Dollar is recovering against European majors in early US session but stays weak against commodity currencies. The greenbacks is still trading as the weakest major of the week, troubled by comments from US President Donald Trump regarding it’s strength. Released from US, initial jobless claims dropped 1k to 234k in the week ended April 8, below expectation of 245k. It’s the 110 straight week of sub-300k reading, longest streak since 1970 and indicates a healthy job market. Continuing claims dropped 7k to 2.03m in the week ended April 1. PPI, however, dropped -0.1% mom March but accelerated to 2.3% yoy. PPI core rose 0.0% mom, and accelerated to 1.6% yoy. Both PPI and core PPI missed expectations. From Canada, new housing price index rose 0.4% mom in February. Manufacturing shipments dropped -0.2% mom. Release in European session, Swiss PPI rose 0.1% mom 1.3% yoy in March. German CPI was finalized at 0.2% mom, 1.6% yoy in March.

Markets question whether Trump would still deliver his promises

In an interview with the Wall Street Journal, US President Donald Trump complained that US dollar "is getting too strong, and partially that’s my fault because people have confidence in me. But that’s hurting – that will hurt ultimately". He added that "it’s very, very hard to compete when you have a strong dollar and other countries are devaluing their currency". Meanwhile, Trump also reversed his position and said that China is "not currency manipulators". And he hailed that Chinese President Xi Jinping "wants to help us with North Korea." Trump also showed in the interview his "respect" for Yellen and suggested that he has not decided whether he would reappoint her for the second term.

The comments regarding Dollar was seen as a factor driving the greenback down. However, it remains to be seen if investors’ worries are more than that. To be specific, traders could be getting increasingly doubtful on what Trump would and could do. His failure in health act and travel ban raised a lot of questions on his administrative ability. Now that his stance on China has had a U-turn. And that further raises questions on whether he will deliver his election promises.

China exports surged in March

Talking about China, trade surplus came in at USD 23.9b in March, much higher than expectation of USD 12.b. Exports surged 16.4% yoy, much stronger than expectation of 3.2% yoy and much more reversed the lunar new year decline of -1.3% yoy back in February. Imports, on the other hand, rose 20.3% yoy, slowed from February’s 38.1% yoy rise. Imports were, nonetheless, also above expectation of 18.0% yoy. Trade surplus with US jumped to USD 17.74b, up from February’s 10.42b. Trade surplus with US for first quarter was at USD 49.6b, just slightly down from 2016 Q1’s USD 50.57b. In CNY terms trade surplus was at CNY 164b, more than double of expectation of CNY 76b. It remains to be seen what action would US and Chin take after Trump and Xi agreed to a 100-day plan for trades after last week’s summit.

Aussie boosted by strong job data

Australia Dollar is boosted by strong employment data today. Employment grew 60.9k in March, triple of expectation of 20.0k. Prior month’s figure was revised up from -6.4k to 2.8k. Full time jobs rose by 74.5k, highest jump in nearly 30 years since December 1987. Part-time jobs dropped -13.6k. Participation rate also rose from 64.6% to 64.8%. Unemployment rate was unchanged at 5.9% as more people are back in the market. Also from Australia, consumer inflation expectation rose 4.1% in April.

Adding to the support to Aussie, RBA said in its semiannual Financial Stability Review that " vulnerabilities related to household debt and the housing market more generally have increased." And, "some riskier types of borrowing, such as interest-only lending, remain prevalent." RBA also expressed the concern that "investors are likely to contribute to the amplification of the cycles in borrowing and housing prices, generating additional risks to the future health of the economy." Today’s job number certainly removed much burden on RBA for lowering interest rate again, with the background of worries on housing market bubble. Q1 CPI and GDP will be the next key pieces of data to watch.

EUR/USD Mid-Day Outlook

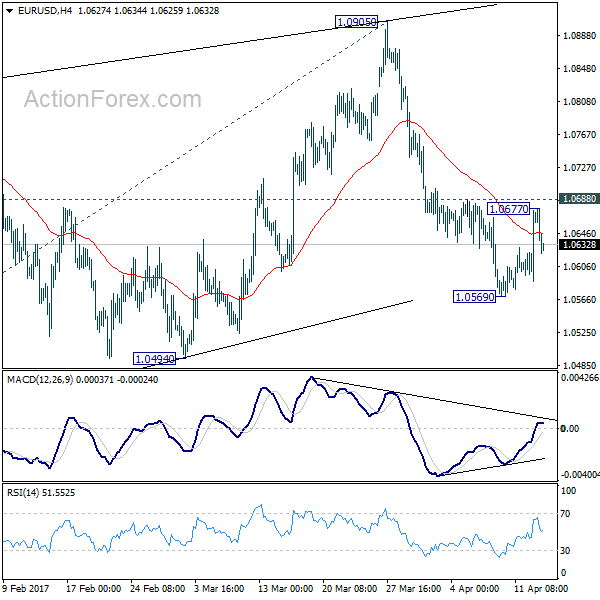

Daily Pivots: (S1) 1.0611; (P) 1.0642 (R1) 1.0697; More….

