Euro ended last week as the weakest one as comments from a top ECB official suggested a forceful easing package to be announced in September. Additionally recession fear in Germany sent 10-year bund yield to new record low. New Zealand Dollar followed as the second weakest on dovish RBNZ expectations. The overbought Yen was the third weakest despite falling yields as it was consolidating recent gains. On the other hand, Sterling was the strongest last week, paring some of recent losses, awaiting the next move regarding Brexit. Dollar followed as the second strongest, mainly because of weakness elsewhere.

The upcoming week could be crucial for the greenback as focus will turn to Fed Chair Jerome Powell’s Jackson Hole speech, and FOMC minutes. Euro, will also look into ECB policy accounts and PMIs. These events could decide whether EUR/USD would extend medium term down trend through 1.1026 low. Such a development could drag down the Euro elsewhere, or push up the greenback broadly, or both.

Significant and impactful package expected from ECB

The decline in German yield and Euro was triggered by dovish comments from ECB Governing Council member Olli Rehn. In short, Rehn said weakening of Europe’s economic outlook justified further action in monetary policy, “as we intend to do in September”. And most importantly, he said “it’s important that we come up with a significant and impactful policy package”, “when you’re working with financial markets, it’s often better to overshoot than undershoot, and better to have a very strong package of policy measures than to tinker.”

The upcoming release of ECB monetary policy accounts could shed some lights of what “package” policy makers were considering. Currently, markets are expecting -10bps cut to the key interest rate from current -0.4%. Also, ECB could restart asset purchase program with fresh EUR 50B per month buying. Meanwhile Eurozone PMIs would likely reinforce the need to more policy stimulus.

DAX weakened on recesssion fear, pared losses on ECB expectations

German 10-year yield hit new historical low at -0.712 last week before closing at -0.684. German DAX hit as low as 11266.48 but recovered to close at 11562.74, with help from ECB easing expectations and falling yields. Though, the overall development suggests that corrective rise from 10279.20 has completed at 12656.05. Some consolidations could be seen with support from 61.8% retracement of 10279.20 to 12656.05 at 1187.15 in proximity. But any recovery should be limited by 55 day EMA (now at 12046.04). Further fall should be seen sooner or later to 10279.20 support.

US-China trade talks at juncture with Hong Kong on the cards

US equities took a roller-coaster ride last week on developments in US-China trade tensions. US announced to delay 10% tariffs of roughly 50-60% of the USD 300B in Chinese imports until December 15. Such move was well received by the markets. Conversations between the two sides were continuing and a meeting is still expected in Washington in September.

But President Donald Trump appeared to have put human rights conditions in Hong Kong as a precondition in any trade deal with China. He also got backing from the Congress, as there was bipartisan agreement to expedite the Hong Kong Human Rights and Democracy Act, which could lead to sanctions of some high profile Chinese and Hong Kong officials. The political development in Hong Kong in the upcoming week is more crucial than ever on US-China relations.

US treasury yields on free fall, 30-year yield hit new record low

Adding to that, yield curve inversion in the US worsened last week, as triggered by fear of global slowdown and domestic recession. 10-year yield, which closed at 1.539, is now way below 3-month yield at 1.871 and just marginally above 2-year yield at 1.488. 30-year yield also hit new record low at 1.1916 before closing at 2.000, below prior historical low of 2.102.

Futures pricing in 100% of September Fed cut ahead of Jacksonhole

For now, Fed fund futures are pricing in 100% chance of at least another FOMC rate cut on September 18. Fed Chair Jerome Powell will again have a chance to set the expectations, at the annual Jackson Hole Economic Symposium. Before that, Fed will release July meetings, which should shed more lights on the debates that lead to the insurance rate cut. From both events, we should know how likely is Fed to deliver another cut next month.

Dollar index staying in up trend after recent volatility

Dollar index drew strong support from 55 day EMA and rebounded strongly last week, along with selloff in EUR/USD. While upside momentum has been unconvincing, the up trend in DXY remains intact. Another high above 98.93 is still expected. Though, a break of 97.03 support will be an early sign of medium term topping and turn focus back to 95.83. The upcoming week, with the above mentioned events in Eurozone and US, will be crucial. Break of 1.1026 low in EUR/USD should at least solidify Dollar index’s near term bullishness.

