Sterling continues to trade as the weakest currency on political turmoils in UK. But so far, downside is limited. GBP/USD is holding above 1.3038 near term support. EUR/GBP below 0.9032 near term resistance. These two pairs are regarded as staying in sideway consolidation. More notable movement is seen in GBP/JPY. While GBP/JPY is also staying in range of 146.92/151.92, the break of 148.42 minor support now suggests fall from September high at 152.82 is ready to resume. Elsewhere, Yen and Swiss Franc are trading broadly higher on risk aversion. The economic calendar is light today but dominated by central bankers’ comments. Many important data, including inflation, growth and sentiments, will be released around the world in the days ahead.

BoE Haldane: Inflation to stay above target for the next few years

BoE chief economist Andy Haldane warned in a blog post published today that "price rises across the whole economy are currently running well above the 2 percent inflation target and are expected to remain above-target for the next few years." And, he added that the rate hike by BoE earlier this month was just "small adjustments". And the move is "unlikely to have a significant impact" on people’s lives. Meanwhile, he also noted that "the rise in inflation through this year has already generated such a squeeze on many households’ purchasing power." And, "this is not something the bank, or anyone else, should wish to see continuing for years to come – hence the nudge up in interest rates."

40 Conservatives MPs ready to channel PM May

It’s reported that the Conservatives are getting more impatient with Prime Minister Theresa May. And, up to 40 Conservative MPs are ready to challenge May’s leadership by signing a letter of no confidence. If eight more MPs are going to join, the letter would trigger a vote of no confidence, which could eventually leader to a leadership contest. Situation for May worsened sharply since the shambolic Conservative conference speech. And the list against her grew week by week after loss of Michael Fallon and Priti Patel in the cabinet.

Brexit Davis warned EU: No number or formula on divorce bill

Regarding Brexit negotiations with EU, Brexit Secretary David Davis dismissed the two-week deadline set of EU’s chief negotiator Michel Barnier. Davis said that "in every negotiation each side tries to control the timetable. The real deadline on this, of course, is December. It’s the December council. One of the key sticky point of the negotiation is that according to EU, "sufficient progress" is needed before moving on to the next stage in trade agreement talks. The divorce bill has to be settled before calling the progress "sufficient". But Davis said that the EU "invented this phrase" and "it’s in their control what it really is". Also, he warned EU that "you won’t have a number or a formula before we move on to the next stage".

ECB Constancio: Positive developments should not lead to complacency.

ECB Vice President Vitor Constancio warned today that "positive developments should not lead to complacency." He pointed out that "inflation, which is the core of our mandate, is still below our target after four years of growth supposedly above potential." And, he emphasized that "we are not yet fulfilling our mandate and that is why monetary policy will have to continue to be very accommodative, assuring favorable financial conditions to foster growth and spur wages and prices,

Fed Harker: "Lightly penciled in" a December rate hike

Philadelphia Fed Patrick Harker said today that he has "lightly penciled in" a December rate hike. He noted in Tokyo that "removing accommodation is the right next step". He forecast that unemployment will "drop below 4% probably late 2018 or early 2019". And that should "p[ut pressure on wages", thus, lift inflation back to target. But he emphasized the word "should" as "we’ve been predicting this for a while and it hasn’t happened".

BoJ Nakata: Fed policies have no direct linkage to Japan

BoJ International Department Director-General Yoshinori Nakata said today that Fed’s monetary policies will not have direct linkage to BoJ’s. In particular, he noted that "we’re confident the Fed will steer the U.S. economy and financial conditions in a correct, positive way so that global spillovers would be quite minimal."

RBA Debelle: Solid upward trajectory in non-mining business investment

RBA Deputy Governor Guy Debelle said "there has been a solid upward trajectory in non-mining business investment over the past couple of years." Also, there is starting to be a "change in mindset from the corporate sector around the willingness to invest, around the willingness to hire." And, that "gives you some hope that eventually we might get into a world where we start to see those wage price pressures emerge." But he also reiterated the central bank’s stance to stand pat until upward pressure in wages or inflation starts to emerge.

