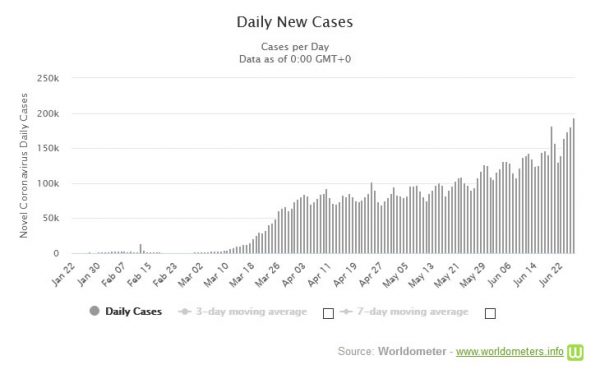

The conditions for risk reversal continued to build up last week and somewhat intensified. On the one hand, daily new coronavirus cases surged to new high for the world world, as well as for the US. Daily global new deaths were steady and the US death tolls trended down. Yet, the development is enough for worries on at least a delay in reopening, with risks of reversing ease of restrictions.

On the other hand, the stage was also set for an acute deterioration in US-China relations. Senate passed the so called Hong Kong Autonomy Act by unanimous vote on Thursday. Secretary of State Mike Pompeo also announced on Friday visa restrictions on Chinese Communist Party officials believed to be responsible for undermining freedoms and autonomy in Hong Kong. The CCP is set to ignore global condemnations and impose new “national security” laws on Hong Kong by this week, bypassing they city’s own legislature. That would in turn very likely trigger new sanctions from the US, and possibly from other countries too.

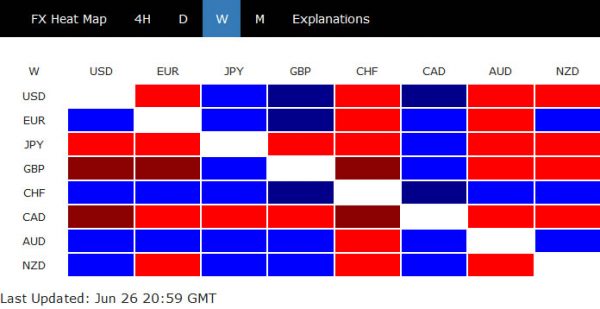

In spite of the developments, risk reversal is not clearly confirmed yet. US stock indicates could merely be extending near term consolidations. There was no sustainable buying in Dollar, nor Yen. Gold’s up trend resumption could be a sign, together with the break of near term support in GBP/CHF and EUR/CHF. Yet, more levels need to be taken out before confirming the come back of risk aversion.

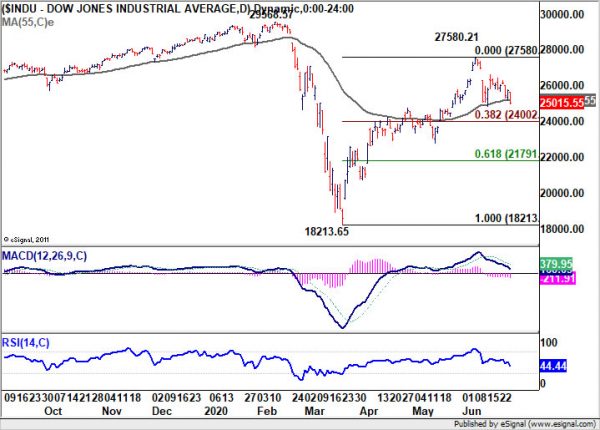

DOW declines as near term consolidation extends

DOW had a very volatile week and closed notably. Yet, the development was not out of expectations. Last week’s fall is just seen as a leg inside the near term consolidation pattern from 27580.21. There is no clear sign of reversal as long as 38.2% retracement of 18213.65 to 27580.21 at 24002.18 holds. Another rise through 27580.21 would remain in favor.

However, sustained break of 24002.18 will suggest that fall from 27580.21 is the third leg of the corrective pattern from 29568.57. In this case, deeper decline would be seen to 61.8% retracement at 21791.67 and below.

