It’s another week with multiple theme happening at the same time. Swiss Franc ended as the strongest on risk aversion. Oil’s free fall could be that extra lift the the Franc. Dollar ended as the second strongest, but that’s mainly due to relatively smaller problems in the US. Sterling was the third strongest after UK and EU agreed on the political declaration on future relationship. On the hand, Australian and Zealand Dollar were the weakest ones on risk aversion. Aussie was additionally pressured by the decline in iron ore prices. Euro was the third weakest one on deteriorating growth outlook. Canadian Dollar follow oil prices lower.

Dollar high but got its own problems too

Dollar ended the week as the second strongest. But that’s mainly due to more serious problems of the others. The US got its own too. For the week, all three major US indices — DOW, S&P 500 and NASDAQ dropped more than -3%. Stocks suffered the worst Thanksgiving week since 2011 as led by tech stocks and oil.

Trump’s administration is now pushing for more stringent export-control rules of a list of 14 categories of new technologies that have national security applications. A request for public comment was published last Monday in the Federal Register. Broadly speaking, the categories include biotechnology, artificial intelligence and machine learning, position and navigation, microprocessor, advanced computing, data analytic, quantum information and sensing, logistics, additive manufacturing, robotics, brain-computer interfaces, hypersonics, advanced materials, advanced surveillance.

Whether the move is another step in Trump’s trade war with China is another question. The implications of the move on technology products are huge. And, companies selling everyday products from Apple to Amazon to even Tesla would be heavily affected. The impact would start from their sourcing of some components, to manufacturing them in some countries, to eventually selling the finished products internationally.

Talking about trade war, just ahead of the Trump-Xi meeting on Nov 30/Dec 1 as sideline of G20 summit in Argentina, the US Trade Representative released an update on the Section 301 IP investigation, which shouldn’t help the negotiation. In short, the report complained that “China has not fundamentally altered its unfair, unreasonable, and market-distorting practices that were the subject of the March 2018 report on our Section 301 investigation.” Habitually, China denied the accusations as groundless.

The outcome of the Trump-Xi meeting is a big wild card for the markets. The WTO released a report last week noting that from May-Oct period, the new trade-restrictive measures covered over USD 480B worth of trade, hitting highest since record began in 2012. And it warned that further escalation remains a “real threat”. It seems that investors were at least not too optimistic on the meeting yet.

NASDAQ still medium term correction

NASDAQ dropped -4.26% or-308.9 pts to 6938.98 last week. Breach of 6922.83 support, suggests resumption of corrective down trend from 8133.30. DOW and S&P 500 are holding above equivalent support for now. We’d maintain in a less bearish case, fall from 8133.30 is only correcting the up trend from 2016 low at 4209.76. And NASDAQ should at least target 38.2% retracement of 4209.76 to 8133.30 at 6634.50 before completing the correction.

Mixed outlook in Dollar index

Outlook is rather mixed in the Dollar index. It’s staying inside near term rising channel and is held well above 95.67 support. It’s also staying above slightly rising 55 week EMA. However, upside momentum is diminishing as seen in daily MACD. At the same time, it’s facing key fibonacci level at 61.8% retracement of 103.82 to 88.25 at 97.87. For now, we won’t turn bearish as long as 95.67 support holds. But we’d prefer to see 97.87 firmly taken out before committing to bullish view in the index.

Euro weighed down by deteriorating growth outlook

Euro was weighed down by deteriorating growth outlook of the Eurozone. In the monetary policy meeting accounts, ECB has twisted its tones to the dovish side a bit. In particular, it noted that “weaker growth pattern in H2 “would have a mechanical impact, via the carry-over effect, on the estimate for annual growth in 2019”. The central bank is still expected to end the asset purchase program after December. But, it could hold interest rates unchanged longer than “at least through summer of 2019:”

Also from Eurozone, PMI manufacturing dropped to 51.5 in November, down from 52.0, missed expectation of 52.0. That’s the lowest reading in 30 months. PMI services dropped to 53.1, down from 53.7 and missed expectation of 53.6. That’s the lowest reading in 25 months. PMI composite dropped to 52.4, down from 53.1, lowest in 47 months. Markit also warned that “the survey data suggest that the weakness of GDP in the third quarter may not have been a blip, and that the underlying trend is one of slower economic growth.”

DAX to extend medium term correction

Development in European stocks didn’t help sentiments neither. DAX has been trying to rebound from 61.8% retracement of 9214.09 to 13596.89 at 10888.32. But the strength of recovery has been very week. And 10888.32 looks rather vulnerable. Near term outlook will stay bearish as long as 11689.96 resistance holds. Firm break of 10888.32 could pave the way to next key support level at 9214.09.

Aussie lower on iron ore and Chinese stocks

Australian Dollar ended as the weakest one last week as pressured on two fronts. On the one hand, iron ore price suffered steep decline, with TIO down -6.2% to 67.51. More importantly, current development suggests cyclical rebound from July’s low at 62.83 has already completed at 75.14. A test on 62.83 will likely be seen ahead, with prospect of having a test on 52.81 in medium term.

