The last week of August was unusually volatile and eventful. It’s a week to remember yet it’s hard to remember all the details. Almost every major currency got its own stories. Swiss Franc and Japanese Yen ended as the first and third strongest ones on risk aversions. And apparently, there were more problems in Europe than in Asia. Sterling was the second strongest with the help of friendly comments from EU on post Brexit relationship. On the other hand, commodity currencies were the weakest ones with Australian and New Zealand Dollar that led the way down. Euro was the third weakest, followed by Canadian Dollar. Even though a the most substantial risks of the world economy, trade war, started from the US, Dollar was mixed while US stocks made new record highs.

Trump’s trade war with Canada, EU and China

To start with, Dollar has benefited from Trump’s hostile trade rhetorics every time this year. Last week, the US and Mexico bypassed Canada and struck a bilateral trade deal. Canadian Foreign Minister Chrystia Freeland cut short her European trip and flew to the US on Tuesday to start a whole week of intensive session. Yet, no result was achieved ahead of Trump’s forcefully imposed deadline of Friday, and demanded that any deal would be “totally on our terms”.

Later in the week, Trump criticized that EU is “almost as bad as China” on trade, “just smaller”. Even though EU offered to drop all tariffs on autos if US does the same, Trump said that’s “not good enough”. He even went further to criticize EU citizen’s own choices and added that “Their consumer habits are to buy their cars, not to buy our cars.” That’s seen as dishonoring the “ceasefire agreement” with EU that drew strong reactions. European Commission President Jean-Claude Juncker warned that EU won’t let others dictate its own trade policies. And, if Trump violates the deal impose auto tariffs, the EU will “also do that”. The EU’s offer was clearly a step in the right direction in bringing down tariffs of the world and Trump’s rejection on it clearly showed his dishonest claims.

Also, it’s reported that Trump is ready to start imposing 25% tariffs on USD 200B in Chinese imports, as soon as public hearing ends this week. Chinese’s retaliation on USD 60B in US imports will start at roughly the same time, slightly after. What caught the markets surprised was Trumps comment that it’s not time for negotiation with China yet. And, he later claim again that China is devaluating its currency. Yet, according to Bloomberg’s calculation, PBoC’s fixing was 0.1% stronger than the average forecast for 17 days in a row. But Trump never needs facts to back up he words as his supporters believe as always. Overall, the development is not surprising to us. The so called restart of trade talks between two low level officials, which we forgot the name and couldn’t care less to find out again, was taken seriously by nobody. It’s probably just wishful thinking of isolated trade dove Steven Mnuchin’s. The measures and counter-measures announced will be realized gradually, till November. There, we’d probably see what really comes next.

In addition, Trump also threatened to exit from the WTO and played victim again, complaining the organization as being unfair to the US. Roberto Azevedo, the WTO’s director general responded and said the organization is working with the members to address some common complaints. But Azevedo warned that “the U.S. is about 11 percent of global trade. So leaving the organization would be a blow to the organization. But it would be a blow to the U.S. as well.” Azevedo added that it would leave the US businesses in dangerous position of being commercially discriminated and “that is the worst thing that could happen for an economy as globally connected as the American economy.”

US stocks made record high and Dollar index rebounded

But after all, the US stock markets performed very well last week despite all the trade threats. Both S&P 500 and NASDAQ made record highs. S&P 500 is picking up upside momentum again as seen in daily MACD. The focus will be on whether the index would accelerate further by breaking upper near term channel resistance. But in either case, SPX will likely target 100% projection of 2691.99 to 2848.03 from 2802.49 at 2958.53 next, with prospect of a take on 3000 psychological level.

Dollar index also rebounded strongly after dipping to 94.43. Overall outlook is unchanged that DXY is in medium term consolidation. More range trading would be seen in near term below 96.98 high. But even in case of deeper fall, down side should be contained by 38.2% retracement of 88.25 to 96.98 at 93.64. Considering that this fibonacci level is close to 55 week EMA (now at 93.75) to bring rebound.

Euro suffered from trade war, Turkey and Italy problems

Euro was admirably resilient last week considering the problems the bloc is facing. German DAX dived sharply on Friday in the wake of Trump’s trade rhetorics. The development suggests that rebound from 12120.65 has completed after touching 55 day EMA. And even though 12104.41 support was defended earlier in August, the weak rebound and limitation by 55 day EMA carry bearish implications. A downside breakout is expected in DAX through 12104.41 eventually, to 11726.62 and below to extend the correction from 13596.89 high.