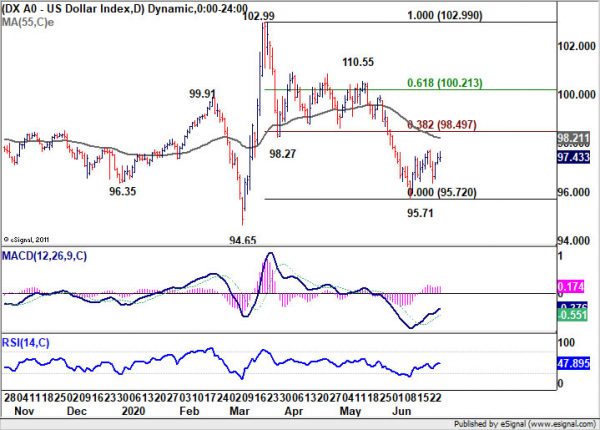

Dollar index extends near term consolidation from 95.71.

Dollar index recovered after initial dip last week but upside momentum has been rather unconvincing. After all, price actions from 95.71 is seen as a consolidation pattern only. Another fall through 95.71 would be in favor as long as 38.2% retracement of 102.99 to 95.71 at 98.49. However, firm break 98.49 will suggest near term reversal for 61.8% retracement at 100.21 and above. That would be another indication of risk reversal if happens.

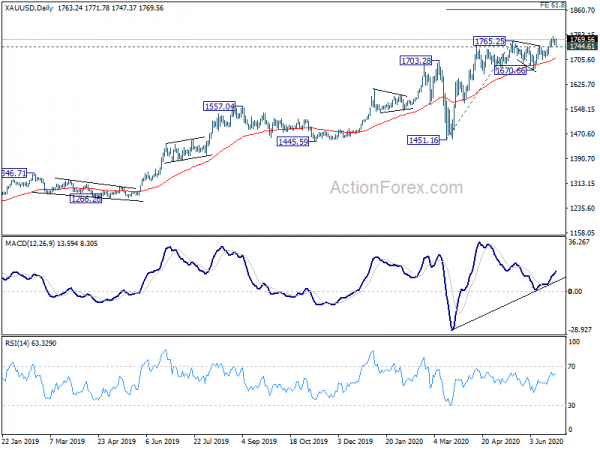

Gold resumes up trend, targets 1864 next

Gold’s rally was one of the few risk aversion developments. The break of 1765.25 confirms up trend resumption. Near term outlook stays bullish as long as 1744.61 support holds. Further rise should be seen to 61.8% projection of 1451.16 to 1765.25 from 1670.66 at 1864.76.

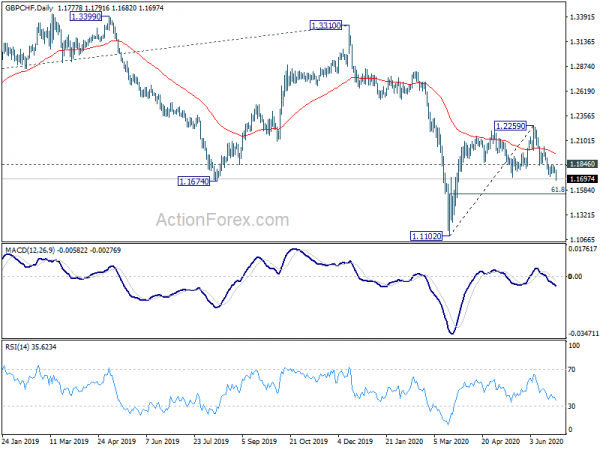

GBP/CHF completed corrective rise, heading back towards 1.1102 low.

GBP/CHF displayed another indication of risk aversion. But that’s more due to weakness of Sterling itself. The break of 1.1716 support suggest that corrective rebound from 1.1102 has completed with three waves up to 1.2259. Further fall is expected as long as 1.1646 resistance holds. Next target is 61.8% retracement of 1.1102 to 1.2259 at 1.1544. Sustained break there will pave the way to retest 1.1102 low.

CAD/JPY holding above 78.02 supported despite decline attempt

However, CAD/JPY continued to hold above 78.02 support despite decline attempt. Further fall is in favor, but break of 78.02 is needed to signal decline resumption. In that case, next near term target will be 61.8% projection of 81.91 to 78.02 from 79.33 at 76.42. That will be another sign of risk reversal.

