Threat of US-China trade war escalation receded last week after both sides offered some concessions. Further than that, there is increasing hope of de-escalation of some form as the idea of an “interim” trade deal floated around. Both sides seemed to be communicating well in preparation for the meeting in October. There is prospect for US to roll back some imposed tariffs if China could offer some commitment regarding intellectual property protection and agricultural purchases.

The return of risk appetite could be well seen in the rebound in major treasury yields. German 10-year yield jumped from -0.634 to close to 0.445, comparing to -0.739 record low made earlier this month. Japan 10-year JGB yield also jumped from -0.245 to -0.155, comparing to this month’s low at -0.285. Yen ended as the weakest one, followed by Canadian Dollar. Sterling was the strongest as it’s looks more likely that no-deal Brexit could be averted on October 31. Australian Dollar was the second strongest on risk appetite.

Markets starting to think Sep Fed cut is last in mid-cycle adjustment

With easing threat of further trade war escalation, and stronger than expected core CPI reading, markets continued to pare back bets on Fed’s rate cut. As of now, fed fund futures point to just 79.6% chance of another -25bps to 1.75-2.00% this week, on September 19. That’s notably down from 100% a month ago and 90% a week ago.

More importantly, fed fund futures are pricing in only 54.9% chance of one more rate cut in December to 1.50-1.75%. A month ago, markets were expecting 89% chance of that. In other words, traders are starting to believe that even if Fed would cut interest rate this week, that might be the last one in this “mid-cycle” adjustment. FOMC statement and Fed Chair Jerome Powell’s press conference will definitely be scrutinized for such message.

More upside in 10- and 30-year yields as short term bottom formed

The turn in market sentiments is best represented in the strong rebound in treasury yields. 10-year yield’s rebound from 1.429 accelerated to close strongly at 1.903 last week. The solid break of 55 day EMA indicates that a short term bottom is at least formed at 1.429. TNX should now target 38.2% retracement of 3.248 to 1.429 at 2.123 next. For now, though, we’re not expecting a firm break there yet, at least not until there are signs that the US economy is regaining momentum.

Similarly, a short term bottom is also at least formed at 1.905 in 30-year yield. With 55 day EMA firmly taken out, further rise should be seen in TYX to 38.2% retracement of 3.455 to 1.905 at 2.497 next.

DOW heading to new record high, but upside might be capped

DOW’s rally continued last week and is getting close to record high at 27398.68. A breach of this record high will very likely be seen. But bearish divergence condition in daily MACD may cap upside above there. DOW could start to feel heavy approaching 61.8% projection of 21712.52 to 26695.96 from 24680.57 at 27760.32. A deep pull back might come if Fed does signal no more rate cut ahead.

Dollar index struggled but stays in up trend

Dollar index struggled in range last week, mainly because EUR/USD defended 1.0926 key support and rebounded. But for now, there is no sign of trend reversal, despite weak upside momentum. As long as 55 week EMA (now at 96.72) holds, up trend from 88.25 should still extend to 78.2% retracement of 103.82 to 88.26 at 100.49.

