Trading remains relatively subdued as markets await speeches of Fed chair Janet Yellen and ECB President Mario Draghi at Jackson Hole symposium today. Yen is trading generally lower following mild come back in risk appetite. Major European indices are in positive zone while US futures point to higher open. On the other hand, dollar is trading broadly lower as comments from Fed officials in the symposium continue to show division on views on December hike. Sterling is trading mildly higher today but remains one of the weakest over the week. Released in US, durable goods orders dropped -6.8% in July, below expectation of -5.8%. Ex-transport orders, however, rose 0.5%, above expectation of 0.4%.

Bundesbank: ECB’s QE helped growth but not inflation

According to Bundesbank’s report, ECB’s EUR 2.3T asset purchase program did little to lift inflation even though it propped up growth. The paper concluded that "we find that ECB balance sheet policies, in the form of direct asset purchases, bring down financial stress for some periods after the shock." And, "this positive effect is reversed thereafter as stress increases above its pre-shock level." And, "at the same time, asset purchase shocks have an expansionary effect on economic activity, while the effect on prices remains insignificant."

German Ifo dropped 0.1 in August

German Ifo business climate dropped slightly to 115.9 in August, down from 116.0 but beat expectation of 115.5. Expectation gauge rose to 107.9, up from 107.3 and beat expectation of 106.8. Current assessment gauge dropped to 124.6, down from 125.5, below expectation of 125.0. Ifo president Clemens Fuest noted that "the sentiment among German businesses remains very strong." Regarding Euro’s strength, Fuest noted that "most companies do not change prices immediately in their foreign markets when the exchange rate changes — that means their margins will be smaller and I’m sure the export industry is concerned about that." And, "if the euro rises above something like $1.20, I think companies will be concerned about it. But it’s just one factor." Also from Germany, Q2 GDP was finalized at 0.6% qoq, unrevised.

Japan CPI improved but still way below target

Japan national CPI core ticked up to 0.5% yoy in July, up fro 0.4% yoy and met expectation. Tokyo CPI core rose to 0.4% mom in August, up from 0.2% yoy and beat expectation of 0.3% yoy. Corporate service price slowed to 0.6% yoy in July, down from 0.7% yoy and missed expectation of 0.8% yoy. The inflation reading is still nowhere near to BoJ’s 2% target even though growth outlook improved. And the central bank just slashed its annual inflation forecast last month. BoJ expects that inflation won’t hit target before 2020.

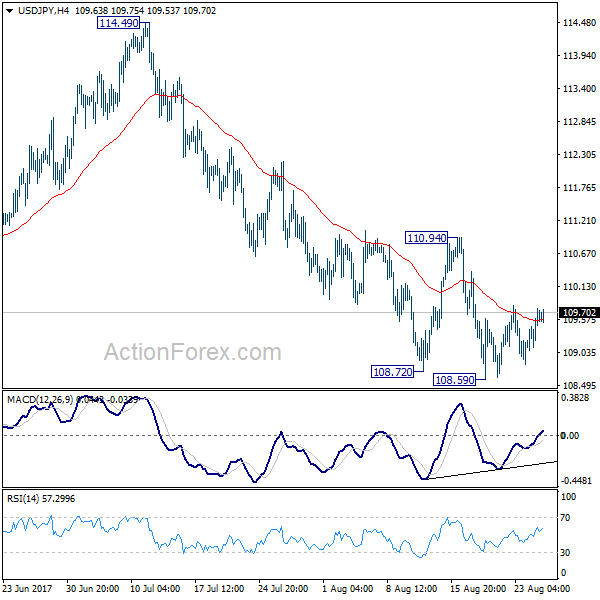

USD/JPY Mid-Day Outlook

Daily Pivots: (S1) 109.05; (P) 109.33; (R1) 109.81; More…

USD/JPY recovers mildly today but it’s staying well below 110.94 resistance. Intraday bias remains neutral with bearish outlook. Deeper decline is still expected. Break of 108.59 will target a test on 108.12 low. Whole corrective decline from 118.65 is possibly resuming and break of 108.12 will target 61.8% retracement of 98.97 to 118.65 at 106.48. Nonetheless, firm break of 110.94 will indicate short term bottoming and turn bias back to the upside.

In the bigger picture, the corrective structure of the fall from 118.65 suggests that rise from 98.97 is not completed yet. Break of 118.65 will target a test on 125.85 high. At this point, it’s uncertain whether rise from 98.97 is resuming the long term up trend from 75.56, or it’s a leg in the consolidation from 125.85. Hence, we’ll be cautious on topping as it approaches 125.85. If fall from 118.65 extends lower, downside should be contained by 61.8% retracement of 98.97 to 118.65 at 106.48 and bring rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | JPY | National CPI Core Y/Y Jul | 0.50% | 0.50% | 0.40% | |

| 23:30 | JPY | Tokyo CPI Core Y/Y Aug | 0.40% | 0.30% | 0.20% | |

| 23:50 | JPY | Corporate Service Price Y/Y Jul | 0.60% | 0.80% | 0.80% | 0.70% |

| 06:00 | EUR | German GDP Q/Q Q2 F | 0.60% | 0.60% | 0.60% | |

| 08:00 | EUR | German IFO – Business Climate Aug | 115.9 | 115.5 | 116 | |

| 08:00 | EUR | German IFO – Expectations Aug | 107.9 | 106.8 | 107.3 | |

| 08:00 | EUR | German IFO – Current Assessment Aug | 124.6 | 125 | 125.4 | 125.5 |

| 12:30 | USD | Durable Goods Orders Jul P | -6.80% | -5.80% | 6.40% | |

| 12:30 | USD | Durables Ex Transportation Jul P | 0.50% | 0.40% | 0.10% | |

| Jackson Hole Symposium |