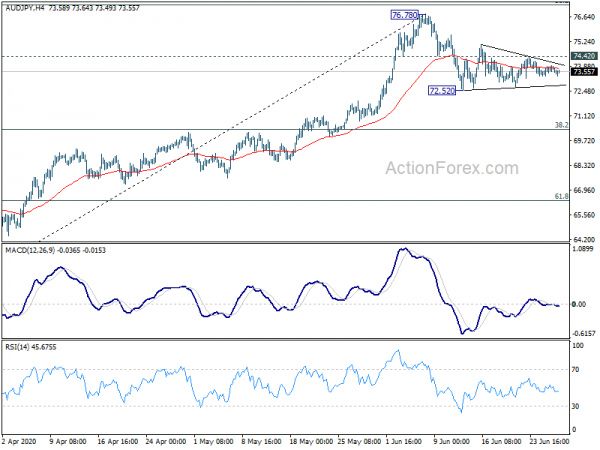

AUD/JPY holding in range, awaiting downside breakout

AUD/JPY holds resilient in range last week too. It becomes clear that price actions from 72.52 are sideway consolidations and fall from 76.78 is not over. Break of 72.52 will resume the decline and target 38.2% retracement of 59.89 to 76.78 at 70.32. That’s another risk reversal indication to look for.

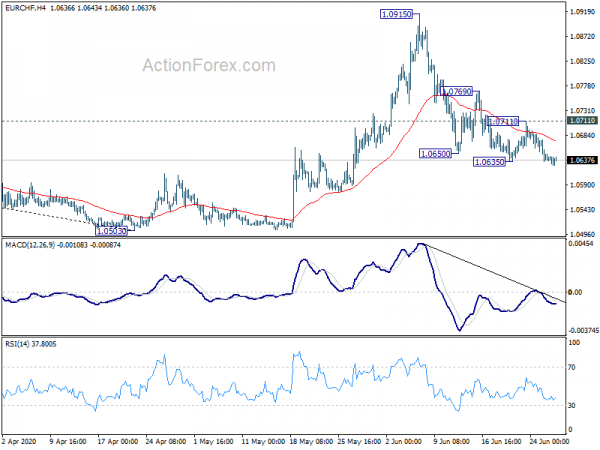

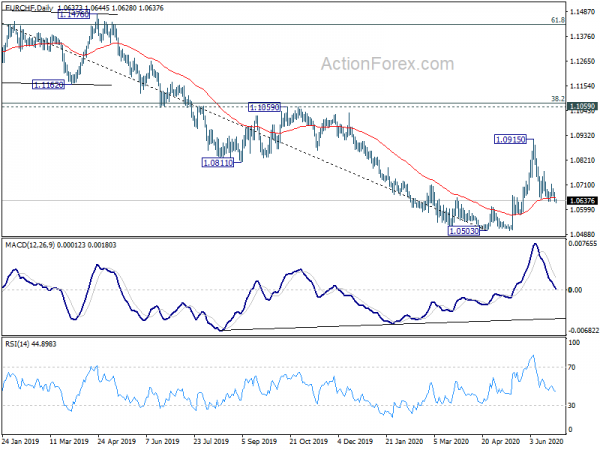

EUR/CHF Weekly Outlook

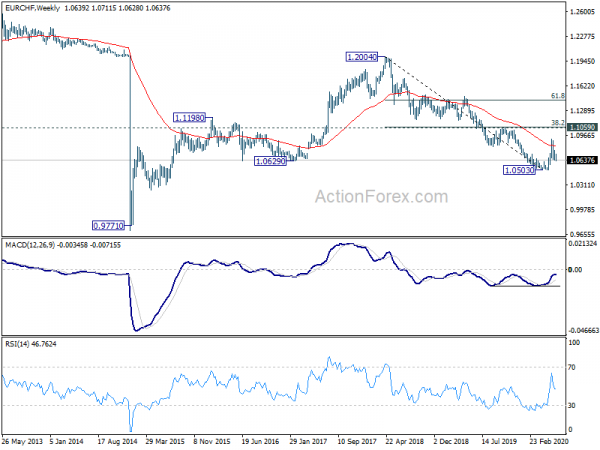

EUR/CHF recovered in the middle of last week but the decline from 1.0915 quickly resumed. Initial bias stays on the downside this week. With 55 day EMA taken out again, deeper fall should be seen to retest 1.0503 low. On the upside, break of 1.0711 resistance is needed to indicate short term bottoming. Otherwise, outlook will remain cautiously bearish in case of recovery.

In the bigger picture, as long as 1.1059 cluster resistance (38.2% retracement of 1.2004 to 1.0503 at 1.1076) holds, price actions from 1.0503 are seen as a consolidation pattern. That is, down trend from 1.2004 (2018 high) would still extend through 1.0503 low at a later stage. However, sustained break of 1.1049/76 will argue that rise from 1.0503 is starting a new up trend and would target 61.8% retracement at 1.1431 and above.