In addition to trade war, Turkish Lira was sold off last week on deepening worries on Turkish banks. Fitch warned that “Turkish banks are particularly exposed to refinancing risk, given their reliance on external funding.” Moody’s also said “there is a heightened risk of a downside funding scenario, where a deterioration in investor sentiment limits access to market funding.”

USD/TRY hit as high as 6.8396, comparing to August low at 5.6919 and high at 7.2069. Lira then recovered mildly on the governments measures on taxing deposits. Withholding tax on foreign currency savings of up to six months was increased from current 18% to 20%. On the other hand, withholding tax on Lira savings of more than one year was lowered from 10% to 0%. The selloff in Lira reminded investors that the problem is not solved yet and that’s another weighing down the Euro.

Then, the fiscal health of Italy came in to spotlight on Friday. Fitch kept Italy’s sovereign debt rating at BBB, but downgraded the outlook from stable to negative. Fitch said it expected the Italian government to push ahead with “fiscal loosening,” leaving its “very high level of public debt more exposed to potential shocks.” Fitch also warned that risks increased due to “the sizable policy differences between its coalition partners, and inconsistencies” between some electoral promises, as well as the “stated objective to reduce public debt.” And, “it is unclear how these policy tensions will be resolved”. Moody’s will provide Italy’s rating review this week.

Italian bonds suffered selloff during the week, with 10 year Italian yield closing at 3.24, highest close this year. On the other hand, German 10 year bund yield dropped again after touching 0.4 handle briefly and closed at 0.33. Suddenly, Italian-German spread is very close to 300 again. More importantly, it remains to be seen whether 10 year bund yield can eventually hold above 0.30 handle.

Sterling lifted as no-deal Brexit risk faded

Sterling, on the hand hand, staged a strong rebound on the back of renewed optimism on Brexit negotiation. The risk of “no-deal” Brexit suddenly dropped drastically. The rebound started when EU chief negotiator Michel Barnier said it’s prepared to offer the UK a ” partnership such as there never has been with any other third country.” That’s seen as a solid commitment that the EU wants a deal. Later in the week, Barnier added that the issue of Irish border was the “most sensitive point” of the negotiations. But he also noted that it is “possible” to have a solution.

UK Brexit Minister Dominic Raab said that he was “stubbornly optimistic” to reach a deal with the EU. He added that “valuable progress” was made but there is clearly “more work to do. And, he is “confident, if not more confident, now that a Brexit deal can be reached”. Both sides also said they’re still targeting a conclusion for the October EU summit.

Separately, it’s reported that EU officials are considering an unscheduled summit in November to conclude Brexit negotiations. It’s actually not news as the October summit is too tight while December one is too late to finalize all the parliamentary approvals. But again, it indicates that EU is working towards a solution with the UK.

Canadian Dollar in deadlock with US on trade talks

Canadian Dollar weakened much due to unsuccessful negotiation with the US. Canada’s stance is clear, they don’t just want “any deal”, but a good one. The so-called Chapter 19 trade dispute resolution mechanism and dairy industries seemed to be the deadlock. Now that the Friday is past, Trump has notified the Congress of his intent to sign a bilateral trade agreement with Mexico, which is called the United States- Mexico Trade Agreement. US-Canada trade negotiations will resume this Wednesday.

There are so much confusions regarding the topic right now. Firstly, is NAFTA still alive? Or it’s dead already? Trump indicated he’s dropped the name of NAFTA. But Mexican and Canadian officials continued to use the name NAFTA in their communications. Secondly, it’s uncertain how Trump could get a bilateral deal with Mexico through the Congress. There seems to be bipartisan consensus that any trade deal must include Canada. And, chief executive of the U.S. Chamber of Commerce, Thomas Donohue also said in a statement that “anything other than a trilateral agreement won’t win Congressional approval and would lose business support.” So in short, the story hasn’t ended yet.

The upcoming BoC meeting on Wednesday will also be a focus. We have been expecting BoC to hike in October meeting. And the speculation of a September hike cooled much last week. Firstly due to trade threats. Secondly, Q2 GDP disappointed a little, thus giving no extra push to hike early.

