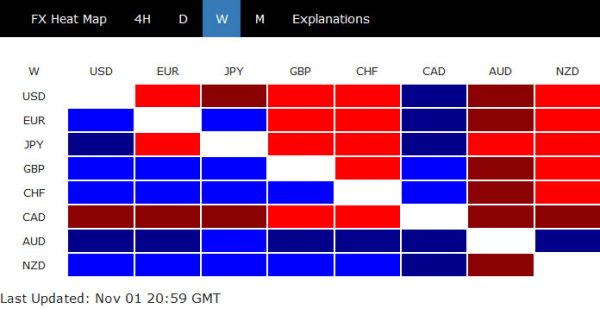

With US-China on track to phase one trade deal, and UK preparing for December election, focus turned back to economic data and central banks last week. In particular, Canadian Dollar ended as the worst performing after BoC’s surprise dovish turn, which opened the door for rate cut. Dollar followed as second weakest as markets believed Fed is just in pause with its mid-cycle adjustment. Australian Dollar, on the other hand, ended as the best performing one as markets pared back bets on imminent RBA cut.

US stocks were boosted by economic data and Fed expectations, with S&P 500 and NASDAQ closed at record highs. Corresponding strength in European and Asian indices was not clear yet. Treasury yields were back under pressure, with US 10-year yield closed below 1.8 at 1.728. German 10-year yield breached -0.4 handle before closing at -0.383. Japan 10-year yield also dropped back to -0.18. Gold also struggled in established range, around 1500 handle, in spite of Dollar’s selloff.

Fed just pause rate cuts for now, not ending?

Fed cut interest rate by -25bps to 1.50-1.75% last week as widely expected. The language that Fed “will act as appropriate…” was removed from the statement. Chair Jerome Powell also said in the press conference that “monetary policy is in a good place” and “a material reassessment of our outlook would be required to change the suitability of the current policy stance”. That’s a clear indication of a pause.

Yet, Powell added that current stance of monetary policy is likely to “remain appropriate as long as incoming information about the economy remains broadly consistent with our outlook.” It’s also mentioned in the statement the timing of future adjustments will be based on “realized and expected economic condition”, taking in to account “a wide range of information” including domestic job and inflation data, as well ass international developments. That is, Fed is maintaining a highly data-dependent approach, without closing the door for further cuts.

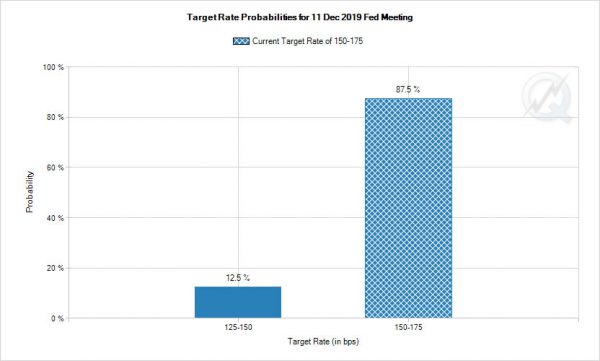

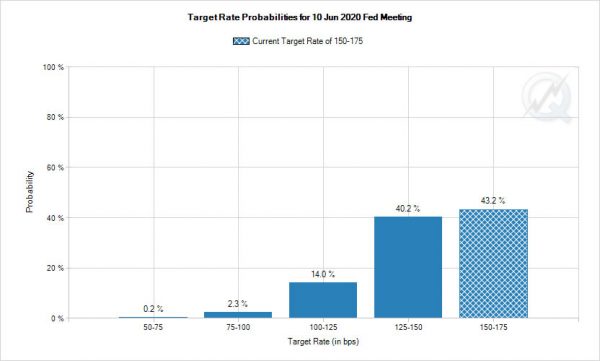

As of end of Friday, Fed fund futures are pricing in 87.5% chance of Fed standing pat in December. However, by June next year, markets are pricing in over 50% chance of at least another rate cut to 1.25-1.50%. That is, markets are betting that Fed is not done with the so called “mid-cycle adjustments” yet.

