Euro remains the weakest major currency for the week so far on political uncertainty in Germany. In addition, dovish comments from ECB President Mario Draghi is also weighing down the common currency. But after all, loss is limited, in particular against Dollar. EUR/USD is holding well above 1.1677 minor support and maintains near term bullish outlook. EUR/JPY breached 131.38 key near term support yesterday but quickly recovered. That’s also helped by weakness in Yen, which pulled back on risk appetite and rebound in treasury yields. Dollar stays mixed as the rally attempt lacks follow through momentum. Australian Dollar weakens in Asian session as RBA minutes suggest interest rate to stay low for longer.

German President Steinmeier: Pause and reconsider your positions

After meeting with Chancellor Angela Merkel, German President Frank-Walter Steinmeier said that "we are now facing a situation that has never happened before in the history of the Federal Republic of Germany, that is for almost 70 years." After the coalition talk between CDU, FDP and Greens collapsed Steinmeier rejected the idea of new elections, but urged political parties to "pause and reconsider their positions". Words used were strong as Steinmeier said "the mission to form a government remains. You can not just hand back responsibility to the electorate." And, "all political parties elected to parliament must act for the common good. I expect a demonstration of readiness to form a government in the near future."

For now, the coalition talks will enter into extra time. But still, worst come to worst, a new election would be called if there is no progress in the negotiations. Recent survey shows that the outcome of another election would not be much different from the one held in September. Meanwhile, although Merkel pledges to run as a candidate again should there be a new election, the latest poll suggests that her popularity has slumped after the talks collapse. The Die Welt poll shows that 61.4% of people believe that she should not be the chancellor again. Apart from a minority government, new election and a return of FDP, a grand coalition is also an option. However, the price the SPD would ask for working with CSU/CDU again would be huge. Merkel not being the chancellor can be a pre-requisite for them to enter the negotiation.

ECB Draghi: Stimulus still need to to secure a sustained return of inflation

ECB President Mario Draghi said that time is still needed for the improvements in labor market to "translate" into "more dynamic wage growth. And he emphasized the "re-calibration" of monetary policy is meant to "preserve the degree of monetary stimulus that is still necessary to secure a sustained return of inflation." ECB announced in October meeting to half the monthly size of asset purchase to EUR 30b, and extend the program to September next year.

Broad agreement among UK minutes to raise divorce offer

BBC reported that after discussions in a cabinet meeting, there is broad agreement among ministers in UK for the government to raise the divorce bill offer to EU. However, there was no substantial discussion on the amounts to be raised. There were reports that UK would double the GBP 20b offered to GBP 40b but Downing Street has rubbished such rumors. European Council President Donald Tusk has set a deadline of completing the sufficient progress before December 14/15 summit, for moving on to trade agreements. And EU chief negotiator Michel Barnier has already be clear that UK has to "settle the accounts accurately" before starting trade talks.

RBA warned of "considerable uncertainty" over wage growth.

RBA signaled in the November meeting minutes that interest rates will remain at current historical level, maybe longer than originally expected. In particular, the central bank warned of "considerable uncertainty" over wage growth. It noted that "although unemployment rates had continued to fall, wage growth had been slow to increase in many economies and core inflation had remained low." And, retreat price inflation had remained subdued as competitions "continued to restrain price rises". Overall, "members noted that the outlook for inflation would be influenced by the persistence of heightened competitive pressures, the outlook for wage growth and the speed with which wage costs might flow through to higher prices."

Fed chair Yellen will step down from Board next year

Fed chair Janet Yellen announced yesterday that she will step down from the Federal Reserve Board of governors in February, after her role as chair ends. Originally, she could stay in the board until 2024. Yellen said in her resignation letter that "I am gratified that the financial system is much stronger than a decade ago. And she added that "I am also gratified by the substantial improvement in the economy since the crisis." There are now altogether four spots in the seven-member board to be filled. And that is seen as a golden opportunity for President Donald Trump to reshape monetary policy direction of the US.

Looking ahead

The economic remains light today. A main focus will be on UK inflation hearing. Swiss will release trade balance in European session. UK will release public sector net borrowing and CBI trends total orders. Canada will release wholesale sales. US will release existing home sales.

EUR/GBP Daily Outlook

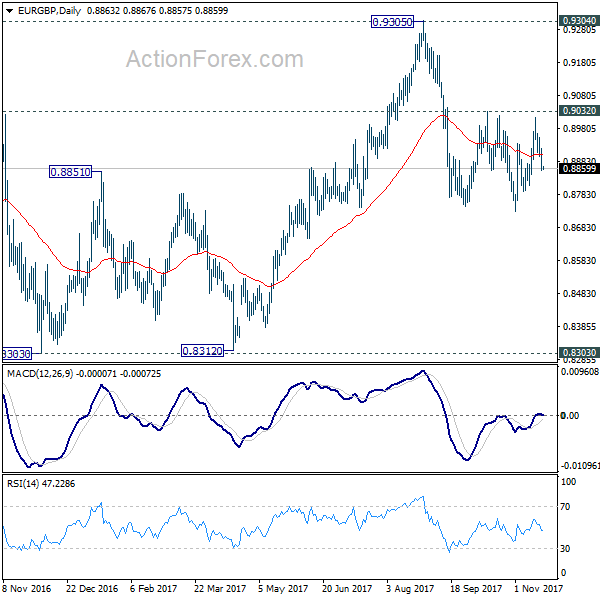

Daily Pivots: (S1) 0.8839; (P) 0.8880; (R1) 0.8905; More…

Intraday bias in EUR/GBP remains neutral as the cross is staying in range of 0.8732/0.9032. With 0.9032 resistance intact, deeper decline is mildly in favor in the cross. Break of 0.8732 will resume the fall from 0.9305 and target 0.8303 key support level. However, on the upside, decisive break of 0.9032 will confirm completion of the decline from 0.9305. In such case, intraday bias will be turned back to the upside for retesting 0.9305 key resistance.

In the bigger picture, there are various ways to interpret price actions from 0.9304 high. But after all, firm break of 0.9304/5 is needed to confirm up trend resumption. Otherwise, range trading will continue with risk of deeper fall. And in that case, EUR/GBP could have a retest on 0.8303. But we’d expect strong support from 0.8116 cluster support (50% retracement of 0.6935 to 0.9304 at 0.8120) to contain downside.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 00:30 | AUD | RBA Minutes Nov | ||||

| 04:30 | JPY | All Industry Activity Index M/M Sep | -0.40% | 0.10% | ||

| 07:00 | CHF | Trade Balance Oct | 3.21B | 2.92B | ||

| 09:30 | GBP | Public Sector Net Borrowing Oct | 6.6B | 5.3B | ||

| 11:00 | GBP | CBI Trends Total Orders Nov | 3 | -2 | ||

| 13:30 | CAD | Wholesale Trade Sales M/M Sep | 0.40% | 0.50% | ||

| 15:00 | USD | Existing Home Sales Oct | 5.42M | 5.39M |