Australian and New Zealand Dollar were the weakest two

Australian Dollar was the weakest one last week as the lift from new Prime Minster Scott Morrison quickly faded. Economists are starting to expect RBA to stay on hold for longer, possibly even through 2020. Adding to that, base metals came under pressure due to escalation in US-China trade war. Judging from the reactions in the stock markets, the Chinese economy could be hurt severely out of trade war. And when your closest trade partner suffers, Australia will definitely be an unintended casualty. More importantly, the trigger for the selloff is Westpac’s mortgage rates hike during the week. It’s partly resulted from the transmission from higher interest rates in the US. The rate hike will like drag on consumer spending which could eventually cool inflation and wage growth.

RBA meeting will be an event to watch this week but there is no chance of any change in interest rate. And given that the next MPS and projections will be released in November, we see no reason for RBA to suddenly sound more dovish.

New Zealand Dollar tumbled sharply as ANZ business confidence dropped to a new -50 in August, hitting a fresh 10 year low. RBNZ Governor Adrian Orr was clear in his message that rate is going to stay low, for longer. And the next move could either be a hike or a cut.

Position trading – Sell AUD/JPY on recovery to 80.25

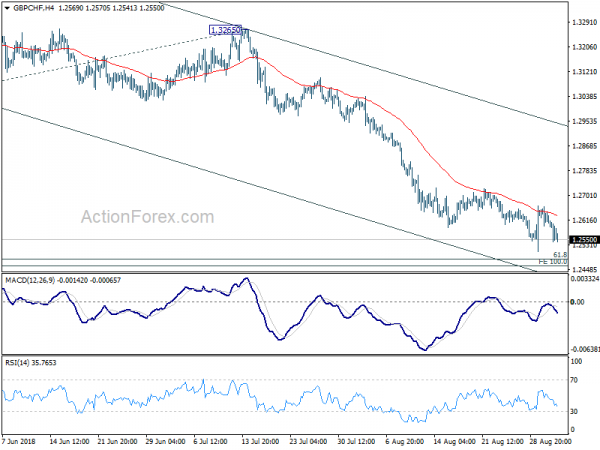

As noted in this update, we’ve exited our GBP/CHF short sold at 1.2971, closed at 1.2587, with 384 pips profits. Price actions after that was rather volatile as GBP/CHF first dived to 1.2509 and then recovered to 1.2665, and gyrated lower to close at 1.2550. We’re mentioned the in the update the reasons for the reasons than expected exit already. EUR/GBP’s reversal was an important trigger. If we didn’t close the position at that time and hold on to it, our 1.2500 target still couldn’t be hit. And by the time GBP/CHF hit 1.2509, we should have tightened our stop to close to 1.2653. That is, we could have stopped out higher. One may argue that we could have exit on the fall to 1.2509. But the dip and rebound happened within one hour. There’s no way for us to really get out at that hourly bar. So, while it’s not perfect, we’ve done our best in this trade already.

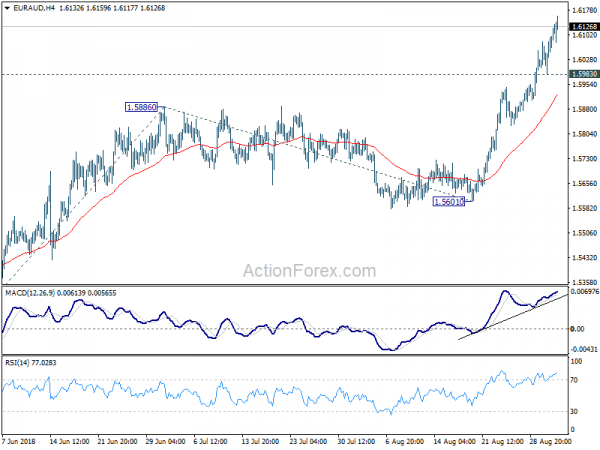

The EUR/AUD rally was missed as we’ve put our long entry at 1.5800, slightly below 38.2% retracement of 1.5601 to 1.5945 at 1.5814. But EUR/AUD dipped to 1.5829, slightly above 1.5814 fibonacci level, and start another rally. We were wrong in anticipating the impact of new Prime Minister Scott Morrison, which didn’t last too long. The order was cancelled, without chasing, because the rise from 1.5829 to to 1.5953 was not convincing. It’s a pity that we couldn’t get this one. But just like the above GBP/CHF trade, we’re most usually on the safe side in terms of position trading. And, there’s a cost that we gracefully accept.

