The forex markets opened the week relatively quietly with the exception of Australian Dollar. Aussie dives broadly after weak retail sales data and stays weak ahead of RBA rate decision. Meanwhile, Yen follows as the second weakest as Tankan survey showed less than expected improvements in sentiments. On the other hand, Euro is paring some of last week’s loss. Focus will turn to French elections in April. Dollar is trading mixed ahead of a string of important economic data. That starts with ISM manufacturing today, ISM services on Wednesday and non-farm payroll on Friday. Fed will also release March FOMC meeting minutes this week.

Japan Tankan showed insufficient improvements

Japan Tankan large manufacturers index rose to 12 in Q1, up from 10 but missed expectation of 14. Large manufacturers outlook rose to 11, up from 8, but missed expectation of 13. Non-manufacturing index rose to 20, up from 18 and beat expectation of 19. Non-manufacturing outlook was unchanged at 16, missed expectation of 19. Large all industry capex rose 0.6%, beat expectation of -0.3% fall. The set of data showed that improvements in business condition in large manufacturers was not as much as anticipated. Some economists noted that the Tankan result point to 2% GDP growth in last quarter. While growth would remain solid, momentum could be starting to slow. And it’s still unlikely for BoJ to meet 2% inflation target within time frame, considering that Tokyo CPI dropped more than expected by -0.4% yoy in March.

Aussie dives after weak retail sales

Australian dollar tumbles sharply today after weaker than expected retail sales. Sales dropped -0.1% mom in February versus expectation of 0.3% rise. Apparels was the biggest drag in sales, posting -2.5% mom fall. Meanwhile, sales of household goods dropped -0.4%. Executive director of the Australian Retailers Association noted that "discretionary spend" is showing impact in the data. Also from Australia TD securities inflation expectation rose 0.1% mom in March. Building approvals jumped 8.3% mom in February.

RBA rate decision is a main focus tomorrow and the central bank is widely expected to keep interest rate unchanged at 1.50%. There is little prospect of a rate cut this year as housing markets heat up again in recent months. Little new information would be given from this week’s meeting as RBA would wait for the set of Q1 data to be released later before adjusting economic outlook. But for the moment, some notable weakness is seen in Aussie broadly.

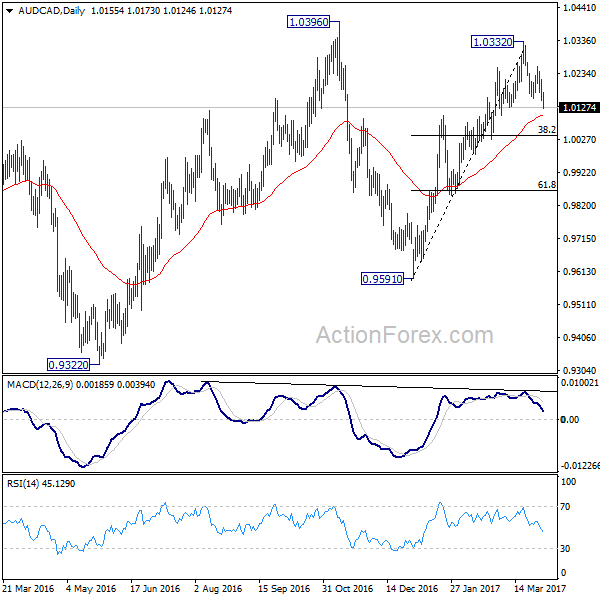

AUD/CAD’s sharp decline today confirms resumption of fall from 1.0332 short term top. The development also suggests that rise from 0.9591 is completed already. Deeper fall should be seen back to 38.2% retracement of 0.9591 to 1.0332 at 1.0049 in near term. And the fall could extend to 61.8% retracement at 0.9874 and below. But overall, the cross is bounded in long term consolidation pattern start at 1.0784 (2012 high). And it stayed in range between 0.9148/1.0784 for more than five years. We’re not seeing any clear long term trend yet.

