Free fall in major government yields extended, and accelerated last week. Meanwhile, it seemed that stocks investors finally woke up with sharply deteriorating sentiments. Major indices staged steep decline as risk aversion heightened. The first factor being the “ever-present” US-China trade tensions. Hard-line rhetorics from official media blossomed after Xi urged his citizens to prepare for a “new long march” earlier in the month.

And now China is also stepping counter-measures to US isolation of Huawei. Rare earth will be used to disrupt US industrial and tech supply chain. And a so called “unreliable entity list” will be set up. There are divided opinions on the effectiveness of China’s moves but they’re somewhat irrelevant. The key message is that there is no room for negotiations for now. Further, on Sunday, China is going to lay out its position on trade talks with the US in a white paper titled “China’s Position on the China-U.S. Economic and Trade Consultations”.

Judging from the intensity of market reactions, Trump’s suddenly move to tariff Mexican products had a more profound impact that unsettle global investor confidence. In short, in order to force Mexico to curb immigration flow through the country to US, Trump announced to impose 5% tariffs on all Mexican products on June 10. That will eventually move up to 25% on October 1 if he’s not satisfied with what Mexico is going to do. That’s an unprecedented move in using tariffs on issues unrelated to trade nor economy. That’s beyond the scope of trade war and it’s no longer just protectionism. It’s weaponization of tariffs for political agenda.

The net results were, over the week: DOW dropped -3.01%. S&P 500 dropped -2.62%. NASDAQ dropped -2.41%. DAX dropped -2.37%. CAC dropped -2.05%. FTSE dropped -1.59%. Nikkei dropped -2.44%. China Shanghai SSE surprisingly rose 1.6%. US 10-year yield dropped -0.182 to -2.142. 30-year yield dropped -0.169 to 2.583. German 10-year yield dropped to record low at -0.211 before closing at -0.20, down -0.086.

In the currency markets, Yen was overwhelmingly the strongest one. It’s surprisingly followed by the resilient Australian Dollar, and then Swiss Franc. Sterling was the worst performing one. Canadian Dollar was second worst, following steep decline in oil price.

Dollar dragged down by Fed cut pricing and falling yields

Dollar was left behind by Yen and France last week and ended mixed despite risk aversion on trade tensions. Increasing bets on Fed rate cut this year was a factor weighing on the greenback. Free fall in treasury yield was another. Both developments could intensify this week with the heavy weight economic data releases. Both ISM indices are expected to stay steady in May. But given that Market PMIs deteriorated sharpy to 50.6 (manufacturing) and 50.9 (services), the markets could be setting themselves up for disappointment. Personal spending in the US has been strong while consumer confidence stayed high. Jobless claims also hovered around very low levels. So, it’s less likely that non-farm payroll would disappoint. But any downside surprise in NFP would trigger huge reactions based on current weak sentiments.

Dollar index has been losing upside momentum for some time, as seen in daily MACD too. But after all, it’s support above 55 day EMA in the current rising leg and there is no clear sign of topping yet. For now, outlook remains cautiously bullish for 100 psychological level. However, firm break of 97.02 support will be an early sign of medium term bearish reversal. And focus will be turned back to 95.74 structure support for confirmation.

Investors now see 73.9% chance of Fed cut by September meeting

Recent comments from Fed officials continued to reinforce the patient stance. Sluggish inflation was seen as transitory and improvements in job market will eventually lift inflation back to target and above. But such view could quickly change if data point to slowdown or even turnaround in employment. Investors are clearly ahead of Fed on the issue.

Fed fund futures are now pricing in 94.1% chance of at least one rate cut by December this year. That’s notably higher than 76.9% a week ago and 61.4% a month ago.

Also, chance for a Fed cut by September meet now stands at 73.9%. It was less than 50% a week and and month ago.

10-year yield close to key support zone after steep decline

10-year yield close to key support zone after steep decline

10-year yield dropped to as low as 2.137 before closing at 2.142. For now, we’d still look for support between 2.034 and 61.8% retracement of 1.336 to 3.248 at 2.066 to bring a recovery. But break of 2.356 resistance is needed to be the first sign of bottoming. Otherwise, outlook will stay bearish and more downside is in favor. Indeed, current downside acceleration suggests that 2.0 handle will likely be taken out too. It’s just a matter of time.

Also, looking at the biggest picture, TNX was held by decade long channel resistance. 55 month EMA was also taken out with last week’s steep fall. It’s still a bit early to say. But sustained trading below 2.0 handle could pave the way back to 1.336 low.

DOW’s fall fro 26685.96 resumed and accelerated

DOW’s decline from 26696.95 extended to as low as 24809.51 last week. It was just inch above 38.2% retracement of 21712.53 to 26695.96 at 24792.28. DOW might try to recover from current level. But break of 25342.28 gap resistance is needed to indicate bottoming. Otherwise, further decline is expected ahead to 61.8% retracement at 23616.20 at least.