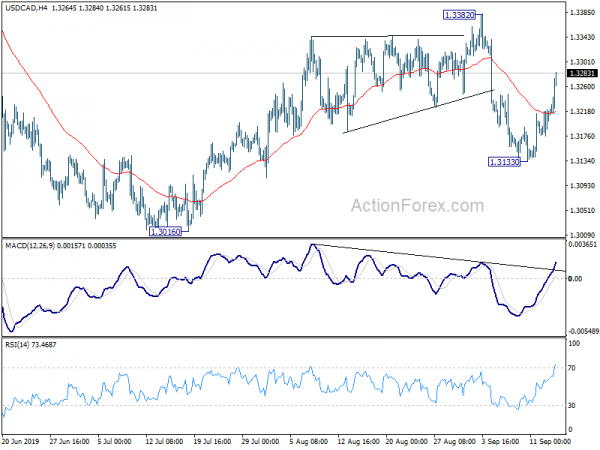

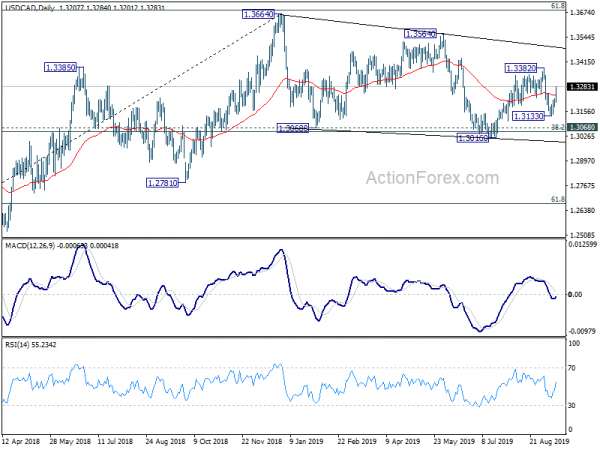

USD/CAD Weekly Outlook

USD/CAD’s decline from 1.3382 extended to as low as 1.3133 last week but rebounded strongly from there. The development suggests that pull back from 1.3382 has completed. And more importantly, rise from 1.3016 is probably not over yet. Initial bias is now on the upside for 1.3382 resistance first. Break will target 1.3564 resistance next. On the downside, though, break of 1.3133 will bring retest of 1.3016 low.

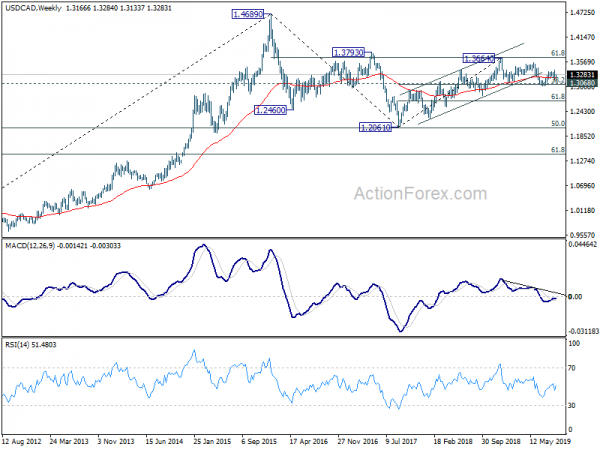

In the bigger picture, key cluster support of 1.3068 (38.2% retracement of 1.2061 to 1.3664 at 1.3052) remains intact. Medium term rise from 1.2061 low is in favor to resume sooner or later. Firm break of 61.8% retracement of 1.4689 (2016 high) to 1.2061 at 1.3685 will confirm and target 1.4689 high. However, sustained break of 1.3052/68 will confirm completion of up trend from 1.2061 (2017 low). Further fall should be seen to 61.8% retracement at 1.2673 next.

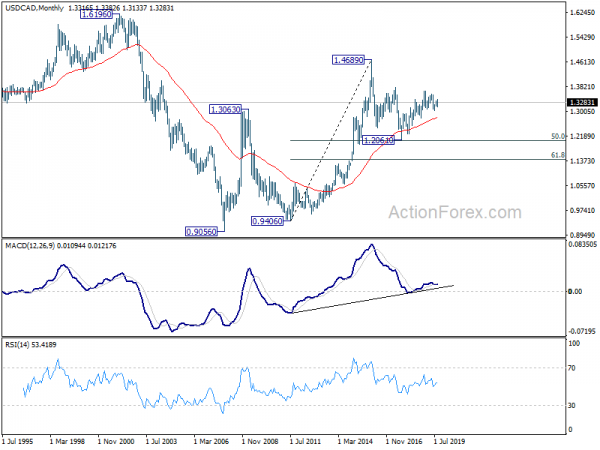

In the longer term picture, outlook remains unchanged that price actions from 1.4689 (2016 high) are forming a corrective pattern. As long as 1.2061 support holds. up trend from 0.9406 (2011 low) in in favor to resume through 1.4689 at a later stage.