The financial markets didn’t start the second quarter with a bang even though coronavirus pandemic carried on. Globally, confirmed cases surged through 1.1m level but that’s now more of an indication of the speed of tests. Death toll, on the other hand, remains worrying as it broke 60k handle without sign of slowing down.

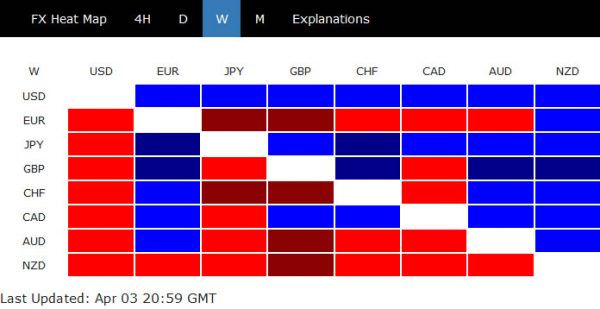

Markets turned into mild risk averse mode, but downside pressure was somewhat eased by rebound in oil price. Dollar rode on risk aversion and ended the week as the strongest one, followed by Yen. USD/JPY’s recovery ahead of 106.75 near term support suggests that Dollar is having an upper hand, for now. New Zealand Dollar ended as the weakest one, followed by Euro and then Aussie.

DOW might be heading back to 18213.65 low as corrective recovery finished

It looked as if DOW’s selloff was back with Wednesday’s gap down. But rebound in oil prices some what gave it a life. Nevertheless, the sustained trading below 55 H EMA is a sign of near term weakness. Corrective recovery from 18213.65 should have completed at 22596.06, after hitting 38.2% retracement of 29568.57 to 18213.65 at 22551.22.

The weak rebound suggests that correction from 29568.57 has not even completed the first leg. A test on 50% retracement of 6469.95 to 29568.57 at 18019.26 should at least be seen before the first leg finishes.

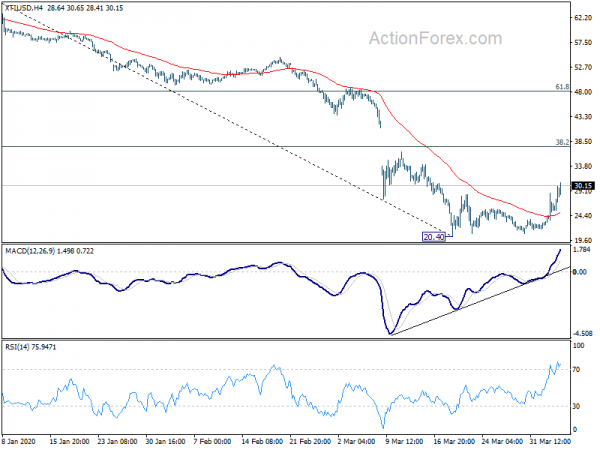

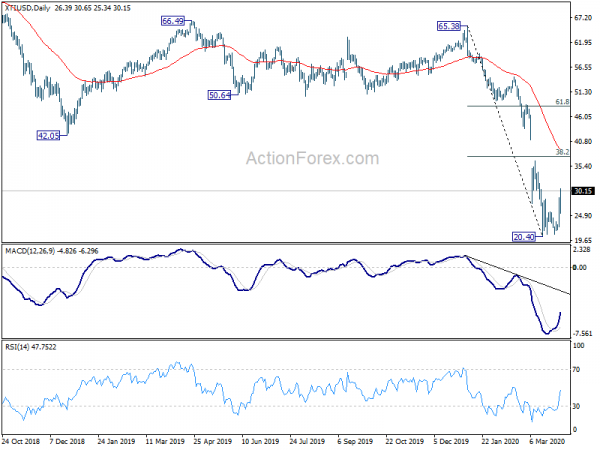

WTI oil rebound on production hope, still unsure if a deal could be reached

WTI crude oil staged a strong rebound last week on talks that OPEC+ are working on a deal to cut production equivalent to around 10% of global supply. However, comments from Saudi Arabia and Russia argued that there are still huge differences between the two. Though, they still have one thing in common in the push for US to cut production of shale oil too, which US is rejecting. The OPEC+ meeting is said to be postponed from April 6 to April 8 or 9 to allow more time for negotiations. We might see oil back under pressure should talks collapse again.

Technically, break of 28.39 resistance suggests short term bottoming at 20.40. Stronger rebound should be seen back to 38.2% retracement from 65.38 to 20.40 at 37.58. We’d expect strong resistance between there and 55 day EMA (now at 38.92) to limit upside, at least on first attempt.

Dollar index rebounded strong, but break of 102.99 not expected soon yet

Dollar index stayed a strong rebound last week and closed at 100.57, back above 100 handle. Notable support was seen between 61.8% retracement of 94.65 to 102.99 at 97.83 and 55 day EMA (now at 98.90). The development so far affirms that price actions from 102.99 are merely forming a consolidation pattern. We’d not expecting a break of 102.99 soon and more sideway trading is in favor. But larger down trend is expected to resume at a later stage.