S&P 500 made record high, with upside acceleration

Economic data from US were not too bad, yet they’re not inspirational. Q3 GDP growth slowed slightly to 1.9% annualized, down from 2.0% in Q2, and beat expectation of 1.6%. However, growth was mainly driven by personal consumptions while business investments remained weak. Core PCE inflation slowed to 1.7% yoy in September, down from 1.8% yoy. ISM manufacturing rose to 48.3 but stayed below 50. New export orders jumped 9.4 to 50.4, but all other components stayed below 50 too. NFP grew 128k in October, above expectation of 105k but that’s hardly an exciting number. Average hourly earnings missed expectation and rose 0.2% mom.

Stocks responded positively though as the set of data suggested stabilization and eased worries of a deep slowdown. Yet, they definitely not strong enough to trigger any Fed hike. Both S&P 500 and NASDAQ closed the week at record highs, and DOW should follow soon. In particular, S&P 500’s break of 61.8% projection of 2728.81 to 3027.98 from 2855.94 at 3040.82 was a sign of acceleration. Further rise should be seen to 100% projection at 3155.11 next.

Dollar index still defending 55 week EMA after weak recovery

Dollar index’s recovery faltered after hitting 98.00, on still dovish Fed outlook. Yet, for now, it’s holding on to 55 week EMA. Any rebound from around the current level would retain medium term bullishness and extend the up trend from 88.25. However, sustained trading below the 55 week EMA (now at 97.03) would at least bring deeper fall to 95.84.

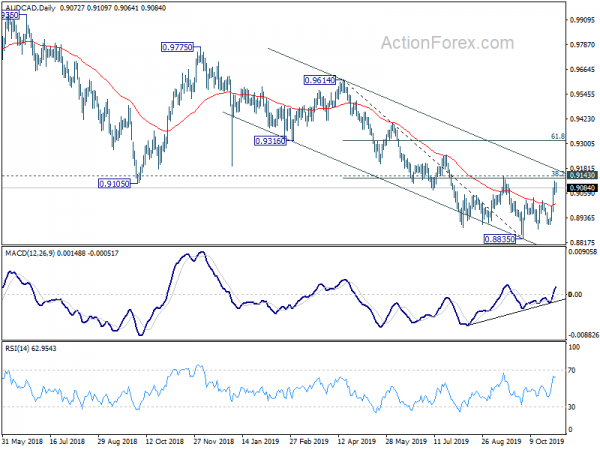

AUD/CAD rebounded on diverging expectations on BoC and RBA

While Dollar was weak, Canadian was even worse. The dovish turn of BoC, after keeping interest rate unchanged at 1.75%, was a big surprise to the markets. The central bank warned that resilience of the economy would be “increasingly tested” by trade tensions and uncertainties. Housing and consumer data would be watched closely, on signs of risks manifesting in other markets in the economy. Policymakers have indeed discussed “insurance” rate cut.

On the other hand, markets have, rather aggressively, been pricing out chance of more RBA rate cut, at least, for the rest of the year. Inflation seemed to have stabilized, even though they’re still below RBA’s target. CPI accelerated to 1.7% yoy in Q3 while RBA trimmed mean CPI was unchanged at 1.6% yoy. Released two weeks ago, Australia unemployment rate also dropped from 5.3% to 5.2% in September. While RBA Governor Philip Lowe repeated that it’s “prepared to ease” further if needed. There no clear imminent need for that for now. The new economic projections to be released this week with the rate decision will provide more clues to RBA’s thinking.

AUD/CAD’s strong rebound last week reflected the above developments. Yet there is no confirmation of trend reversal yet. As long as 0.9143 cluster resistance (38.2% retracement of 0.9614 to 0.8835 at 0.9133), medium term down trend from is still in favor to extend through 0.8835 low. However, sustained break of 0.9143 should confirm medium term bottoming, on bullish convergence condition in daily MACD. In this, stronger rise should be seen back to 0.9316/9614 resistance zone at least.

