Major US indices surged to new record high overnight as boosted by solid ADP job data. Positive sentiments also carry on in Asian session. DOW gained 135.53 pts, or 0.65% to close at 2114.18, a record close even if it’s slightly short of record intraday high at 21169.11. S&P 500 rose 18.26 pts, or 0.76% to close at 2430.06. NASDAQ rose 48.31 pts or 0.78% to close at 6264.83. Both were also record close. Nikkei follows in Asia and is trading up 1.4% at the time of writing, at 20140. That’s also the first time Nikkei tops 20000 handle since December 2015. Elsewhere, 10 year yield closed up 0.021 at 2.217 but was way off session high at 2.239. Gold struggled to find follow through buying above 1270 again and is back at 1262. WTI crude oil stays soft at around 48.

In the currency markets, Sterling stabilized this week and is trading mildly higher against all other major currencies. In particular, the rebound in GBP/JPY, more thanks to weakness in Yen, suggests short term bottoming at 141.43. But the Pound could stay vulnerable as the election on June 8 approaches. Euro follows as the second strongest major currency for the week on expectation that ECB will tweak its language to the hawkish side in June meeting. Aussie and Loonie are trading as the weakest ones for the week so far, followed by Dollar. The greenback will look into today’s non-farm payroll report.

A solid NFP expected with focus on wage

The markets are expecting NFP to show 185k growth in May. Unemployment rate is expected to be unchanged at 4.4%. Average hourly earnings are expected to rise 0.2% mom. Looking at other related data, the "rip-roaring" ADP report suggests that is upside potential in today’s NFP. ADP private jobs grew 253k in May, well above expectation of 181k. Four week moving average of initial claims dropped to 238k in the week ended May 27, down from 243k four weeks ago. Continuing claims stayed below 2m handle for all of the May data released so far. Employment component of ISM manufacturing rose slightly to 53.5, up from 52.0. Conference board consumer confidence dropped for the second month to 117.9 in May but the three month average stayed at the highest level since 2001. Overall, there is much prospect of a strong NFP report today. The focus would be on whether such healthy growth in job markets could push up wages.

Trump announced withdrawal from Paris climate accord

Some attributed the surge in stocks to US President Donald Trump’s announce to withdraw from the Paris accord on climate change. But we would like to point out that such a move should be well priced in as Trump is just delivering his election promise. And, based on the reactions from European leaders during and after Trump’s visit to Europe, it was already clear that the withdrawal was a decision made. So, we’d maintain our view that the surge in stocks was mainly due to optimism on the US economy.

Trump announced US is withdrawing from the Paris climate pact yesterday and said that "we are getting out, but we will start to negotiate and we will see if we can make a deal, and if we can, that’s great." Environmentalist reacted to the announcement with anger as many could easily predict. But there were also business leaders who expressed disagreement to the move. Tesla CEO Elon Musk tweeted that his is leaving the presidential councils and warned that "leaving Paris is not goof for America or the world:". Walt Disney CE Robert Iger also resigned from presidential council over the withdrawal, "as a matter or principle". Goldman Sachs CEO Lloyd Blankfein tweeted for the first time ever that the decision was a "setback for the environment and for the US’s leadership position in the world".

Elsewhere…

Japan monetary base rose 19.4% yoy in May. Consumer confidence will be released in Asian session. UK will release construction PMI in European session while Eurozone PPI will be featured US and Canada will release trade balance today too. Meanwhile, the main focus is of course on US non-farm payroll.

USD/CAD Daily Outlook

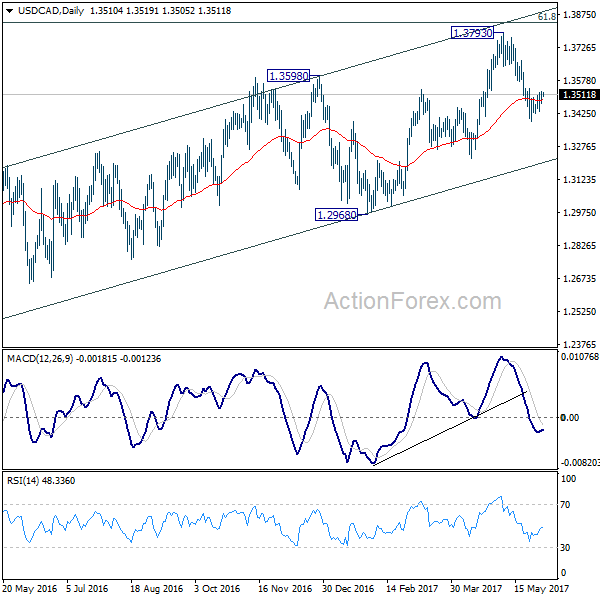

Daily Pivots: (S1) 1.3482; (P) 1.3505; (R1) 1.3538; More….

USD/CAD’s consolidation from 1.3387 is still in progress and outlook is unchanged. Intraday bias remains neutral first. Upside of recovery is expected to be limited by 1.3570 resistance to bring another decline. At this point, we’re still favoring the case that rise from 1.2968 has completed. And the larger rise from 1.2460 could have finished too. Below 1.3387 will target 1.3222 support first. Break of 1.3222 will affirm our bearish view and target 1.2968 key support level for confirmation. However, break of 1.3570 will turn focus back to 1.3793 high instead.

In the bigger picture, price actions from 1.4689 medium term top are seen as a correction pattern. The first leg has completed at 1.2460. Rise from 1.2460 is seen as the second leg and could have completed at 1.3793, ahead of 61.8% retracement of 1.4689 to 1.2460 at 1.3838. Break of 1.3222 should indicate the start of the third leg while further break of 1.2968 should confirm. Nonetheless, sustained trading above 1.3838 would pave the way to retest 1.4689 high.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Monetary Base Y/Y May | 19.40% | 19.60% | 19.80% | |

| 5:00 | JPY | Consumer Confidence May | 43.5 | 43.2 | ||

| 8:30 | GBP | Construction PMI May | 52.6 | 53.1 | ||

| 9:00 | EUR | Eurozone PPI M/M Apr | 0.20% | -0.30% | ||

| 9:00 | EUR | Eurozone PPI Y/Y Apr | 4.50% | 3.90% | ||

| 12:30 | CAD | Labor Productivity Q/Q Q1 | 0.40% | |||

| 12:30 | CAD | International Merchandise Trade (CAD) Apr | 0.0B | -0.1B | ||

| 12:30 | USD | Trade Balance Apr | -45.5B | -43.7B | ||

| 12:30 | USD | Change in Non-farm Payrolls May | 185K | 211K | ||

| 12:30 | USD | Unemployment Rate May | 4.40% | 4.40% | ||

| 12:30 | USD | Average Hourly Earnings M/M May | 0.20% | 0.30% |