The Japanese Yen is trading as the weakest major currency today as it’s paring back this month’s gain. Canadian Dollar is so far the strongest one for the day as supported by strength in oil price. Dollar attempted to extend Friday’s rally earlier today but no follow through buying in seen yet. Meanwhile, Euro is weighed down mildly by news on French presidential election. Overall, trading activity is quite subdued today as traders are probably starting preparing for holiday and long weekend ahead.

French election becomes a four-way match

In France, support for far left Jean-Luc Melenchon and conservative Francois Fillon jumped recently. That makes the presidential election in April and May a four-way match together with far right Marine Le Pen and centrist Emmanuel Macron. The latest Kantar Sofres poll published on Sunday showed that Macron and Le Pen tied for first with 24% support, Melenchon at 18% and Fillon at 17%. For the moment, anti-Euro Le Pen and pro-Euro Macron are still the favorites to enter into the run-off in May. And in that case, Macron is the favorite to win. However, the odds of Le Pen winning could jump if Fillon or Melenchon run the run-off with her. And, in that case, Frexit risk will also surge.

Released from Eurozone, Sentix investor confidence rose to 23.9 in April, up from 20.7, above expectation of 23.9.

BoJ concerned of Trump’s trade policies

BoJ Governor Haruhiko Kuroda said at a quarterly meeting of regional branch managers that Japan’s economy "continues to recover moderately as a trend". And he’s optimistic that it would "turn into a moderate expansion". Meanwhile, he also reiterated his pledge to maintain ultra loose monetary policy until the 2% inflation target is hit. A report of the meeting noted that business plains could be affected by uncertainties over US President Donald Trump’s trade balance. In particular, the reported noted a postponement of a metal product plant in Mexico even though there was no change in the investment plan in Japan. Also, there were growing concerns that US trade policies could affect exports and overseas production.

Released in Asian session, Japan economy watcher sentiment dropped to 47.4 in March. Current account surplus widened to JPY 2.12T in February. From Australia, home loans dropped -0.5% in February.

CAD strengthens as oil extends rally

Bank of Canada rate decision on Wednesday will be a major focus this week. BoC is widely expected to keep interest rate unchanged at 0.50%. The tone of the statement could remain slightly dovish in spite of improvements in economic data. Nonetheless, Canadian Dollar will likely follow more on oil prices as WTI crude oil could be heading back to 55.24 resistance due to geopolitical tensions. In addition, Libya’s Sharara field halted production just one week after re-opening. Meanwhile, Russia Energy Minister Alexander Novak was reported saying that he’s considering an extension of the OPEC-led production cuts by another six-month.

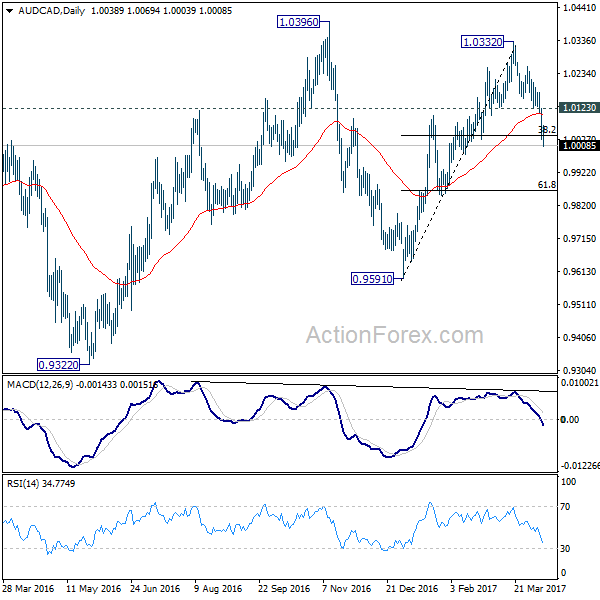

AUD/CAD to head lower to 0.9874 fibonacci level.

Canadian Dollar continues to enjoy much strength against Australian Dollar. As we mentioned back in the Daily Report on April 3, 1.0332 was confirmed to be a top and rise from 0.9591 is finished. The cross dropped through 38.2% retracement of 0.9591 to 1.0332 at 1.0049 as expected. And there is no sign of bottoming yet. Outlook in AUD/CAD will remains bearish as long as 1.0123 resistance holds. Current fall should extend to 61.8% retracement at 0.9874 and below. But overall, the cross is bounded in long term consolidation pattern start at 1.0784 (2012 high). And it stayed in range between 0.9148/1.0784 for more than five years. We’re not seeing any clear long term trend yet.

