Dollar rebounds further today as US markets are returning from holiday. Mild strength is seen in US yields with 10 year yield back pressing 2.9 handle. DOW futures point to triple digit loss at open. In the currency markets, Dollar is leading the way higher, followed by Sterling for today. Swiss Franc and Yen are trading as the weakest ones. Technically, there is generally no change in outlook as most pairs are bounded in range. In particular, EUR/USD is held above 1.2205 support while USD/JPY is well below 108.27 resistance. Dollar remains bearish in spite of the rebound.

German ZEW pulled back from record high

German ZEW economic sentiment dropped to 17.8 in February, down from 20.4 record high but beat expectation of 17.9. Current situation gauge dropped to 92.3, down from 95.2 and missed expectation of 94.0. Eurozone ZEW economic sentiment dropped to 29.3, down from 31.8, above expectation of 28.4. ZEW President Achim Wambach noted in the release that "the latest survey results continue to show a positive outlook for the German economy." And, "the assessment of the current economic situation is still on a very high level and the economy is expected to improve in the coming six months."

Receding political uncertainty in Germany would likely help business sentiments ahead. Over 450k members of the Social Democratic party start voting on reforming the grand coalition with Chancellor Angela Merkel’s Christian Democratic Union. They will have until March 2 to submit their votes. Result is expected to be announced on March 4. The result is still open but favors are on getting the notion passed eventually. Newspaper Bild am Sonntag polled the mayors of the 35 biggest towns and cities ruled by the SPD. 26 of them said they back coalition.

Spanish de Guindos becomes ECB Vice

Spanish economic minister Luis de Guindos will become the vice president of ECB as the overhaul of the board starts. That came after the only other candidate, Irish central bank governor Philip Lane pulled out from the race yesterday. Eurozone finance ministers made the decision of the appointment in Brussels de Guindos will replace Vitor Constâncio when his eight year term expires in May.

Also from Europe, Swiss trade surplus narrowed to CHF 2.09b in January. UK CBI trends total orders dropped to 10 in February.

RBA cautiously neutral

RBA minutes showed that policymakers are maintaining the cautiously neutral stance. The low interest rate is helping to bring down unemployment rate and keep inflation inside target band. But it echoed recent comments from officials that "further progress on these goals was expected over the period ahead but the increase in inflation was likely to occur only gradually as the economy strengthened." The minutes also warned that "there was still a risk that growth in consumption might turn out to be weaker than forecast if household income growth were to increase by less than expected." It’s generally expected that RBA will be on hold throughout 2018. But views on whether it will hike in early 2019 are divided.

Also from down under, New Zealand PPI input rose 0.9% qoq in Q4, PPI output rose 1.0% qoq.

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.2372; (P) 1.2403 (R1) 1.2439; More….

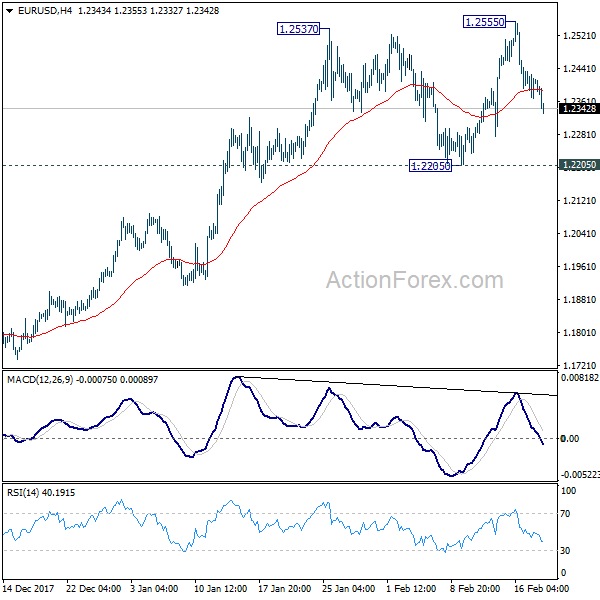

EUR/USD’s fall from 1.2555 extends lower today but it’s staying well above 1.2205 key support so far. Intraday bias remains neutral at this point. On the upside, break of 1.2555 will revive the bullish case of up trend resumption and target 100% projection of 1.0569 to 1.2091 from 1.1553 at 1.3075. However, break of 1.2205 will confirm rejection by 1.2516 key fibonacci level and trend reversal.

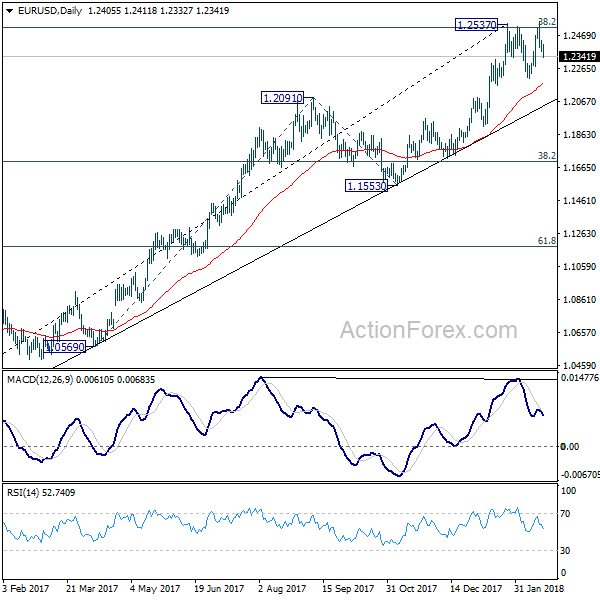

In the bigger picture, key fibonacci level at 38.2% retracement of 1.6039 (2008 high) to 1.0339 (2017 low) at 1.2516 remains intact despite attempts to break. Hence, rise from 1.0339 medium term bottom is still seen as a corrective move for the moment. Rejection from 1.2516 will maintain long term bearish outlook and keep the case for retesting 1.0039 alive. However, sustained break of 1.2516 will carry larger bullish implication and target 61.8% retracement of 1.6039 to 1.0339 at 1.3862.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | PPI Input Q/Q Q4 | 0.90% | 0.30% | 1.00% | 1.10% |

| 21:45 | NZD | PPI Output Q/Q Q4 | 1.00% | 0.40% | 1.00% | |

| 00:30 | AUD | RBA February Meeting Minutes | ||||

| 07:00 | EUR | German PPI M/M Jan | 0.50% | 0.50% | 0.20% | |

| 07:00 | EUR | German PPI Y/Y Jan | 2.10% | 1.80% | 2.30% | |

| 07:00 | CHF | Trade Balance (CHF) Jan | 2.09B | 2.78B | 2.63B | |

| 10:00 | EUR | German ZEW Economic Sentiment Feb | 17.8 | 16 | 20.4 | |

| 10:00 | EUR | German ZEW Current Situation Feb | 92.3 | 94 | 95.2 | |

| 10:00 | EUR | Eurozone ZEW Economic Sentiment Feb | 29.3 | 28.4 | 31.8 | |

| 11:00 | GBP | CBI Trends Total Orders Feb | 10 | 11 | 14 | |

| 13:30 | CAD | Wholesale Trade Sales M/M Dec | -0.50% | 0.40% | 0.70% | |

| 15:00 | EUR | Eurozone Consumer Confidence Feb A | 1 | 1.3 |