The financial markets are lacking clear direction for the moment. DJIA hit new record high at 20155.35 overnight but pared back much gain to close at 20090.29, up only 0.19%. Treasury yields dropped rather notably with 10 year yield closed down -0.024 at 2.389 as recent consolidation extends. Dollar index reached as high as 100.72 but failed to break through 55 day EMA and retreated, currently at 110.40. Dollar’s rebound lost momentum as weighed down mildly by dovish comments from a Fed official. Meanwhile, Sterling regained footing after hawkish comments from BoE policy maker. Some more time is needed for the markets to seek clarity on the directions.

Fed Kashkari Indicated He’s Patient on Hike

Minneapolis Fed President Neel Kashkari’s views expressed in an unusual blog post "Why I Voted to Keep Rates Steady" indicated that he’s in no rush to hike interest rate. He pointed out that monetary policy has been accommodative for several years without rapid tightening of job market, nor sudden surge in inflation. And hence, "this suggests monetary policy has only been moderately accommodative over this period." And, job markets has "improved substantially" and the US is "approaching maximum employment". However, "we aren’t sure if we have yet reached it. We may not have." He concluded by noting that "from a risk management perspective, we have stronger tools to deal with high inflation than low inflation."

BoE Forbes: Rates Could Rise Soon

Sterling recovers after some hawkish comments. BoE policy maker Kristin Forbes said "if the real economy remains solid and the pickup in the nominal data continues, this could soon suggest an increase in bank rate." She noted that it’s "increasingly difficult" for her to justify "tolerating" a "large and likely overshoot of inflation". Meanwhile, "the forecasted sharp deterioration in unemployment and growth in the immediate aftermath of the referendum has not transpired." Swaps are pricing in around 30% of a BoE rate hike by year end.

BoJ Cautious on Global Developments

BoJ released the summary of opinions from the January 30-31 meeting today. The board generally saw improvements in exports, consumer spending and capital expenditure. One policy maker noted that Japan’s economic recovery has "strengthened" since the second half of 2016. And, "positive synergy effects are being produced by improvement in overseas economies, economic stimulus measures by the government, and enhanced monetary easing." However, there was a tone a caution in general over political developments globally, including US president Donald Trump’s policies and Brexit.

EUR/GBP Daily Outlook

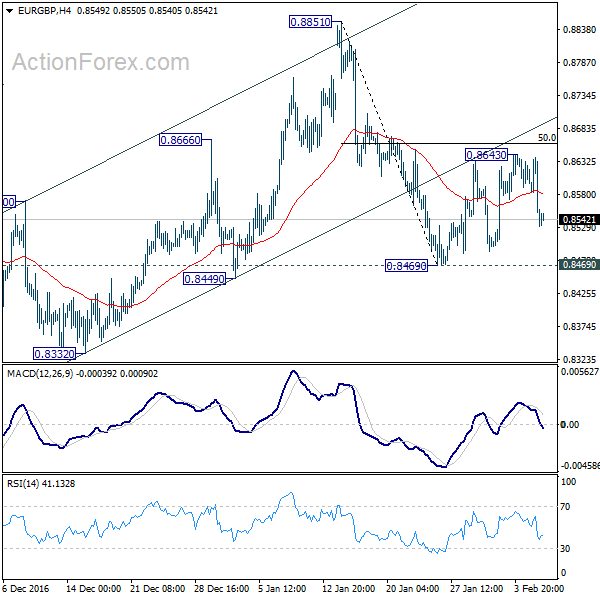

Daily Pivots: (S1) 0.8500; (P) 0.8570; (R1) 0.8608; More…

EUR/GBP dips further today but it’s staying in range above 0.8469. Intraday bias remains neutral for the moment. Structure of the rise from 0.8469 affirmed our view that it’s a corrective move. And this, in turn, affirmed the view that fall from 0.8851 is the third leg of the corrective pattern from 0.9304. Overall, we’d expect upside to be limited by 50% retracement of 0.8851 to 0.8469 at 0.8660 in case the consolidation from 0.8469 extends. On the downside, break o.8469 will target 0.8303 low next.

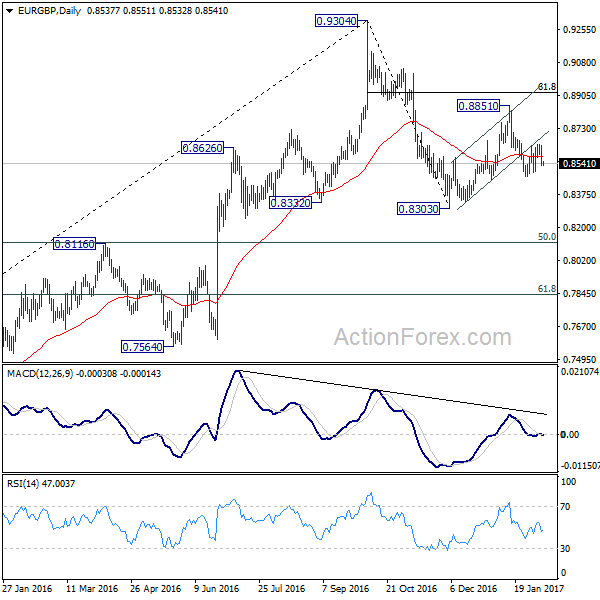

In the bigger picture, price actions from 0.9304 are viewed as a medium term corrective pattern. Deeper fall cannot be ruled out yet. But we’d expect strong support from 0.8116 cluster support (50% retracement of 0.6935 to 0.9304 at 0.8120) to contain downside. Overall, the corrective pattern would take some time to complete before long term up trend resumes at a later stage. Break of 0.9304 will pave the way to 0.9799 (2008 high).

Economic Indicators Update

| GMT | Ccy | Events | Actual | Consensus | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | BOJ Summary of Opinions | ||||

| 23:50 | JPY | Current Account (JPY) Dec | 1.67T | 1.71T | 1.80T | |

| 5:00 | JPY | Eco Watchers Survey Current Jan | 51.8 | 51.4 | ||

| 13:15 | CAD | Housing Starts Jan | 200.0k | 207.0k | ||

| 15:30 | USD | Crude Oil Inventories | 6.5M | |||

| 20:00 | NZD | RBNZ Rate Decision | 1.75% | 1.75% |

Subscribe to our daily and mid-day newsletter to get this report delivered to your mail box