After being pressured initially, Dollar staged a strong come back European session. The greenback is now trading as the strongest one for day, followed by Canadian Dollar and then Yen. On the other hand, Sterling and Euro are suffering broad based selling together with Aussie. There is no apparent catalyst for the move. Fading fear of trade war, or realizing that the theme is exaggerated, or no matter what it’s called, lifted global stocks. At the time of writing, DAX is trading up 1.8%, CAC up 1.4% and FTSE up 2%. If that’s true, we should be seeing persistent weakness in Yen, and more rebound in Aussie. But that’s not what we’re seeing today. It’s believed that as holiday approaches and without any real market moving events scheduled, traders are already starting quarter-end position squaring.

European Commission: Economic sentiment weakened in all the five largest euro-area economies

Eurozone economic confidence dropped to 112.6 in March, down from 114.2 and missed expectation of 113.3. In the release, EC noted that the deterioration of sentiment was resulted from drops in industry, services and retail trade. And, the index in all the five largest Eurozone economies also dropped. That includes Germany (-2.4), Italy (-1.8) and Spain (-1.2) and, less so, in the Netherlands (-0.5) and France (-0.4). For EU, economic confidence dropped -1.9 to 112.5. The larger decline in EU was mainly due to marked deterioration of sentiment in the largest non-euro area EU economies, the UK (-4.2), and Poland (-2.0).

Also released from Eurozone, M3 money supply rose 4.2% yoy in February. German import price dropped -0.6% mom in February.

ECB Nowotny: Could reduce asset purchase “significantly” after September

Outspoken ECB Governing Council member Ewald Nowotny commented again today. He said that the central bank will decide on the future of monetary policy in the summer. This is rather apparent as the current EUR 30b per month asset purchase program is set to end in September. Nowotny also said that “if things continue as they are, ECB will be able to reduce asset purchases significantly” after that. While he cautioned not to make any abrupt change to policy, he also emphasized not to fall behind the curve. Overall, Nowotny’s comments were consistent with his usual stance, which is slightly on the hawkish side of the spectrum.

ECB Liikanen assures no abrupt sudden changes when QE ends

Another ECB Governing Council member Erkki Liikanen spoke on monetary policy today too. He said that the central bank have been careful in the communications. And he reiterated that “we’re extending net asset purchases until September and beyond if needed.” He further qualified that “gradual tightening of monetary policy will rest on a more solid basis when indications of inflation rates to potentially temporarily exceed two percent become more prominent in inflation expectations.” For Eurozone, “inflation rate is sustainable when the ECB’s price stability objective can be met even without an exceptionally accommodative monetary policy”.

Regarding the tools, interest rates, asset purchase and forward guidance, he said that ” if the economy will be stronger and more convergence will take place, the role of the net asset purchase program will be smaller. And at the same time the other three elements will gain more importance especially forward guidance.” But Liikanen assured that “there will be no abrupt sudden changes even if one day the net purchases will be finished.”

Fed Mester supports gradual rate hike, against a steep path

Cleveland Fed President Loretta Mester said yesterday that she supports gradual rate hike “this year and next year”. At the same time, she’s “against a steep path” in tightening because “we want to give inflation time to move back to goal”. She sounds optimistic saying that “this year is shaping up to be another good year for the economy.” And for monetary policymakers, the task is to “calibrate policy to this healthy economy so that the expansion is sustained.”

The government’s tax cut poses “some upside risk” to the forecast, and Mester expects a better read on household spending “over the next several months”. Globally, she noted that “for the first time in many years, economic activity around the world is picking up and forecasts for global growth are being revised up.” And, “this should have a positive feedback effect on the U.S. economy via exports.”

Meanwhile, she warned that trade developments are a “risk to the forecasts”. And the uncertainty “may not be resolved quickly”. But it didn’t change her outlook for the over economy yet.

