Markets are engaging in quiet holiday trading today while Dollar is paring some losses. But for the week, the greenback is still set to end as the worst performing one. Trading will likely stay subdued today as traders are already having their eyes on next week. In particular, the Senate will return from Thanksgiving recess and would floor the tax bill. Markets will then have a clearer idea on what the final version of Senate tax bill then. And assessment could then be done on the final reconciled version between House and Senate.

Economists believe tax plan would boost debt, uncertain on economy

For now, according to a poll by University of Chicago’s Booth School of Business, economists are in consensus that the tax plan will boost US debt but unsure on it’s help on the economy. 38 economists from schools like Yale and MIT were surveyed.

The first question was whether enacting "a tax bill similar to those currently moving through the House and Senate" would lead to a "substantially higher" rate of economic growth a decade from now than it would otherwise. 36% said they were uncertain, 33% disagreed and 19% strongly disagreed.

The second question was whether a tax bill like those in the House and Senate right now would leave the U.S. debt-to-GDP ratio "substantially higher" in a decade than otherwise. 43% agreed and 45% strongly agreed. None disagreed.

Japan PMI manufacturing posted strongest improvement since 2014

Japan PMI manufacturing rose to 53.8 in November, up from 52.8 and beat expectation of 52.6. That’s the strongest improvements for 44 months since March 2014. Markit economists Joe Hayes noted that "new orders increased strongly, underpinned by business from abroad amid recent yen weakness. New export orders expanded at the fastest pace in almost four years." However, he also warned that " cheaper yen and higher material prices have intensified cost pressures, as input price inflation increased to a 35-month high in November."

New Zealand trade deficit narrowed despite record imports

New Zealand trade deficit narrowed to NZD -871m in October, larger than expectation of NZD -750m. Imports surged to a record high at USD 5.4b, but that was offset by rise in exports to NZD 4.56b. Jump in imports include intermediate goods, used as ingredients or inputs into the production of other goods and services. Meanwhile dairy and lamb shipments were the key drivers of export growth.

Looking ahead

German IFO business climate will be the main feature in a quiet day. US will release manufacturing and services PMIs.

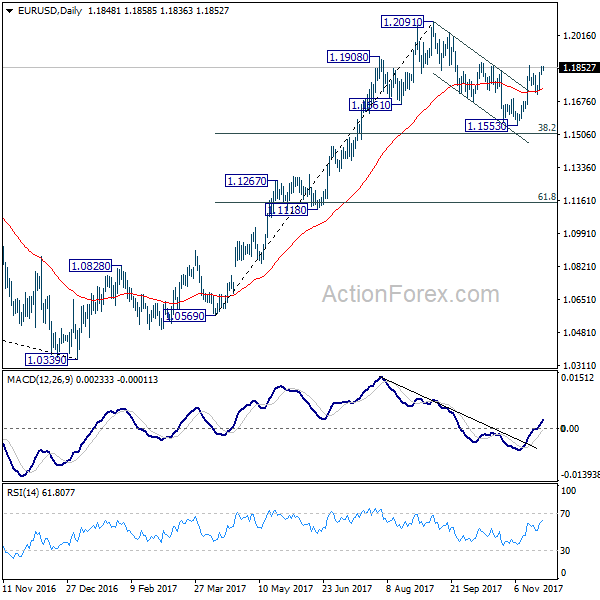

EUR/USD Daily Outlook

Daily Pivots: (S1) 1.1822; (P) 1.1839 (R1) 1.1865; More….

Intraday bias in EUR/USD remains neutral with focus on 1.1860 resistance. Break there will confirm resumption of rise from 1.1553. As noted before, corrective fall from 1.2091 has completed at 1.1553 already, ahead of 38.2% retracement of 1.0569 to 1.2091 at 1.1510. Above 1.1860 will extend the rally to retest 1.2091 high. In any case, near term outlook will remain cautiously bullish as long as 1.1677 support holds.

In the bigger picture, rise from 1.0339 medium term bottom is seen as a corrective move for the moment. Therefore, in case of another rally, we’d be cautious on 38.2% retracement of 1.6039 (2008 high) to 1.0339 (2017 low) at 1.2516 to limit upside and bring reversal. Meanwhile, sustained trading below 55 week EMA (now at 1.1373) will suggest that such medium term rebound is completed and could then bring retest of 1.0339 low.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | Trade Balance Oct | -871M | -750M | -1143M | -1156M |

| 0:30 | JPY | PMI Manufacturing Nov P | 53.8 | 52.6 | 52.8 | |

| 9:00 | EUR | German IFO Business Climate Nov | 116.5 | 116.7 | ||

| 9:00 | EUR | German IFO Expectations Nov | 108.8 | 109.1 | ||

| 9:00 | EUR | German IFO Current Assessment Nov | 125 | 124.8 | ||

| 14:45 | USD | Manufacturing PMI Nov P | 55 | 54.6 | ||

| 14:45 | USD | Services PMI Nov P | 55.4 | 55.3 |