EUR/USD recovered to 1.0677 but failed to take out 1.0688 resistance and retreated. Intraday bias remains neutral first. Near term bearish outlook is unchanged. Corrective rise from 1.0339 is likely finished after being rejected by 55 week EMA. And, the larger down trend is ready to resume. Below 1.0569 will turn bias to the downside for 1.0494 support first. Break will confirm this bearish case and send EUR/USD through 1.0339 to 100% projection of 1.1298 to 1.0339 from 1.0905 at 0.9946. On the upside, however, break of 1.0688 resistance will delay the bearish case and turn focus back to 1.0905 resistance instead.

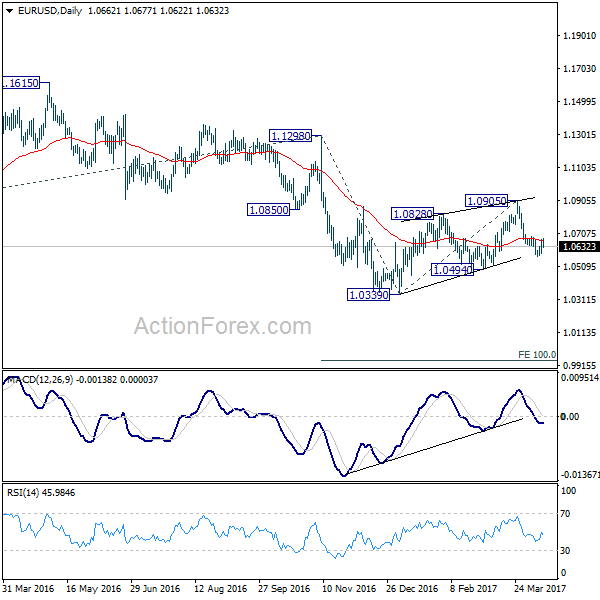

In the bigger picture, as long as 1.1298 key resistance holds, whole down trend from 1.6039 (2008 high) is still expected to continue. Break of 1.0339 low will send EUR/USD through parity to 61.8% projection of 1.3993 to 1.0461 from 1.1298 at 0.9115. However, considering bullish convergence condition in weekly MACD, break of 1.1298 will indicate term reversal. this would also be supported by sustained trading above 55 week EMA.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Japan Money Stock M2+CD Y/Y Mar | 4.30% | 4.20% | 4.20% | |

| 01:00 | AUD | Consumer Inflation Expectation Apr | 4.10% | 4.00% | ||

| 01:30 | AUD | RBA Financial Stability Review | ||||

| 01:30 | AUD | Employment Change Mar | 60.9k | 20.0k | -6.4k | 2.8k |

| 01:30 | AUD | Unemployment Rate Mar | 5.90% | 5.90% | 5.90% | |

| 03:15 | CNY | Trade Balance (USD) Mar | 23.9B | 12.5B | -9.1B | |

| 03:15 | CNY | Trade Balance (CNY) Mar | 164B | 76B | -60B | |

| 06:00 | EUR | German CPI M/M Mar F | 0.20% | 0.20% | 0.20% | |

| 06:00 | EUR | German CPI Y/Y Mar F | 1.60% | 1.60% | 1.60% | |

| 07:15 | CHF | Producer & Import Prices M/M Mar | 0.10% | 0.10% | -0.20% | |

| 07:15 | CHF | Producer & Import Prices Y/Y Mar | 1.30% | 0.90% | 1.30% | |

| 12:30 | CAD | New Housing Price Index M/M Feb | 0.40% | 0.20% | 0.10% | |

| 12:30 | CAD | Manufacturing Shipments M/M Feb | -0.20% | -0.70% | 0.60% | |

| 12:30 | USD | PPI M/M Mar | -0.10% | 0.00% | 0.30% | |

| 12:30 | USD | PPI Y/Y Mar | 2.30% | 2.40% | 2.20% | |

| 12:30 | USD | PPI Core M/M Mar | 0.00% | 0.20% | 0.30% | |

| 12:30 | USD | PPI Core Y/Y Mar | 1.60% | 1.80% | 1.50% | |

| 12:30 | USD | Initial Jobless Claims (APR 08) | 234K | 245k | 234k | 235K |

| 14:00 | USD | U. of Michigan Confidence Apr P | 96.6 | 96.9 | ||

| 14:30 | USD | Natural Gas Storage | 2B |