Canadian Dollar stays firm against dollar in early US session even though it’s mixed against other currencies. USD/CAD, trading at 1.2550, has been losing some downside momentum this week, but is still on course to test 2016 low at 1.2460. Headline Canadian CPI dropped -0.1% mom in June. The annual rate slowed to 1.0% yoy, down from 1.3% yoy and missed expectation of 1.1% yoy. That’s also the lowest level since October 2015. Nonetheless, two of the three core inflation measures of BoC picked up in the same month. CPI core common rose to 1.4% yoy, up from 1.3% yoy. CPI core median rose to 1.6% yoy, up from 1.5% yoy CPI core trim was unchanged at 1.2% yoy. Meanwhile, Canadian retail sales rose solidly by 0.6% mom in May, beating expectation of 0.4% mom. Ex-auto sales dropped -0.1% mom, missing expectation of 0.4% mom.

Meanwhile, Dollar is set to end the week as the second weakest currency, just after Sterling. Politics and its impact on Fed’s tightening path is seen as the main factor driving the greenback down. Investors are also like having no clue on when US President Donald Trump would start the work on pushing his economic policies and tax reforms through the Congress. At the same time Trump is persistently being distracted by other issues. Special counsel Robert Mueller’s Russia investigation is currently under the spot light. It’s reported that Mueller has expanded his investigations regarding the possible ties between Trump’s election campaign and Russia. The investigations will now cover transactions involving Trump’s businesses as well as his associates’. And it’s now reported the Trump’s legal team is seeking ways to control and block Mueller’s investigations.

Earlier today, Australian Dollar dipped notably on comments from RBA Deputy Governor Guy Debelle. Debelle urged the markets not to read too much into the board’s discussion on neutral rate. He said that "no significance should be read into the fact the neutral rate was discussed at this particular meeting" And, "most meetings, the board allocates some time to discussing a policy-relevant issue in more detail, and on this occasion it was the neutral rate." He also emphasized that "other central banks increase their policy rates does not automatically mean that the policy rate here needs to increase."

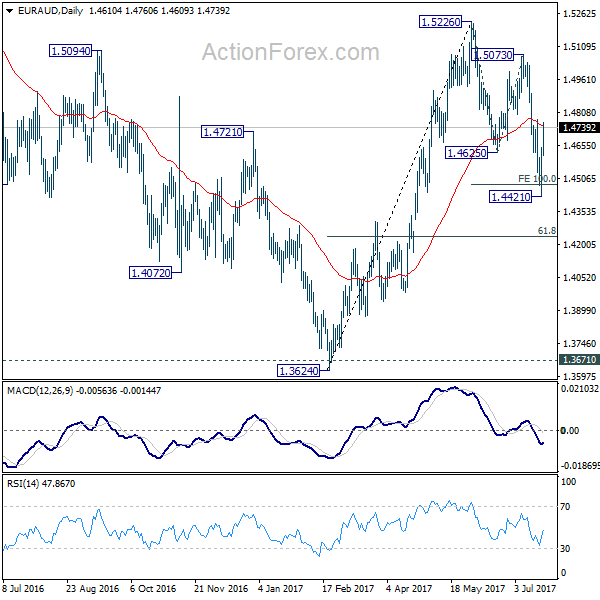

EUR/AUD Daily Outlook

Daily Pivots: (S1) 1.4474; (P) 1.4561; (R1) 1.4701; More…

EUR/AUD’s strong rebound indicates short term bottoming at 1.4421, after hitting 100% projection of 1.5226 to 1.4625 from 1.4472. The development also suggests completion of the correction from 1.5226, with three waves down to 1.4421. Intraday bias is back on the downside. Sustained trading above 55 day EMA (now at 1.4744) will target 1.5073 resistance. Break there will indicate resumption of whole rise from 1.3624. On the downside, below 1.4585 minor support will turn focus back to 1.4421 instead.

In the bigger picture, we’re holding on to the view that corrective decline from 1.6587 medium term has completed at 1.3624. Rise from 1.3624 is expected to resume to retest 1.6587. The corrective structure of the fall from 1.5226 is affirming this view. Above 1.5226 will target a test on 1.6587 key resistance. However, further downside acceleration will dampen our view and would drag EUR/AUD lower to retest key support zone around 1.3624.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 08:30 | GBP | Public Sector Net Borrowing (GBP) Jun | 6.3B | 4.3B | 6.0B | 6.4B |

| 12:30 | CAD | CPI M/M Jun | -0.10% | 0.00% | 0.10% | |

| 12:30 | CAD | CPI Y/Y Jun | 1.00% | 1.10% | 1.30% | |

| 12:30 | CAD | CPI Core – Common Y/Y Jun | 1.40% | 1.30% | ||

| 12:30 | CAD | CPI Core – Trim Y/Y Jun | 1.20% | 1.20% | ||

| 12:30 | CAD | CPI Core – Median Y/Y Jun | 1.60% | 1.50% | ||

| 12:30 | CAD | Retail Sales M/M May | 0.60% | 0.40% | 0.80% | 0.70% |

| 12:30 | CAD | Retail Sales Less Autos M/M May | -0.10% | 0.40% | 1.50% | 1.30% |