PMI data the highlights today

PMI data will be the main focus today. Swiss will release retail sales and SVME PMI. Eurozone will release PPI, unemployment rate and PMI manufacturing final. UK will release PMI manufacturing. US will release ISM manufacturing and construction spending. Looking ahead, a number of important economic data will be released from US, including non-farm payroll. Fed will also release March FOMC minutes. However, it should be noted that based on recent Fedspeaks, two more hikes remains the base case in most policymakers’ mind. Improvements in economic data could trigger speculation of one more hike. But the re-establishment of trend would likely depend on US president Donald Trump’s economic policies. Here are some highlights for the week ahead:

- Tuesday: Australia trade balance; UK construction PMI; Eurozone retail sales; Canada trade balance; US trade balance, factory orders

- Wednesday: Eurozone services PMI final; UK services PMI; US ADP employment, ISM services, FOMC minutes

- Thursday: Japan consumer confidence; Germany factory orders; Swiss CPI; Eurozone retail PMI, ECB meeting accounts; US jobless claims; Canada building permits

- Friday: Japan labor cash earnings; leading indicator; Swiss unemployment, foreign currency reserves; German industrial production, trade balance; UK industrial and manufacturing production, trade balance; Canada employment, Ivey PMI; US non-farm payroll

USD/JPY Daily Outlook

Daily Pivots: (S1) 111.02; (P) 111.60; (R1) 111.98; More….

Intraday bias in USD/JPY remains neutral for the moment. On the upside, break of 112.19 temporary will turn bias back to the upside for 115.49 resistance. Decisive break there should confirm completion of the correction from 118.65. In that case, further rise should be seen to 118.65 and above to resume the rally from 98.97. On the downside, though, below 110.99 minor support will turn bias back to the downside for 110.10 and break will extend the corrective fall from 118.65.

In the bigger picture, price actions from 125.85 high are seen as a corrective pattern. The impulsive structure of the rise from 98.97 suggests that the correction is completed and larger up trend is resuming. Decisive break of 125.85 will confirm and target 61.8% projection of 75.56 to 125.85 from 98.97 at 130.04 and then 135.20 long term resistance. Nonetheless, sustained trading below 55 week EMA (now at 111.16) will extend the consolidation from 125.85 with another fall through 98.97 before completion.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Tankan Large Manufacturers Index Q1 | 12 | 14 | 10 | |

| 23:50 | JPY | Tankan Large Manufacturers Outlook Q1 | 11 | 13 | 8 | |

| 23:50 | JPY | Tankan Non-Manufacturing Index Q1 | 20 | 19 | 18 | |

| 23:50 | JPY | Tankan Non-Manufacturing Outlook Q1 | 16 | 19 | 16 | |

| 23:50 | JPY | Tankan Large All Industry Capex Q1 | 0.60% | -0.30% | 5.50% | |

| 23:50 | JPY | Tankan Small Mfg Index Q1 | 5 | 3 | 1 | |

| 23:50 | JPY | Tankan Small Mfg Outlook Q1 | 0 | 1 | -4 | |

| 23:50 | JPY | Tankan Small Non-Mfg Index Q1 | 4 | 2 | 2 | |

| 23:50 | JPY | Tankan Small Non-Mfg Outlook Q1 | -1 | -1 | -2 | |

| 0:30 | JPY | PMI Manufacturing Mar F | 52.4 | 52.6 | 52.6 | |

| 1:00 | AUD | TD Securities Inflation M/M Mar | 0.10% | -0.30% | ||

| 1:30 | AUD | Retail Sales M/M Feb | -0.10% | 0.30% | 0.40% | |

| 1:30 | AUD | Building Approvals M/M Feb | 8.30% | -1.50% | 1.80% | |

| 7:15 | CHF | Retail Sales (Real) Y/Y Feb | -0.80% | -1.40% | ||

| 7:30 | CHF | SVME PMI Mar | 58 | 57.8 | ||

| 7:45 | EUR | Italy Manufacturing PMI Mar | 55.1 | 55 | ||

| 7:50 | EUR | France Manufacturing PMI Mar F | 53.4 | 53.4 | ||

| 7:55 | EUR | Germany Manufacturing PMI Mar F | 58.3 | 58.3 | ||

| 8:00 | EUR | Eurozone Manufacturing PMI Mar F | 56.2 | 56.2 | ||

| 8:30 | GBP | PMI Manufacturing Mar | 55 | 54.6 | ||

| 9:00 | EUR | Eurozone PPI M/M Feb | 0.10% | 0.70% | ||

| 9:00 | EUR | Eurozone PPI Y/Y Feb | 4.30% | 3.50% | ||

| 9:00 | EUR | Eurozone Unemployment Rate Feb | 9.50% | 9.60% | ||

| 14:00 | USD | ISM Manufacturing Mar | 57.1 | 57.7 | ||

| 14:00 | USD | ISM Prices Paid Mar | 66 | 68 | ||

| 14:00 | USD | Construction Spending M/M Feb | 1.00% | -1.00% |