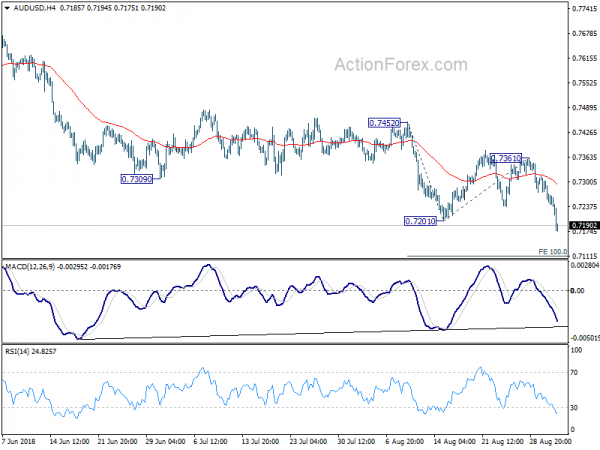

For the week ahead, we’ll look at short opportunity in AUD/JPY. Firstly, EUR/AUD took the lead in rally resumption two weeks ago already. AUD/USD followed last week and broke 0.7201 to resume down trend from 0.8135. AUD/CAD also extended the down trend from 1.0241 to as low as 0.9361 last week. AUD/NZD also extended the fall from 1.1174 and should have reversed the up trend from 1.0486. These developments point to more AUD weakness ahead.

Meanwhile, EUR/JPY, GBP/JPY and USD/JPY should have topped out at least temporarily last week. Asian stocks weakened in general with the exception of the resilient Nikkei. 10 year JGB yield dipped to 0.093 last week but managed to closed above 0.100 at 0.109. These factors suggests more upside in JPY, possibly except USD and CHF.