Also, we’ve pointed out before that fall from 26696.95 is seen as the third leg of the consolidation pattern from 26951.981 high. Such decline could even have a take on 50% retracement of 15450.56 to 26951.81 at 21201.18 before completion. That’s not too bearish a view already as we’re not seeing it as correction to the whole up trend from 2009 low at 6469.96 (yet).

Comparing long term charts of DAX, Nikkei and DOW

However, if we look at DAX, it’s hard to deny that it’s corrective the up trend from 2009 low at 3588.88.

And Nikkei is also correcting whole up trend from 2009 low at 6995.89.

So, maybe DOW is doing so too. We’ll see.

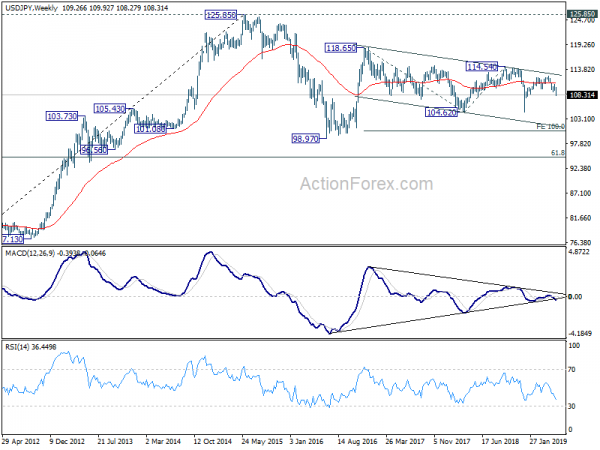

USD/JPY Weekly Outlook

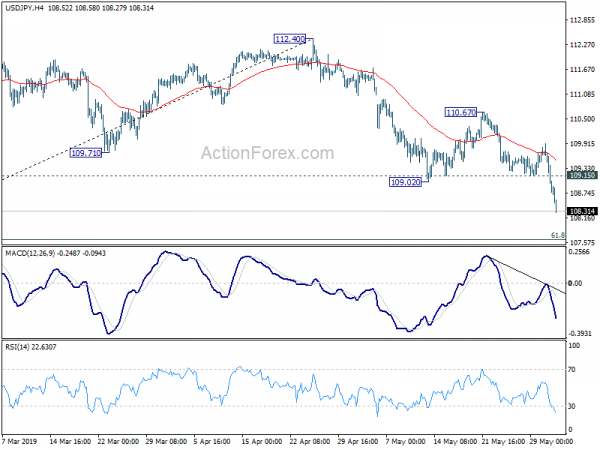

USD/JPY’s decline from 112.40 resumed last week by dropping through 109.02 support and hit as low as 108.27. Initial bias stays on the downside this week for 61.8% retracement of 104.69 to 112.40 at 107.63. Sustained break there will pave the way back to 104.62/9 key support zone. On the upside, break of 109.15 support turned resistance is needed to be the first sign of short term bottoming. Otherwise, outlook will remain bearish in case of recovery.

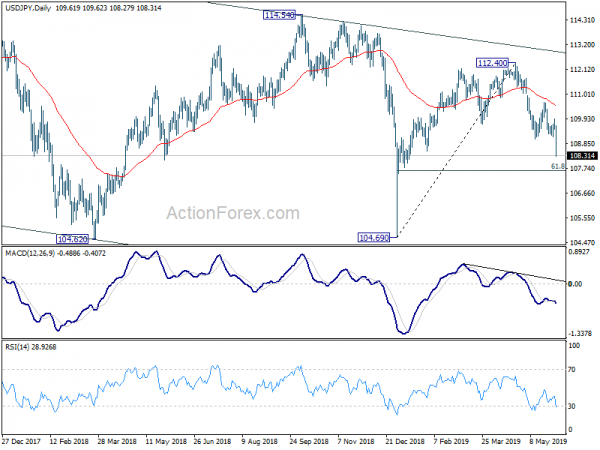

In the bigger picture, decline from 118.65 (Dec 2016) is still in progress, with the pair staying indicate long term falling channel. Break of 104.62 will target 100% projection of 118.65 to 104.62 from 114.54 at 100.51. For now, we’d expect strong support above 98.97 (2016 low) to contain downside to bring rebound.

In the long term picture, the rise from 75.56 (2011 low) long term bottom to 125.85 (2015 high) is viewed as an impulsive move, no change in this view. Price actions from 125.85 are seen as a corrective move which could still extend. In case of deeper fall, downside should be contained by 61.8% retracement of 75.56 to 125.85 at 94.77. Up trend from 75.56 is expected to resume at a later stage for above 135.20/147.68 resistance zone.