Dollar remains in red for the week, except versus Yen and Canadian Dollar, as markets await Donald Trump’s inauguration. Treasury Secretary nominee Steven Mnuchin had sent USD higher. As he suggested, USD’s "long-term strength, over long periods of time, is important". He added that "the US currency has been the most attractive currency to be in for very, very long periods of time. I think that it’s important". Regarding President-elect Donald Trump’s recent statement that the greenback was too strong, Mnuchin clarified that "when the president-elect made a comment on the US currency, it wasn’t meant to be a long-term comment".

Fed chair Janet Yellen said that monetary policy has not "fallen behind the curve". Also, she doesn’t see overheating in labor market to cause inflation to surge. She expected labor market to strengthen as a moderate pace with GDP growth held down by "a variety of forces". That include, slow labor-force and productivity growth and weak global growth. And thus, it is "prudent to adjust the stance of monetary policy gradually over time". Traders saw that as a sign of no urgency for a faster hike and that limits dollar’s strength in rebound attempt.

Yesterday, ECB left its policies unchanged, with the base interest rate staying at 0% and the deposit rate at -0.4%. Meanwhile, the current QE program stayed at EUR 80b per month. It would be extended until December, but at a decreased rate of EUR 60b from March on. On economic developments, President Mario Draghi acknowledged recent strength in activity indicators, but noted that "there are no signs yet of a convincing upward trend in underlying inflation". Draghi added that "the Governing Council will continue to look through changes in HICP inflation if judged to be transient and to have no implication for the medium-term outlook for price stability". On the monetary policy outlook, he reiterated that need to maintain low interest rates as "the recovery of all of the Eurozone is in the interests of everybody, including Germany".

BoJ governor Haruhiko Kuroda said yesterday that he hasn’t heard any "pessimism about Abenomics". Yet, the central bank’s 2% inflation target "has not yet been achieved". And, BoJ will "continue with monetary easing to hit the 2 percent target at the earliest possible time." He also said that he would closely monitor US president-elect Donald Trump’s policies. But he showed little concern that protectionism under Trump would hurt the global economy. BoJ deputy governor Hiroshi Nakaso warned of a surge in dollar funding cost as policies diverge. But he didn’t seen any "particular problem emerging for now".

China’s GDP expanded 6.8% yoy in 4Q17, up from 6.7% in the prior quarter. Industrial production grew 6% yoy in December, down from 6.2% in November. The market had anticipated a 6.1% growth. Retail sales expanded 10.9% yoy, beating consensus of 10.7% and November’s 10.8%. Urban fixed asset investment increased 8.1% for the full year 2016, slowing from 8.3% in the first 11 months of the year. Looking ahead, Germany will release PPI in European session. UK will release retail sales. Canada will also release retail sales and CPI today.

AUD/USD Daily Outlook

Daily Pivots: (S1) 0.7511; (P) 0.7542; (R1) 0.7592; More…

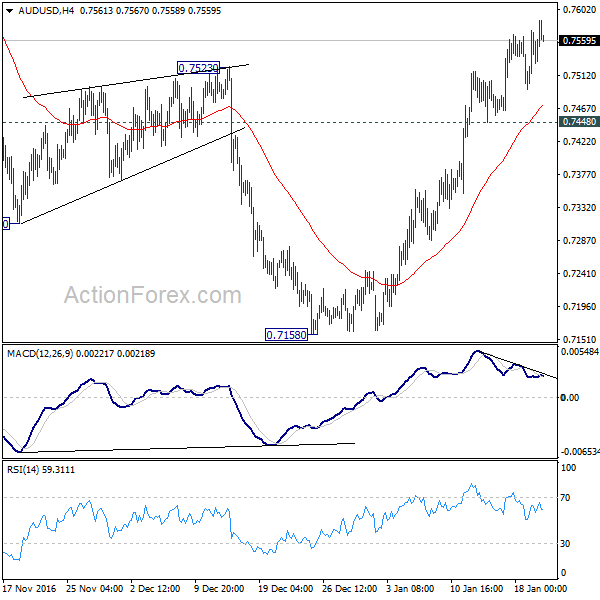

AUD/USD continues to lose upside momentum as seen in 4 hour MACD. But with 0.7448 minor support intact, rebound from 0.7158 could extend higher towards 0.7777/7833 resistance zone. At this point, we’d expect strong resistance from this zone to limit upside. On the downside, below 0.7448 minor support will turn bias back to the downside for 0.7144 key support level.

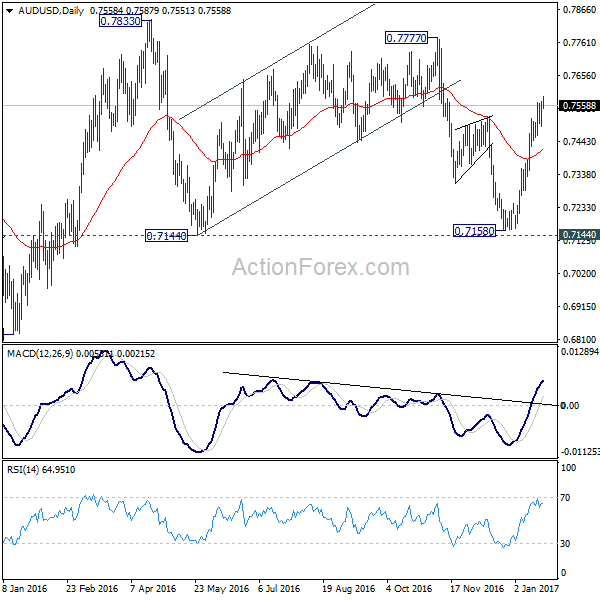

In the bigger picture, AUD/USD is staying inside long term falling channel and it’s likely that the down trend from 1.1079 is still in progress. Break of 0.6826 low will confirm this bearish case. We’ll be looking for bottoming sign again as it approaches 0.6008 key support level. Meanwhile, sustained break of 0.7833 resistance will be a strong sign of medium term reversal.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Consensus | Previous | Revised |

|---|---|---|---|---|---|---|

| 2:00 | CNY | GDP Y/Y Q4 | 6.80% | 6.70% | 6.70% | |

| 2:00 | CNY | Industrial Production Y/Y Dec | 6.00% | 6.10% | 6.20% | |

| 2:00 | CNY | Retail Sales Y/Y Dec | 10.90% | 10.70% | 10.80% | |

| 2:00 | CNY | Fixed Assets Ex Rural YTD Y/Y Dec | 8.10% | 8.30% | 8.30% | |

| 7:00 | EUR | German PPI M/M Dec | 0.40% | 0.30% | ||

| 7:00 | EUR | German PPI Y/Y Dec | 1.00% | 0.10% | ||

| 9:30 | GBP | Retail Sales M/M Dec | -0.10% | 0.20% | ||

| 13:30 | CAD | Retail Sales M/M Nov | 1.10% | |||

| 13:30 | CAD | Retail Sales Less Autos M/M Nov | 1.40% |

Subscribe to our daily and mid-day newsletter to get this report delivered to your mail box