Aussie stays in tight range today after RBA left cash rate unchanged at 1.50% as widely expected. The central bank also maintained a neutral stance and noted that "the Board judged that holding the stance of monetary policy unchanged at this meeting would be consistent with sustainable growth in the economy and achieving the inflation target over time." Regarding the economy, the statement pointed out that "year-ended GDP growth is expected to have slowed in the March quarter, reflecting the quarter-to-quarter variation in the growth figures." But Governor Philip Lowe is optimistic that "economic growth is still expected to increase gradually over the next couple of years to a little above 3 per cent."

Nonetheless, RBA also pointed out that "indicators of labour market remain mixed". While there was stronger employment growth, the growth in "total hours worked remains weak". Wage growth stays low and is "likely to continue for a while yet". And, as inflation will increase gradually, slow real wages growth will retrain growth in household consumption. RBA also stays alerted with the housing market. And it pointed out that "growth in housing debt has outpaced the slow growth in household income".

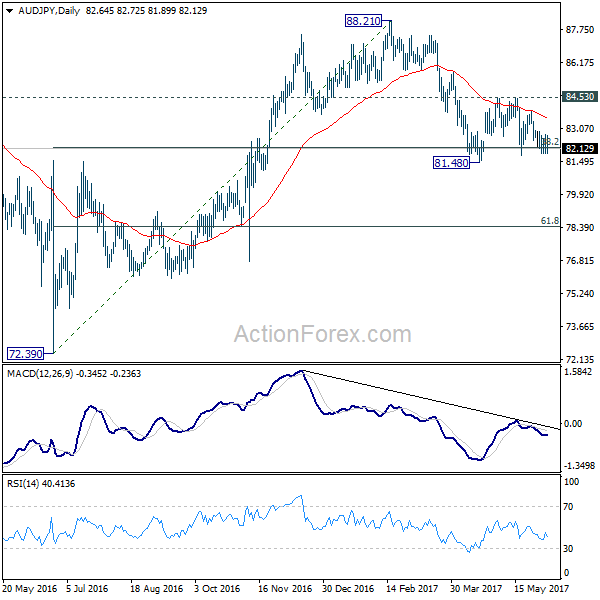

AUD/JPY gyrates in tight range after the release and overall outlook is unchanged. Recovery from 81.48 should have completed after failing to sustain above 55 day EMA. Fall from 88.21 is in expected to resume. Break of 81.48 will pave the way to 38.2% retracement of 72.39 to 88.21 at 78.43. This will be the favored case as long as 84.53 resistance holds.

Yen surges against dollar

Talking about Yen, it resumes recent rally against the greenback with USD/JPY diving through 110 handle. Markets are getting more nervous ahead of former FBI director James Comey’s testimony before Senate Intelligence Committee on Thursday. Comey, dismissed by US President Donald Trump, will certainly be asked about the investigation into Russian interference in the presidential election last year. Also, Comey will be asked about Trump’s interference in the investigation on former national security advisor Michael Flynn’s tie to Russia.

Yesterday, the Intercept published a leaked report by the National Security Agency, detailing how Russian hackers conducted a spear-phishing scheme targeted at the US election infrastructure. And the scheme penetrated the system deeper than previously believed. The report was confirmed by the US government. Also, a private contractor was arrested for leaking the report to media.

Elsewhere…

UK BRC retail sales monitor dropped -0.4% yoy in May. Japan labor cash earnings rose 0.5% yoy in April. Australia current account deficit narrowed to AUD -3.1b in Q1. Looking ahead, Eurozone will release retail sales and Sentix investor confidence in European session. Canada will release Ivey PMI in US session.

USD/JPY Daily Outlook

Daily Pivots: (S1) 110.27; (P) 110.50; (R1) 110.69; More…

USD/JPY’s fall from 114.36 resumes by taking out 110.23 support an reaches as low as 109.65 so far. Intraday bias stays on the downside for 108.12 support next. Whole decline from 118.65 is seen as a correction and is still in progress. Break of 108.12 will target 61.8% retracement of 98.97 to 118.65 at 106.48. We’ll look for bottoming signal around 106.48. On the upside, above 110.72 minor resistance will turn bias neutral first. But near term outlook will remain bearish as long as 111.70 resistance holds.

In the bigger picture, price actions from 125.85 high are seen as a corrective pattern. It’s uncertain whether it’s completed yet. But in case of another fall, downside should be contained by 61.8% retracement of 75.56 to 125.85 at 94.77 to bring rebound. Overall, rise from 75.56 is still expected to resume later after the correction from 125.85 completes.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:01 | GBP | BRC Retail Sales Monitor Y/Y May | -0.40% | -0.50% | 5.60% | |

| 0:00 | JPY | Labor Cash Earnings Y/Y Apr | 0.50% | 0.30% | -0.40% | 0.00% |

| 1:30 | AUD | Current Account Balance (AUD) Q1 | -3.1B | -0.5B | -3.9B | |

| 4:30 | AUD | RBA Rate Decision | 1.50% | 1.50% | 1.50% | |

| 8:30 | EUR | Eurozone Sentix Investor Confidence Jun | 27.4 | 27.4 | ||

| 9:00 | EUR | Eurozone Retail Sales M/M Apr | 0.10% | 0.30% | ||

| 14:00 | CAD | Ivey PMI May | 62 | 62.4 |