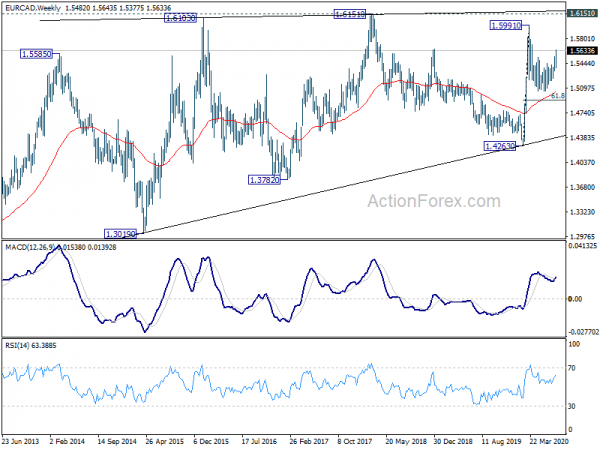

EUR/CAD heading to 1.5591 resistance and above

Euro’s strength was clear against Canadian Dollar too. The rebound from 1.5052 accelerated to as high as 1.5643 last week. The development clearly suggests that pull back from 1.5991 has completed. Near term outlook will stay bullish as long as 1.5377 support holds. Current rise should target 1.5991 and above. Nevertheless, long term resistance at 1.6151 would be the real challenge for the cross.

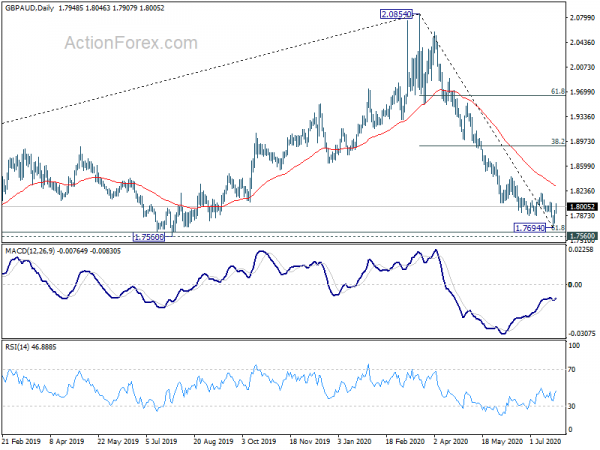

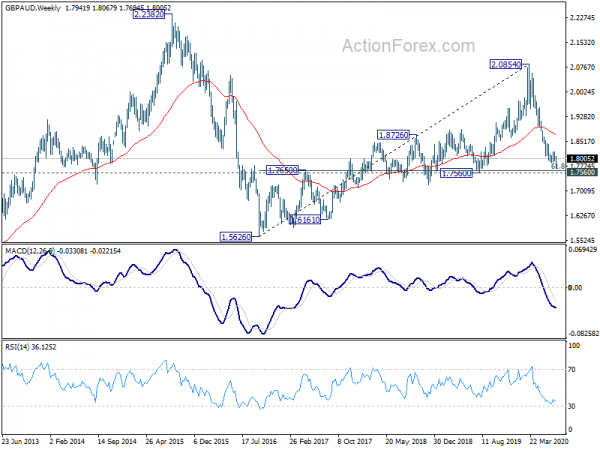

GBP/AUD formed short term bottom at 1.7694, stronger rebound could lie ahead

GBP/AUD, while being in downside since March, appears to be finally bottoming out. The strong rebound late last week suggests short term bottoming at 1.7964, on bullish convergence condition in daily MACD. That came just ahead of long term cluster support at 1.7560, 61.8% retracement of 1.5626 to 2.0854 at 1.7623. Near term focus will be on 55 day EMA (now at 1.8308). Firm break there will also indicate medium term bottoming, and bring stronger rise to 38.2% retracement of 2.0854 to 1.7694 at 1.8901 at least. If happens, that could be a sign of weakness in Aussie elsewhere too.

