After initial spike on news of French presidential election, Euro quickly retreated. While weakness in the common currency is limited so far, the price actions suggest that it’s now in a near consolidation phase. And focus will move away from Euro to others. Two major focuses of the week are BoE Super Thursday and RBNZ rate decision. In particular, Sterling could ride on cross buying in EUR/GBP and a hawkish twist in BoE inflation report to extend recent rise. Meanwhile, Loonie and Aussie will look into development in energy and commodity markets. Canadian Dollar rebounds today with the help of recovery in oil price. However, WTI is starting to feel heavy again ahead of 47 handle. Overall, Dollar recovers broadly but the outlook is mixed so far as it’s not in focus.

French parliamentary election in June watched

After the landslide victory, French President-elect Emmanuel Macron vowed to "fight with all my energy against the deepening divisions" in France. But now the focus will be quickly turned to parliamentary election in June. His EN Marche! movement basically has no experience with legislative election. And without a solid coalition, it would be very hard for Macron to push through his agenda. And Macron is also expected to push for reform in EU too. Talking about EU, German Chancellor Angela Merkel hailed that Macron "carries the hopes of millions of French people, and of many people in Germany and the whole of Europe". Belgian Prime Minister Charles Michel also failed that Macron’s victory represented "a clear rejection of a dangerous project of European withdrawal."

More on French Election in Macron Becomes French President In Landslide Victory.

ECB Mersch: Risks almost back in balance

ECB Executive Board member Yves Mersch delivered an upbeat speech in Tokyo today. Mersch said that "the recovery in the euro area is gaining more and more traction." And, "the confirmation of a broadly balanced risk outlook for growth is within reach." He also noted that "political uncertainties and fragilities have consistently evolved in a positive fashion in Europe since the beginning of the year." And, if conditions continue to improve, "a discussion on policy normalization becomes warranted in the future." But for now, he emphasized that "the Governing Council is convinced of the need to continue an accommodative monetary policy stance without deviation from the announced measures under implementation to be expected."

Eurozone investor sentiment jumped to near 10 year high

Eurozone Sentix investor sentiment rose sharply to 27.4 in May, up from 23.9 and beat expectation of 25.2. That’s also the highest level since July 2007. Current condition sub-index jumped to 34.5, up fro 28.8, highest since January 2008. Expectation sub-index rose to 20.5, up from 19.3, best since August 2015. Sentix noted that "before the decisive second round in the French presidential election, investors are once again assessing the economic situation in the euro zone improved. Investors are obviously expecting a decrease in political uncertainties in the euro zone." Separately, Germany factory orders rose 1.0% mom in March.

BoJ Kuroda: Faced challenging situation with inflation close to zero

In Japan, BoJ Governor Haruhiko Kuroda said during the weekend that inflation being close to zero for four years was "certainly a very challenging situation for central bank governors and central bankers in Japan." Nonetheless, he acknowledged that growth and price conditions have "greatly improved" and pledged to continue with "strong" monetary easing. Regarding exchange rate, Kuroda said that "in the case of Japan, exchange rates are affecting not much the trade balance but the corporate profit situation, through which domestic demand will fluctuate.

China exports and imports grew less than expected

China trade surplus widened to USD 38.1b in April, up from USD 23.9b and beat expectation of USD 35.3b. However, exports rose merely 8.0% yoy while imports rose 11.9% yoy. Both fell short of expectation of 10.4% yoy and 18.0% yoy respectively. In Yuan terms, trade surplus widened to CNY 262b, up from CNY 164b and beat expectation of CNY 197b. The data showed softening domestic demand that weighed down imports. There would likely be more downward pressure with the government’s tightening policies.

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.0962; (P) 1.0981 (R1) 1.1015; More….

