Euro soars across the broad today as markets are happy with the results of the first round of French presidential election. With 97% of the vote counted, centrist Emmanuel Macron and far-right Marine Le Pen secured 23.9% and 21.4% support respectively. And as generally expected, they will enter the second and final round of the French election, scheduled on May 7. Higher support for Macron is also seen as a sign of solid support for staying with Euro. Meanwhile, after accepting defeat conservative Francois Fillon and leftist Benoit Hamon called their supports to choose Macron over Le Pen. According to recent polls by Ifop, Ipsos and Elabe, Macron would easily beat Le Pen in a head-to-head run-off, by a wide margin.

More in French Election: Macron And Le Pen Enter Final, Euro Soars Across The Board

BoJ to keep policies unchanged this week

BoJ is widely expected to keep monetary policies unchanged this week. Governor Haruhiko Kuroda said last week that it’s "premature to discuss in an exact way about exit strategy." Meanwhile, Kuroda also talked down the question of scarcity of assets to purchase. Kuroda noted that "I don’t think our monetary policy is constrained by the fact that we have acquired 40 percent of JGBs already, or our balance sheet is about 80 percent of GDP, which is certainly large compared with other central banks." Regarding inflation, he said that it’s still around zero percent in Japan and it’s a "long way to go" to hit the 2% target.

BoJ will also released the updated quarterly Outlook for Economic Activity and Prices report after the meeting. There are some speculations that BoJ would lower inflation projection for fiscal 2017. In January forecast, BoJ projected core CPI to hit 1.5% yoy in this fiscal year. But core CPI is currently standing at 0.2% yoy in February with weak momentum for price growth. Eyes will also be on whether BoJ would change the inflation forecast for 2018 and 2019, which were projected at 1.7% and 2.0% in January report.

ECB also expected to stand pat

ECB is also widely expected to keep monetary policies unchanged this week. President Mario Draghi warned last week that risks remain tilted to the downside. And "very substantial" accommodation is still needed. Nonetheless, he sounded a bit more relieved that there are "signs" of broadening recovery "across countries and sectors", with a "somewhat brighter global recovery and increasing global trade". Chief economist Peter Praet also noted that time for stimulus exit is yet to come.

Separately, governing council member Ewald Nowotny said that the policy path for 2017 is "decided". And ECB will "continuing bond purchases at a reduced level and leaving the interest-rate structures as they are." Another member Francois Villeroy de Galhau said that current policies were "fully appropriate" and recovery is "still fragile.

There were some speculations that ECB could lift interest before end of asset purchase. In particular, some members seemed to be concerned with the unknown impact of negative deposit rate. But such talks quickly were quickly cooled by comments from ECB officials in recent weeks.

Other highlights of the week

Elsewhere, there are a number of key economic data to watch. The list includes Australia CPI, US GDP, UK GDP and Japan CPI. Here are some highlights for the week ahead

- Monday: German Ifo business climate; Canada wholesale sales

- Tuesday: UK public sector net borrowing; US house price indices, consumer confidence, new home sales

- Wednesday: Australia CPI; Swiss UBS consumption indicator; Canada retail sales

- Thursday: BoJ rate decision; Swiss trade balance; German Gfk consumer sentiment, CPI, ECB rate decision; US durable goods orders, trade balance, wholesale inventories, pending home sales

- Friday: New Zealand building permits, trade balance; Japan CPI, unemployment rate, industrial production retail sales, household spending; Australia PPI; German retail sales, import prices, Eurozone M3, CPI; Swiss KOF; UK GDP, Canada GDP, IPPI and RMPI; US GDP, Chicago PMI