On the other hand, Chinese stocks rally attempt faltered again. Shanghai SSE’s sharp fall on Friday suggests that corrective rebound from 2449.19 might have completed already. Medium term outlook is kept bearish with the index held inside falling channel. Rejection by 55 day EMA is another bearish sign. We could see a retest and even break of 2449.19 low rather soon. Bother developments could weigh on the Aussie.

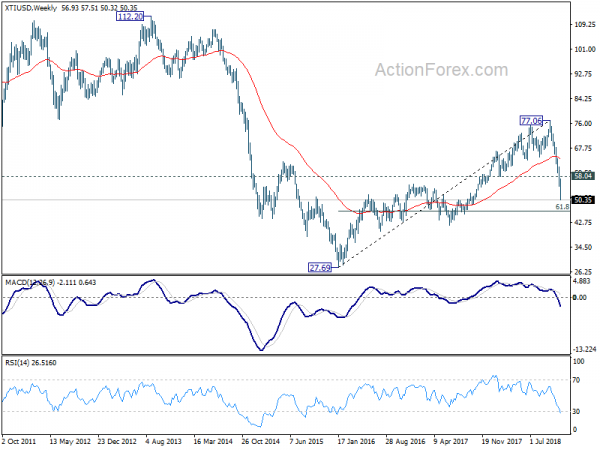

Oil price free fall to continue in near term

Canadian data released last week were not bad. But the Loonie was clearly dragged down by the free fall in oil prices. WTI crude oil closed at 50.35 and that’s -35% off October’s high at 77.06. Near term outlook will stay bearish as long as 58.04 resistance holds. WTI should now target 61.8% retracement of 27.69 to 77.06 at 46.54. We’d probably only see buying comes in again, gradually, below this 46.54 fibonacci level.

Position trading

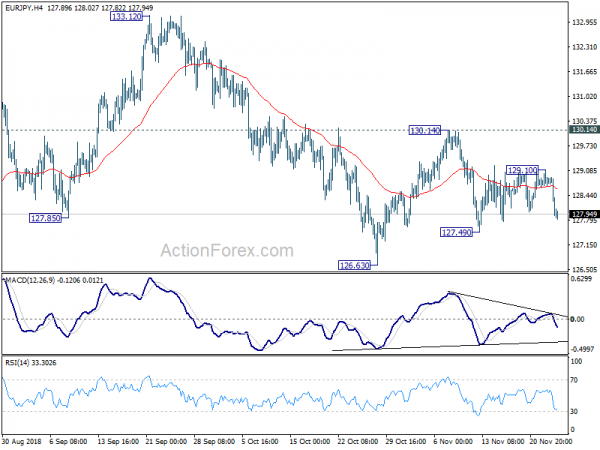

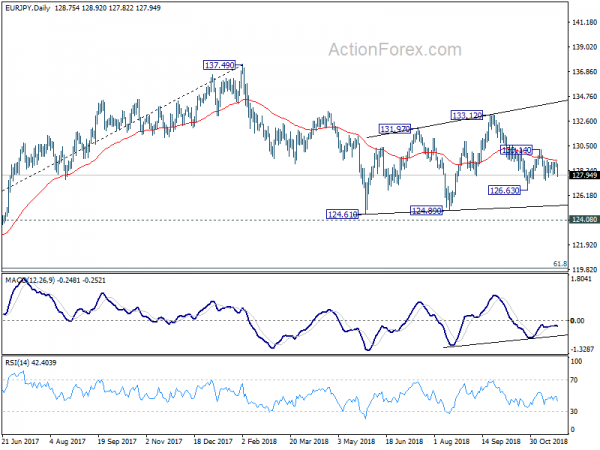

In our view, Aussie and Euro are two candidates to short based on the above bearish development. Aussie is actually a one but there is a wild card of Trump-Xi meeting. So, we’d better give in a pass. For Euro, at this point, we can’t really think of any special development that can give it a pop. A trade deal with the US could be but there is little chance of having some tangible progress for the near term. Negative Brexit development will shoot up EUR/GBP for sure, but that should be confined to EUR/GBP only. And, we are not expecting upcoming data to show any turn around. For we’re slightly favoring more decline in USD/JPY in the near term, we’ll choose to sell EUR/JPY.

In our view, the corrective rise from 126.63 should have completed at 130.14. And staying below 55 day EMA is a bearish sign too. We’d expect the fall from 133.12 to resume eventually for a test on 124.61/89 support zone. But we’d actually expecting the fall from 137.49 to resume and extend to 61.8% retracement of 109.03 to 137.49 at 119.90.

So, we’ll sell EUR/JPY on break of 127.49, with stop at 129.00, slightly below 129.10 resistance. We’ll put 120.00 as target first, with risk reward at around 1:4.9. But we’d be cautious on the reaction fro 124.08 key support and might exit earlier.