USD/CHF Mid-Day Outlook

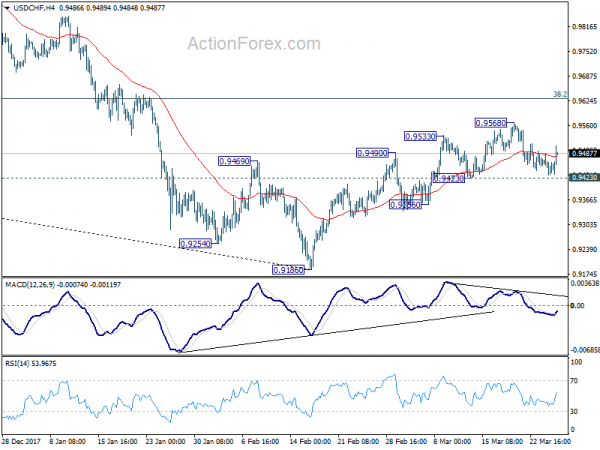

Daily Pivots: (S1) 0.9442; (P) 0.9469; (R1) 0.9493; More…

USD/CHF recovered ahead of 0.9423 near term support and intraday bias remains neutral. While rebound from 0.9186 might extend higher, we’d expect strong resistance from0.9626 key fibonacci level to limit upside. That’s supported by divergence condition in 4 hour MACD. On the downside, break of 0.9432 support will indicate near term reversal and completion of rebound from 0.9186. In this case, intraday bias will be turned back to the downside for retesting 0.9186 low. However, sustained break of 0.9626 will carry larger bullish implications.

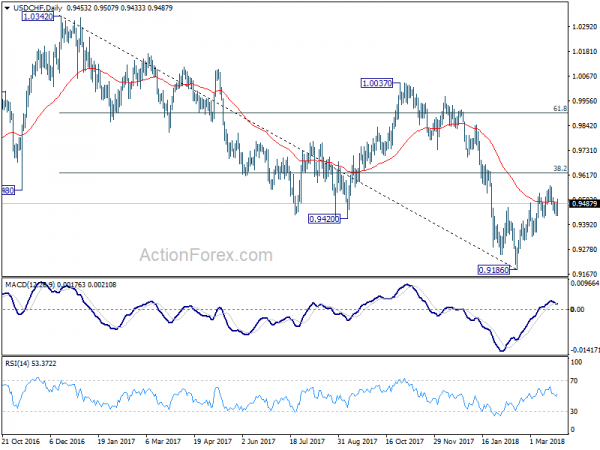

In the bigger picture, fall from 1.0342 is seen as a medium term down trend. Main focus is on 38.2% retracement of 1.0342 (2016 high) to 0.9186 (2018 low) at 0.9626. Sustained break there will add to the case of trend reversal and target 61.8% retracement at 0.9900 and above). However, rejection from 0.9626 will maintain medium term bearishness for another low below 0.9186.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Corporate Service Price Y/Y Feb | 0.60% | 0.70% | 0.70% | |

| 06:00 | EUR | German Import Price Index M/M Feb | -0.60% | -0.30% | 0.50% | |

| 08:00 | EUR | Eurozone M3 Money Supply Y/Y Feb | 4.20% | 4.60% | 4.60% | 4.50% |

| 09:00 | EUR | Eurozone Economic Confidence Mar | 112.6 | 113.3 | 114.1 | 114.2 |

| 09:00 | EUR | Eurozone Business Climate Indicator Mar | 1.34 | 1.36 | 1.48 | |

| 09:00 | EUR | Eurozone Industrial Confidence Mar | 6.4 | 6.9 | 8 | |

| 09:00 | EUR | Eurozone Services Confidence Mar | 16.3 | 16.5 | 17.5 | 17.6 |

| 09:00 | EUR | Eurozone Consumer Confidence Mar F | 0.1 | 0.1 | 0.1 | |

| 13:00 | USD | S&P/Case-Shiller Composite-20 Y/Y Jan | 6.40% | 6.10% | 6.30% | |

| 14:00 | USD | Consumer Confidence Mar | 131 | 130.8 |