Dollar trades mildly higher today but stays in range except versus Canadian dollar. Focus is now on Donald Trump’s inauguration. Traders are generally cautious ahead of the events and keen awaiting to see whether Trump would assure that markets of his expansive policies or disappoint. Meanwhile, Canadian dollar is pressured by BoC’s governor Stephen Poloz comments earlier this week. Additional selling is seen after disappointing data. Canada retail sales rose 0.2% mom in November versus expectation of 0.5% mom. Ex-auto sales rose 0.1% mom, in line with consensus. CPI dropped -0.2% mom, rose 1.5% yoy in December, below expectation of 0.0% mom, 1.7% yoy. Core CPI dropped -0.3% mom, rose 1.6% yoy versus expectation of -0.2% mom, 1.7% yoy.

ECB executive board member Benoit Coeure said that it would be "challenging" to have a new framework that is "strong enough" to keep the current euro clearing houses in London after Brexit. He also noted that the single market is a set of "rules" to protect investors, consumers, ensuring a level playing field for financial institution and deliver financial stability. And "when this is gone we will have to know which other set of rules will provide that." Regarding ECB’s quantitative easing program, Coeure said that it "will not last forever" but "it’s too early to start a discussion on tapering." Released from Eurozone, German PPI rose 0.4% mom, 1.0% yoy in December. Also from Europe, UK retail sales dropped -1.9% mom in December.

Yesterday, ECB left its policies unchanged, with the base interest rate staying at 0% and the deposit rate at -0.4%. Meanwhile, the current QE program stayed at EUR 80b per month. It would be extended until December, but at a decreased rate of EUR 60b from March on. On economic developments, President Mario Draghi acknowledged recent strength in activity indicators, but noted that "there are no signs yet of a convincing upward trend in underlying inflation". Draghi added that "the Governing Council will continue to look through changes in HICP inflation if judged to be transient and to have no implication for the medium-term outlook for price stability". On the monetary policy outlook, he reiterated that need to maintain low interest rates as "the recovery of all of the Eurozone is in the interests of everybody, including Germany".

China’s GDP expanded 6.8% yoy in 4Q17, up from 6.7% in the prior quarter. Industrial production grew 6% yoy in December, down from 6.2% in November. The market had anticipated a 6.1% growth. Retail sales expanded 10.9% yoy, beating consensus of 10.7% and November’s 10.8%. Urban fixed asset investment increased 8.1% for the full year 2016, slowing from 8.3% in the first 11 months of the year.

EUR/USD Mid-Day Outlook

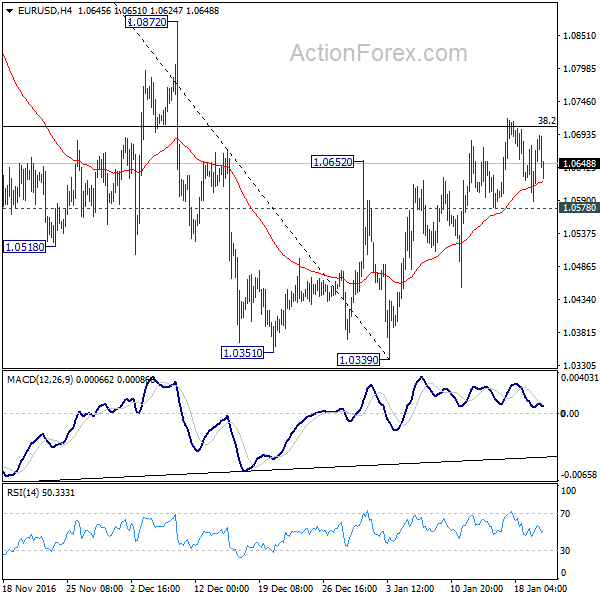

Daily Pivots: (S1) 1.0607; (P) 1.0642 (R1) 1.0695; More…..

Intraday bias in EUR/USD remains neutral for the moment. Rebound from 1.0339 is seen as a corrective move. Below 1.0453 will argue that it’s completed and turn bias back to the downside for 1.0339 support. Break there will extend the larger down trend towards parity. In case of another rise, we’d expect upside to be limited by 1.0872 resistance and bring reversal.

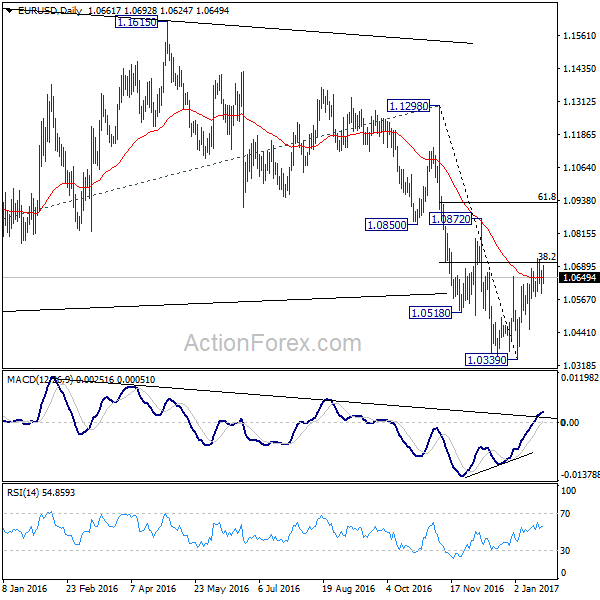

In the bigger picture, whole down trend from 1.6039 (2008 high) is in progress. Such down trend is expected to extend to 61.8% projection of 1.3993 to 1.0461 from 1.1298 at 0.9115. On the upside, break of 1.1298 resistance is needed to confirm medium term bottoming. Otherwise, outlook will stay bearish in case of rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Consensus | Previous | Revised |

|---|---|---|---|---|---|---|

| 02:00 | CNY | GDP Y/Y Q4 | 6.80% | 6.70% | 6.70% | |

| 02:00 | CNY | Industrial Production Y/Y Dec | 6.00% | 6.10% | 6.20% | |

| 02:00 | CNY | Retail Sales Y/Y Dec | 10.90% | 10.70% | 10.80% | |

| 02:00 | CNY | Fixed Assets Ex Rural YTD Y/Y Dec | 8.10% | 8.30% | 8.30% | |

| 07:00 | EUR | German PPI M/M Dec | 0.40% | 0.40% | 0.30% | |

| 07:00 | EUR | German PPI Y/Y Dec | 1.00% | 1.00% | 0.10% | |

| 09:30 | GBP | Retail Sales M/M Dec | -1.90% | -0.10% | 0.20% | -0.10% |

| 13:30 | CAD | Retail Sales M/M Nov | 0.20% | 0.50% | 1.10% | 1.20% |

| 13:30 | CAD | Retail Sales Less Autos M/M Nov | 0.10% | 0.10% | 1.40% | |

| 13:30 | CAD | CPI M/M Dec | -0.20% | 0.00% | -0.40% | |

| 13:30 | CAD | CPI Y/Y Dec | 1.50% | 1.70% | 1.20% | |

| 13:30 | CAD | BoC CPI Core M/M Dec | -0.30% | -0.20% | -0.50% | |

| 13:30 | CAD | BoC CPI Core Y/Y Dec | 1.60% | 1.70% | 1.50% |

Subscribe to our daily and mid-day newsletter to get this report delivered to your mail box