Euro recovers today as lifted by German investor sentiment data. Meanwhile, Dollar softens broadly after uninspiring comments from Fed chair Janet Yellen. German ZEW economic sentiment rose to 19.5 in April, up from 12.8, beat expectation of 14.8. That’s also the highest level since August 2015. Current situation assessment rose to 80.1, up from 77.3, beat expectation of 80.1. ZEW President Achim Wambach said that the "German economic situation has proved fairly robust in the first quarter" And, that was highlighted by "solid figures for growth in industrial production, the construction sector and retail sales from February." Also, "consistently high labour demand has boosted private consumption." Eurozone ZEW economic sentiment rose to 26.3, up from 25.6, beat expectation of 25.0. Also from Eurozone, industrial production dropped -0.3% mom in February versus expectation of 0.1% mom rise.

Yesterday, ECB President Mario Draghi said in the central bank’s annual report that 2016 "ended with the economy on its firmest footing since the crisis," even though the year began "shrouded in economic uncertainty". The report noted that the scaling back of asset purchase from EUR 80b per month to EUR 60b "reflected the success of our actions earlier in the year: growing confidence in the euro area economy and disappearing deflation risks". However, overall, the Eurozone economy’s recovery is still dependent on massive support from the central bank. And the report also reiterated the calls on governments’ effort on fiscal reforms.

UK CPI unchanged at 2.3% yoy

UK CPI was unchanged at 2.3% yoy in March in line with expectation. Core CPI, however, dropped to 1.8% yoy, down from 2.0% yoy and missed expectation of 1.9% yoy. RPI also slowed to 3.1% yoy, down from 3.2% yoy. Headline inflation stayed inside BoE’s target rate of 2-3%. Risk to headline inflation should remain on the upside as BoE projects CPI to peak at 2.75% next year. Governor Mark Carney made himself clear that he is willing to tolerate overshooting the target as UK prepares for Brexit. But this view is not shared by all MPC members. Kristin Forbes voted for a rate hike back in March meeting. But for now, at least, inflation outlook is not worsening and Sterling softens a touch against Euro today. PPI input rose 0.4% mom, 17.9% yoy. PPI Output rose 0.4% mom, 3.6% yoy. PPI output core rose 0.3% mom, 2.5% yoy. House price index rose 5.8% yoy in February. BRC retail sales monitor dropped -1.0% yoy in March

Uninspiring comments from Fed chair Yellen

Yellen’s comments yesterday were uninspiring. On the job market, the Fed chair indicated that unemployment is now "a bit below" full employment. the March employment report suggested that the unemployment rate surprisingly fell to a post-recession low of 4.5% from 4.7% in February. The participation stayed unchanged at 63%. The number of nonfarm payrolls increased 98K in March, missing expectations of 180K and the downwardly revised 219K in February. On inflation, Yellen noted that it remained "slightly below" the 2% target. With the Fed’s focus now turned to sustaining economic growth, Yellen reiterated that "a gradual path of increases in short-term interest rates can get us to where we need to be, but we don’t want to wait too long to have that happen".

On a separate note, St. Louis Fed president James Bullard, speaking in Australia, signaled he favored only one rate hike this year, compared with three as suggested in the Fed’s median dot plot. Rather, he urged to begin balance sheet reduction this year. As the St. Louis Fed president noted, there is not "much further to go on rates and therefore the next step that would be natural would be to allow the run-off of the balance sheet".

Australia business conditions improved, confidence dropped

Australia NAB business confidence rose 5 pts to 14 in March, hitting the highest level since the global financial crisis. But business confidence dropped 1 pt to 6. NAB noted that "the bounce in business conditions this month came as a bit of a surprise, especially the big improvement in Queensland in light of the likely disruptions from Cyclone Debbie in late March." And, "one possibility is that ‘Debbie’ is having the unexpected effect of overstating conditions in March given that the cyclone coincided with a lower response rate from firms in Northern Queensland.". But overall, "conditions have improved almost across the board to levels that suggest a strong economy in the near term."

EUR/USD Mid-Day Outlook

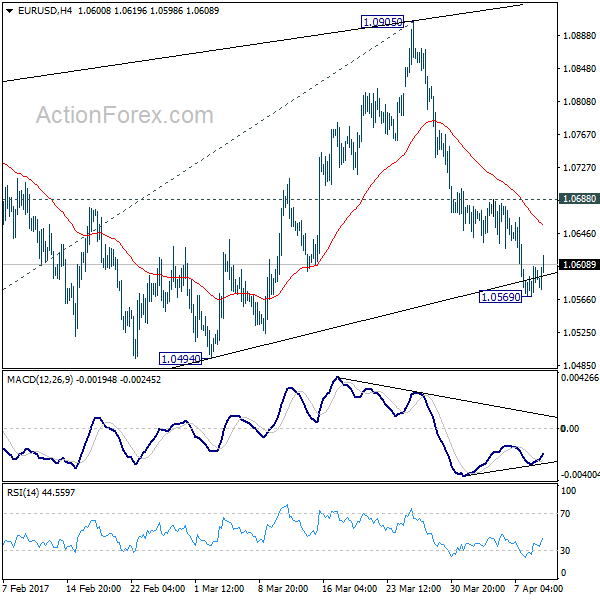

Daily Pivots: (S1) 1.0574; (P) 1.0590 (R1) 1.0611; More….