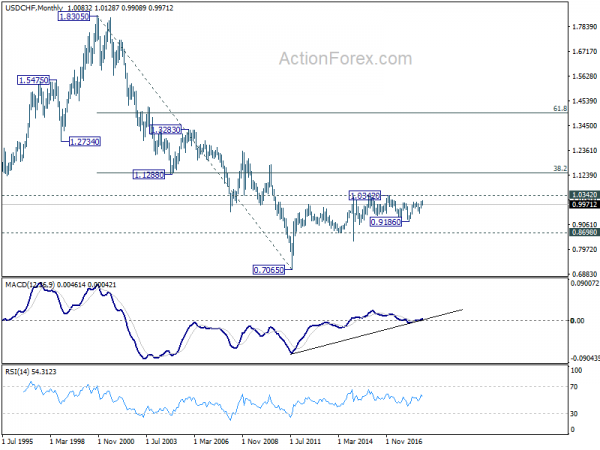

USD/CHF Weekly Outlook

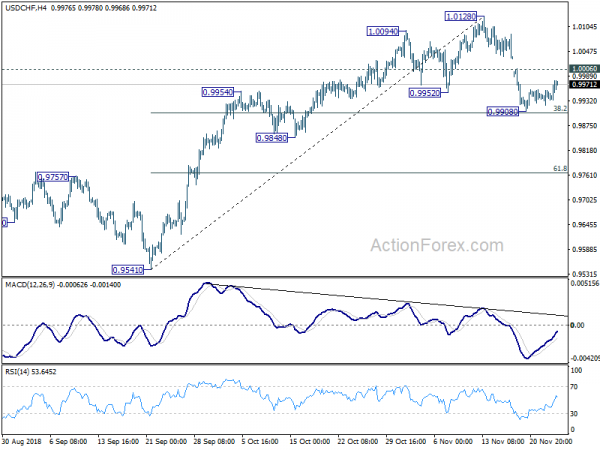

USD/CHF dropped to as low as 0.9908 last week but drew support from 38.2% retracement of 0.9541 to 1.0128 at 0.9904 and recovered. Initial bias is neutral this week first. On the upside, break of 1.0006 minor support will argue that the pull back from 1.0128 has completed. Intraday bias will be turned back to the upside for retesting 1.1028. However, on the downside, break of 0.9904 will target 0.9848 key support level.

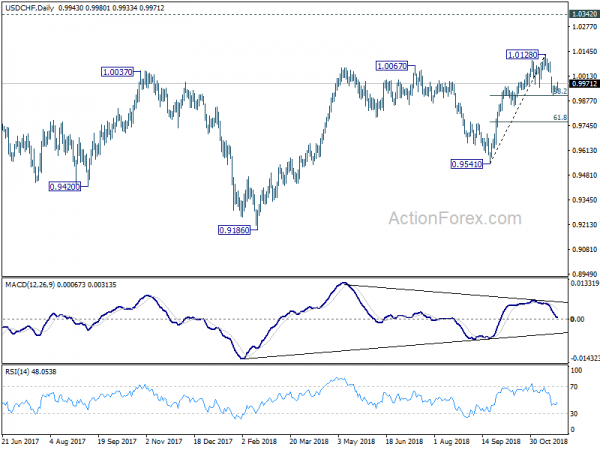

In the bigger picture, the pullback from 1.0067 has completed at 0.9541 already. And rise from 0.9186 is likely resuming. Firm break of 1.0067 will pave the way to retest 1.0342 key resistance. We’d be cautious on strong resistance from there to limit upside to bring another medium term fall to extend long term range trading. However, break of 0.9848 near term support will dampen this view and bring deeper decline back to 0.9541 support and possibly below.

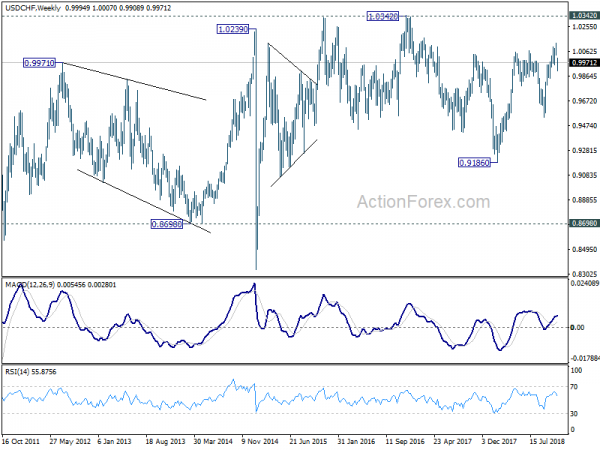

In the long term picture, price actions from 0.7065 (2011 low) are not clearly impulsive yet. Thus, we’ll treat it as developing into a corrective pattern, at least, until a firm break of 1.0342 resistance.