Commodity currencies are set to end the week as the strongest ones, but not because of commodity prices. Canadian dollar is the largest gainer for the week after the hawkish twist in BoC comments. Meanwhile, Aussie was boosted by unemployment data and receding bet on RBA cut. Sterling and Dollar followed as supported by hawkishness of respective central banks. Meanwhile, Yen tumbled across the board as the global economy is starting to exit the era of ultra-loose monetary policies. In other markets, gold suffered steep selloff this week and is now trying to find support around 55 day EMA at 1257. WTI crude oil dropped to as low as 44.22 and couldn’t find buying to recovery back above 45 handle yet.

UK PM May agreed to start Brexit negotiation with the bill

In UK, it’s reported that Prime Minister Theresa May has finally conceded and agreed to start the Brexit negotiation with EU with the divorce bill first. That’s what EU’s negotiator Michel Barnier has been pushing for, settle on the bill, citizens right and border of Ireland before moving on to trade agreement. But Barnier emphasized there that is "no" bill for punishment but settlement of the accounts. UK’s Brexit minister David Davis emphasized that US will pay what is due but "not just what the EU wants. The formal negotiation will start next Monday and continue throughout summer.

BoJ Kuroda refrained from talking about stimulus exit

In Japan, BoJ Governor Haruhiko Kuroda said in the post meeting press conference that "with the 2% inflation target still some way off, it is not appropriate to talk about how an exit is going to work, or show simulations on what an exit would mean in terms of the BOJ’s financial health." He refrained to talk about any exit strategies. Instead, Kuroda pointed to the fact that what Fed is doing now, started to raise interest rate before shrinking the balance sheet, was not what it has indicated before.

BoJ on hold, slightly more upbeat

BoJ left monetary policies unchanged as widely expected. Benchmark interest is kept at -0.1%. Meanwhile, under the yield curve control framework, the central bank continues to target 10 year JGB yield at around 0%. Annual pace of asset purchase is held at JPY 80T. Locally, BoJ noted that "private consumption has shown increased resilience against a background of steady improvement in the employment and income situation". Globally, BoJ said that overseas economies were "continuing to grow at a moderate pace as a whole". Overall tone in the central’s statement was slightly more upbeat than the previous one.

On the data front…

US housing starts dropped to 1.09m annualized in May. Building permits dropped to 1.17m. Canada international securities transactions dropped to CAD 10.5b in April. Eurozone CPI was finalized at 1.4% yoy, core CPI at 0.9% yoy in May. New Zealand business NZ manufacturing index rose to 58.5 in May.

USD/JPY Mid-Day Outlook

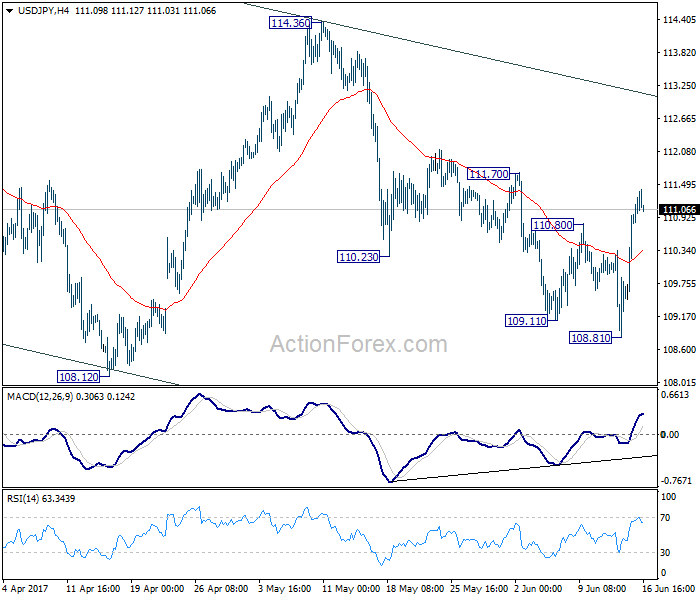

Daily Pivots: (S1) 109.81; (P) 110.39; (R1) 111.52; More…

Intraday bias in USD/JPY remains on the upside for near term channel resistance (now at 113.06). Sustained break there will suggest that whole pull back from 118.65 has completed at 108.12 already. In such case, further rise should be seen to 114.36 resistance for confirmation. Nonetheless, break of 108.81 will still extend the fall from 118.65 through 108.12 low before completion.

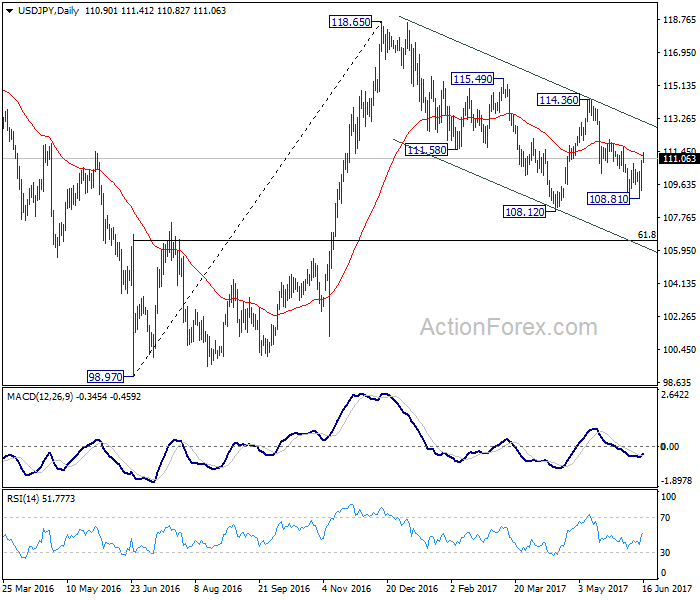

In the bigger picture, price actions from 125.85 high are seen as a corrective pattern. It’s uncertain whether it’s completed yet. But in case of another fall, downside should be contained by 61.8% retracement of 75.56 to 125.85 at 94.77 to bring rebound. Overall, rise from 75.56 is still expected to resume later after the correction from 125.85 completes.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| JPY | Monetary Policy Statement | |||||

| 22:30 | NZD | Business NZ Manufacturing Index May | 58.5 | 56.8 | 56.9 | |

| 09:00 | EUR | Eurozone CPI M/M May | -0.10% | -0.10% | -0.10% | |

| 09:00 | EUR | Eurozone CPI Y/Y May F | 1.40% | 1.40% | 1.40% | |

| 09:00 | EUR | Eurozone CPI – Core Y/Y May F | 0.90% | 0.90% | 0.90% | |

| 12:30 | CAD | International Securities Transactions (CAD) Apr | 10.6B | 12.14B | 15.13B | 15.1B |

| 12:30 | USD | Housing Starts May | 1.09M | 1.21M | 1.17M | 1.16M |

| 12:30 | USD | Building Permits May | 1.17M | 1.25M | 1.23M | |

| 14:00 | USD | Labor Market Conditions Index | 3 | 3.5 | ||

| 14:00 | USD | U. of Michigan Confidence (JUN P) | 97.3 | 97.1 |