Dollar recovers after Fed doesn’t disappoint the market and raised federal funds rate by 25bps to 1.00-1.25%. Minneapolis Fed President Neel Kashkari dissented and voted for standing pat this time. But the greenback is supported by the fact that Fed didn’t change inflation forecast for 2018 and 2019. Also, Fed maintained interest rate projections unchanged for 2017 and 2018. Fed released an "addendum to the political normalization principles" laying down the guidelines to shrink its balance sheet. Overall, even though the greenback was sold off after CPI disappointment earlier today, it’s kept above key support level around 1.13 handle against Euro and more stimulus is needed to trigger sustained breakout.

In short, Fed raised 2017 GDP growth forecast to 2.2%, up from 2.1%. For 2018 and 2019, Fed projects GDP growth to be at 2.1% and 1.9%, unchanged from prior forecast. Forecasts on unemployment rate were revised down to 4.3% in 2017, 4.2% in 2018 and 4.2% in 2019, down from 4.5% for all the three years in prior projections. Headline CPE was revised to 1.6% in 2017, down from 1.9%. But for 2018 and 2019, headline PCE forecasts were kept unchanged at 2.0%. Core PCE forecast for 2017 was also revised to 1.7% , down from 1.9%. And, core PCE forecasts for 2018 and 2019 were also kept unchanged at 2.0%.

Meanwhile Fed fund rate projections were kept unchanged at 1.4% and 2.1% in 2017 and 2018 respectively. That means Fed is still projecting another rate hike this year. Rate projection for 2019 was just revised slightly down to 2.9%, down from 3.0%.

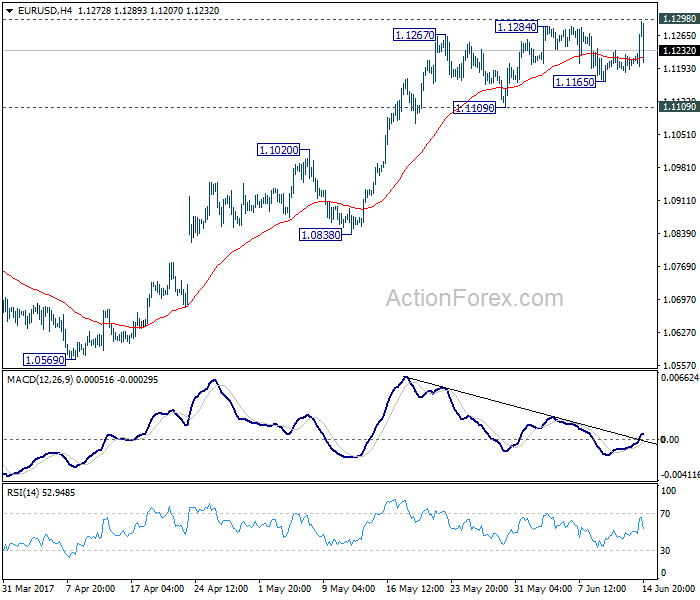

EUR/USD surged to as high as 1.2615 earlier today but hesitate ahead of 1.1298 resistance. The pair retreated after FOMC announcement. While we’re staying bullish with 1.1109 support intact, at this point, there is no clear momentum to break through 1.1298 key resistance to confirm medium term bullish reversal yet.