GBP/USD Mid-Day Outlook

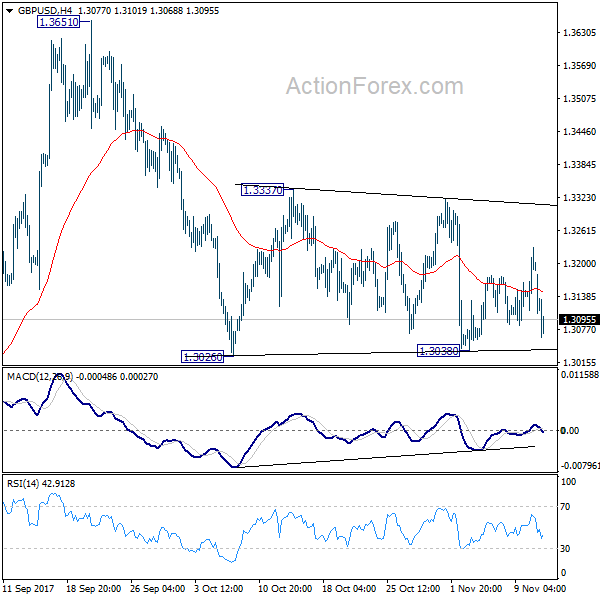

Daily Pivots: (S1) 1.3124; (P) 1.3177; (R1) 1.3241; More….

At this point, GBP/USD is still holding above 1.3038 support and bounded in established range. Intraday bias remains neutral first. In case of another recovery, upside should bel limited below 1.3337 resistance to bring fall resumption. Break of 1.3038 will now resume decline from 1.3651 to 1.2773 key support level. However, decisive break of 1.3337 will indicate that pull back from 1.3651 is completed and medium term rise from 1.1946 is resuming.

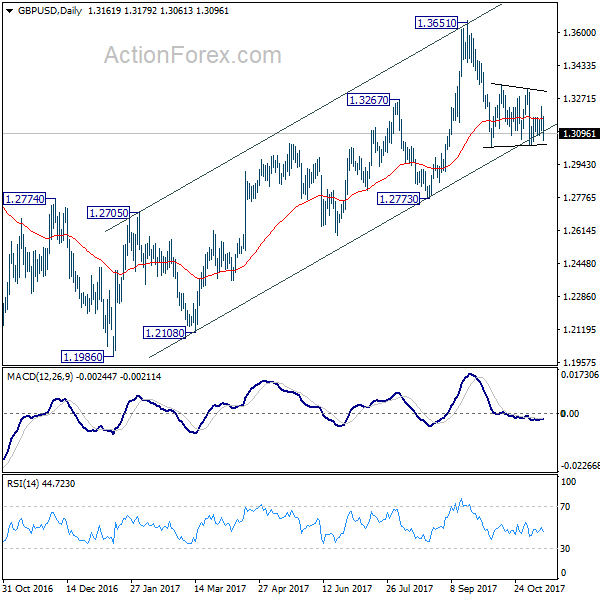

In the bigger picture, as noted before, GBP/USD hit strong resistance from the long term falling trend line. Current development is starting to favor that corrective rebound from 1.1946 low has completed at 1.3651. Decisive break of 1.2773 will confirm this bearish case and target a test on 1.1946 low next, with prospect of resuming the low term down trend. Nonetheless, break of 1.3320 resistance will restore the rise from 1.1946 for 38.2% retracement of 2.1161 (2007 high) to 1.1946 (2016 low) at 1.5466.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Domestic CGPI Y/Y Oct | 3.40% | 3.10% | 3.00% | 3.10% |

| 0:01 | GBP | Rightmove House Prices M/M Nov | -0.80% | 1.10% | ||

| 6:00 | JPY | Machine Tool Orders Y/Y Oct P | 49.90% | 45.00% | ||

| 7:00 | EUR | German Wholesale Price Index M/M Oct | 0.00% | 0.40% | 0.60% | |

| 19:00 | USD | Monthly Budget Statement Oct | -58.2B | 8.0B |