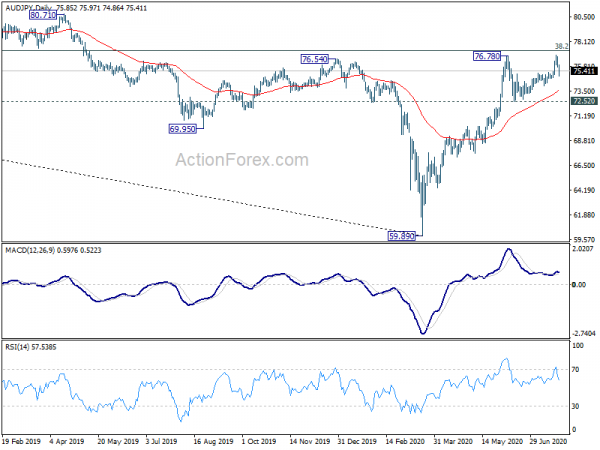

AUD/JPY rejected by 76.78 resistance, heading back to 55 day EMA first

Talking about Aussie, AUD/JPY reversed and dropped sharply to close at 75.41, after rejection by 76.78 resistance. Near term bias will now be mildly on the downside for 55 day EMA (now at 73.53) and possibly below. But outlook will stay bullish for up trend resumption as long as 72.52 resistance holds. However, considering that AUD/JPY was close to 38.2% retracement of 105.42 to 59.89 at 77.28. Firm break of 72.52 will indicate bearish reversal with double top formation.

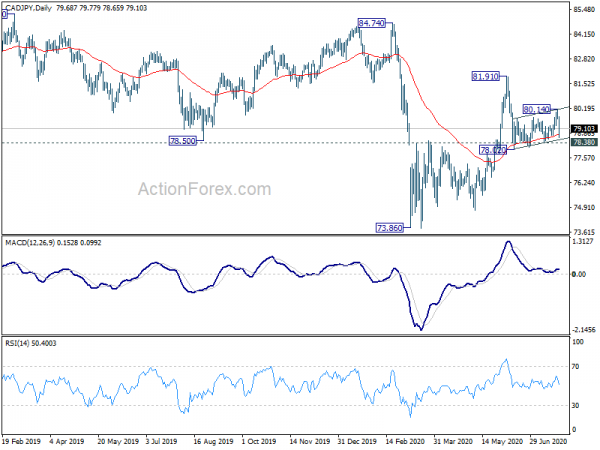

CAD/JPY completed corrective recovery, resuming fall from 81.91

CAD/JPY’s sharp decline on Friday argues that corrective rise from 78.02 has completed at 80.14 already. Initial focus in on 78.38 support this week. Break there should resume the fall from 81.91 to 61.8% projection of 81.91 to 78.02 from 80.14 at 77.73. Also note that CAD/JPY has been in a long term falling channel and it’s just rejected by 55 week EMA again. Break of 77.73 would likely bring more downside acceleration to 100% projection at 76.25 at least.

EUR/USD Weekly Outlook

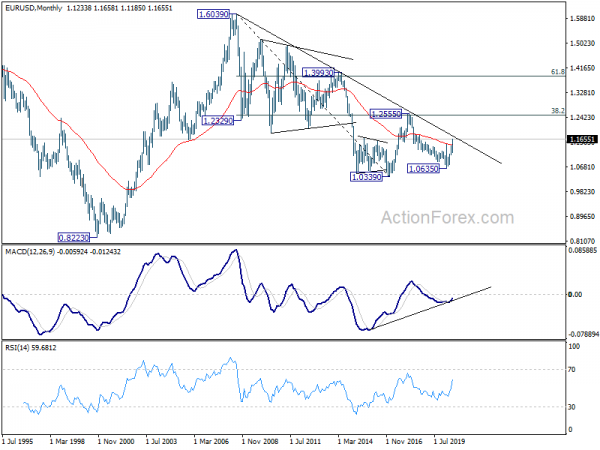

EUR/USD surged to as high as 1.1658 last week as rise from 1.0635 extended. Initial bias remains on the upside this week. Next target will be 100% projection of 1.0774 to 1.1422 from 1.1168 at 1.1816. On the downside, below 1.1581 minor support will turn intraday bias neutral and bring consolidations first. But retreat should be contained by 1.1422 resistance turned support to bring rise resumption.

In the bigger picture, the strong break of 1.1496 resistance now suggests that whole down trend from 1.2555 (2018 high) has completed at 1.0635 already. Rise form 1.0635 should be the third leg of the pattern from 1.0339 (2017 low). Further rise should be seen to cluster resistance at 1.2555 next, (38.2% retracement of 1.6039 to 1.0339 at 1.2516 ). This will remain the favored case as long as 1.1168 support holds.

In the long term picture, the strong break of 55 month EMA is taken as a sign of long term trend reversal. Immediate focus will be on decade long trend line resistance (now at 1.1777). Sustained trading above there will add more credence to the case that down trend from 1.6039 (2008 high) has finished at 1.0339. Further break of 1.2555 cluster resistance (38.2% retracement of 1.6039 to 1.0339 at 1.2516 ) will confirm and target 61.8% retracement at 1.3862 and above.