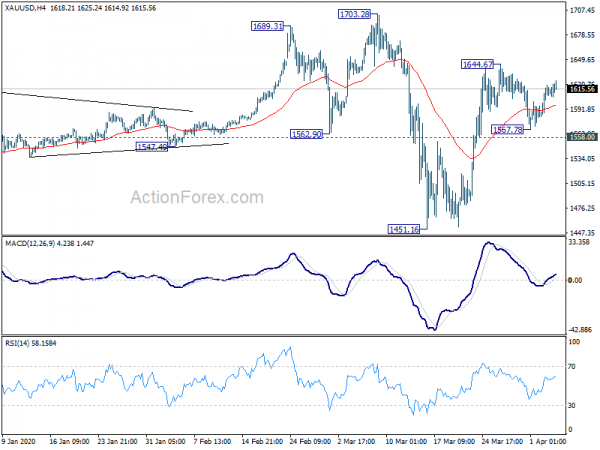

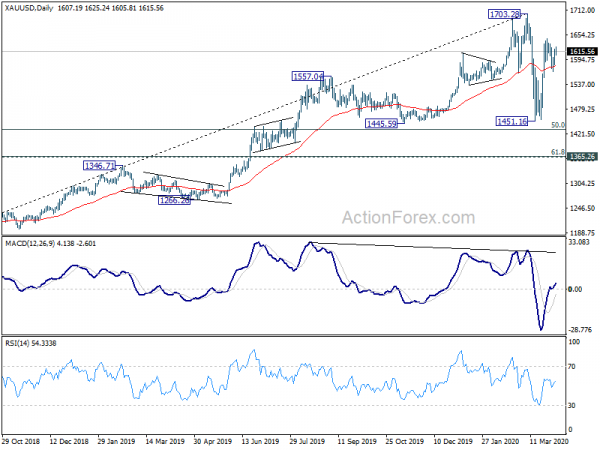

Gold’s could still have another rise before completing rise from 1451

Gold’s decline form 1644.67 extended lower to 1567.78 last week but failed to take out 1558.00 support and recovered. There is no confirmation of completion of rise from 1451.16 yet. Break of 1644.67 will target a test on 1703.28. Though, even in this case, we don’t expect a break there to resume larger up trend.

On the other hand, break of 1558, will indicate that the rebound from 1451.16 has completed and bring retest of this support. We’d maintain our view that gold’s development could be a litmus test for Dollar’s underlying strength. We won’t favor a above mentioned 102.99 high in dollar index until we see a break of 1558.00 in gold.

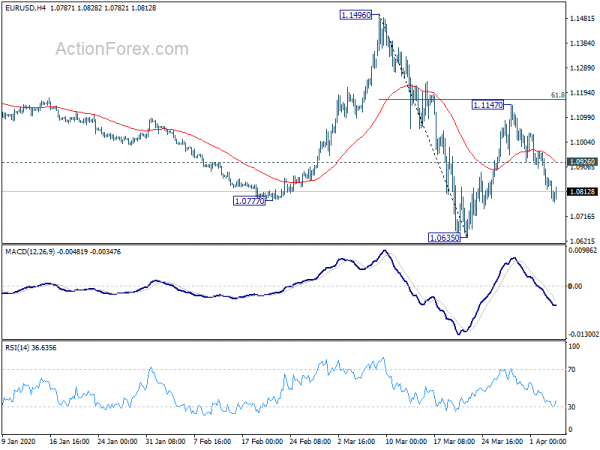

EUR/USD Weekly Outlook

EUR/USD’s fall last week suggests that corrective recovery from 1.0635 has completed at 1.1147, after rejection by 61.8% retracement of 1.1496 to 1.0635 at 1.1167. Initial bias stays on the downside this week for retesting 1.0635 low first. Decisive break there will resume larger down trend. On the upside, above 1.0926 minor resistance will extend the correction from 1.0635. Intraday bias will be turned back to the upside for 1.1167.

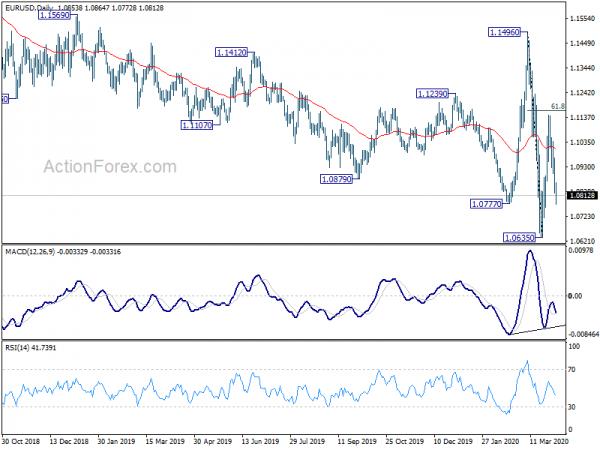

In the bigger picture, as long as 1.1496 resistance holds, whole down trend from 1.2555 (2018 high) should still be in progress. Next target is 1.0339 (2017 low). However, sustained break of 1.1496 will argue that such down trend has completed. Rise from 1.0635 could then be seen as the third leg of the pattern from 1.0339. In this case, outlook will be turned bullish for retesting 1.2555.

In the long term picture, outlook remains bearish for now. EUR/USD is held below decade long trend line that started from 1.6039 (2008 high). It was also rejected by 38.2% retracement of 1.6039 to 1.0339 at 1.2516 before. On break of 1.0339, next target will be 100% projection of 1.3993 to 1.0339 from 1.2555 at 0.8901.