Dollar recovers in general today as markets turned into consolidation mode. Euro is treading water while markets await ECB rate decision and press conference. Traders would be eager to hear how ECB President Mario Draghi would clarify his comments in the past few weeks. Or Draghi will just let markets’ perceived ECB hawkishness be an assumed base case. Meanwhile, Yen is steady as BoJ delivered what are expected, keeping policies unchanged, raising growth forecast and lowering inflation forecast. Aussie was lifted briefly by solid job data but quickly retreated.

BoJ left policies unchanged, raised growth forecast, cut inflation projections

BoJ left monetary policies unchanged as widely expected. Short term policy interest rate was held at -0.1%. The central bank also maintained the annual pace of asset purchase at JPY 80T to keep 10 year JGB yield at around 0%. Meanwhile, BoJ noted in the quarterly report that "recent price developments have been relatively weak, as companies remained cautious in raising wages and prices." And, "risks to the economy and price outlook are skewed to the downside." Also as widely expected, BoJ lowered inflation projections and raised growth projections. The timing for meeting 2% inflation target is pushed back for the sixth time. BoJ now expects inflation to hit target in the fiscal year ending March 2020. Here is a summary of the revisions.

For fiscal 2017:

- Core inflation is projected at 1.1%, down from prior forecast of 1.4%

- GDP growth is projected at 1.8%; up from prior forecast of 1.6%

For fiscal 2018:

- Core inflation is projected at 1.5%, down from prior forecast of 1.7%

- GDP growth is projected at 1.4%; up from prior forecast of 1.3%

For fiscal 2019:

- Core inflation is projected at 1.8%, down from prior forecast of 1.9%

- GDP growth is projected at 0.7%; unchanged from prior forecast of 0.7%

Also from Japan, trade surplus narrowed to JPY 0.08T in June. All industry activity index dropped -0.9% mom in May.

Aussie enjoyed brief lift by solid job data

Aussie is lifted earlier today by solid job data but is seen losing momentum. Headline job data showed 14k growth in June, slightly below expectation of 15k. Prior month’s figure was revised down from 42k to 38k. Unemployment rate was unchanged at 5.6%. Looking at the details, full-time jobs rose 62k while partly offset by -48k fall in part-time jobs. Australia NAB business confidence was unchanged at 7 in Q2.

Aussie jumped sharply this week as RBA noted that the neutral nominal rate is now at 3.5%. But with reduction in risk aversion and/or increase in trend growth rate, the neutral real interest rate could rise back from current 1.0% to 1.5%. And that indirectly implies that the neutral nominal rate could also follow and rise. Australia Prime Minister Malcolm Turnbull tried to calm the market and said that RBA is only "sending a signal, which is probably prudent, which is to say … rates are more likely to go up than go down."

Euro cautious ahead of ECB

Euro is trading mixed as markets are awaiting ECB rate decision and press conference. The central bank is widely expected to keep policies unchanged today. The common currency was shot up in late June after ECB President Mario Draghi’s upbeat comments on the economy and receding political risks. Draghi further noted that renewed reflationary forces could now give room for "adjustment of parameters" of the current stimulus program. There are speculations that ECB could announce tapering of some sort in the September meeting, or by latest in October. But in any case, today’s press conference will give Draghi a chance to clarify if the markets have misjudged him. Without any clarifications, market will take the assumption of tapering in 2018 as a assumption and that could provide additional lift to the Euro.

Elsewhere

UK retail sales will be a focus in European session today. Germany will release PPI. Swiss will release trade balance. from US, jobless claims, Philly Fed survey and leading indicators will be featured.

EUR/AUD Daily Outlook

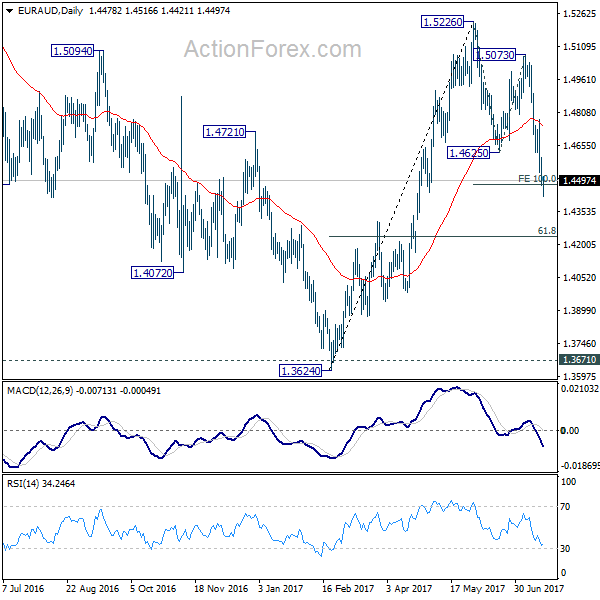

Daily Pivots: (S1) 1.4432; (P) 1.4518; (R1) 1.4563; More…

EUR/AUD drops to as low as 1.4421 so far today and met 100% projection of 1.5226 to 1.4625 from 1.4472. The cross quickly recovered. But for the moment, with 1.4617 minor resistance intact, intraday bias remains on the downside. Firm break of 1.4472 will pave the way to larger fibonacci level at 61.8% retracement of 1.3624 to 1.5226 at 1.4236. Meanwhile, above 1.4617 will indicate short term bottoming and turn bias back to the upside for 55 day EMA (now at 1.4744).

In the bigger picture, we’re holding on to the view that corrective decline from 1.6587 medium term has completed at 1.3624. But we will monitor the structure of the decline from 1.5226 to adjust our view. Above 1.5226 will target a test on 1.6587 key resistance. However, further downside acceleration will dampen our view and would drag EUR/AUD lower to retest key support zone around 1.3624.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| JPY | BOJ Monetary Policy Statement | |||||

| 23:50 | JPY | Trade Balance (JPY) Jun | 0.08T | 0.12T | 0.13T | 0.12T |

| 1:30 | AUD | NAB Business Confidence Q2 | 7 | 6 | 7 | |

| 1:30 | AUD | Employment Change Jun | 14.0k | 15.0k | 42.0k | 38.0k |

| 1:30 | AUD | Unemployment Rate Jun | 5.60% | 5.60% | 5.50% | 5.60% |

| 4:30 | JPY | All Industry Activity Index M/M May | -0.90% | -0.80% | 2.10% | 2.30% |

| 6:00 | CHF | Trade Balance (CHF) Jun | 2.89B | 3.40B | ||

| 6:00 | EUR | German PPI M/M Jun | -0.10% | -0.20% | ||

| 6:00 | EUR | German PPI Y/Y Jun | 2.30% | 2.80% | ||

| 8:00 | EUR | Eurozone Current Account (EUR) May | 23.3B | 22.2B | ||

| 8:30 | GBP | Retail Sales M/M Jun | 0.30% | -1.20% | ||

| 11:45 | EUR | ECB Rate Decision | 0.00% | 0.00% | ||

| 12:30 | EUR | ECB Press Conference | ||||

| 12:30 | USD | Initial Jobless Claims (JUL 15) | 245K | 247K | ||

| 12:30 | USD | Philly Fed Manufacturing Jul | 23.7 | 27.6 | ||

| 14:00 | EUR | Eurozone Consumer Confidence Jul A | -1.1 | -1.3 | ||

| 14:00 | USD | Leading Indicators Jun | 0.40% | 0.30% | ||

| 14:30 | USD | Natural Gas Storage | 57B |