US-China trade war is the dominant theme in the markets today. Initial reactions were muted to US announcement of the product list in Section 301 tariffs on China. However, global stock markets were rocked by China’s immediate response of its own retaliation measures against the US. The speed of response showed that China is not backing down. The more optimistic read of today’s development is that there is no implementation date for the tariffs of both side yet. And China already expressed the willingness to go back to negotiation table. But at the same time, the “intensity” of China’s response surprised most of the analysts. And the tensions could escalate easily if the US respond by counter-retaliation measure. Then, the cycle will be never-ending.

Nonetheless, for now, there should be much time for markets to digest the news. US public and companies will have until May 22 to comment and object to the Section 301 tariff product list. And, China will certainly not initiate any further action before the US tariffs are finalized and implemented.

Global stocks hit by trade war news, Dollar mildly higher after ADP

The global stock markets are hit hard today. Hong Kong, as the center of the storm, has its HSI index dropped -2.19%. It’s sort of an escape for Chinese stock traders as the Ministry of Finance’s announcement was made after market close. And there will be two days of holidays in China ahead. In Europe, DAX is being the worst victim as it’s losing -1.2% at the time of writing. DAX is down -0.87%. FTSE is down just -0.36%, partly thanks to Sterling’s weakness. US futures point to sharply lower open that could completely reverse yesterday’s rebound.

In the currency markets, Dollar is lifted mildly higher into US session. Much better than expected ADP employment data, (241k vs expectation of 205k) is giving the greenback a lift. But for the day New Zealand Dollar and Yen are the strongest ones. Canadian Dollar is, on the other hand, the weakest one followed by Sterling.

China announced 25% retaliation tariffs to USD 50b of US imports, including soybeans, aircrafts

In response to the Section 301 tariffs of the US, China announced retaliation tariffs on 106 US products. Total product values add up to USD 50b, matching the size of the US action. Products include soybeans, autos, aircrafts etc, targeted at Trump’s and Republicans’ supporter base. Tariff rate is 25%. There is no implementation date yet. Vice Finance Minister Zhu Guangyao said there is room for negotiation and hoped there will be a resolution via WTO. There is no arrangement for public comments, no hearing whatsoever regarding the retaliation tariffs. And actually, no one expects such kind of democratic arrangements in China. That’s being said, China is ready to fire any time.

Trump: We’re not in trade war with China… but we cannot let this continue

US President delivered his morning tweets as usual. Regarding China, he said “We are not in a trade war with China, that war was lost many years ago by the foolish, or incompetent, people who represented the U.S. Now we have a Trade Deficit of $500 Billion a year, with Intellectual Property Theft of another $300 Billion. We cannot let this continue!”

He also mentioned Mexico and Canada and said “Our Border Laws are very weak while those of Mexico & Canada are very strong. Congress must change these Obama era, and other, laws NOW! The Democrats stand in our way – they want people to pour into our country unchecked….CRIME! We will be taking strong action today.” It usual if there is anything to do with this tweet and the rumored rushed preparation of NAFTA draft.

US announced tariffs on 1300 products, targeting “Made in China 2025” plan

Earlier today, the US Office of the United States Trade Representative released the list of products regarding the Section 301 tariffs against China. The action will impose 25% tariffs on approximately USD 50b of Chinese imports to the US “in response to China’s policies that coerce American companies into transferring their technology and intellectual property to domestic Chinese enterprises.” And the Trade Res presentative claimed in the statement that these policies “bolster China’s stated intention of seizing economic leadership in advanced technology” in its “Made in China 2025” plan.

The proposed list of products covers around 1300 tariff lines, focusing on technological and industrial products, like televisions, medical devices, batteries, aircraft parts etc. The list will be finalized after public comment, including a hearing on May 15 in Washington. And companies will have until May 22 to file final objections. There is no implementation date yet.

