Some volatility is finally see in early US session even though there is still a lack of follow through momentum. US equities open lower with DOW losing over 150 pts, back below 24000 handle at the time of writing. Dollar accompanies the fall in DOW with a rally attempt. The was some brief support to the greenback on much stronger than expected ISM prices paid, but the the impact quickly faded. For now, Sterling continues to trade as the strongest one for the day, followed by Euro. Dollar and Yen are among the weakest. But Australian Dollar is also soft ahead of RBA rate decision in the upcoming Asian session.

ISM manufacturing dropped to 59.3, but price surged as Trump’s tariffs triggered panic buying

ISM manufacturing index rose dropped to 59.3 in March, down from 60.8 and was slightly below expectation of 60.0. Prices paid component surged to 78.1, up from 74.2, beat expectation of 72.5. Employment component dropped to 57.3, down from 59.7.

Overall, despite slight deterioration in the headline index and employment component, the set of data remained solid. However, there were some concerns expressed regarding the newly announced tariffs. As noted in the “What respondents are saying section…” section of the release:

- “Much concern in the industry regarding the steel and aluminum tariffs recently [imposed]. This is causing panic buying, driving the near-term prices higher and [leading to] inventory shortages for non-contract customers.” (Machinery)

- “New tariffs are causing concern across the supply chain. Full impact will take a few weeks to reveal itself.” (Miscellaneous Manufacturing)

- “Significant price increases in the steel commodity due to 232 [the tariffs]. The price increases will begin to impact our company’s performance.” (Primary Metals)

The release itself also noted that “the Prices Index registered 78.1 percent in March, a 3.9 percentage point increase from the February reading of 74.2 percent, indicating higher raw materials prices for the 25th consecutive month.”

This could be the reason why dollar is trying to have a positive response to the release while stocks extends initial weakness.

Also released in US session, US construction spending rose 0.1% mom in February. Manufacturing PMI was revised down to 55.6 in March. Canada manufacturing PMI rose 0.1 to 55.7 in March.

Japan Tankan shows slight deterioration in large manufacturer sentiment

There were slight deterioration in large manufacturing index from 26 to 24 and missed expectation of 25, and large manufacturers outlook from 21 to 20, missing expectation of 22. Large non-manufacturing index dropped to 23, down from 25 and missed expectation of 24. Large non-manufacturing outlook was unchanged at 20, below consensus of 21. Over business confidence were firm though. The fall in confidence and outlook is likely more due to Yen’s recent appreciation. And so far, the fear of a global trade war had limit impact on sentiments. The indices were calculated, like many other similar series in the world, by subtracting the number of respondents saying conditions are poor from those responding conditions are good.

Also released from Japan, PMI manufacturing was finalized at 53.1 in March, revised down from 53.2.

China starts tariffs on 128 US products, in response to 232 steel tariffs

China formally starts the tariffs on 7 types, 128 products from the US today, according to a statement by the Ministry of Finance. This is part of the packaged announced last month which targets up to USD 3b in imports. And it’s a counter measure to the 232 steel and aluminum tariffs of the US that’s non-geo-targeted.

China’s response is seen by many as symbolic so far, and refrained. And the impact should be negligible comparing to the size of the bilateral trading relationship between the countries. Also, it’s reported that the US is already in negotiation with China regarding a trade deal. However, for now, China is still holding the cards regarding the Section 301 tariffs, which are targeted on Chinese goods that adds up to USD 50-60b of value.

Talking about the Section 301 tariffs, Trump administration is expected to announce the list of products to be affected. It’s believed that the list will concentrate on those affected by intellectual property theft only. And a major portion would be cutting-edge technology products.

China Caixin PMI manufacturing showed “marginal weakening” in March

China Caixin PMI manufacturing dropped to 51.0 in March, down from 51.6 and missed expectation of 51.7. That’s also the lowest level in four months. Dr. Zhengsheng Zhong, Director of Macroeconomic Analysis at CEBM Group noted in the release that “manufacturing PMI reading in March showed that demand was not as strong as expected, leading to lower willingness of manufacturers to produce and restock.”

However, “the ability of manufacturers to make a profit was beefed up by the stable increase in new orders and the much slower jump in input costs.” Zhong also noted that “the growth momentum of the Chinese manufacturing economy may have weakened in March, but at a marginal pace.”

Released over the weekend, however, the official China PMI manufacturing rose to 51.5, up from 50.3. Official PMI manufacturing rose to 54.6, up from 54.4.

RBA to stand pat, AUD to stay weak

RBA is widely expected to keep the cash rate unchanged at 1.50% tomorrow. Economists have been pushing back their expectation on the timing of an RBA hike after recent sluggish wage growth and inflation data. Late last year, there were speculations that RBA could hike twice by the end of this year. And now, markets are only pricing in around 40% chance of one hike in 2018. The majority expects that tightening won’t start until 2019.

While the job markets have been strong in Australia, wage growth remained sluggish. Unemployment rate has now stabilized at 5.5-5.6% after last year’s growth. However,the figure is floored by continue rise in participation rate. In that sense, the unemployment rate would stays away from hitting 5% level for a while, the level considered to be at full employment. That is, slack will remain in the economy.