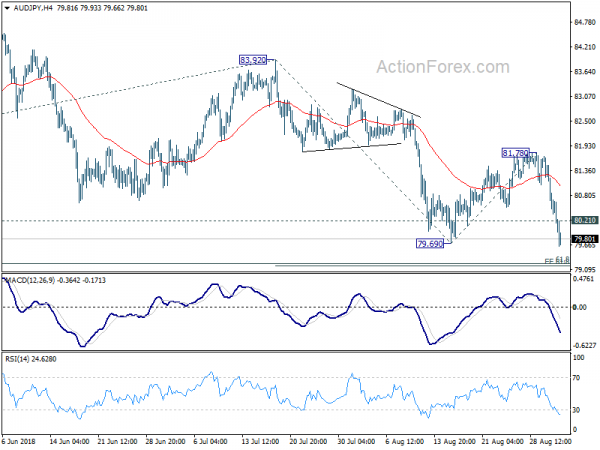

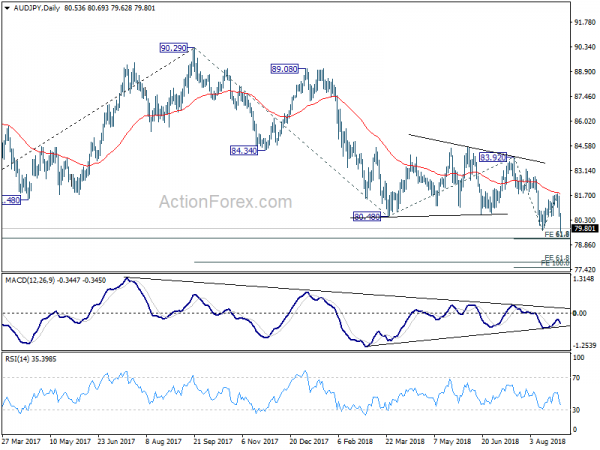

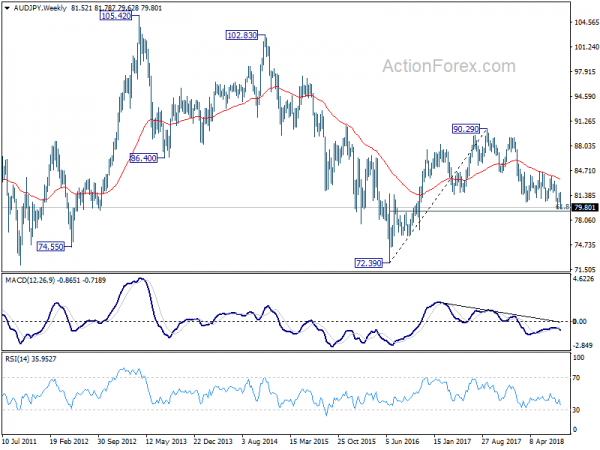

Now, AUD/JPY. The rebound from 79.69 was stronger than we expected here. We were wrong in seeing the rebound as correction to fall from 82.78, but instead it corrected fall from 83.92. Nonetheless, it’s still a correction that completed at 81.78 and larger fall from 90.29 is resuming. Next target is 61.8% projection of 83.92 to 79.69 from 81.78 at 79.16. This level is close to 61.8% retracement of 72.39 to 90.29 at 79.22. But based on current downside momentum, AUD/JPY shouldn’t have any problem passing through this 79.16/22 level. The real test lies in 77.55/85 (61.8% projection of 90.29 to 80.48 from 83.92 at 77.85, 100% projection of 83.92 to 79.69 from 81.78 at 77.55).

As AUD’s selloff was a bit stretched last week, we’ll sell AUD/JPY on recovery this week at 80.25, with stop at 81.00 (close to 4 hour 55 EMA now). Initial target is at 78.00, slightly above 77.55/85 zone. This gives risk/reward ratio of 1:3, which is acceptable. However, we won’t rigidly get out at 78.00 for now but look at the downside momentum to decide where the exit is. There is prospect of falling deeper.

AUD/USD Weekly Outlook

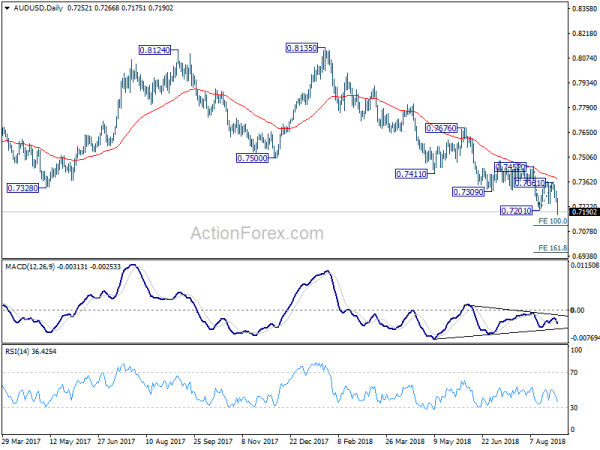

AUD/USD dropped to as low as 0.7175 last week and the break of 0.7201 confirmed resumption of down trend from 0.8135. Initial bias is on the downside this week for 100% projection of 0.7452 to 0.7201 from 0.7361 at 0.7110. Break will target 161.8% projection at 0.6955. On the upside, break of 0.7361 résistance is needed to indicate short term bottoming. Otherwise, outlook will remain bearish in case of recovery.

In the bigger picture, rebound from 0.6826 (2016 low) is seen as a corrective move that should be completed at 0.8135. Fall from there would extend to have a test on 0.6826. There is prospect of resuming long term down trend from 1.1079 (2011 high). But we’ll look at downside momentum to assess at a later stage. On the upside, break of 0.7452 resistance, however, will indicate medium term bottoming, on bullish convergence condition in daily MACD. In that case, a medium term correction should be seen first before down trend resumption.

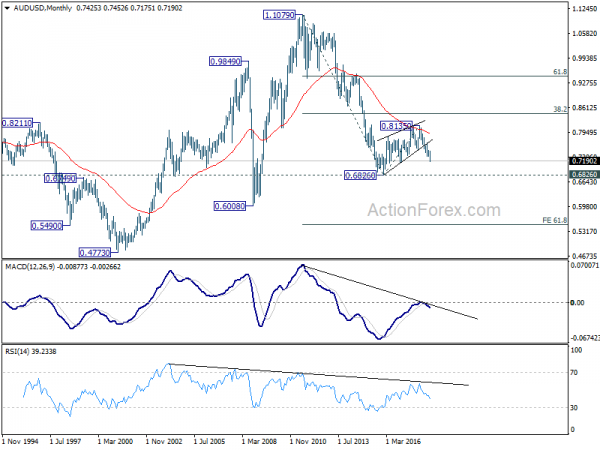

In the longer term picture, rebound from 0.682 (2016 low) should have completed at 0.8135 already. Failure to reach 38.2% retracement of 1.1079 (2011 high) to 0.6826 at 0.8451 carries bearish implications. This is also supported by the corrective structure from 0.6826 to 0.8135, as well as the rejection by 55 month EMA. The down trend from 1.1079 is in favor to extend. On break of 0.6826, next target will be 61.8% projection of 1.1079 to 0.6826 from 0.8135 at 0.5507.