The British Pound drops across the board as the week starts. It’s reported that prime minister Theresa May is schedule to deliver a speech on Tuesday to lay out the plan of Brexit. And, May is expected to outline a "hard Brexit" approach. And UK is prepared to withdraw from tariff-free trade relationship with EU, in return for the control of immigration. GBP/USD drops through 1.2036 support and breaches 1.2 handle as recent decline resumes. EUR/GBP also extended recent rebound from 0.8303 and reaches as high as 0.8844. GBP/JPY also drops sharply to as low as 136.94 so far. Sterling’s selloff slowed a bit on news that Treasury is going to talk to major banks to smooth market reactions. But the pound remains vulnerable to further decline.

Meanwhile, Dollar recovers mildly today as focus turns to president-elect Donald Trump’s inauguration on Friday, January 20. While this would mostly be a ceremonial occasion, Trump could make use of the occasion to outline his priorities and policies on taxes, trade and immigration. The market would also closely watch for comments and announcement from his administration, on issues regarding trades and legislation, in following days. Besides, Fed Chair Janet Yellen will speak on Wednesday and Thursday this week, she might acknowledge the recent solid improvement in job and inflation data.

As for today, UK Rightmove house price index rose 0.4% mom in January. Japan machine orders dropped -5.1% mom in November. Machine tool orders rose 4.4% yoy in December. Domestic CGPI rose 0.6% mom in December. Tertiary industry index rose 0.2% mom in November. Australia TD securities inflation rose 0.5% mom in December. US markets are on holiday today.

Looking ahead, BoC and ECB will meet this week and would likely be non-event. Indeed, ECB just announced to extend the QE until December 2017, but lower the pace to EUR 60b per month from April 2017. There will be a number of key data from UK this week, including CPI and employment. Fed will release Beige Book economic report. Aussie traders will look into employment data and a string of data from China on Friday. Here are some highlights:

- Tuesday: Australia home loans; UK CPI, PPI; German ZEW; US Empire state manufacturing

- Wednesday: German CPI final; UK job; Eurozone CPI final; US CPI, industrial production, NAHB housing index; Fed’s Beige Book; BoC rate decision.

- Thursday: Australia employment; Swiss PPI; ECB rate decision; Canada manufacturing sales; US housing starts, Philly Fed survey, jobless claims

- Friday: China GDP; industrial production; fixed asset investment, retail sales; German PPI; UK retail sales; Canada CPI, retail sales

GBP/JPY Daily Outlook

Daily Pivots: (S1) 138.89; (P) 139.73; (R1) 140.39; More…

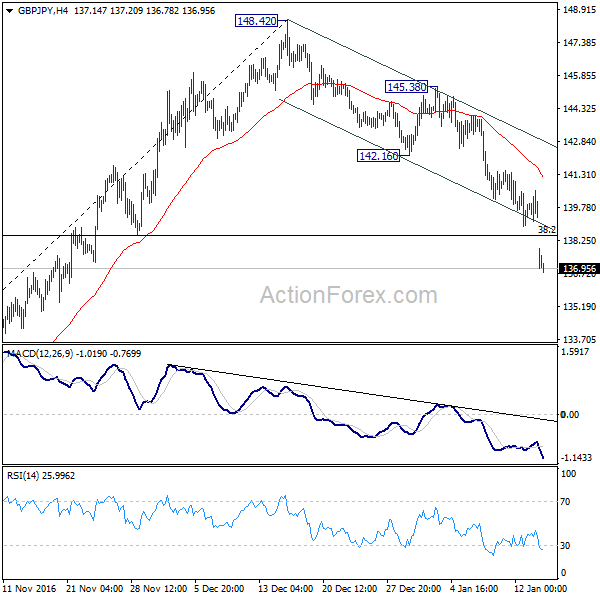

GBP/JPY’s decline from 148.20 accelerated by breaking the channel line decisively. 38.2% retracement of 122.36 to 148.42 at 138.46 was also taken out firmly. The development suggests that whole corrective rise from 122.36 has completed at 148.42. Intraday bias stays on the downside for 61.8% retracement at 132.31 and below. On the upside, break of 142.16 support turned resistance is needed to indicate completion of such decline. Otherwise, outlook will stay bearish in case of recovery.

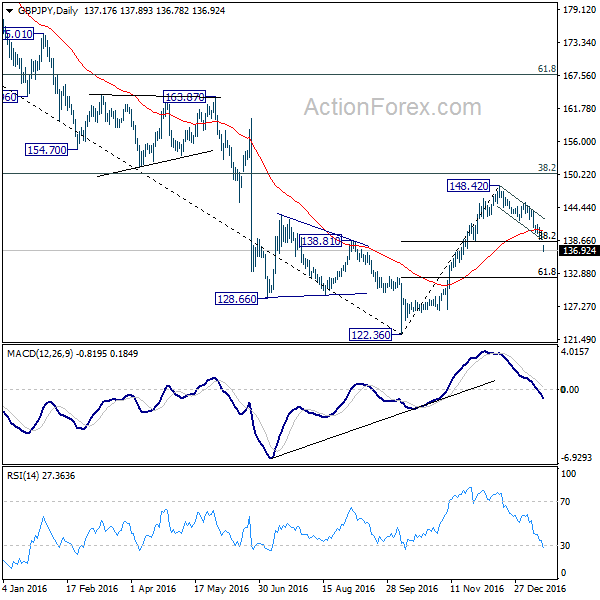

In the bigger picture, price actions from 122.36 medium term bottom are seen as developing into a corrective pattern. Upside is so far limited by 38.2% retracement of 195.86 to 122.36 at 150.4 for setting the medium term range. At this point, we don’t expect a break of 122.36 in near term and the corrective pattern would extend for a while.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Consensus | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Machine Orders M/M Nov | -5.10% | -1.40% | 4.10% | |

| 23:50 | JPY | Domestic CGPI M/M Dec | 0.60% | 0.40% | 0.40% | |

| 0:00 | AUD | TD Securities Inflation M/M Dec | 0.50% | 0.10% | ||

| 0:01 | GBP | Rightmove House Prices M/M Jan | 0.40% | -2.10% | ||

| 4:30 | JPY | Tertiary Industry Index M/M Nov | 0.20% | 0.20% | 0.20% | 0.00% |

| 6:00 | JPY | Machine Tool Orders Y/Y Dec P | 4.40% | -5.60% | ||

| 10:00 | EUR | Eurozone Trade Balance (EUR) Nov | 20.8B | 19.7B |

Subscribe to our daily and mid-day newsletter to get this report delivered to your mail box