Dollar strengthens mildly in early US session after positive comments from New York Fed President William Dudley. He didn’t sound much concerned with low inflation. Instead, he noted that the US is "pretty close to full employment. And if labor market continues to tighten further "wages will gradually pick up". And with that "inflation will gradually get back to 2%". Regarding the economy, Dudley also expressed that he is "confident" that the expansion has "quite a long way to go". USD/JPY could be revisiting last week’s high at 111.41. But the EUR/USD is holding well above 1.1109 support which keeps it mildly bullish. Overall, the forex markets are staying inside Friday’s range.

Leading business groups urged soft Brexit

As the negotiation between UK and EU formally starts today, five leading Business groups sent an open letter to the government urging it to soften the approach. The joint letter came from the British Chambers of Commerce, Confederation of British Industry, EEF, Federation of Small Businesses, and Institute of Directors. The emphasized that the government should "put the economy first" and maintain the "economic benefits" of access to the EU single market. Meanwhile, Chancellor of the Exchequer Philip Hammond said that "no deal would be a very, very bad outcome for Britain". And that’s in sharp contrast to Prime Minister Theresa May’s no deal is better than a bad deal stance.

The formal Brexit negotiations starts in European Commission buildings in Brussels today. UK’s Brexit Secretary David Davis said that there is a "long road ahead" but that will lead to a "deep and special partnership", "a deal like no other in history". He also pledged to approach the difficulties in a "constructive way". The negotiations would start with EU’s top priorities including the divorce bill, rights of citizens and border of Ireland. Meanwhile, EU’s chief negotiator Michel Barnier would report in October this year on whether there are sufficient progress to move on to phase two of trade agreements. And it’s expected that the whole talks would last until October 2018 before making an agreement. Davis and Barnier would be meeting for one week every month and return to their base to develop the positions.

ECB Smets concerned with low inflation expectations

ECB Governing Council member Jan Smets expressed his concerns that "inflation expectations are remaining pretty low" even though core inflation is going up. And he emphasized the need of "solid re-anchoring of these inflation expectations". Wage growth is something that ECB will be looking at closely too. Regarding what to do after the current EUR 60b asset purchase program ends, Smets said that "we’ll not wait until New Year’s Eve to tell what will happen on Jan.1" And, ECB will look into the matter in the "next months".

IMF Lipton: Not the time for BoJ to discuss exit strategy

IMF first deputy managing director David Lipton said that it’s premature for BoJ to discuss exit strategy. He noted that "right now there’s a need for continued accommodation because the inflation rate in Japan remains well below target". And, "there’s need for the reflation effort to become more advanced." He also hailed that the move from a fixed target of JPY 80T per annum bond purchase to yield curve control is a "useful" switch. He noted that the strategy to "focus on price rather than a focus on quantity" is "likely to be a sustainable one". But he also emphasized the third arrow of Abenomics, structural policies, have to be strengthened.

Japan trade surplus narrowed to JPY 0.13% in May, below expectation of 0.35T. Export growth was flat monthly at 0.0% mom. But annually, exports jumped 14.9% yoy, highest since 2015. Nevertheless, that was below expectation of 18.2% yoy. It’s also overshadowed by the 0.3% mom, 17.8% yoy rise in imports.

RBA Lowe expects stronger economy ahead

RBA Governor Philip Lowe said in a speech in Canberra that growth in Australia over the next couple of years will be "a bit stronger than it has been recently". And, the "pick-up in the global economy is helping us". He noted that monetary policy continues to provide support to the economy and "survey-based measures of business conditions have improved noticeably". He also added that "employment growth has also strengthened over recent months." But he also warned that wage growth is "unusually low" and averages hours worked have "declined". Also, the "nature of employment is changing" while there are higher debt levels for households. He emphasized the need to watch these issues carefully.

USD/JPY Mid-Day Outlook

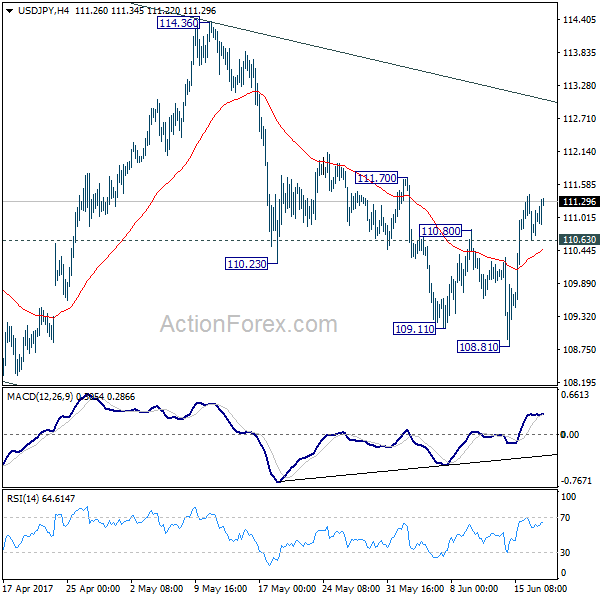

Daily Pivots: (S1) 110.52; (P) 110.97; (R1) 111.29; More…

Intraday bias in USD/JPY remains on mildly the upside as rise rebound from 108.81 is expected to continue to near term channel resistance (now at 113.05). Sustained break there will suggest that whole pull back from 118.65 has completed at 108.12 already. In such case, further rise should be seen to 114.36 resistance for confirmation. On the downside, below 110.63 minor support will turn intraday bias neutral. Break of 108.81 will extend the fall from 118.65 through 108.12 low before completion.

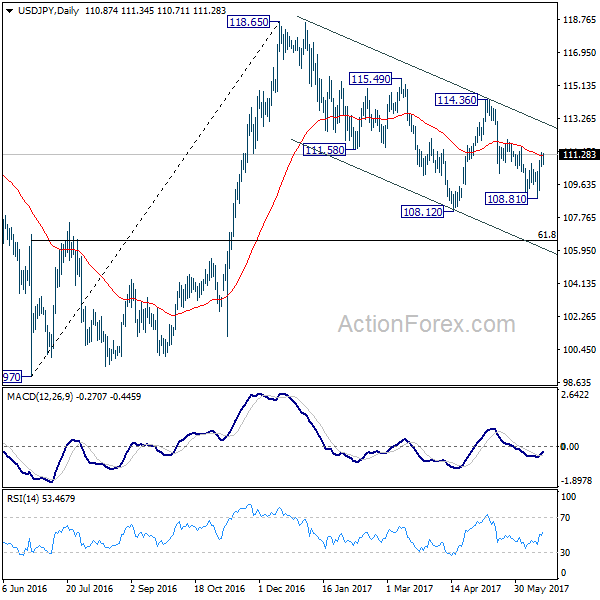

In the bigger picture, price actions from 125.85 high are seen as a corrective pattern. It’s uncertain whether it’s completed yet. But in case of another fall, downside should be contained by 61.8% retracement of 75.56 to 125.85 at 94.77 to bring rebound. Overall, rise from 75.56 is still expected to resume later after the correction from 125.85 completes.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:01 | GBP | Rightmove House Prices M/M Jun | -0.40% | 1.20% | ||

| 23:50 | JPY | Trade Balance (JPY) May | 0.13T | 0.35T | 0.10T | 0.16T |

| 1:30 | AUD | New Motor Vehicle Sales M/M May | 2.90% | 0.30% | ||

| 23:00 | USD | Fed’s Evans Speaks in New York |