The financial markets started the week relatively quietly. US and South Korea have kicked off the join annual military exercise today. North Korea warned that the drills would worsen the tensions by "throwing fuel on fire". But markets have little reaction to the news so far. Yen is trading mildly higher, possibly because of that, but strength is limited. On the other hand, European majors are broadly softer. The economic calendar is rather light today. UK Rightmove house price index dropped -0.9% mom in August. Japan all industry activity index rose 0.4% mom in June, in line with expectations. Canada wholesale sales is the only other notable featured data. Markets will have one eye on the developments in the White House, and another eye looking forward to Jackson Hole symposium later in the week.

Economists expected Cohn as front-runner to replace Yellen

In US, there are some findings from a survey by the National Association for Business Economics, polled 184 economists from July 18 to August 2. Only 17% expected Fed Chair Janet Yellen would be offered a second term when the current four-year term ends next February. 67% expected that Yellen will be replaced while 16% don’t know. Among the contenders, 49% expect White House economic adviser Gary Cohn would be picked for the top Fed job. That’s a wide margin from former Fed Governor Kevin Warsh’s 9% as second. However, it should be noted that the survey was done way before US President Donald Trump’s controversial remarks on the Charlottesville clash between Neo Nazi and counter protestors. Cohn was rumored to quite White House last week but denied.

The same survey showed that the respondents are "quite pessimistic about prospects for ‘meaningful, revenue-neutral tax reform’ in the near term." The survey showed only 10% chance of such legislation this year and 15% chance in 2018. Meanwhile, over 50% said Trump’s tax reform will eventually add less than 1% to real GDP growth over the next decade. A third said that impact would be between 1-2%.

Regarding Fed’s unwinding of balance sheet, 41% expect 10 year yield to rise by just 0.5% or less. 25% expect the jump in yield to be 0.75%-1.00%. NABE President Stuart Mackintosh noted that "the overall view of the panel is that the likely interest-rate impact of the Federal Reserve’s balance sheet normalization is fairly benign."

UK stepped up pressure on EU on Brexit trade negotiations

In UK, Prime Minister Theresa May’s government declared that it’s stepping up pressure on EU to move the Brexit negotiation into trade agreements as soon as October. Brexit Secretary David Davis warned in an article in the Sunday Times that "with the clock ticking, it wouldn’t be in either of our interests to run aspects of the negotiations twice." And, he argued that "it is simply not possible to reach a near-final agreement on the border issue until we’ve begun to talk about how our broader future customs arrangements will work." "Furthermore, if we get the comprehensive free trade agreement we’re seeking as part of our future partnership, solutions in Northern Ireland are easier to deliver." EU’s chief Brexit negotiator Michel Barnier responded by tweeting that the quicker an agreement was found on the breakup topics "the quicker we can discuss customs & future relationship."

UK government started releasing a series of policy documents, covering topics such as Northern Ireland and the customs union, for Brexit negotiations, since last week. A paper titled "Future Customs Arrangements" released last week triggered demand from businesses for a plan to replace customs union, an arrangement that allows movements of goods across the borders of EU member states without tariffs. Without proposing an concrete and feasible alternative, the paper indicated that leaving the EU represents leaving the EU Customs Union, and the government seeks a new arrangement that "facilitates the freest and most frictionless trade possible in goods between the UK and the EU".

The next round of Brexit talks, which start on 29 August.

Jackson Hole as main focus with few top-tier data featured

Looking ahead, the focus of the week is on the Kansas City Fed’s Jackson Hole symposium beginning on Thursday evening. Key financial officials of major economies would be speaking. ECB President Mario Draghi is due to speak on Thursday and Fed Chair Janet Yellen on Friday. Yellen’s comment on financial stability is expected to set the tone for the US dollar and US Treasuries in the near-term. The FOMC minutes for the July meeting unveiled that some policymakers maintained the stance to hike interest rates further later this year, despite weak inflation. We would look to see if Yellen is in this camp.

Few top-tiered macroeconomic data would be released this week. In the US, the flash Markit manufacturing and services PMIs for August would be released on Wednesday, followed by existing home sales in July on Thursday and the preliminary reading durable goods orders in July on Friday. In the Eurozone, the ZEW survey would be due Tuesday, followed by flash PMI readings for the bloc and individual countries on Wednesday. Wednesday also comes the European Commission’s flash consumer confidence index for August. Germany, the Eurozone’s biggest economy would release its first composition of GDP growth estimate for 2Q17, as well August’s IFO survey, on Friday. The Asia focus is on Japan, where the manufacturing PMI as well as inflation data for August would be released this week.

Here are some highlights for the week ahead:

- Tuesday: Swiss trade balance; UK public sector net borrowing; German ZEW; Canada retail sales; US house price index

- Wednesday: Japan PMI manufacturing; Eurozone PMIs; US PMIs, new home sales

- Thursday: New Zealand trade balance; UK GDP revision; US jobless claims, existing home sales

- Friday: Japan CPI; German GDP final; US durable goods

USD/CAD Daily Outlook

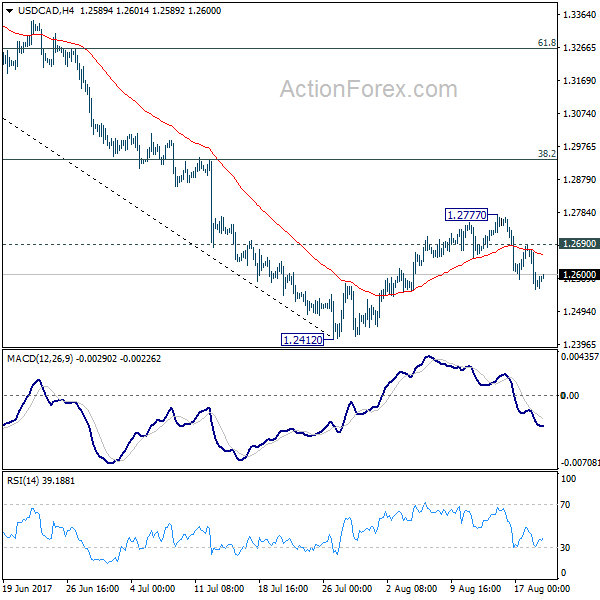

Daily Pivots: (S1) 1.2618; (P) 1.2650; (R1) 1.2714; More….

Intraday bias in USD/CAD remains on the downside for the moment. As noted before, corrective recovery from 1.2412 could have completed at 1.2777 already. Deeper decline would be seen back to 1.2412 low first. Break there will resume the larger decline and target next long term fibonacci level at 1.2048. On the upside, above 1.2690 will extend the correction from 1.2412 with another rise. But we’d expect upside to be limited by 38.2% retracement of 1.3793 to 1.2412 at 1.2940 to bring fall resumption eventually.

In the bigger picture, price actions from 1.4689 medium term top are seen as a correction pattern. Such corrective fall is still expected to extend to 50% retracement of 0.9406 to 1.4869 at 1.2048. At this point, we’d look for strong support from there to contain downside and bring rebound. Nonetheless, on the upside, sustained break of 1.2968, 38.2% retracement of 1.3793 to 1.2412 at 1.2940 will be the first sign of completion of the correction and will turn focus back to 1.3793 key resistance.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:01 | GBP | Rightmove House Prices M/M Aug | -0.90% | 0.10% | ||

| 4:30 | JPY | All Industry Activity Index M/M Jun | 0.40% | 0.40% | -0.90% | -0.80% |

| 12:30 | CAD | Wholesale Sales M/M Jun | -0.20% | 0.90% |