US treasury yields rally continues with 10 year yield hitting as high as 3.109 in Asian session. But the lift to Dollar is rather non-existence this time. The greenback is trading generally lower against others today and is mixed for the week. Sterling, on the other hand, is the strongest one today as lifted by news that UK could stay in customs union after Brexit. Canadian Dollar is also firm with WTI crude oil is staying comfortable above 71.5 handle. Euro remains the weakest one for the weak as weighed down by Italian politics. But the common currency is paring some losses against Dollar and Yen.

Technically, Dollar failed to take out near term resistance of 1.3448 against Sterling and 1.0056 against Swiss Franc. It’s actually kept quite well off 0.7566 against Aussie and 1.2998 against Canadian. That suggests the greenback’s rally was one-sided (or two sided?) against Euro and Yen only. On the other hand, there is prospect of a reversal in GBP/USD. And 1.3607 minor resistance is a level to watch today.

Sterling rebounds as UK could stay in customs union beyond 2021

The Telegraph reported that UK is preparing to stay in the customs union after Brexit, and beyond 2021. The news came after Prime Minister Theresa May said she’s aiming for a “future customs union” with the EU. And, her top ministers agreed this week on a last-resort plan to avoid a hard Irish border. Foreign Secretary Boris Johnson and Environment Secretary Michael Gove objected the plan but were “outgunned” by other during the meeting.

Australia jobs added 22.6k, participation rate made another record high

Australia employment market grew 22.6k in April (seasonally adjusted), slightly above expectation of 20.0k. Full time employment grew 32.7k while part time jobs dropped -10k. Unemployment rate rose 0.1% to 5.6%, above expectation of being unchanged at 5.5%. Participation rate rose to a further record high of 65.6%. ABS Chief Economist Bruce Hockman said “the labour force participation rate was the highest it has been since the series began in 1978, indicating increasing attachment to the labour force.”

Also from Australia consumer inflation expectation rose to 3.7% in May.

New Zealand PPI input slowed to 0.6% qoq in Q1 but beat expectation of 0.3% qoq. PPI output slowed to 0.2% qoq, in line with consensus.

Japan ready for retaliation against US steel tariffs

The NHK reported that Japan is readying retaliation against US tariffs. And it’s completing final arrangements to inform the WTO. It should be noted that Japan is one of the top 10 steel importers to the US who is not even granted a temporary exemption of the steel and aluminum tariffs. Meanwhile, South Korea was given permanent exemptions after updating the trade agreement.

Japan is said to be considering to impose tariffs on US imports that are worth USD 409m, equivalent of duties levied by the US through its tariffs. The list of goods was not publicized.

Release from Japan, machine orders dropped -3.9% mom in March versus expectation of -2.9% mom.

No news on NAFTA as May 17 deadline looms

There is so far no positive news out of NAFTA negotiation yet. House Speaker Paul Ryan said today (Thursday) is the last day the Congress has to receive a notification of a deal, if it is to pass it within this year. But it’s believed that the fundamental differences regarding auto contents and sunset clause remain between the US and the other two countries, Mexico and Canada.

BoC Governing Council Member Schembri said yesterday that uncertainty on NAFTA is impacting firms’ investment decisions. And, capacity is being “hindered” by firms’ reluctance to take on investment in face of uncertainty. And some of which is related to NAFTA.

Looking ahead

The calendar is rather light today. Focus will be on US jobless claims and Philly Fed survey. US will release release leading indicator. Canada will release international securities transactions.

GBP/USD Daily Outlook

Daily Pivots: (S1) 1.3451; (P) 1.3495; (R1) 1.3535; More…

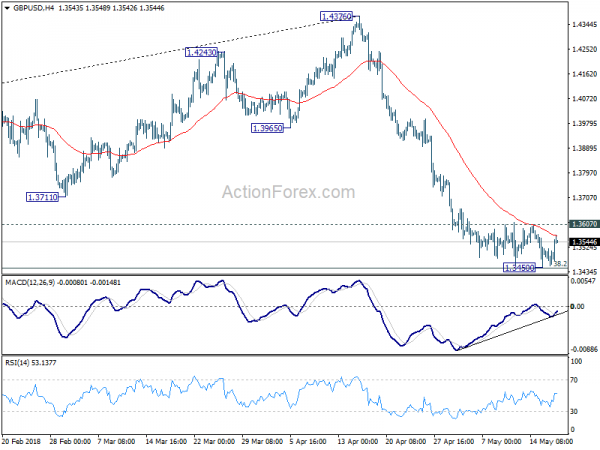

GBP/USD’s strong recovery, with 4 hour MACD crossed above signal line, suggests temporary bottoming again at 1.3450, ahead of 1.3448 fibonacci level. Intraday bias is turned neutral again as fall from 1.4376 failed to resume. For now, near term outlook will remain bearish as long as 1.3607 minor resistance holds and deeper decline is expected. Firm break of 1.3448 will pave the way to next fibonacci level at 1.2874. However, break of 1.3607 will indicate near term bottoming, with bullish convergence condition in 4 hour MACD. Intraday bias will then be turned back to the upside for 55 day EMA (now at 1.3815).

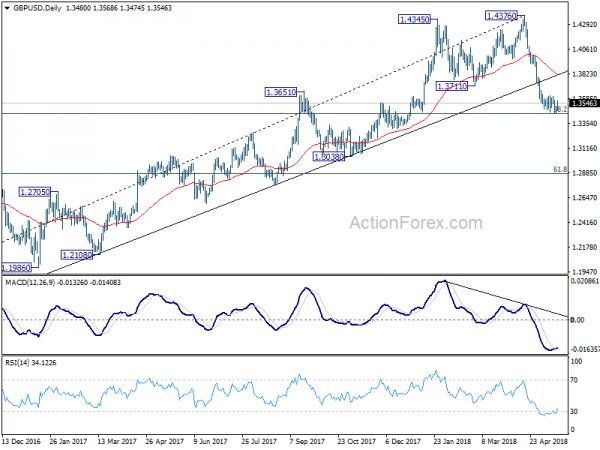

In the bigger picture, current development suggests that whole medium term rebound from 1.1936 (2016 low) has completed at 1.4376 already, with trend line broken, on bearish divergence condition in daily MACD, after rejection from 55 month EMA (now at 1.4223). 38.2% retracement of 1.1936 (2016 low) to 1.4376 at 1.3448 was almost met. Break there will target 61.8% retracement at 1.2874 and below. Outlook will stay bearish as long as 55 day EMA (now at 1.3815) holds, even in case of strong rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | PPI Input Q/Q Q1 | 0.60% | 0.30% | 0.90% | |

| 22:45 | NZD | PPI Output Q/Q Q1 | 0.20% | 0.20% | 1.00% | |

| 23:50 | JPY | Machine Orders M/M Mar | -3.90% | -2.80% | 2.10% | |

| 1:00 | AUD | Consumer Inflation Expectation May | 3.70% | 3.60% | ||

| 1:30 | AUD | Employment Change Apr | 22.5k | 20.0k | 4.9k | -0.7k |

| 1:30 | AUD | Unemployment Rate Apr | 5.60% | 5.50% | 5.50% | |

| 12:30 | CAD | International Securities Transactions (CAD) Mar | 3.96B | |||

| 12:30 | USD | Initial Jobless Claims (MAY 12) | 215K | 211K | ||

| 12:30 | USD | Philadelphia Fed Business Outlook May | 21.1 | 23.2 | ||

| 14:00 | USD | Leading Index Apr | 0.40% | 0.30% | ||

| 14:30 | USD | Natural Gas Storage | 89B |