RBA rate speculations, falling iron ore price and worries regarding US-China trade war left Aussie as one of the weakest back in March, in particular against Euro and Sterling. Aussie will likely stay pressured after tomorrow’s RBA rate statement.

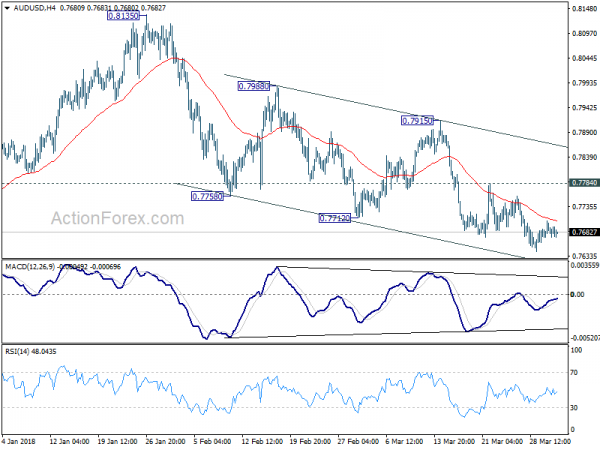

AUD/USD Daily Outlook

Daily Pivots: (S1) 0.7662; (P) 0.7684; (R1) 0.7698; More…

No change in AUD/USD’s outlook. With 0.7784 minor resistance intact, further decline is expected. Current fall fro 0.8135 would target a test on 0.7500 key support level. At this point, we’ll stay cautious on strong support from there to bring rebound. On the upside, however, break of 0.7784 will suggest near term reversal and turn bias to the upside for 0.7915 resistance first.

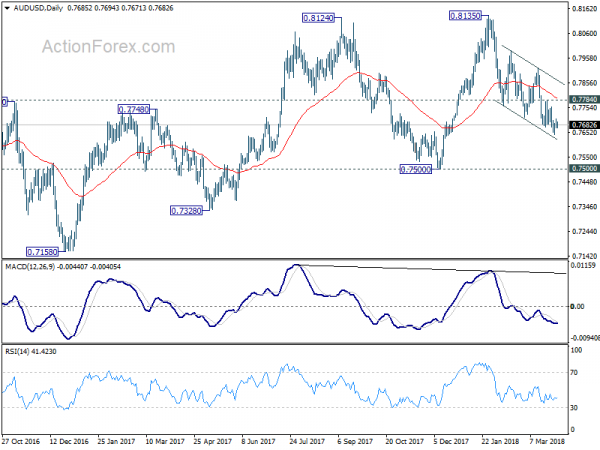

In the bigger picture, medium term rebound from 0.6826 is seen as a corrective move. It might still extend higher but we’d expect strong resistance from 38.2% retracement of 1.1079 to 0.6826 at 0.8451 to limit upside to bring long term down trend resumption. On the downside, break of 0.7500 support will now be an important signal that such corrective rebound is completed. In that case, AUD/USD would be heading back to 0.6826 low in medium term.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Tankan Large Manufacturing Index Q1 | 24 | 25 | 25 | 26 |

| 23:50 | JPY | Tankan Large Manufacturers Outlook Q1 | 20 | 22 | 19 | 21 |

| 23:50 | JPY | Tankan Large Non-Manufacturing Index Q1 | 23 | 24 | 23 | 25 |

| 23:50 | JPY | Tankan Non-Manufacturing Outlook Q1 | 20 | 21 | 20 | |

| 23:50 | JPY | Tankan Small Manufacturing Index Q1 | 15 | 14 | 15 | |

| 23:50 | JPY | Tankan Small Manufacturing Outlook Q1 | 12 | 10 | 11 | |

| 23:50 | JPY | Tankan Small Non-Manufacturing Index Q1 | 10 | 8 | 9 | |

| 23:50 | JPY | Tankan Small Non-Manufacturing Outlook Q1 | 5 | 5 | 5 | |

| 23:50 | JPY | Tankan Large All Industry Capex Q1 | 2.30% | 1.00% | 7.40% | 6.40% |

| 00:30 | JPY | PMI Manufacturing Mar F | 53.1 | 53.2 | 53.2 | |

| 01:00 | AUD | TD Securities Inflation M/M Mar | 0.10% | -0.10% | ||

| 01:45 | CNY | Caixin PMI Manufacturing Mar | 51 | 51.7 | 51.6 | |

| 13:30 | CAD | Manufacturing PMI Mar | 55.7 | 55.6 | ||

| 13:45 | USD | Manufacturing PMI Mar F | 55.6 | 55.7 | 55.7 | |

| 14:00 | USD | Construction Spending M/M Feb | 0.10% | 0.40% | 0.00% | |

| 14:00 | USD | ISM Manufacturing Mar | 59.3 | 60 | 60.8 | |

| 14:00 | USD | ISM Prices Paid Mar | 78.1 | 72.5 | 74.2 | |

| 14:00 | USD | ISM Employment Mar | 57.3 | 59.7 |