EUR/JPY Daily Outlook

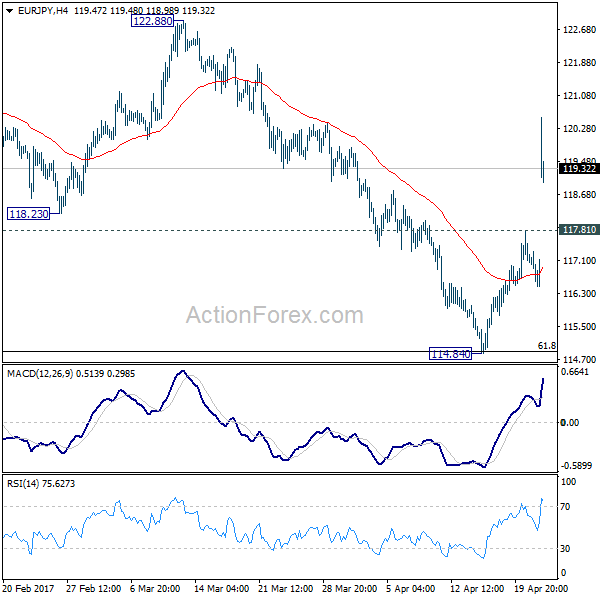

Daily Pivots: (S1) 116.52; (P) 116.91; (R1) 117.37; More…

EUR/JPY surges sharply to as high as 120.53 today. The strong break of 118.23 support turned resistance indicates that fall from 124.08 has completed at 114.84 already. Note that firstly, such decline has a three wave corrective structure. And it’s contained just by 61.8% retracement of 109.20 to 124.08 at 114.88. Hence, fall from 124.08 to 114.84 is seen as a corrective move. That in turn indicates that rebound from 109.20 is not finished. Intraday bias is turned back to the upside for 122.88 resistance first. Break will extend the whole rise from 109.20 to 126.09 key resistance next. On the downside, though, 117.81 minor support will turn focus back to 114.84 low instead.

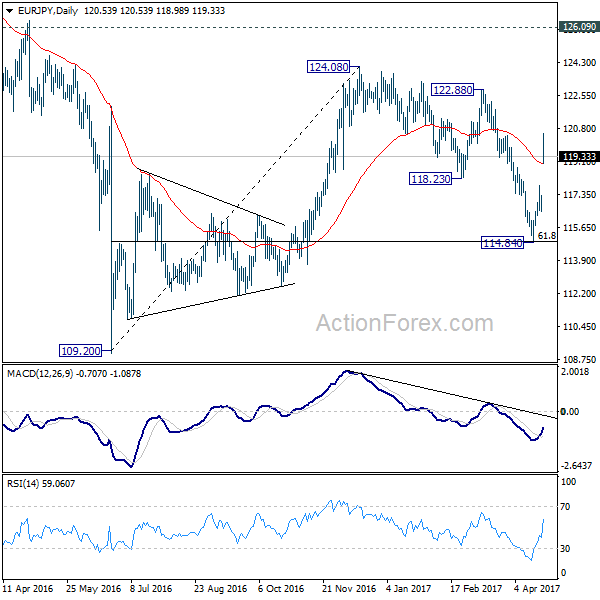

In the bigger picture, price actions from 109.20 is still seen as a corrective move for the moment. But current development suggests that the first leg is finished at 109.20, second leg at 114.84. And rise from 114.84 is possibly developing into the third leg. Further rise will now be mildly in favor through 124.08 resistance. Strong break of 126.09 support turned resistance will confirm completion of whole fall from 149.76 at 109.20. In such case, rise fro 109.20 is developing into a medium term move for 141.04 and above.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| EUR | First Round of French Presidential Election | |||||

| 23:01 | GBP | Rightmove House Prices M/M Apr | 1.10% | 1.30% | ||

| 08:00 | EUR | German IFO – Business Climate Apr | 112.4 | 112.3 | ||

| 08:00 | EUR | German IFO – Expectations Apr | 105.9 | 105.7 | ||

| 08:00 | EUR | German IFO – Current Assessment Apr | 119.2 | 119.3 | ||

| 10:00 | GBP | CBI Trends Total Orders Apr | 6 | 8 | ||

| 12:30 | CAD | Wholesale Sales M/M Feb | -0.90% | 3.30% | ||

| 13:00 | CNY | Conference Board Leading Index Mar | 1.20% |