EUR/USD Weekly Outlook

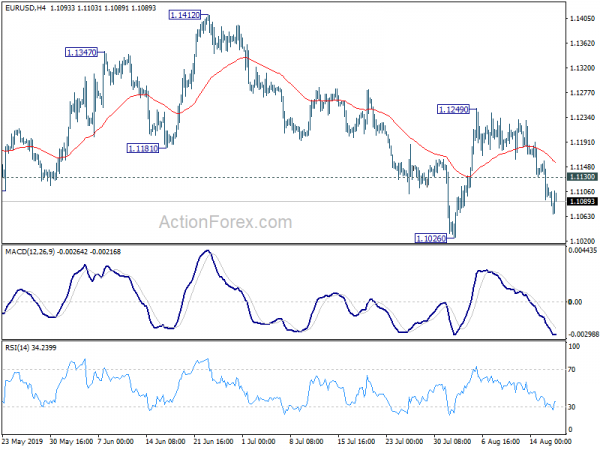

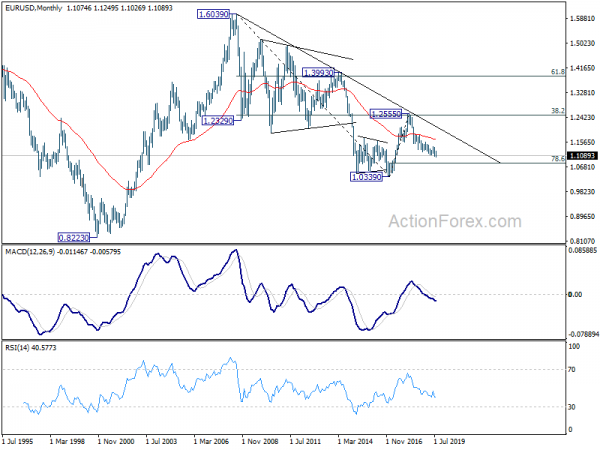

EUR/USD’s sharp decline last week suggests that rebound from 1.1026 has completed at 1.1249, after failing to sustain above 55 day EMA (now at 1.1202). Initial bias stays on the downside this week for retesting 1.1026 low first. Decisive break there will extend the downtrend from 1.2555. On the downside, above 1.1130 minor resistance will turn intraday bias back to the upside to extend the corrective. But in that case, we’d expect strong resistance from 1.1282 to limit upside.

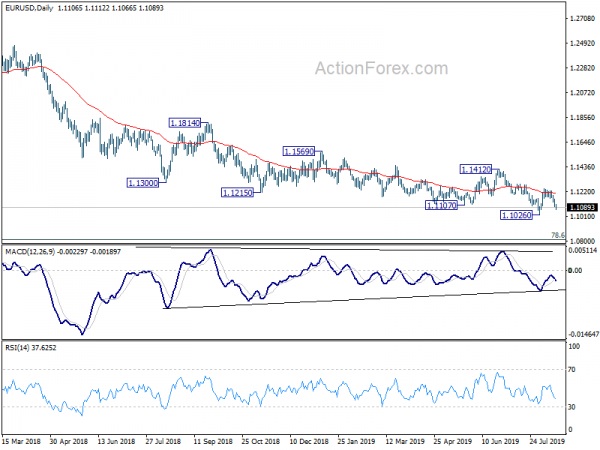

In the bigger picture, down trend from 1.2555 (2018 high) is in progress and extending. Prior rejection of 55 week EMA also maintained bearishness. Further fall should be seen to 78.6% retracement of 1.0339 to 1.2555 at 1.0813. Decisive break there will target 1.0339 (2017 low). On the upside, break of 1.1412 resistance is needed to indicate medium term bottoming. Otherwise, outlook will stay bearish in case of rebound.

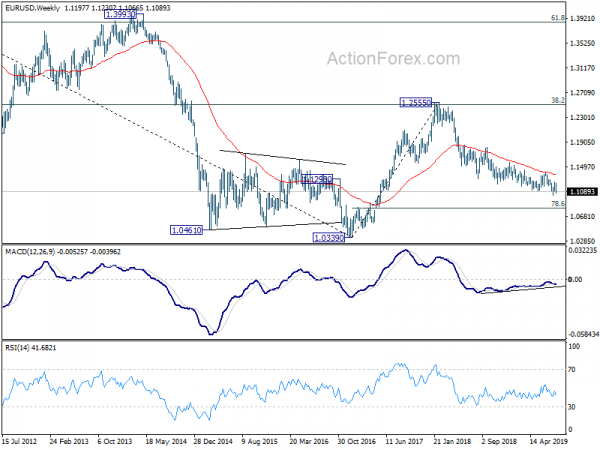

In the long term picture, outlook remains bearish for now. EUR/USD is held below decade long trend line that started from 1.6039 (2008 high). It was also rejected by 38.2% retracement of 1.6039 to 1.0339 at 1.2516 before. A break of 1.0039 low will remain in favor as long as 55 month EMA (now at 1.1632) holds.