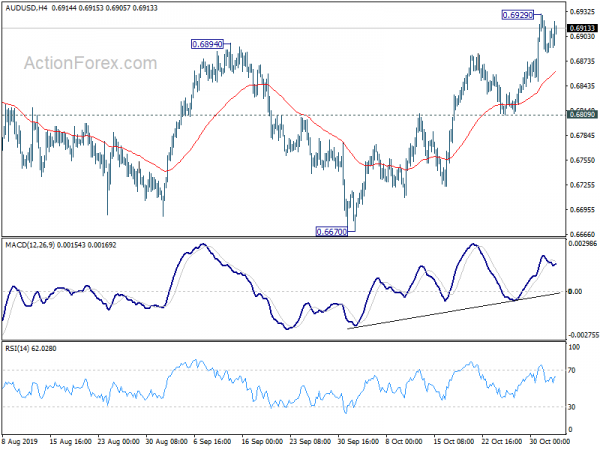

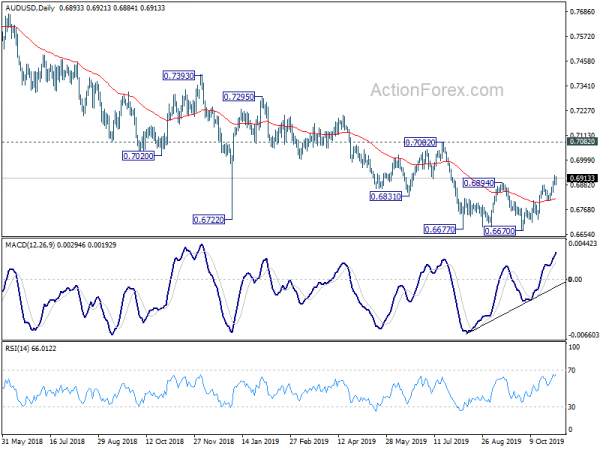

AUD/USD Weekly Outlook

AUD/USD’s rebound from 0.6670 extended to as high as 0.6929 last week but formed a temporary top there. Initial bias is neutral this week for some consolations first. But downside of retreat should be contained above 0.6809 support to bring another rise. Break of 0.6894 resistance was taken as the first sign of medium term reversal. This is affirmed by the strong support by 45 day EMA. Above 0.6929 will target 0.7082 key resistance for confirmation. On the downside, though, break of 0.6809 support will revive bearishness and target 0.6670 low again.

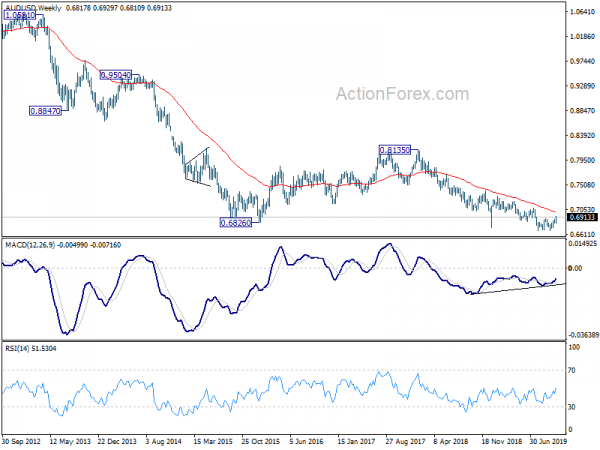

In the bigger picture, the case of medium term bullish reversal is building up with bullish convergence condition in weekly MACD. But there is no clear confirmation yet. As long as 0.7082 resistance holds, larger down trend from 0.8135 (2018 high) is still expect to continue to 0.6008 (2008 low). However, decisive break of 0.7082 will confirm medium term bottoming and bring stronger rally back to 55 month EMA (now at 0.7531).

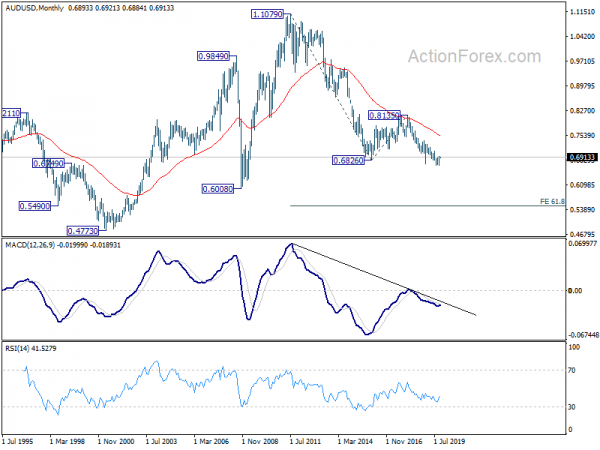

In the longer term picture, prior rejection by 55 month EMA maintained long term bearishness in AUD/USD. That is, down trend from 1.1079 (2011 high) is still in progress. Next downside target is 61.8% projection of 1.1079 to 0.6826 from 0.8135 at 0.5507.