Eurozone unemployment dropped to decade low, CPI accelerated

From Europe, Eurozone CPI accelerated to 1.4% yoy in March, up from 1.1%, and met expectation. Core CPI, however, was unchanged at 1.1% yoy, missing expectation of 1.1% yoy. Unemployment rate dropped to 8.5% in February, met expectation, and hit the lowest level since 2008.

UK PMI construction, however, dropped to 47 in March, down from 51.4, much worse than expectation of 51.0. Markit noted construction activity fell amid unusually bad weather in March. UK BRC shop price dropped -1.0% yoy in March.

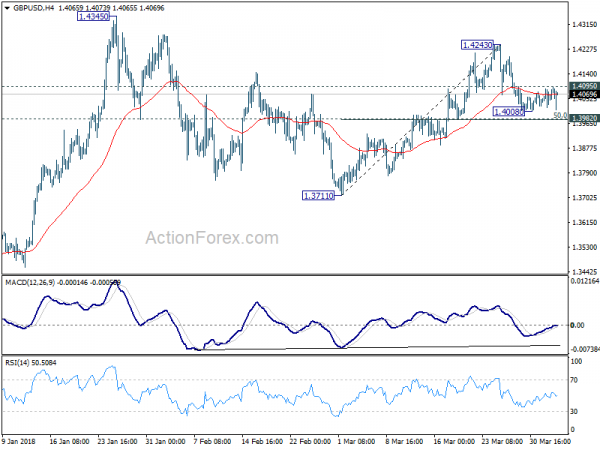

GBP/USD Mid-Day Outlook

Daily Pivots: (S1) 1.4023; (P) 1.4056; (R1) 1.4091; More….

Much volatility is seen in GBP/USD today but it’s, after all, bounded in tight range above 1.4008 temporary low. Intraday bias stays neutral first. On the downside, firm break of 1.3982 support will indicate completion of the rise from 1.3711. In that case, intraday bias will be turned back to the downside for retesting 1.3711. Nonetheless, strong rebound from 1.3982, followed by break of 1.4095 minor resistance will turn bias to the upside for 1.4243. Break will resume the rally from 1.3711 for 1.4345 high first.

In the bigger picture, as long as 1.3038 support holds, medium term outlook in GBP/USD will remains bullish. Rise from 1.1946 is at least correcting the long term down from 2007 high at 2.1161. Further rally would be seen back to 38.2% retracement of 2.1161 (2007 high) to 1.1946 (2016 low) at 1.5466. However, GBP/USD fails to sustain above 55 month EMA (now at 1.4259) so far. Break of 1.3038 support, will suggest that rise from 1.1946 has completed and will turn outlook bearish for retesting this low.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:01 | GBP | BRC Shop Price Index Y/Y Mar | -1.00% | -0.80% | ||

| 01:30 | AUD | Retail Sales M/M Feb | 0.60% | 0.30% | 0.10% | |

| 01:30 | AUD | Building Approvals M/M Feb | -6.20% | -5.00% | 17.10% | |

| 01:45 | CNY | Caixin PMI Services Mar | 52.3 | 54.5 | 54.2 | |

| 08:30 | GBP | Construction PMI Mar | 47 | 51 | 51.4 | |

| 09:00 | EUR | Eurozone Unemployment Rate Feb | 8.50% | 8.50% | 8.60% | |

| 09:00 | EUR | Eurozone CPI Estimate Y/Y Mar | 1.40% | 1.40% | 1.20% | 1.10% |

| 09:00 | EUR | Eurozone CPI Core Y/Y Mar A | 1.00% | 1.10% | 1.00% | |

| 12:15 | USD | ADP Employment Change Mar | 241K | 205K | 235K | 246K |

| 13:45 | USD | US Services PMI Mar F | 54.3 | 54.1 | ||

| 14:00 | USD | ISM Non-Manufacturing/Services Composite Mar | 59 | 59.5 | ||

| 14:00 | USD | Factory Orders Feb | 1.70% | -1.40% | ||

| 14:30 | USD | Crude Oil Inventories | 1.4M | 1.6M |