USD/CHF Mid-Day Outlook

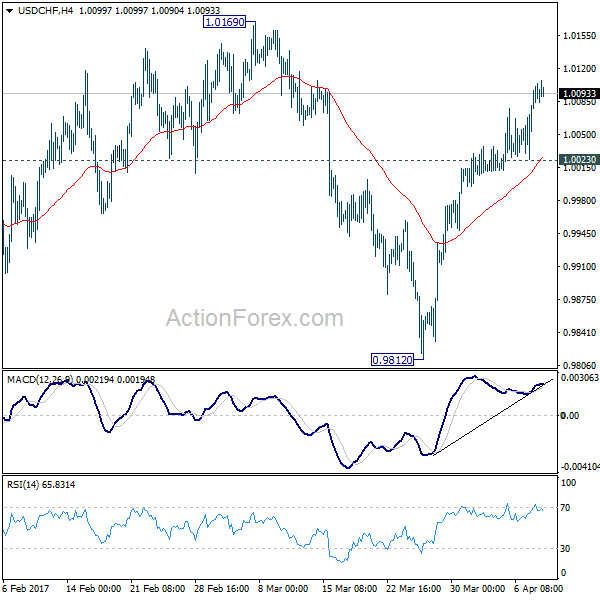

Daily Pivots: (S1) 1.0043; (P) 1.0069; (R1) 1.0117; More…..

Intraday bias in USD/CHF remains on the upside as the rise from 0.9812 is still in progress. As noted before, corrective fall from 1.0342 should have finished with three waves down to 0.9812. Further rise should now be seen to 1.0169 resistance first . Decisive break there will confirm this bullish case and target 1.0342 key resistance next. On the downside, below 1.0023 minor support will turn bias neutral and bring consolidations before staging another rally.

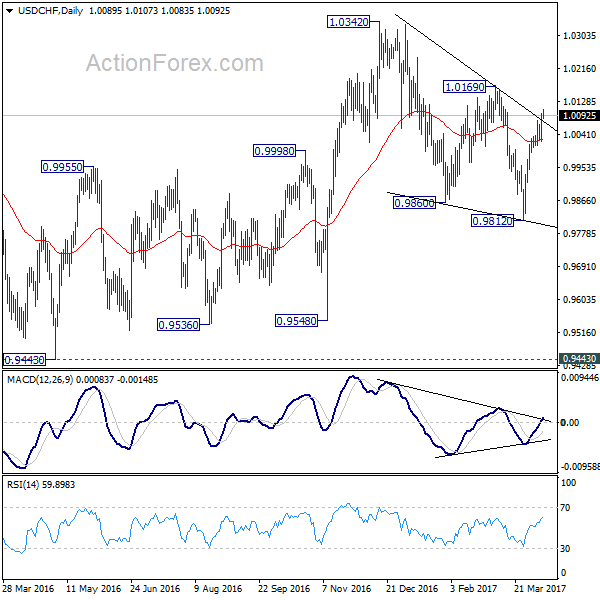

In the bigger picture, we’re still maintain that firm break of 1.0342 key resistance is needed to confirm underlying bullish momentum in the cross. However, the corrective nature of the fall from 1.0342 to 0.9812 is starting to give the medium term outlook a bullish favor. Hence, in stead of looking for topping signal around 1.0342, we’d now pay closer attention to upside acceleration as USD/CHF approaches this level again.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Current Account (JPY) Feb | 2.21T | 1.79T | 1.26T | |

| 01:30 | AUD | Home Loans Feb | -0.50% | 0.00% | 0.50% | 0.40% |

| 05:00 | JPY | Eco Watchers Survey Current Mar | 47.4 | 49.8 | 48.6 | |

| 08:30 | EUR | Eurozone Sentix Investor Confidence Apr | 23.9 | 21 | 20.7 | |

| 12:15 | CAD | Housing Starts Mar | 254K | 215.5k | 210.2k | 214K |

| 14:00 | USD | Labor Market Conditions Index Change Mar | 1.3 |