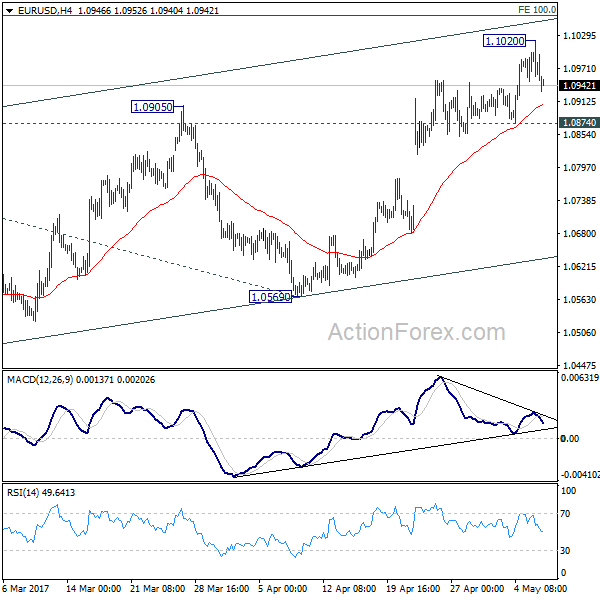

A temporary top is in place at 1.1030 with 4 hour MACD crossed below signal line. Intraday bias in EUR/USD is turned neutral for consolidation. Another rise will be expected as long as 1.0874 support holds. Above 1.1020 will extend current rally to 100% projection of 1.0339 to 1.0828 from 1.0569 at 1.1058. However, rise from 1.0339 is still seen as a corrective move. Hence we’d expect strong resistance from 1.1058 projection to limit upside and bring near term reversal. On the downside, break of 1.0874 support will turn bias back to the downside for 1.0569 support first.

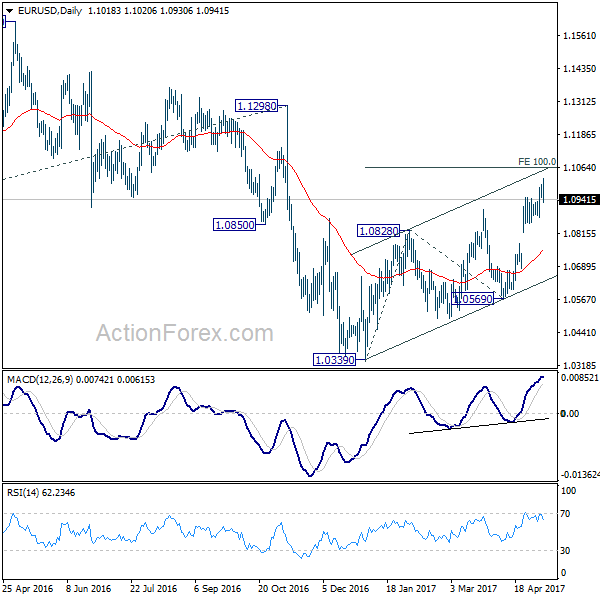

In the bigger picture, as long as 1.1298 key resistance holds, whole down trend from 1.6039 (2008 high) is still expected to continue. Break of 1.0339 low will send EUR/USD through parity to 61.8% projection of 1.3993 to 1.0461 from 1.1298 at 0.9115. However, considering bullish convergence condition in weekly MACD, break of 1.1298 will indicate long term reversal.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| EUR | Second and Final Round of French Presidential Election | |||||

| 01:30 | AUD | Building Approvals M/M Mar | -13.40% | -4.00% | 8.30% | 8.90% |

| 01:30 | AUD | NAB Business Confidence Apr | 13 | 6 | ||

| 03:25 | CNY | Trade Balance USD Apr | 38.05B | 35.3B | 23.9B | |

| 03:25 | CNY | Trade Balance CNY Apr | 262B | 197B | 164B | |

| 05:00 | JPY | Consumer Confidence Index Apr | 43.2 | 44.3 | 43.9 | |

| 06:00 | EUR | German Factory Orders M/M Mar | 1.00% | 0.70% | 3.40% | |

| 08:30 | EUR | Eurozone Sentix Investor Confidence May | 27.4 | 25.2 | 23.9 | |

| 12:15 | CAD | Housing Starts Apr | 214K | 220.0k | 253.7k | 253K |

| 14:00 | USD | Labor Market Conditions Index Change Apr | 0.4 |