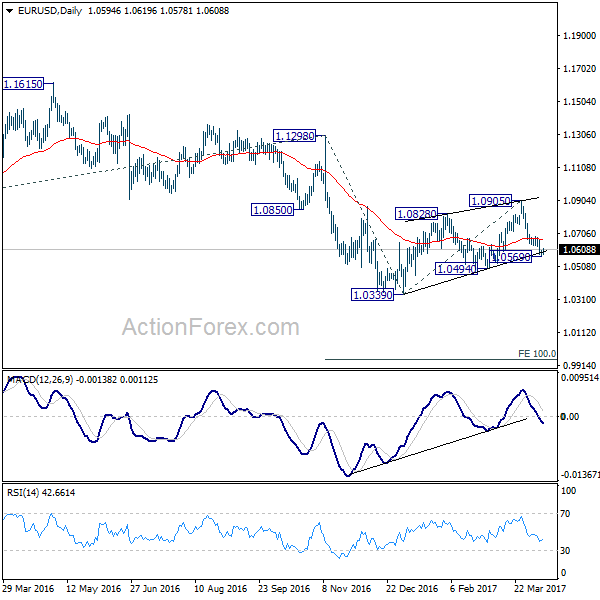

A temporary low is in place at 1.0569 as EUR/USD recovers. Intraday bias is turned neutral first. But we’d expect upside of recovery to be limited by 1.0688 resistance and bring fall resumption. As noted before, corrective rise from 1.0339 is likely finished after being rejected by 55 week EMA. And, the larger down trend is ready to resume. Below 1.0569 will turn bias to the downside for 1.0494 support first. Break will confirm this bearish case and send EUR/USD through 1.0339 to 100% projection of 1.1298 to 1.0339 from 1.0905 at 0.9946. On the upside, however, break of 1.0688 resistance will delay the bearish case and turn focus back to 1.0905 resistance instead.

In the bigger picture, as long as 1.1298 key resistance holds, whole down trend from 1.6039 (2008 high) is still expected to continue. Break of 1.0339 low will send EUR/USD through parity to 61.8% projection of 1.3993 to 1.0461 from 1.1298 at 0.9115. However, considering bullish convergence condition in weekly MACD, break of 1.1298 will indicate term reversal. this would also be supported by sustained trading above 55 week EMA.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:01 | GBP | BRC Retail Sales Monitor Y/Y Mar | -1.00% | -0.50% | -0.40% | |

| 1:30 | AUD | NAB Business Confidence Mar | 6 | 7 | ||

| 6:00 | JPY | Machine Tool Orders Y/Y Mar P | 22.60% | 9.10% | ||

| 8:30 | GBP | CPI M/M Mar | 0.40% | 0.30% | 0.70% | |

| 8:30 | GBP | CPI Y/Y Mar | 2.30% | 2.30% | 2.30% | |

| 8:30 | GBP | Core CPI Y/Y Mar | 1.80% | 1.90% | 2.00% | |

| 8:30 | GBP | RPI M/M Mar | 0.30% | 0.40% | 1.10% | |

| 8:30 | GBP | RPI Y/Y Mar | 3.10% | 3.20% | 3.20% | |

| 8:30 | GBP | PPI Input M/M Mar | 0.40% | -0.10% | -0.40% | -0.10% |

| 8:30 | GBP | PPI Input Y/Y Mar | 17.90% | 17.00% | 19.10% | 19.40% |

| 8:30 | GBP | PPI Output M/M Mar | 0.40% | 0.10% | 0.20% | |

| 8:30 | GBP | PPI Output Y/Y Mar | 3.60% | 3.40% | 3.70% | |

| 8:30 | GBP | PPI Output Core M/M Mar | 0.30% | 0.20% | 0.00% | |

| 8:30 | GBP | PPI Output Core Y/Y Mar | 2.50% | 2.50% | 2.40% | |

| 8:30 | GBP | House Price Index Y/Y Feb | 5.80% | 6.10% | 6.20% | |

| 9:00 | EUR | Eurozone Industrial Production M/M Feb | -0.30% | 0.10% | 0.90% | |

| 9:00 | EUR | German ZEW (Economic Sentiment) Apr | 19.5 | 14.8 | 12.8 | |

| 9:00 | EUR | German ZEW (Current Situation) Apr | 80.1 | 77.5 | 77.3 | |

| 9:00 | EUR | Eurozone ZEW (Economic Sentiment) Apr | 26.3 | 25 | 25.6 |