Dollar ended as the strongest major currency last week, largely thanks to late buying before weekly close. It remains to be proved whether that was due to month end flows. But somewhat receding risk of US-China decoupling and expectations of aggressive Fed cut could have provided some help too. Though, the greenback will then be facing risks some another round of important economic data this week, including non-farm payrolls.

Staying in the currency markets, Canadian Dollar was the second strongest last week as supported by solid GDP report, followed by Australian Dollar. Swiss Franc Franc and Euro were the weakest ones. In particular, Euro hit new two year low against Dollar. Sterling ended just mixed after Prime Minister Boris Johnson’s move to suspend parliament, as a tactic to force through no-deal Brexit.

New Tariffs on China to Start While Conversations Continue

The planned 15% tariffs on the first tranche of USD 300B of Chinese imports will take effect this weekend. Tariffs on the second tranche are expected to take effect on December 15. However, last week, China appeared to have backed down and indicated it won’t retaliate on Trump’s tariff escalation from 10% to 15%. It’s believed that conversations between the two sides continued, and they’re still working towards a meeting in Washington in September. For now, risk of worst scenario of complete US-China decoupling receded mildly.

US stocks were supported by the news and rebounded, but lacked follow through buying. S&P 500 failed to take out 2943.31 resistance. The index is kept in consolidation pattern from 2822.12. For now, further fall is still expected through 2822.12 to 38.2% retracement of 2346.58 to 3027.98 at 2767.68 at least.

Dollar Jumps Despite Trump’s Attack on Fed

Rally in Dollar took off before weekly close, after US President Donald Trump criticized Fed again. He tweeted that “We don’t have a Tariff problem (we are reigning in bad and/or unfair players), we have a Fed problem.” Yet, traders seemed to be slightly flipping their expectation on September Fed cut again. As of now, fed fund futures are pricing in only 96.9% chance of a -25bps cut to 1.75-2.00%.

Dollar index breached 98.93 resistance last week to resume medium term up trend. Further rise is expected this week. Next short term target will be 100% projection of 95.83 to 98.93 from 97.16 at 100.25. In the bigger picture, the up trend from 88.25 is still in progress despite relatively weak upside momentum. DXY is, nonetheless, staying well above rising 55 week EMA. Next medium term target will by 78.6% retracement of 103.82 to 88.25 at 100.49.

EUR/USD Weekly Outlook

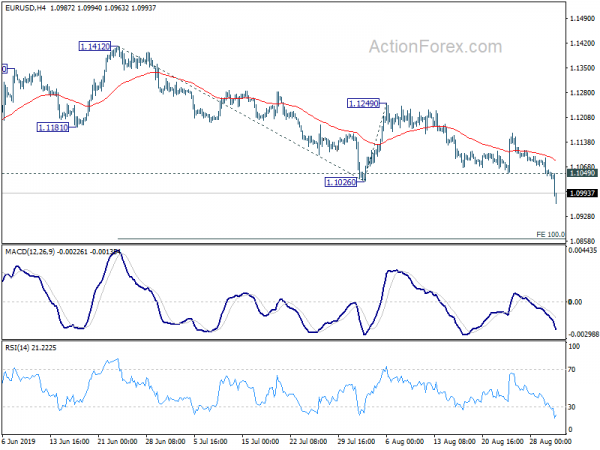

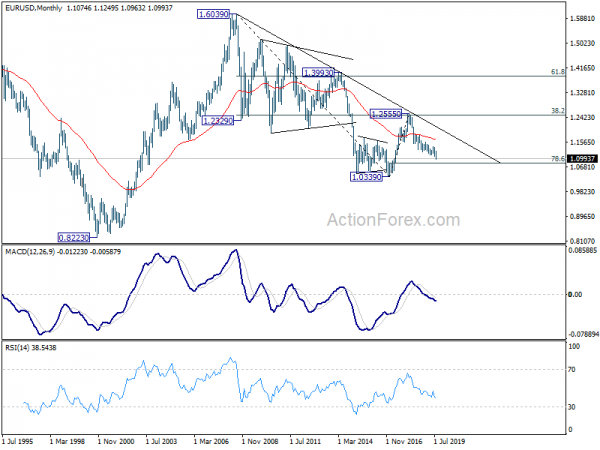

EUR/USD dropped to as low as 1.0963 last week and break of 1.1026 confirms down trend resumption. Initial bias remains on the downside this week. Next near term target is 100% projection of 1.1412 to 1.1026 from 1.1249 at 1.0683. On the upside, above 1.1049 minor resistance will turn intraday bias neutral and bring consolidations again first.

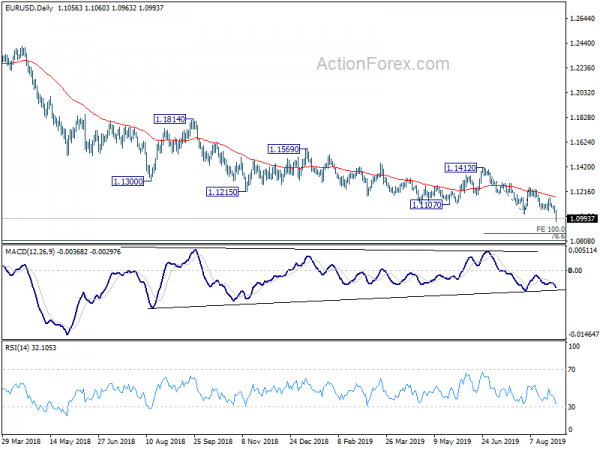

In the bigger picture, down trend from 1.2555 (2018 high) is in progress and extending. Prior rejection of 55 week EMA also maintained bearishness. Further fall should be seen to 78.6% retracement of 1.0339 to 1.2555 at 1.0813. Decisive break there will target 1.0339 (2017 low). On the upside, break of 1.1412 resistance is needed to indicate medium term bottoming. Otherwise, outlook will stay bearish in case of rebound.

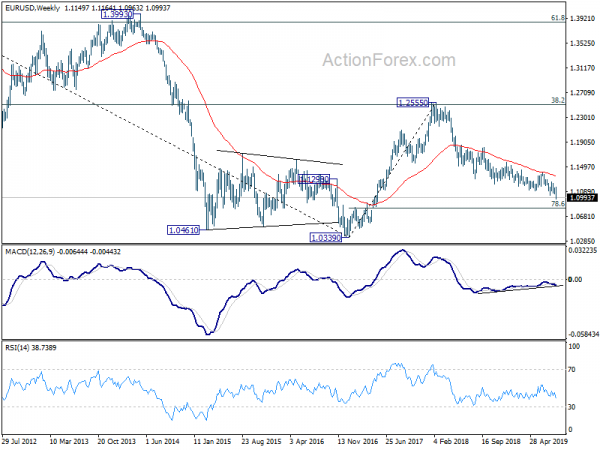

In the long term picture, outlook remains bearish for now. EUR/USD is held below decade long trend line that started from 1.6039 (2008 high). It was also rejected by 38.2% retracement of 1.6039 to 1.0339 at 1.2516 before. A break of 1.0039 low will remain in favor as long as 55 month EMA (now at 1.1629) holds.